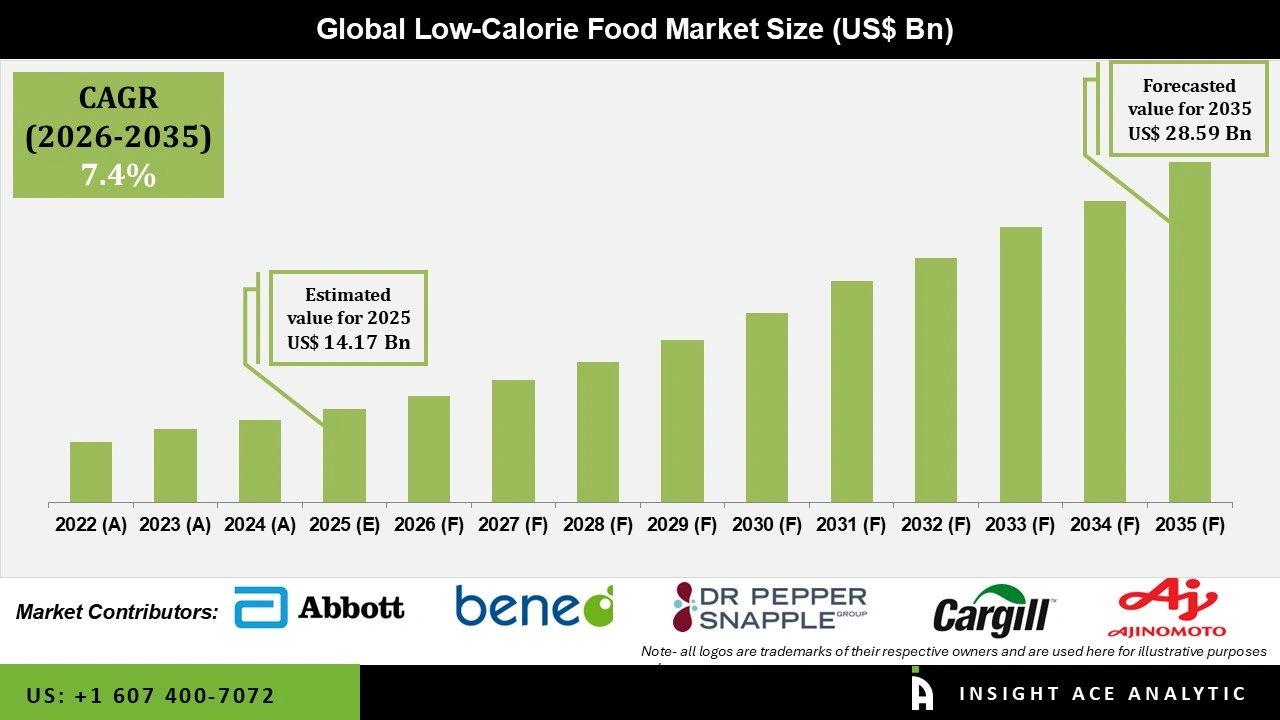

Global Low-Calorie Food Market Size is valued at USD 14.17 billion in 2025 and is predicted to reach USD 28.59 billion by the year 2035 at an 7.4% CAGR during the forecast period for 2026 to 2035.

