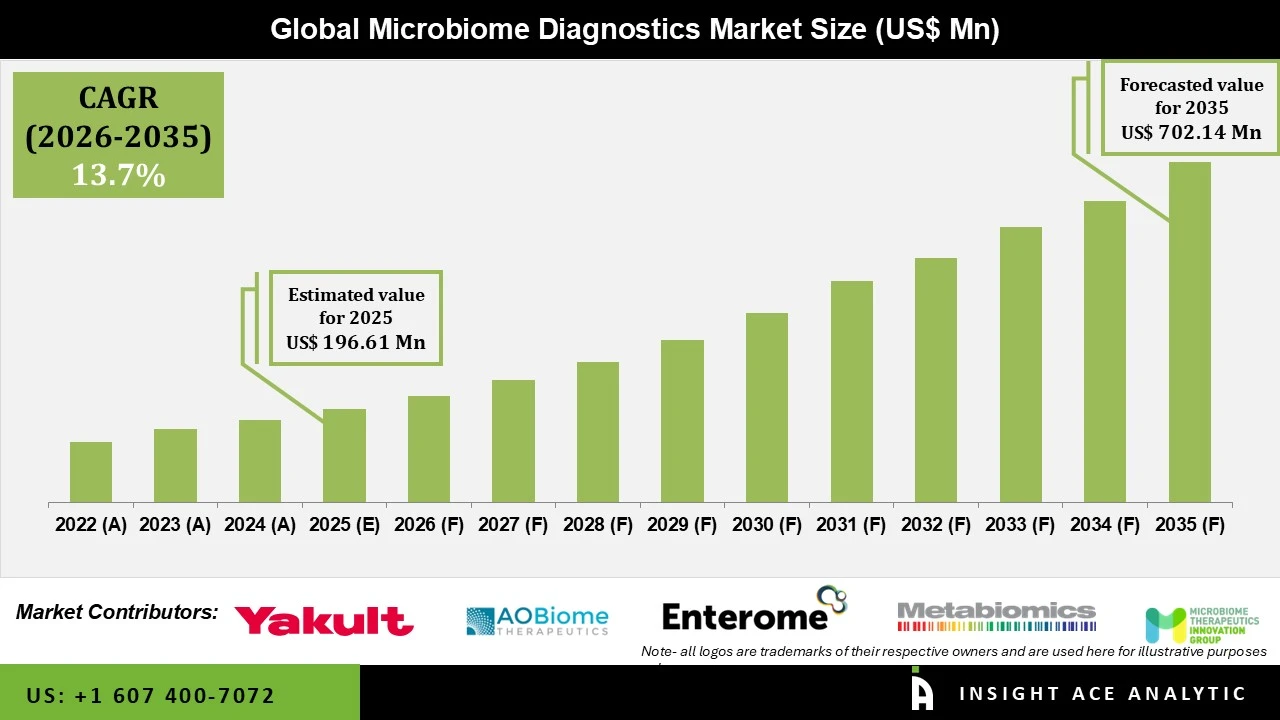

Microbiome Diagnostics Market Size is valued at USD 196.61 Mn in 2025 and is predicted to reach USD 702.14 Mn by the year 2035 at a 13.7% CAGR during the forecast period for 2026 to 2035.

