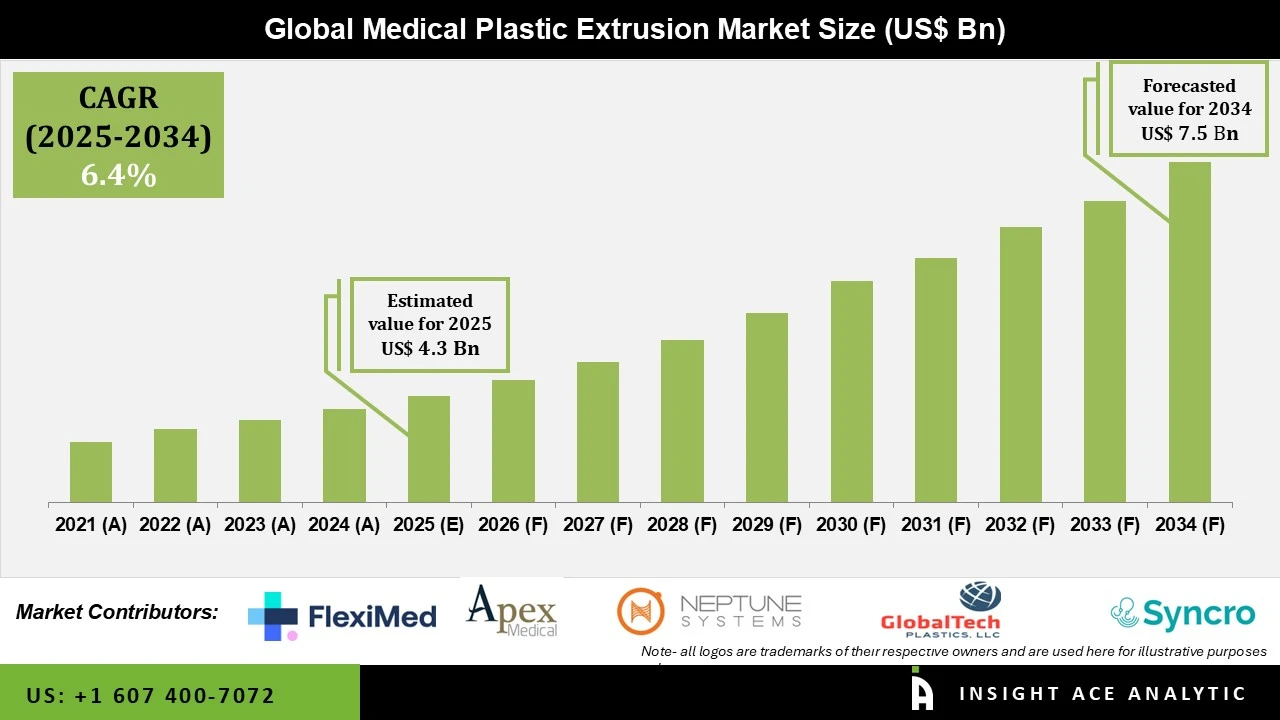

Global Medical Plastic Extrusion Market Size is valued at USD 4.3 Bn in 2024 and is predicted to reach USD 7.5 Bn by the year 2034 at a 6.4% CAGR during the forecast period for 2025 to 2034.