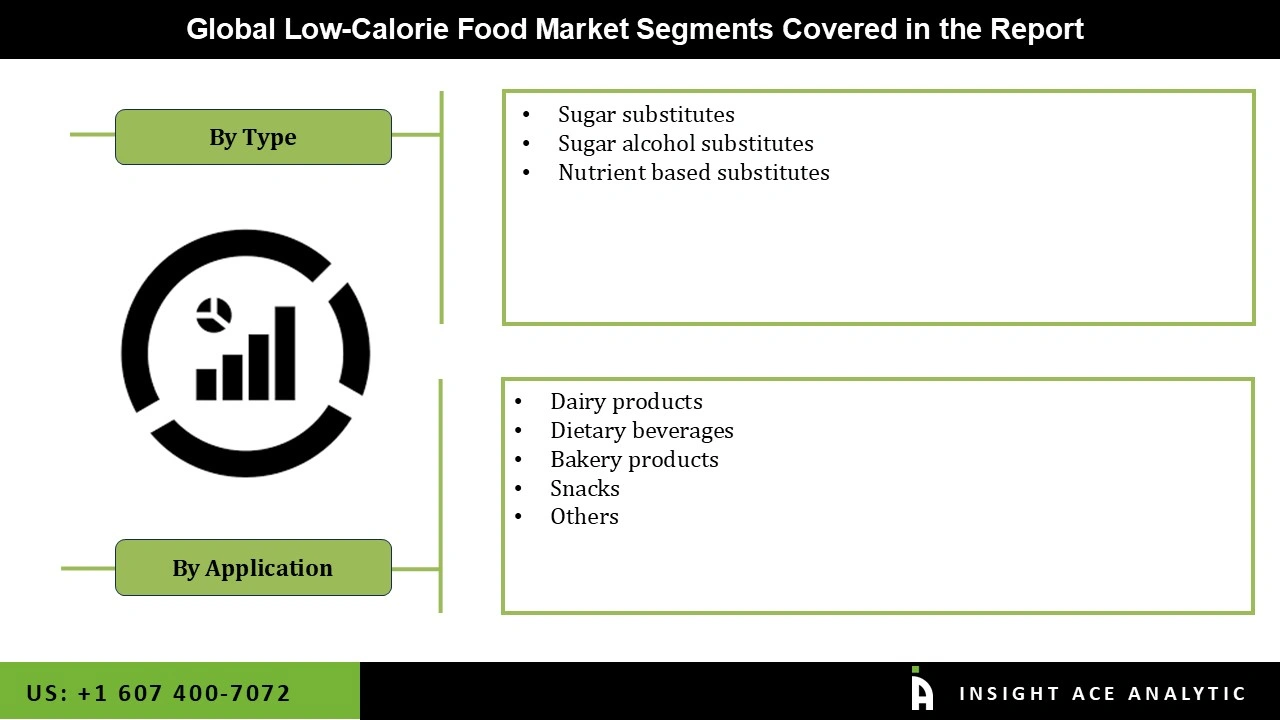

Low-Calorie Food Market Size, Share & Trends Analysis Report By Type (Sugar Substitutes, Sugar Alcohol Substitutes And Nutrient-Based Substitutes) And Application (Dairy Items, Dietary Beverages, Bakery Items, Snacks, And Others), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

A very low-calorie diet called a tractor-trailer or crash diet calls for little to no daily nutritional energy. Since it is restricted to 800 kilocalories or less per day, it is occasionally called a fad diet. The main market opportunity is the wide range of low-calorie products, constantly expanding. For people with diabetes and specific health conditions, low-fat or high-calorie products were developed but expensive. Consumer demand for low-fat or calorie items has rapidly increased to reduce health risks, reduce or stabilize weight, and adhere to a healthy diet.

Due to rising health consciousness among consumers worldwide, the global market for low-calorie foods is anticipated to expand significantly over the following years. Demand for foods with reduced fat content has increased due to the rise in obesity, diabetes, and cardiovascular diseases over the past ten years, which is likely to drive market demand.

Consumer lifestyle changes and rapid urbanization, particularly in emerging nations like China, India, Brazil, and Mexico, are predicted to be significant market growth drivers. However, the market is anticipated to be constrained over the projected period due to the potential health risks associated with sugar substitutes and ready-to-eat processed food items. Low-calorie foods provide various physiological and psychological advantages, such as helping people lose weight, control their diabetes, and reduce the dangers associated with obesity, which are expected to play a significant role in their rising appeal to consumers.

The global low-calorie food market is segmented based on type and application. Based on product, the market is segmented as sugar substitutes, sugar alcohol substitutes and nutrient-based substitutes. By application, the market is segmented into dairy items, dietary beverages, bakery items, snacks, and others.

The sugar substitutes category will hold a significant share of the global low-calorie food market in 2021. Sugar substitutes have fewer calories than traditional sugar, and most health-conscious consumers favor them. The use of sugar substitutes benefits consumers who are concerned about their health. For instance, using sugar substitutes can help in managing diabetes and weight. Diet drinks do not raise blood sugar levels because they are not carbohydrates. A teaspoon of sugar comprises about 15 calories, compared to nearly none in sugar substitutes.

The dietary beverages segment is projected to grow rapidly in the global low-calorie food market. As people's health problems worsen, low-calorie food and beverage products are essential to assist them in maintaining a balanced diet. Most health-conscious consumers prefer sugar alternatives because they have fewer calories than regular sugar. Individuals who are concerned about their health benefit from using sugar replacements. Utilizing sugar replacements, for instance, can assist with diabetes care and weight. Since diet beverages don't include carbohydrates, they don't cause blood sugar levels to rise. Compared to sugar alternatives, which have almost no calories, a sugar-based teaspoon has roughly 15 calories., especially in countries such as the US, Germany, the UK, China, and India.

