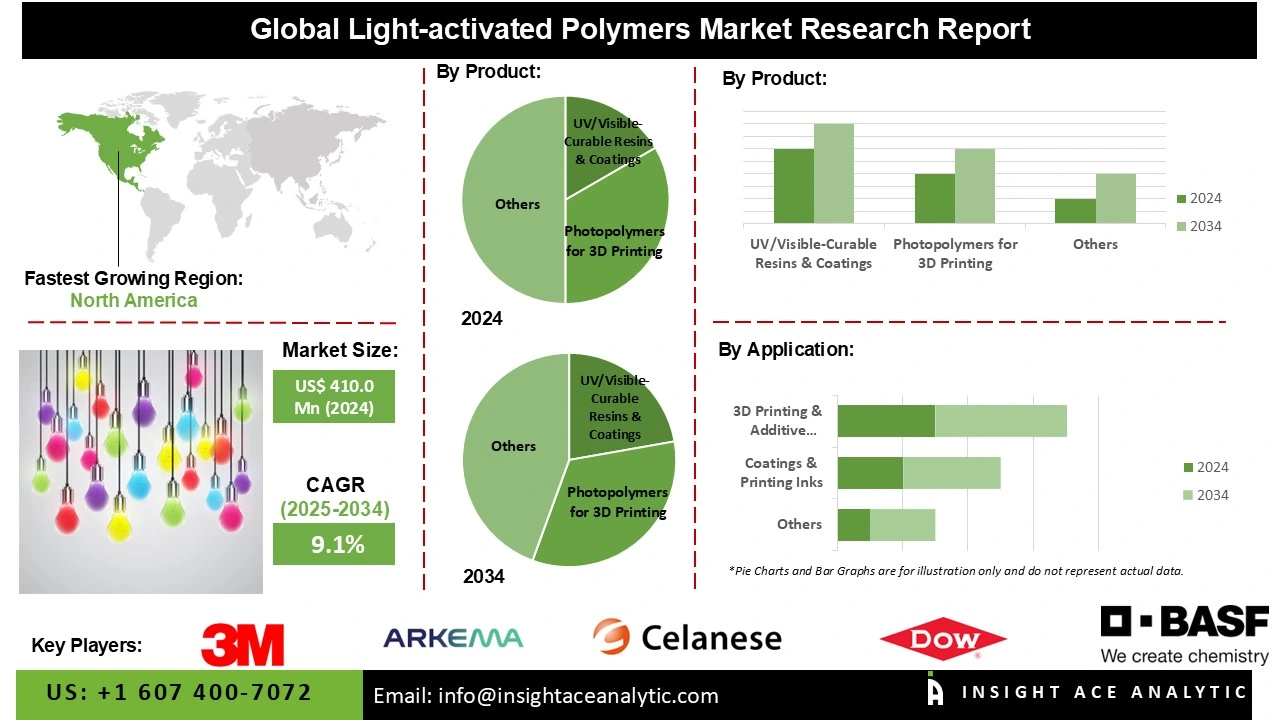

Global Light-activated Polymers Market Size is valued at US$ 410.0 Mn in 2024 and is predicted to reach US$ 970.4 Mn by the year 2034 at an 9.1% CAGR during the forecast period for 2025-2034.

Light-activated polymers allow for exact control over their structure, solubility, or bonding because they react to particular light wavelengths. Drug delivery systems, self-healing materials, and responsive coatings are just a few of the uses for these polymers, which react to external stimuli like light. This integration promotes the products' usability and versatility, which is in line with consumers' increasing desire for sustainable and intelligent materials.

The combination of light-activated polymers with smart materials is anticipated to grow, creating new opportunities for innovation and application as industries look for more effective and flexible solutions. The main advantage of light-activated polymers is that their ability to respond to external stimuli, eliminates the need for extra energy sources and allows greater efficiency in resource usage. The global market for Light-activated Polymers is expanding due to a significant trend towards integration with smart materials, backed by advancements in material science and increasing demand for adaptive solutions.

The growing need for adaptable and sustainable solutions across a variety of sectors is another element propelling the Light-activated Polymers market. The Light-activated Polymers market is expanding because of growing need to innovate is particularly noticeable in industries including electronics, automotive, and healthcare, where there is a push to create high-performing, sustainable products. According to the journal Health Affairs, the average annual growth of National Health expenditures is expected to reach around 5.5% in year 2027 at U.S. However, high development and manufacturing costs of these sophisticated technologies are some of the obstacles impeding the growth of the Light-activated Polymers sector. Over the course of the forecast period, opportunities for the Light-activated Polymers market will be created by expansion into emerging applications, specificaly in fields that need responsive and adaptive materials.

Some of the Key Players in Light-activated Polymers Market:

· 3M

· Arkema

· BASF SE

· Celanese Corporation

· Covestro AG

· Dow Inc.