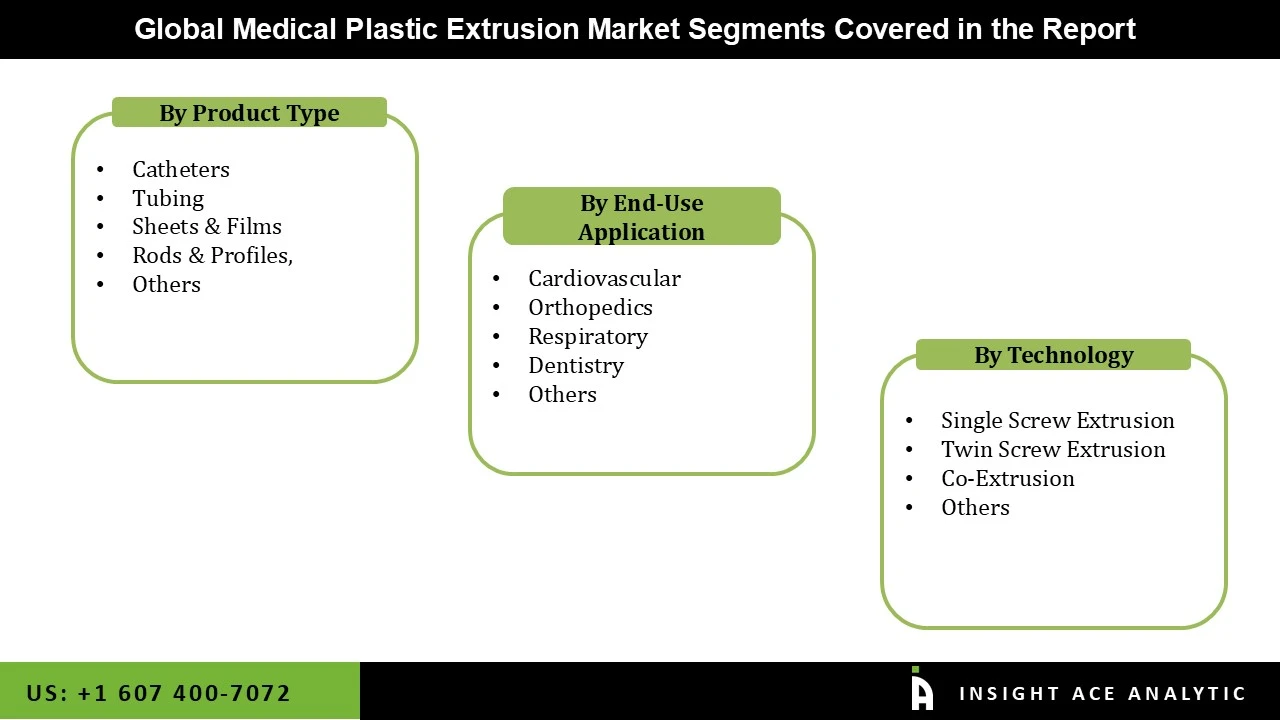

Medical Plastic Extrusion Market Size, Share & Trends Analysis Distribution by Type (Catheters, Sheets & Films, Tubing, Rods & Profiles, and Others), Technology (Co-Extrusion, Single Screw Extrusion, Twin Screw Extrusion, and Others), End-user (Cardiovascular, Respiratory, Dentistry, Orthopedics, and Others), and Segment Forecasts, 2025 to 2034

Medical plastic extrusion is a specialized manufacturing process that creates a range of medical devices and components by shaping Plastic materials into continuous profiles. To create precise shapes like tubes, catheters, and sheaths, medical-grade plastics like PVC, polyethylene, and polypropylene are melted and forced through a die that has been carefully made. High accuracy and consistency, which are essential for medical applications with tight tolerances and products that must meet strict safety and regulatory requirements, are provided by the extrusion method. The medical plastic extrusion market is seeing tremendous growth as a result of the increased need for sterilizable, biocompatible, and lightweight medical components, especially in applications such as intravenous tubing, catheter-based therapies, and diagnostic packages.

Additionally, the need for better medical devices has increased due to the growing incidence of chronic illnesses worldwide, which has increased the demand for medical plastic extrusion solutions. In order to address worries about medical waste, the market is also seeing innovation in more ecologically friendly materials. Furthermore, the strict rules from organizations like the FDA and ISO standards guarantee the quality and safety of products, impacting the selection of materials and production methods. Thus, the market is anticipated to rise steadily due to the demand for minimally invasive treatment choices, improved healthcare infrastructure, and technological advancements. In addition, the need for sterile, long-lasting, and lightweight plastic medical supplies is also being increased by the growing number of surgeries and long-term care requirements among the elderly. Consequently, the market for medical plastic extrusion is being driven by the world's aging population.