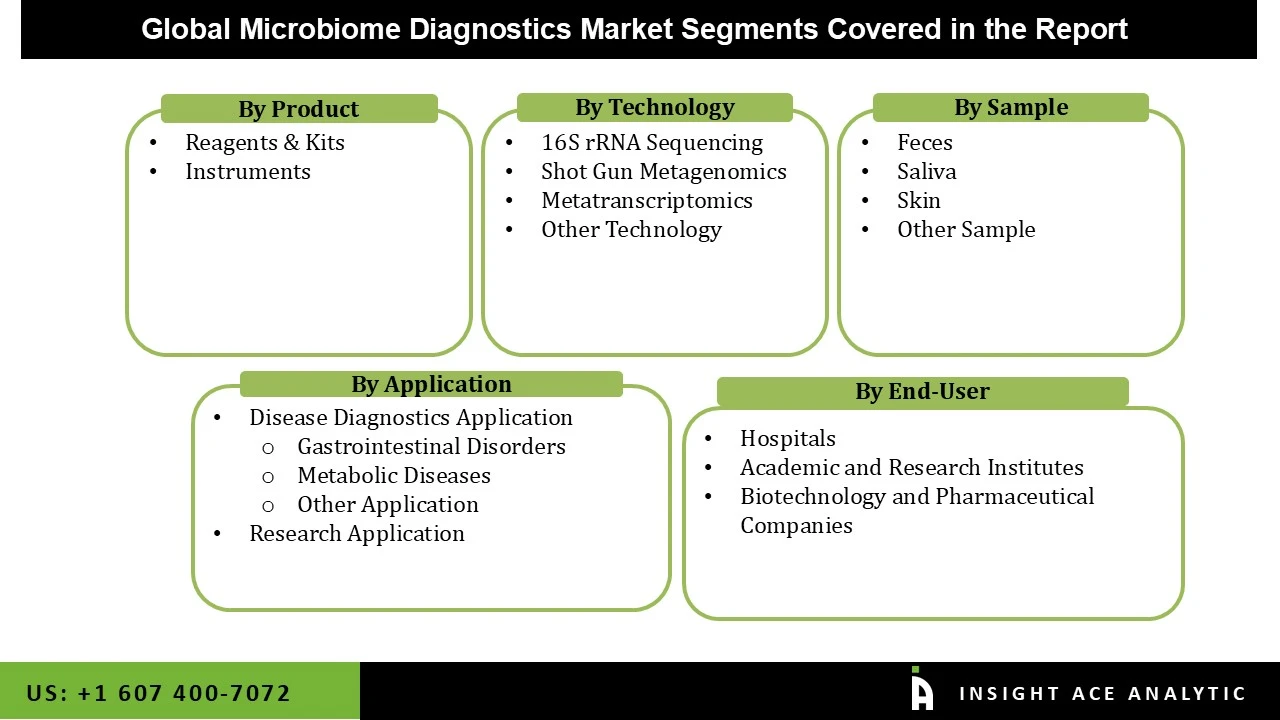

Microbiome Diagnostics Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Instruments), By Technology (16S rRNA Sequencing, Shot Gun Metagenomics, Metatranscriptomics, Other Technology), By Sample (Feces, Saliva, Skin, Other Sample), By Application (Disease Diagnostics Application (Gastrointestinal Disorders, Metabolic Diseases, Other Application), Research Application), By End-User (Hospitals, Academic and Research Institutes, Biotechnology and Pharmaceutical Companies), By Region, And By Segment Forecasts, 2026 to 2035

Utilizing advanced genomic and bioinformatic techniques, these diagnostics can profile microbial DNA from samples (e.g., gut, skin, oral cavity) to understand the composition and function of the microbiome. Applications range from disease diagnosis and risk assessment to personalized medicine and predicting drug responses, by identifying specific microbiome signatures associated with certain diseases or health states.

The Microbiome Diagnostics market growth can be attributed to its use of progressive scientific procedures and technologies to inspect the configuration and operation of microbiomes in particular environments, especially within the human body. The microbiome diagnostics market is witnessing steady growth, driven by increasing awareness of the role of microbial communities in health and disease. Advancements in technologies and bioinformatic have enabled more accurate and comprehensive microbiome analysis. However, challenges such as standardization of testing protocols and regulatory hurdles remain, shaping the landscape of this rapidly evolving Market.

The COVID-19 pandemic has positively as well as negatively impacted the microbiome diagnostics market. While there has been increased interest in understanding the pivotal role of the microbiome in immunity and disease susceptibility, disruptions in healthcare systems and reduced research funding have slowed market growth. However, the pandemic has increased the adoption of remote healthcare solutions, leading to a surge in demand for microbiome diagnostics for telemedicine and home testing. Overall, the Market has faced challenges regarding supply chain disruptions and reduced access to healthcare facilities. Still, opportunities have emerged in remote diagnostics and personalized medicine.

The Microbiome Diagnostics Market is segmented by product, Technology, sample, application, end-user, and region. The segmentation based on the products is Reagents & Kits and Instruments. The sample segment comprises Fecal, Saliva, and Skin. Based on application, the segmentation includes Disease Diagnostics Applications, Gastrointestinal Disorders, Metabolic Diseases, and Other Applications. Based on End-User, the segmentation includes Hospitals, Academic and Research Institutes, Biotechnology, and Pharmaceutical Companies.

High consumption of consumables such as kits and reagents and their repeated purchases, along with the increasing number of microbiome diagnostic tests performed across the globe, support the growth of the reagents & kits product segment. The demand for microbiome diagnostics is rising as the instruments play an important role in sanctioning the correct and precise investigation of microbiome samples. Next-generation sequencing apparatus, mass spectrometers, and quantitative PCR gadgets are important in this field. NGS devices are important for sequencing DNA and RNA from microbiome samples, offering comprehensive particulars about the configuration of microbial sections.

The Pharmaceutical and Biotechnologies Segment dominated the Market based on end users. They appear as a sizeable fragment of microbiome diagnostics end users. The microbiome diagnostics market trends include utilizing microbiome data to fabricate inventive remedies, customized medicines, and progressive probiotics. These firms are entrenched in disentangling the complex associations between the human microbiome and varied illnesses. By engaging microbiome diagnostics, they project to distinguish contemporary drug targets, enhance drug efficacy, and lessen the prevalence of unfavourable outcomes.

