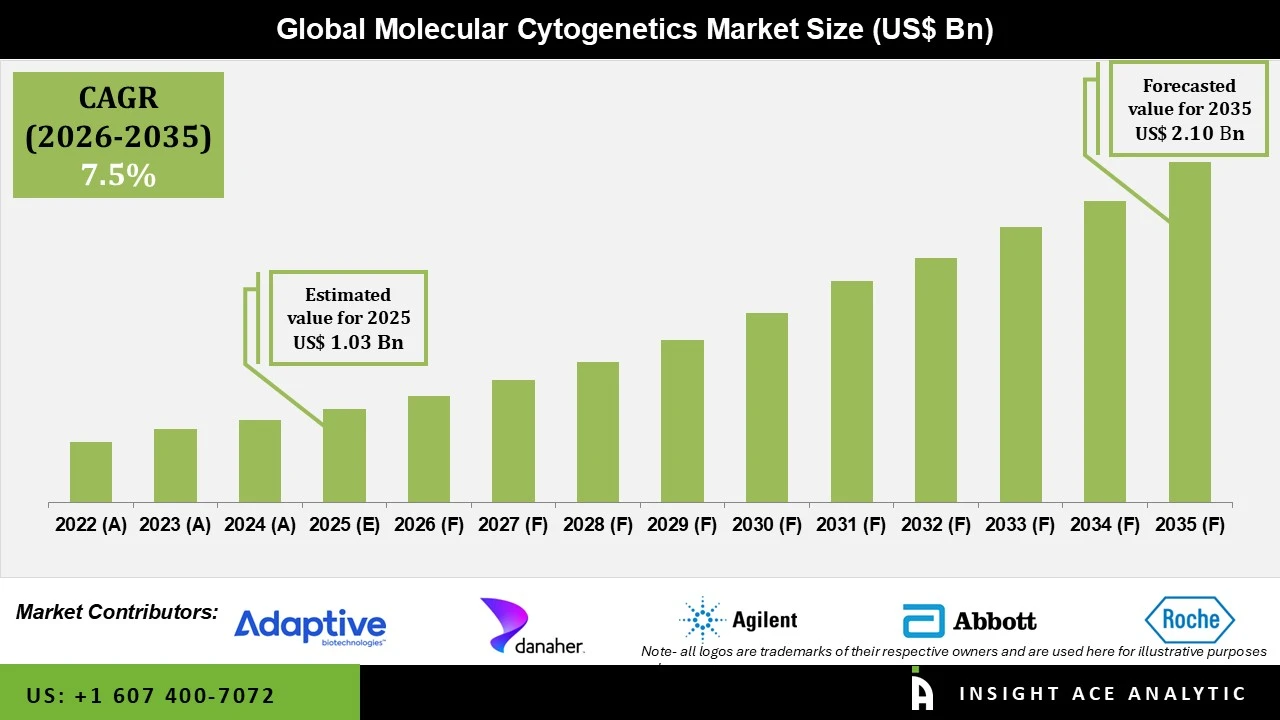

Molecular Cytogenetics Market Size is valued at USD 1.03 Bn in 2025 and is predicted to reach USD 2.10 Bn by the year 2035 at an 7.5% CAGR during the forecast period for 2026 to 2035.