In addition, the medical plastic extrusion industry is seeing an increase in small-batch production and customization, which facilitates speedier prototyping and the introduction of novel medical equipment. Specialized tubing, catheters, and packaging solutions are in high demand due to the growth of tailored medication and diagnostic equipment. Additionally, producers are under pressure to innovate in extrusion materials and finishes because of regulatory agencies' emphasis on traceability and sterilizing considerations. However, the medical plastics extrusion market has significant limitations despite its benefits. The high expense of cleanroom production facilities and precision tooling is one of the main obstacles. Small-scale manufacturers find it challenging to enter the market due to these infrastructure needs.

Driver

Growing Older People and the Burden of Chronic Illnesses

The medical plastics extrusion market is growing due in large part to the worldwide increase in the elderly population and related chronic illnesses. The rising frequency of chronic illnesses, including diabetes, respiratory problems, and cardiovascular disease, which necessitate regular use of medical equipment and continuous clinical intervention, is intimately linked to this demographic transition. Hospital, home care, and ambulatory settings are constantly in need of products like intravenous (IV) lines, peripherally inserted central catheters (PICCs), drainage tubing, and respiratory circuits, which are mostly manufactured utilizing precision plastic extrusion. The increased rates of orthopedic implants, surgeries, and rehabilitation services—all of which significantly depend on long-lasting and sterile extruded plastic components—are another effect of aging populations. Additionally, the need for single-use, patient-friendly devices that lower infection risks and enhance treatment compliance is rising due to the global expansion of long-term care and eldercare facilities.

Restrain/Challenge

High Cost of Material

The medical plastics extrusion market may be significantly hampered by high material costs. Due to the strict regulations they must adhere to to guarantee safety and biocompatibility, medical-grade plastics, including polyvinyl chloride (PVC), polyethylene, and polypropylene, are sometimes expensive. Production expenses are increased because these plastics must adhere to strict medical regulations. Because of this, manufacturers can find it difficult to maintain profitability while satisfying consumer demand for reasonably priced, high-quality medical products. Additionally, the use of sophisticated extrusion technologies—which are necessary for the manufacture of complex medical components like catheters, tubing, and other healthcare devices—may be restricted by rising material costs. Smaller firms may find it difficult to cover the higher costs of premium raw materials, which would reduce their ability to compete in the market. Furthermore, these high costs could be transferred to healthcare providers, increasing the cost of medical equipment and decreasing patient affordability.

The catheters category held the largest share in the Medical Plastic Extrusion market in 2024 because the performance, comfort, and safety of catheters are largely dependent on extruded polymer tubing. The need for a variety of catheter types (guiding, diagnostic, central venous, urinary, and specialty catheters) is growing due to rising procedure volumes, particularly in cardiovascular, urology, neurovascular, dialysis, and critical care. Each type of catheter requires precise dimensional tolerances and multi-layer constructions. The trend toward minimally invasive and image-guided interventions, which employ more single-use catheter-based devices and increase the usage of precision-extruded shafts, liners, and jackets, is another factor contributing to the expansion. Additionally, OEMs are forced to work with specialized extrusion partners who can produce high-consistency, validated products due to ongoing regulatory and quality requirements. This encourages outsourcing and maintains the demand for high-precision medical-grade extruded catheter tubing.

In 2024, the Single Screw Extrusion category dominated the Medical Plastic Extrusion market, driven by its affordability, ease of use, and capacity to consistently deliver high-quality products. A variety of medical items, such as films, sheets, and tubes, are made using the popular single screw extrusion process. The technology makes it possible to process a variety of materials, including PVC, polyethylene, and polypropylene, efficiently. Additionally, firms seeking to produce high-quality medical items at scale will find the single screw extrusion technique perfect due to its simplicity, particularly in situations where accuracy and consistency are critical. Furthermore, it is an extremely economical production method, which is crucial in the cutthroat market for medical device manufacture. Therefore, in medical plastic extrusion, single screw extrusion continues to be the leading technology.

