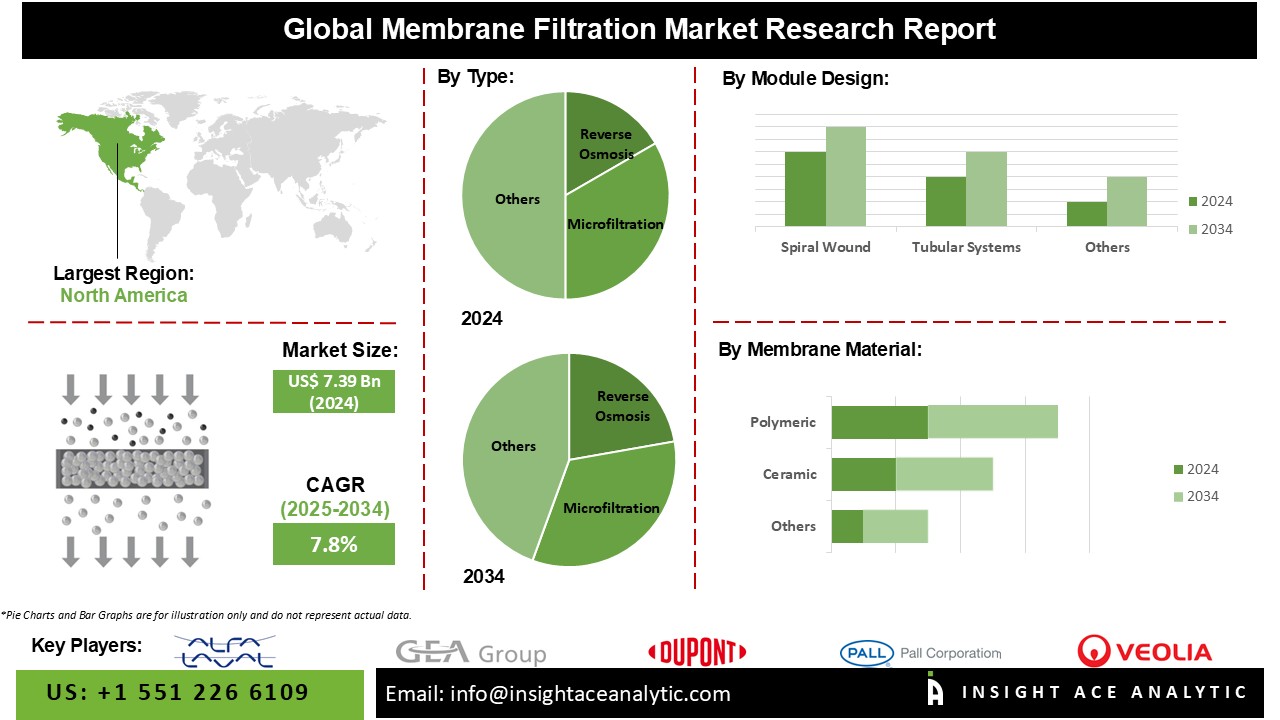

Membrane Filtration Market Size is valued at USD 7.39 Bn in 2024 and is predicted to reach USD 15.44 Bn by the year 2034 at a 7.8% CAGR during the forecast period for 2025-2034.

Membrane filtration (MF) is a pressure-driven separation method that uses a membrane to mechanically and chemically sieve particles and macromolecules. The food and beverage industries extensively use membrane filtering systems for various applications, including wastewater purification, sterilization, concentration operations, and separation.

Clean drinking water treated using a membrane filtering method is available and is projected to contribute to the market's growth in the future years. Many sectors, including the food and dairy sectors and the chemical processing sectors, use membrane filtering. This process is so effective that it can recycle the old water used in the pharmaceutical industries and remove any organic debris and germs from the drinking water. Different-sized molecules can be efficiently separated by applying pressure on each side of a membrane. Furthermore, especially important for the long-term viability of wine and beer, membrane filtration aids in product stabilization by removing unwanted particles, leading to enhanced clarity and stability.

However, the market growth is hampered by the strict regulatory criteria for the safety and health of the membrane filtration market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity of membrane filtration. Accumulation of chemicals on membrane surfaces and within membrane holes is possible. This is a risk of introducing even more contaminants into the water or product that the membrane is filtering. Because of this, membrane filtering performance will suffer.

Membrane fouling describes this problem, resulting in spoiled water or goods. Damage to the system or equipment that uses the water or product will occur due to the quality change brought on by the membrane filtering. Because of this, it is one of the most difficult aspects of the membrane filtering industry to overcome. The COVID-19 outbreak significantly impacted the membrane filtration industry. Regulations on personal space and the lockout imposed by the government affect this sector. The outbreak will eventually affect the growth of this market.

The membrane filtration market is segmented based on Type, Membrane Material, Application, and Module Design. By Type, the segment is divided into Reverse Osmosis, Microfiltration, Ultrafiltration, and Nanofiltration. According to Module Design, the market is segmented into Spiral Wounds, Tubular Systems, Plate & Frame and Hollow fibre. As per the Membrane Material segment, the market is divided into Ceramic and Polymeric. The Application segment includes Dairy Products (Liquid Milk (Milk Protein Fractionation, Milk Pre-Concentration, Milk Concentration, Water Recovery), Other Dairy Products (Whey, Milk and whey-based ingredients, Cheese)), Drinks and concentrates, Wine & Beer, Other Food & Beverage Applications).

The Wine and beer membrane filtration market is expected to lead with a major global market share in 2024. Wine and beer benefit bone health by increasing bone density and decreasing the likelihood of bone illnesses like osteoporosis.

The plate & frame industry makes up the bulk of membrane filtration usage because of the frame and plate's small footprint, strong adaptability to materials, simple design, easy operation, stable operation, and straightforward maintenance for a wide range of small and medium-sized sludge dewatering projects, especially in countries like the US, Germany, the UK, China, and India.

The North American membrane filtration market is expected to record the maximum market share in revenue in the near future. This can be attributed to the great need for membrane filtration in the food industry to accommodate rising numbers of people. Due to the rising population, there is a greater need for long-term water purification systems. In addition, Asia Pacific is estimated to grow rapidly in the global membrane filtration market, attributed to the region's large industrial base and the rising demand for ultrafiltration from the region's pharmaceutical and food and beverage industries. Increased government efforts to attract investments from multiple foreign companies are expected to fuel rapid expansion of the APAC ultrafiltration market over the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 7.39 Bn |

| Revenue Forecast In 2034 | USD 15.44 Bn |

| Growth Rate CAGR | CAGR of 7.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Membrane Material, By Application, By Module Design |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), DuPont (US), Pall Corporation (US), Veolia (France), 3M (US), Pentair (US), Porvair Filtration Group (UK), Donaldson Company, Inc. (US), MMS Membrane Systems (Switzerland), Koch Separation Solutions (US), ProMinent (Germany), SPX Flow (US), Hydranautics- A Nitto group Company (Japan), Synder Filtration Inc. (US), TORAY INDUSTRIES, INC. (Japan), MANN+HUMMEL (Germany), Graver Technologies (US), Critical Process Filtration Inc. (US), Novasep (France), Nilsan Nishotech Systems Pvt. Ltd (India), Applied Membranes, Inc. (US), ZwitterCo (US), Membrane Solutions (Nantong) (China), Membrane System Specialists, Inc. (US), Imemflo (Germany) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Application

By Module Design

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.