Global Lithium Mining Market Size is valued at USD 419.6 Mn in 2024 and is predicted to reach USD 839.1 Mn by the year 2034 at an 7.3% CAGR during the forecast period for 2025-2034.

The process of lithium mining is used to extract metal from a variety of sources, including brines and hard rocks. It is a solid element and the lightest metal ever discovered by nature. Its high energy density, thermal resistance, extended durability, and low maintenance requirements positively influence the market. As a result, they have a wide range of uses, including in manufacturing batteries, glass, grease, and air conditioning systems.

The rising demand for lithium-based batteries for electric vehicles is to blame for the market's expansion. Market expansion is anticipated to be aided by rising global demand for EVs, supported by programs to reduce carbon emissions. Additionally, it is anticipated that increased public-private investment in the mining sector will promote market expansion.

Another essential element anticipated to fuel market expansion is the rising sales of battery-powered electric vehicles (BEVs). The International Energy Agency (IEA) reports that 2,008,024 BEVs were sold globally in 2020, an increase from the 1,542,867 vehicles sold in 2019. The adoption of clean fuel to reduce vehicle pollution is becoming increasingly popular, which is expected to boost market expansion.

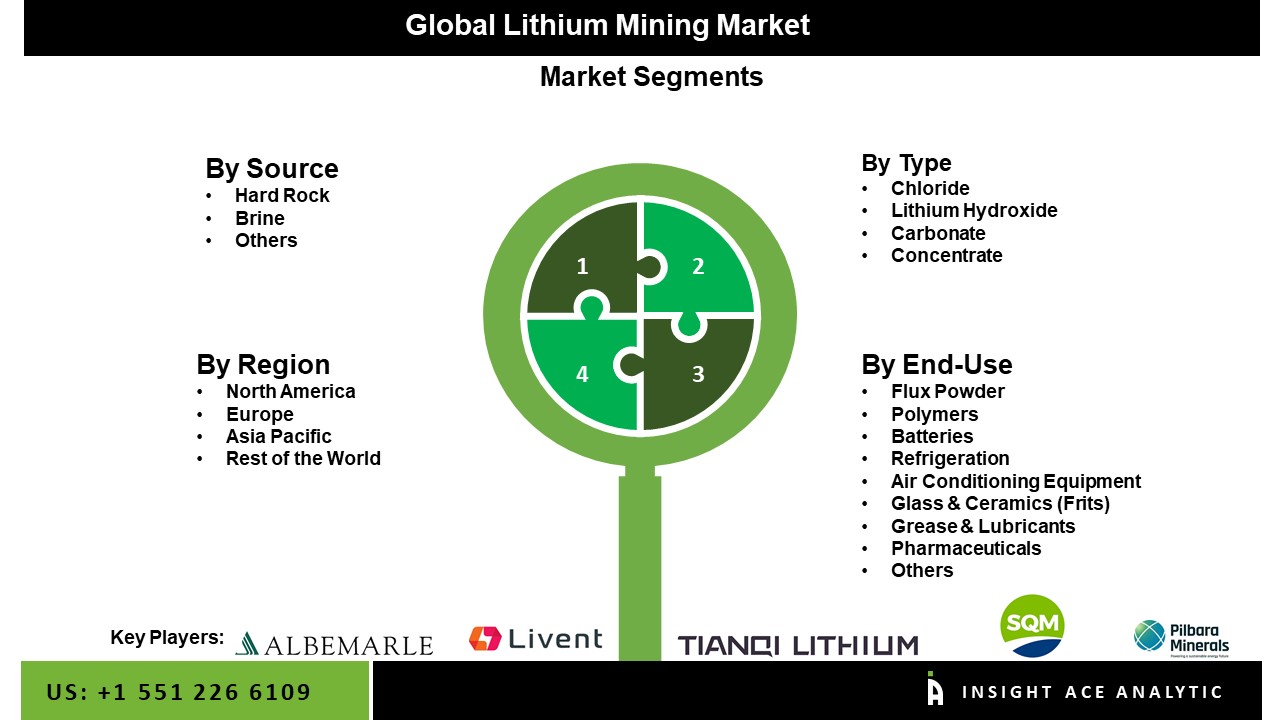

Market Segmentation:

The lithium mining market is segmented on the source, type, and end-use. Based on the source, the market is segmented into hard rock, brine and others. Based on type, the lithium mining market is segmented into chloride, lithium hydroxide, carbonate and concentrate. Based on end-use, the lithium mining market is segmented into flux powder, polymers, batteries, refrigeration, air conditioning equipment, glass & ceramics (frits), grease & lubricants, pharmaceuticals and others.

The hard rock category grabbed the highest revenue share, and it is anticipated that it will continue to hold that position during the scheduled time. Due to its extensive output via brines and hard rock mining, lithium carbonate accounts for the majority of mining. It contributes to the bulk of metal produced since it is simple to create. It is widely utilized to address issues connected to mental health in the glass and ceramic industries and the medical field. The concentrate market is also indirectly anticipated to expand as a result of the increased complex rock mining activity around the world. With new technological developments in the brine manufacturing process, a boost in chloride production is anticipated, and this expansion will be very rapid.

The batteries category is anticipated to grow significantly over the forecast period. Lithium-ion batteries' rising popularity is anticipated to fuel this segment's revenue growth. Compared to lead-acid and other lithium batteries, lithium iron phosphate batteries provide a variety of advantages, such as improved discharge and charge efficiency, a longer lifespan, and the ability to deep cycle while maintaining power. These batteries often cost more upfront, but their lifetime expenses are significantly lower. They have a long lifespan and don't need any maintenance, making them an excellent long-term decision. Lithium batteries can also live up to 10 times longer than lead-acid batteries and maintain 80% of their nominal capacity even after 2,000 cycles.

The Asia Pacific lithium mining market is expected to register the highest market share in revenue in the near future because more and more products, like batteries, glass, grease, and air conditioning equipment, are made of lightweight metal. Due to the remarkable qualities that the metal offers, including high efficiency, energy density, and other qualities, the batteries category currently has the lion's share and is predicted to maintain its dominance in the market. In addition, North America is projected to increase in the global lithium mining market because the electrical and electronic sectors are producing more lithium-ion batteries. The market is anticipated to be driven by increasing end-use industry investments throughout the projected period.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 419.6 Mn |

| Revenue forecast in 2034 | USD 839.1 Mn |

| Growth rate CAGR | CAGR of 7.3% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn , Volume (KT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Source, Type, And End-use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Ganfeng Lithium Co., Ltd., Albemarle Corporation, Tianqi Lithium Corp., SQM S.A., Pilbara Minerals Limited, Livent, Orocobre Limited Pty Ltd., Mineral Resources, Lithium Americas Corporation and Piedmont Lithium, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. Find purchase alternatives. |

Segmentation of Lithium Mining Market-

Lithium Mining Market By Source

Lithium Mining Market By Type

Lithium Mining Market By End-Use

Lithium Mining Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.