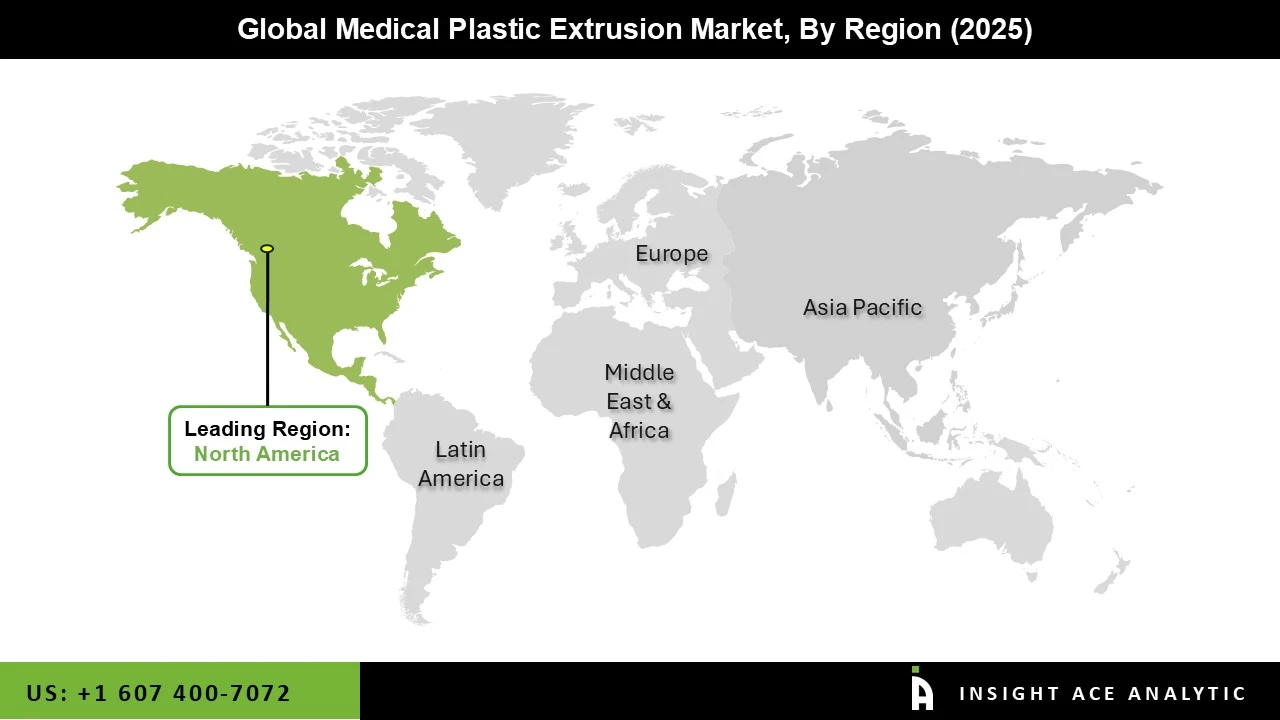

The Medical Plastic Extrusion market was dominated by the North America region in 2024 due to the region's robust demand for pharmaceuticals and medical devices, as well as its well-established healthcare infrastructure. With a sizable number of manufacturers and end users in the medical industry, the United States, in particular, contributes significantly to the market.

Additionally, the demand for plastic extrusion goods used in medical applications is increased by the presence of top pharmaceutical businesses, medical device companies, and healthcare facilities in the area. Furthermore, North America is anticipated to keep its leading position in the medical plastic extrusion market as long as the area keeps investing in infrastructure and healthcare innovation.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 4.3 Bn |

| Revenue forecast in 2034 | USD 7.5 Bn |

| Growth Rate CAGR | CAGR of 6.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025 to 2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Technology, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | MedPlast Technologies, PrimeFlex Plastics, PolyMed Extrusions, Neptune Extrusion Systems, Extruded Medical Solutions Inc., Viridian Medical Components, Radiate Polymers, FlexiMed Extrusion Corp., BioTube Manufacturing, Apex Medical Plastics, Global MedTech Plastics, and SyncroMed Polymers. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.