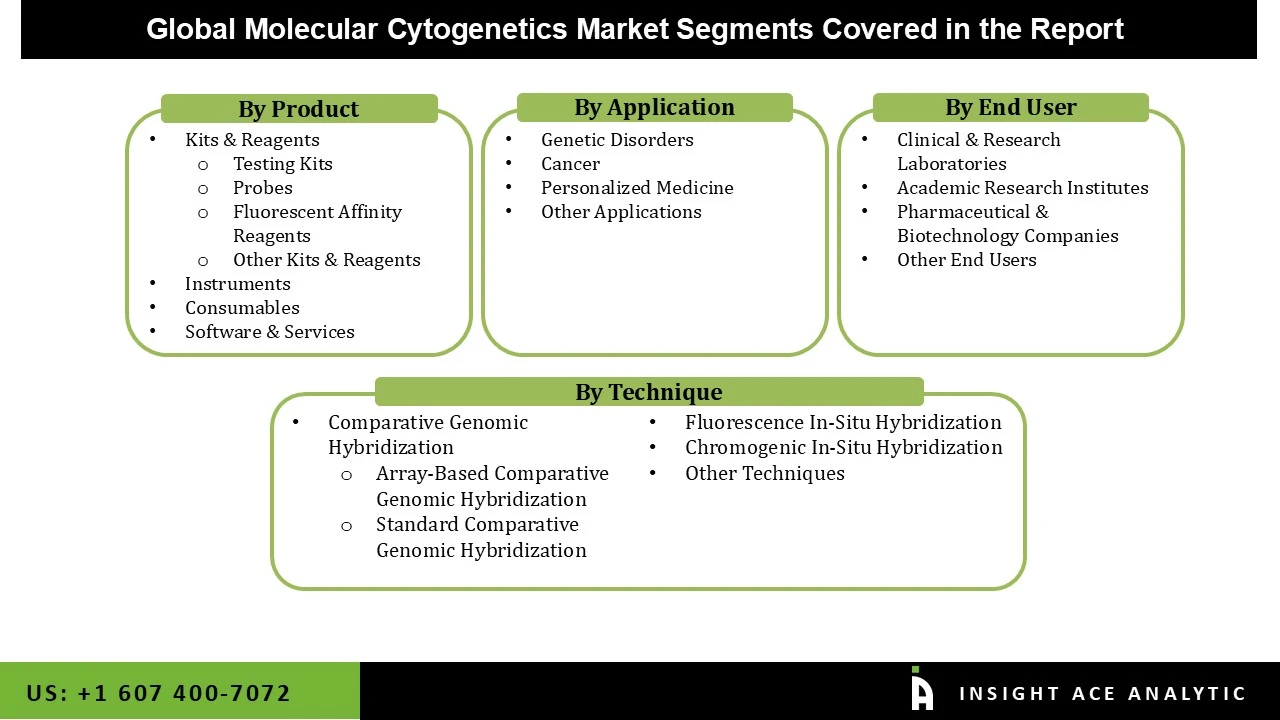

Molecular Cytogenetics Market Size, Share & Trends Analysis Distribution by Product (Kits & Reagents, Instruments, Consumables, Software & Services), Technique (Comparative Genomic Hybridization, Fluorescence In-Situ Hybridization, Chromogenic In-Situ Hybridization, Other Techniques), Application, End User and Segment Forecasts, 2026 to 2035

Molecular cytogenetics merges molecular biology with cytogenetic techniques to study chromosomes and their abnormalities, which is important in disease diagnosis caused by genetic anomalies or cancer. Advanced methods like Fluorescence In Situ Hybridization (FISH) and Comparative Genomic Hybridization (CGH) are used in molecular cytogenetics. FISH is applied for visualizing specific DNA sequences on chromosomes, thus helping detect chromosomal anomalies such as deletions and translocations, especially in the case of cancerous cells. CGH compares the genomic contents of a test sample and a reference to highlight gains or losses within chromosomal regions, giving insight into numerous genetic disorders.

Molecular cytogenetics is applied in both clinical diagnostics and prenatal diagnosis besides research in cancers. The principal application of diagnosing genetic disorders, such as Down's syndrome, or identifying mutations associated with cancers may result in targeted therapies being developed. The ever-increasing incidence of genetic disorders and cancers is one of the prime drivers of this molecular cytogenetics market. Improving awareness and diagnosis rates coupled with increasing demands for sophisticated and high-precision diagnostic tools are further fueled by ongoing research and technology, which is bettering the accessibility and effectiveness.

The molecular cytogenetics market is segmented by product, technique, application, and end user. By product the market is segmented into kits & reagents, instruments, consumables, software & services. By kits & reagents it is sub segmented into testing kits, probes, fluorescent affinity reagents, other kits & reagents. By Technique market is comparative genomic hybridization, fluorescence in-situ hybridization, chromogenic in-situ hybridization, other techniques. Comparative genomic hybridization is sub segmented into array-based comparative genomic hybridization, standard comparative genomic hybridization. By application market is categorized into genetic disorders, cancer, personalized medicine, other applications. By end user the market is categorized into clinical & research laboratories, academic research institutes, pharmaceutical & biotechnology companies, and other end users.

The Kits & Reagents segment is leading the molecular cytogenetics market, with its greatest importance in diagnostics and research. High demand for these kits, probes, and fluorescent affinity reagents is required in clinical labs as well as research institutes in detecting chromosomal anomalies and genetic diseases, thereby fueling the demand. Such products are also being increasingly used for diagnosis and planning of treatments because of the increasing incidence of cancers and genetic disorders. The same productivity and efficiency of these products combined with growth in personalized medicine are going to continue to make the segment hold sway over the market.

The Array-Based Comparative Genomic Hybridization (aCGH) segment is experiencing rapid growth in the molecular cytogenetics market due to its high resolution and sensitivity, allowing for the detection of submicroscopic chromosomal alterations like deletions, duplications, and copy number variations (CNVs) often missed by traditional methods. The simplified process-the elimination of the need for cell culture and the ability to directly analyze DNA from tissue samples-advances testing, increases accessibility in the clinical lab, and improves the process. Advances that could be made were next-generation sequence and high-density arrays, which put aCGH on a faster track to higher accuracy and fully genomic analyses. This means that as aCGH continues to be integrated into clinical diagnostics, especially in oncology and prenatal testing, it now replaces the older conventional techniques such as FISH-based due to its efficiency and value in personalized medicine.