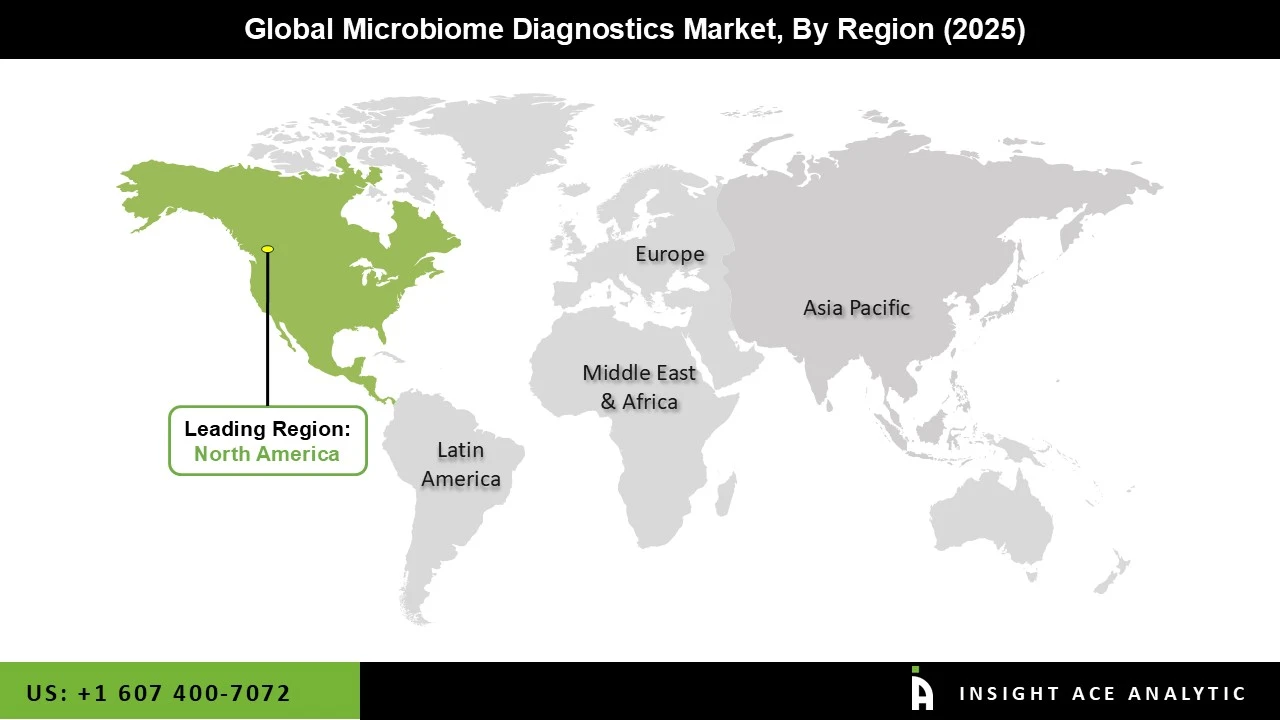

North America emerges as the most dominant Market due to the region's strong healthcare framework, the notable pervasiveness of gastrointestinal illnesses, and growing consciousness regarding the importance of microbiome balance, which are important elements pushing the assimilation of microbiome diagnostics within the region. North America dominates the microbiome market because of the strong base of healthcare facilities, rising investment from key players, a growing number of processes about drug development, and a rising number of research activities in this region. The joint ventures regarding research between leading economies of this region also boost the market growth. There is an increase in government initiatives to promote awareness, growing research and education activities in the region, a rise in the incidences of lifestyle-related diseases and autoimmune disorders, and a growing demand for quality healthcare.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 196.61 Mn |

| Revenue Forecast In 2035 | USD 702.14 Mn |

| Growth Rate CAGR | CAGR of 13.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Technology, Sample, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Yakult Honsha Co., AOBiome, Enterome Biosciences SA, Metabiomics Corp., Microbiome Therapeutics LLC, Osel, Inc., Rebiotix, Inc., Second Genome, Seres Therapeutics, Synthetic Biologics, Vedanta Biosciences, 4D Pharma, Du Pont De Nemours and Co., Ferring Pharmaceuticals, Genetic Analysis AS, Atlas Biomed, Biome Oxford Ltd., Illumina Inc., Microba Life Sciences, Dna Genotek (Orasure Technologies, Inc.), Viome Life Sciences, Sun Genomics, Becton, Dickinson And Company, Daytwo, OraSure Technologies, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Microbiome Diagnostics Market By Product-

Microbiome Diagnostics Market By Technology-

Microbiome Diagnostics Market By Sample-

Microbiome Diagnostics Market By Application-

Microbiome Diagnostics Market By End-User-

Microbiome Diagnostics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.