The Global Metal Foam Market Size is valued at 100.17 million in 2023 and is predicted to reach 155.15 million by the year 2031 at an 5.79% CAGR during the forecast period for 2024-2031.

Metal foams are solid metal cellular structures with many gas-filled pores. Open-cell foam is produced when these pores are interconnected rather than being sealed up, as in closed-cell foam. While closed-cell foam is called metal foam, open-cell foam is known as porous metal.

Many industries use metal foam, particularly those related to transportation, building, and infrastructure. It is predicted that the increasing use of metal foams across a range of end-user industries, including the expanding automotive and building and infrastructure sectors, will pave the way for metal foam market expansion.

Additionally, expanding industries, including those in construction, aviation, and defense, contribute to increased market demand. The market for metal foam will continue to expand rapidly because of the rising need for products that are resistant to water and high temperatures. The market for metal foam is anticipated to be driven by the materials' standout qualities, including electrical proficiency, thermal management, and shock absorption capabilities.

Aluminum foams are predicted to rise in popularity due to their high strength, lightweight, and toughness in the automotive and transportation sectors. The environmental restrictions that demand using lightweight automotive parts to reduce vehicular contamination give industry participants even more lucrative prospects. The expansion of research and development centers to create new technologies and lower the price of products will also contribute to the metal foam market demand.

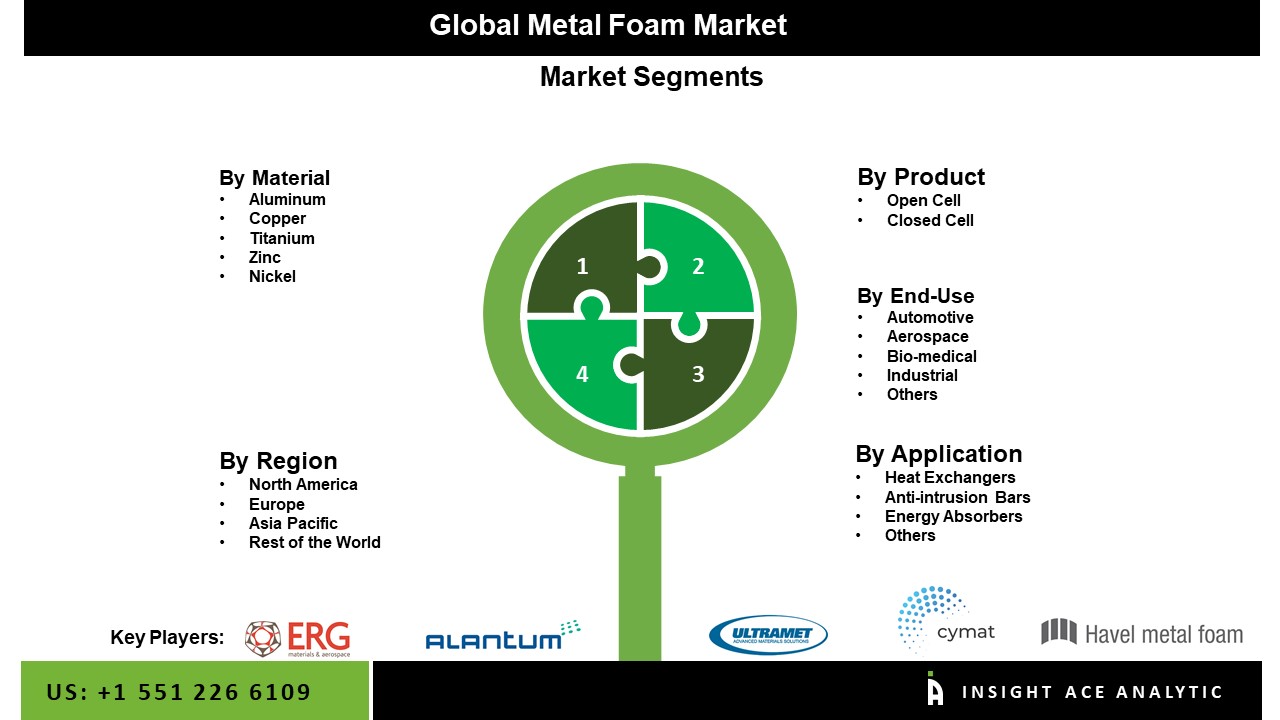

The metal foam market is segmented on the material, product, application and end-use. Based on material, the market is segmented into aluminum, copper, titanium, zinc and nickel. Based on product, the market is segmented into open cell and closed cell. Based on application, the market is segmented into heat exhchangers, anti-intrusion bars, energy absorbers and others. Based on end-use, the market is segmented into automotive, aerospace, bio-medical, industrial and others.

The water-soluble fertilizers category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time due to its qualities, which include highly developed repair and maintenance technology, recycling compatibility, the ability to reform during the manufacturing and service lifecycle stages, simplicity in assembly, a wide range of hardening abilities, high impact resistance, high formability, easy availability, low cost, versatility, etc. Additionally, aluminum is a lightweight metal, which makes it a great material for creating foams with a high fatigue resistance and an extraordinary strength-to-weight ratio. Aluminum foam is perfect for usage in automotive applications like car bumpers, vehicle exteriors, and engine surrounds because to its distinctive combination of qualities (grilles).

The automotive category is anticipated to grow significantly over the forecast period. Metal foams are becoming more popular because of their high performance and low weight in the production of lightweight automobiles. Another reason for the widespread use of metal foams in the automotive industry is concern over greenhouse gas (GHG) emissions. Transportation, particularly personal vehicles, is a major source of carbon dioxide emissions. Vehicle weight reduction has become more popular in producing both large and small cars since it significantly cuts carbon dioxide emissions.

The Asia Pacific metal foam market is expected to register the highest market share in revenue in the near future. Some of the fastest-growing metal industries and successful firms in the APAC area can be found there. Additionally, the APAC area has the world's fastest growth rate. The market is also experiencing a high level of urbanization and industrialization, propelling the industry toward expansion. In addition, North America is projected to grow rapidly in the global metal foam Industry because governments are investing more money, and the car industry is expanding, especially in developed nations like the US and Canada. Metal foam is mostly used in this region's automotive, aerospace, and military industries. The rising need for lightweight materials in these industries is driving the growth of the metal foam market development in North America.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 100.17 Mn |

| Revenue forecast in 2031 | USD 155.15 Mn |

| Growth rate CAGR | CAGR of 5.79% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material, Product, Application, End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | ERG Aerospace, CYMAT Technologies Ltd., Mott, Ultramet, Alantum, Havel Metal Foam GmbH, Mayser GmbH & Co.KG, Pohltech Metalfoam GmbH, Liaoning Rontec Advanced Material Technology Co and American Elements. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Metal Foam Market By Material

Metal Foam Market By Product

Metal Foam Market By Application

Metal Foam Market By End-use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.