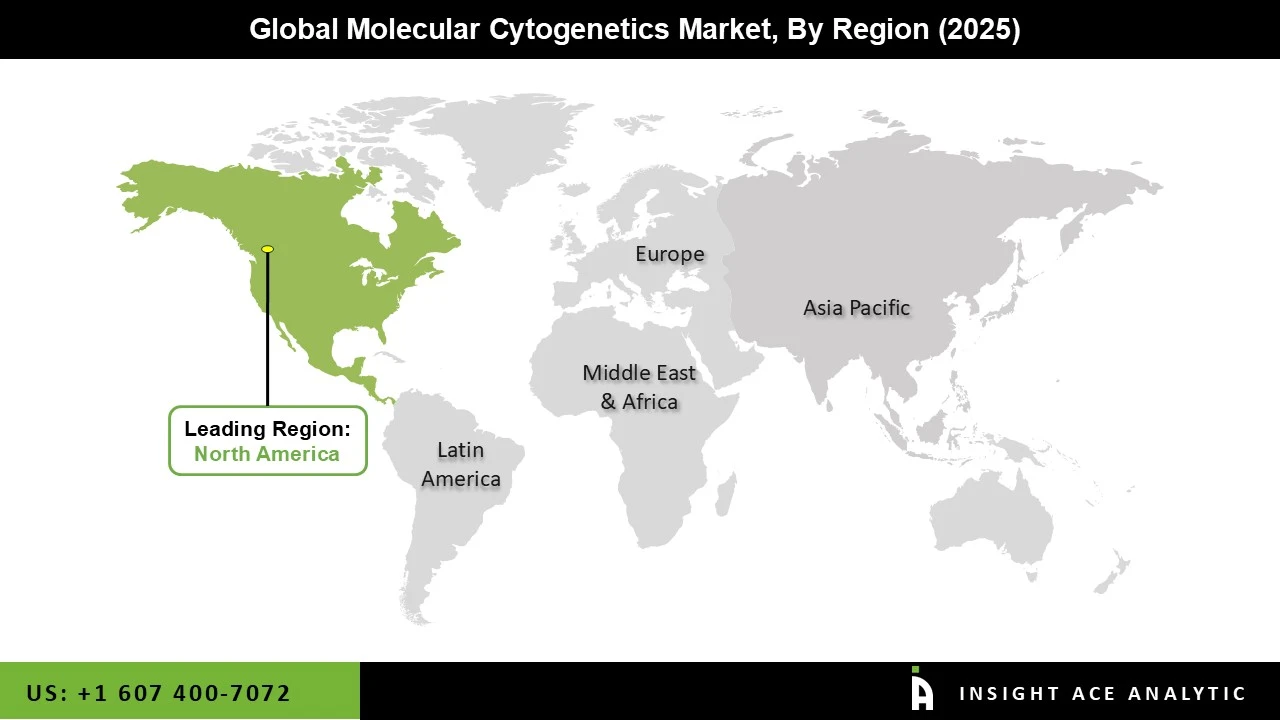

Advanced healthcare infrastructure and a huge investment in R&D make North America a prominent region for the molecular cytogenetics market. The healthcare system is strong; hence, it has the space to quickly adopt new technologies both in diagnostics and research. Innovation activities are conducted by companies such as Agilent Technologies, Illumina, and Thermo Fisher Scientific, who also make a large R&D investment. But it is the rising prevalence of genetic disorders as well as chronic diseases such as cancer and sickle cell disease-that affect about 70,000 to 100,000 Americans-driving the molecular cytogenetics market. Government efforts in the form of campaigns advocating genetic testing and offering grants to engage in genomic research also propel the market with widened clinical use of such advanced diagnostic methods.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.03 Bn |

| Revenue Forecast In 2035 | USD 2.10 Bn |

| Growth Rate CAGR | CAGR of 7.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Technique, Application, End User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | F. Hoffmann-La Roche Ltd., Danaher Corporation, Agilent Technologies, Inc., Abbott Laboratories, Thermo Fisher Scientific, Inc., Illumina Inc., Revvity, Pacific Biosciences, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, Genedx, Oncocyte Corporation, Bioview, Oxford Gene Technology Ip Limited (Part of Sysmex), Applied Spectral Imaging, Inc., Cytotest Inc., Kromatid, Inc., Genial Genetic Solutions Ltd., Cytognomix, Inc., Metasystems, Scigene, Biomodal, Biocare Medical, Biodot, Oncodna |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.