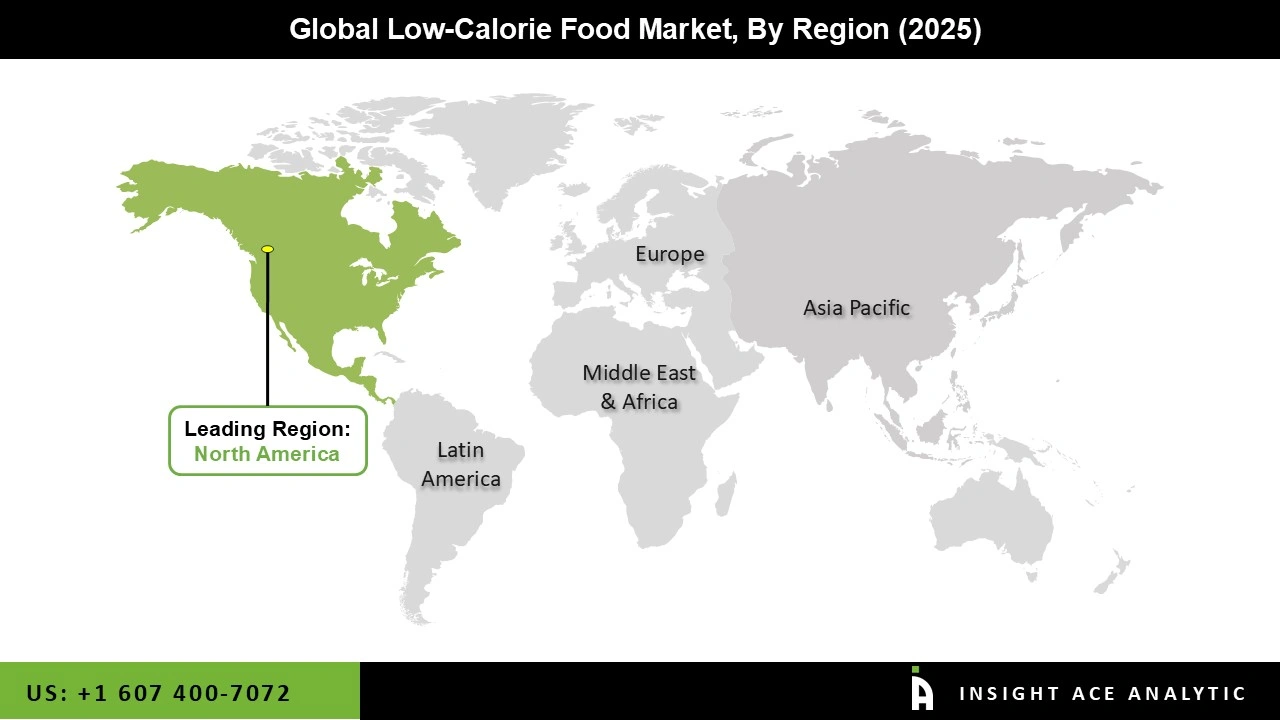

The North America global low-calorie food market is expected to register the highest market share in revenue soon. Growing consumer awareness of health will hasten the adoption of a happier life and fuel the market for low-calorie foods. Due to a rise in the popularity of healthy activities like yoga, working out at the gym, and eating nutritious food, there is a rising demand for low-calorie cuisine. As obesity rates rise, low-calorie meals are also growing in popularity. Two adults are overweight out of every three, on average.

Rising health concerns will drive the market in the North American region. According to projections, the US market for low-calorie food will be the most significant worldwide. In addition, Asia Pacific is projected to grow rapidly in the global Low-Calorie Food market. The changing lifestyles of consumers and rising health concerns have led to growth in the Asia Pacific market. The area's market is changing dramatically due to changing dietary preferences, growing urbanization, and free trade rules in the food sector.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 14.17 Bn |

| Revenue forecast in 2035 | USD 28.59 Bn |

| Growth rate CAGR | CAGR of 7.4% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Abbott Laboratories, Ajinomoto U.S.A. Inc., Beneo Group, Bernard Food Industries, Cargill, Dr Pepper Snapple Group Inc., DSM, DuPont, Galam Ltd, Grain Processing Corporation , Groupe Danone, Ingredion Incorporated, Keurig Dr Pepper, Inc., McNeil Nutritionals LLC, , Nestle SA, Pepsico Inc., PureCircle, Roquette Frères, Tate & Lyle, The Brooklyn Creamery, The Coca-Cola Company, Zydus Wellness Ltd, and Other Prominent players. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Low-Calorie Food Market By Type

Low-Calorie Food Market By Application

Low-Calorie Food Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.