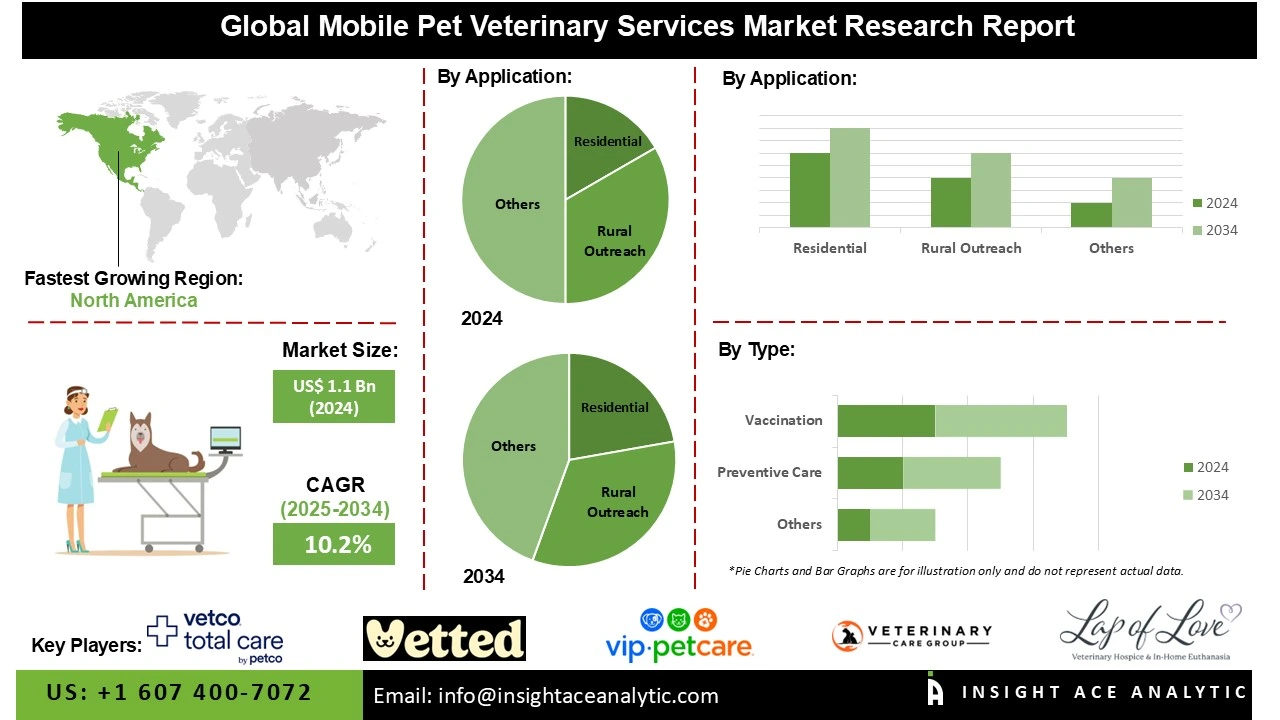

Global Mobile Pet Veterinary Services Market Size is valued at US$ 1.1 Bn in 2024 and is predicted to reach US$ 2.7 Bn by the year 2034 at an 10.2% CAGR during the forecast period for 2025-2034.

Mobile pet veterinary services provide professional veterinary care at your residence or a nearby site, enhancing convenience and alleviating stress for both pets and their owners. These services often encompass basic wellness examinations, immunizations, spaying/neutering operations, microchipping, dental care, diagnostics like as blood testing or ultrasound, and occasionally surgical interventions. With the rising number of pets, the high prevalence of chronic illnesses, & increased knowledge of veterinary care, the market for mobile pet veterinary services is expected to expand. It meets the increasing demand for individualized and flexible pet care solutions, driven by the need for stress-free veterinary appointments and the rise in pet ownership.

Additionally, mobile veterinarian care is a desirable substitute for conventional brick-and-mortar clinics due to pet owners' hectic schedules and restricted transportation alternatives, especially in suburban and rural locations. Further propelling the market expansion are developments in mobile technology, such as telehealth capabilities and portable diagnostic devices, which are improving the caliber and range of services provided. But there are other difficulties facing the sector as well. Regional differences in licensing requirements and regulatory barriers will also affect the expansion of the mobile pet veterinary services market.

Some of the Key Players in Mobile Pet Veterinary Services Market:

The Mobile Pet Veterinary Services market is categorized by service type and application area. Service types include Vaccination, Preventive Care, and Emergency Treatment. Application areas encompass Residential services, Pet Events, and Rural Outreach.

The preventive care category dominated the market in 2024. In the field of mobile pet veterinary services, preventative care includes routine examinations, proper oral hygiene, parasite protection, and advice on healthy diets, all of which can be conveniently provided at the pet owner's residence. This technology has generated a lot of excitement because it allows pets to receive an early diagnosis, maintain their health over time, and avoid future costly treatments.

In 2024, the pet events category led the mobile pet veterinary services market. On-site care, including health screening and microchipping, is provided by mobile veterinarian services at pet events like adoption fairs, community fairs, and pet expos. Such arrangements help to promote the idea of public health by using numerous pets at once and improve brand exposure.

North America dominates the market for mobile pet veterinary services. High pet ownership and state-of-the-art veterinary facilities are advantageous to the area. The strong demand for easy pet care solutions in the US, in particular, propels growth. The market is further fueled by growing awareness about pet wellbeing and health. Additionally, US mobile providers are advancing quickly with improved diagnostic tools, wellness subscription programs, and app-based appointment systems. Growth and investment in the mobile pet veterinary services industry are being driven by consumer demand for stress-free, at-home care and convenience.

The market for mobile pet veterinary services is expanding quickly in Europe as a result of rising pet ownership rates and increased knowledge of animal healthcare. Among the most sought-after services provided on-site are emergency treatments, immunizations, and preventive care. Furthermore, in remote and underserved communities, outreach efforts in rural areas are helping to close the accessibility gap. The use of digital booking platforms and telehealth platforms is also improving the effectiveness and reach of mobile veterinary services in the area.

Mobile Pet Veterinary Services Market by Type-

· Vaccination

· Preventive Care

· Emergency Treatment

Mobile Pet Veterinary Services Market by Application-

· Residential

· Pet Events

· Rural Outreach

Mobile Pet Veterinary Services Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.