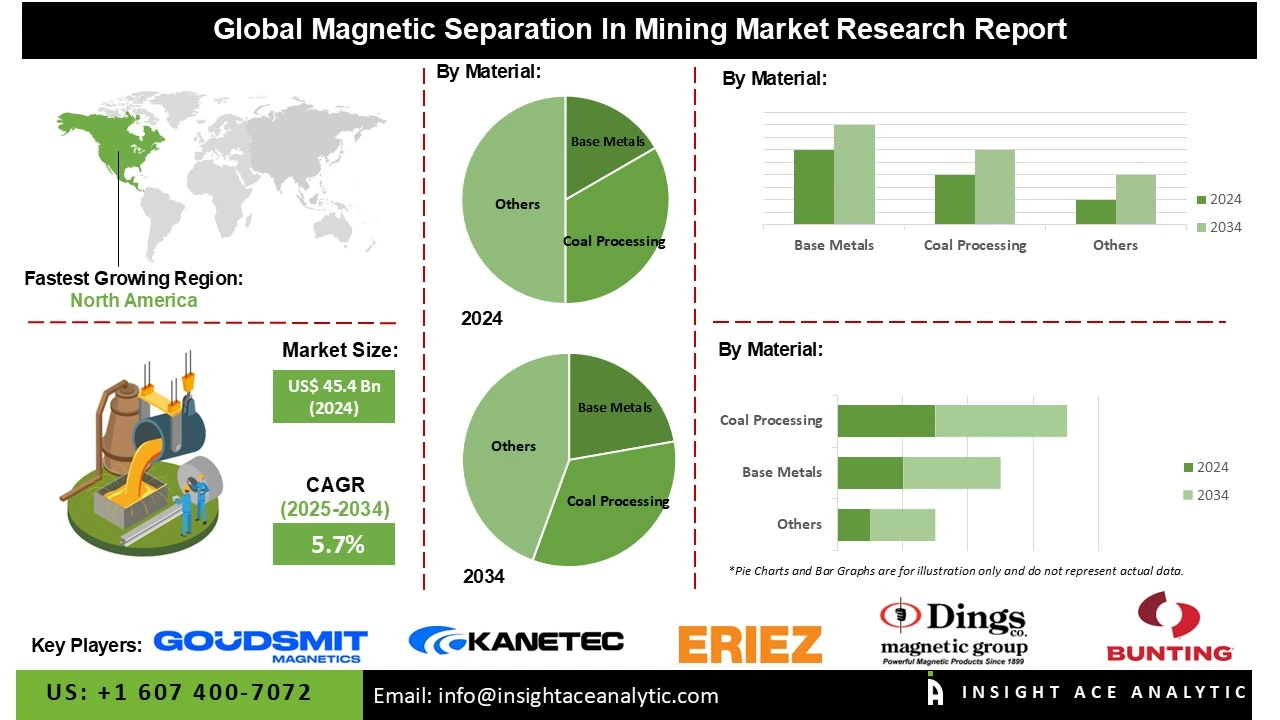

Magnetic Separation In Mining Market is valued at US$ 45.4 Bn in 2024 and it is expected to reach US$ 77.5 Bn by 2034, with a CAGR of 5.7% during the forecast period of 2025-2034.

Magnetic separation is a mineral processing technique that uses magnetic forces to separate materials based on their magnetic properties. It effectively extracts valuable magnetic minerals from non-magnetic waste materials in mining operations. Magnetic separation has established itself as a cornerstone technology in modern mineral processing, valued for its precision in recovering valuable minerals from increasingly complex and lower-grade ore bodies.

The technology plays a critical role in supplying consistent, high-quality feedstock to essential downstream industries, including steel manufacturing, battery production, and catalyst development. Recent technological advances, particularly the development of high-gradient and superconducting magnetic separators, have significantly enhanced the ability to process fine or weakly magnetic minerals that were previously unrecoverable with conventional equipment. These innovations are extending mine operational lifespans, improving overall resource recovery, and supporting more sustainable practices through reduced waste generation.

The continued evolution of magnetic separation technology represents a key driver in its growing adoption across the mining sector. As mining companies face persistent challenges related to declining ore grades and operational cost pressures, these advanced separation methods provide essential solutions for maintaining processing efficiency and economic viability.

The technology's importance is particularly evident in major mining regions such as the Asia Pacific, where it supports substantial iron ore production operations. While the significant capital investment required for advanced magnetic separation systems can present challenges for small and mid-sized mining operations, the ongoing integration of real-time monitoring, artificial intelligence, and data-driven control systems is creating new opportunities for enhanced performance and broader accessibility across the industry.

Some of the Key Players in the Magnetic Separation In Mining Market:

The magnetic separation in mining market is segmented by material. By material, the market is segmented into iron ore & magnetite beneficiation, base metals, coal processing, industrial minerals, and others.

The largest and fastest-growing material is iron ore & magnetite beneficiation, a trend driven by the growing demand for premium iron ore used in steel production worldwide. As steel production grows in nations that are developing, like China, Brazil, and India, mining companies swiftly embrace advanced magnetic separation procedures to improve ore purity and recovery rates. Due to the depletion of readily available high-grade deposits, miners are now more motivated to concentrate on beneficiation techniques that can effectively extract iron content from low-grade ores, cutting waste and increasing total operational yield.

Asia Pacific dominated the magnetic separation in mining market in 2024. This is due to the rising demand for iron ore beneficiation in China, India, and Australia. As ore grades continue to decline, miners are relying on magnetic separation systems to upgrade material quality for steelmaking efficiently. This growing emphasis on beneficiation is directly boosting the adoption of advanced magnetic separation technologies. The region’s dominance in iron ore production and consumption is reinforcing this demand, as steel manufacturers seek consistent high-grade feedstock for expanding infrastructure and construction activities.

With magnetic separation, mining services are in high demand, becoming more and more common in the North American area. The magnetic separation in the mining industry in North America is expanding steadily, driven by the growing focus on mineral beneficiation and the modernization of mining operations in the U.S. and Canada. Infrastructure development and renewed domestic mining initiatives are reinforcing this demand across the region.

· In Feb 2024, Eriez introduced its new "Xpress" line of magnetic separators, designed for rapid deployment and easy installation. The pre-engineered, modular units aim to reduce downtime during plant upgrades or expansions. This solution addresses the need for flexible and quick-to-implement processing solutions in active mining operations, enhancing operational efficiency.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 45.4 Bn |

| Revenue Forecast In 2034 | USD 77.5 Bn |

| Growth Rate CAGR | CAGR of 5.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Material, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Bunting Magnetics Co., Dings Magnetic Group, Eriez Manufacturing Co., Goudsmit Magnetics Group, Kanetec Co., Ltd., LONGi Magnet Co., Ltd., Metso Outotec Corporation, Multotec Pty Ltd., SLon Magnetic Separator Ltd., STEINERT GmbH, and Illumina, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Magnetic Separation In Mining Market by Material-

· Iron Ore & Magnetite Beneficiation

· Base Metals

· Coal Processing

· Industrial Minerals

· Others

Magnetic Separation In Mining Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.