· Evonik

· Heraeus

· Parker Hannifin

· RTP Company

· Solvay S.A.

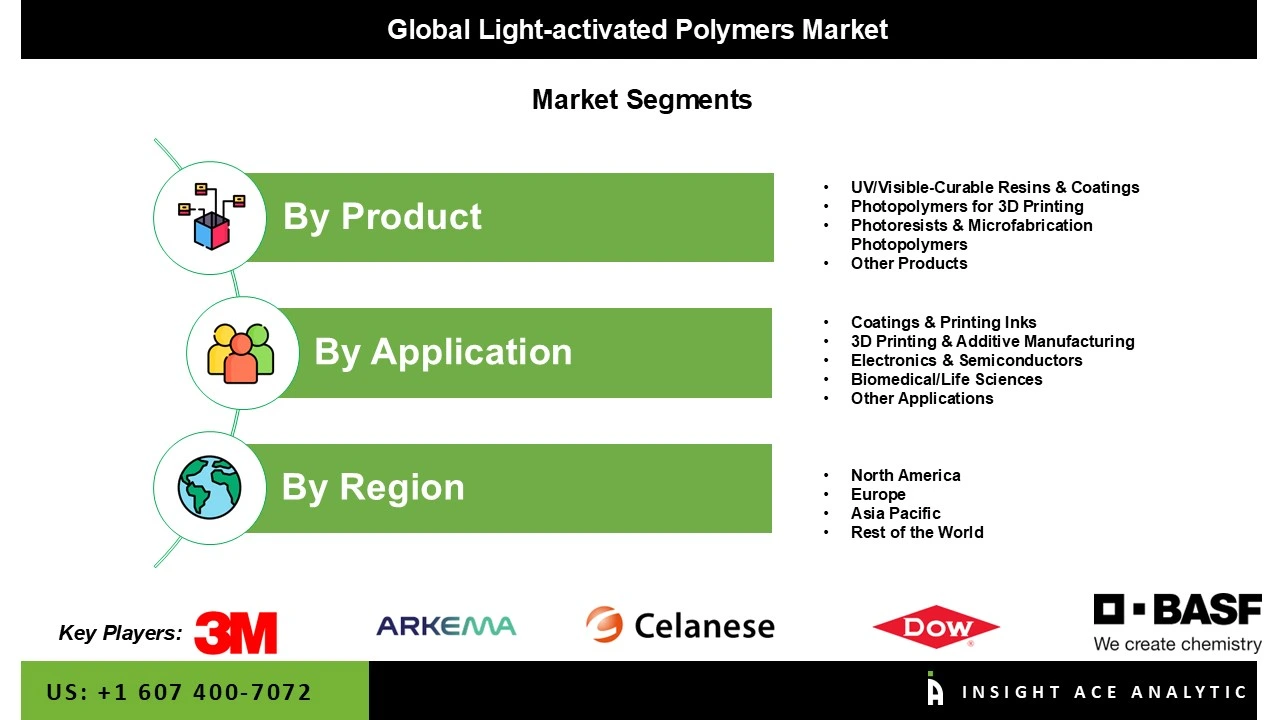

The light-activated polymers market is segmented by product and application. By product, the market is segmented into UV/visible-curable resins & coatings, photopolymers for 3D printing, photoresists & microfabrication photopolymers, and other products. By application, the market is segmented into coatings & printing inks, 3D printing & additive manufacturing, electronics & semiconductors, biomedical/life sciences, and other applications.

The UV/visible-curable resins & coatings category led the light-activated polymers market in 2024. This convergence is driven by their widespread use in industrial coatings, adhesives, inks, and electronics assembly. These polymers undergo rapid curing upon exposure to ultraviolet or visible light, offering high throughput, low energy consumption, and solvent-free processing features increasingly aligned with sustainability regulations and energy-efficiency mandates. As manufacturing shifts toward faster and cleaner curing technologies, UV-curable systems capture share from thermal and solvent-based alternatives.

The largest and fastest-growing application is coatings & printing inks. Instant curing, high gloss, abrasion resistance, and solvent-free processing are made possible by these materials, primarily UV- and visible-curable resins, which align with the growing sustainability criteria in the production of consumer and industrial goods. Automotive clearcoats, wood finishes, packaging, and commercial printing are industries with the highest adoption rates, as quick curing results in increased throughput and lower volatile organic compound emissions.

North America dominated the light-activated polymers market in 2024. The United States is at the forefront of this expansion. A robust infrastructure for research and development in North America, particularly in the United States, fosters innovation in light-activated polymers. The region is at the forefront of manufacturing novel materials, backed by major investments in academic research, government-funded projects, and an established network of prominent polymer manufacturers. This setting accelerates the commercialisation of innovative light-responsive polymers for various electronic, medical, and environmental applications. The collaboration between academic institutions and business leaders fuels North America's market dominance.

With rapid development and urbanisation becoming increasingly common in the Asia-Pacific region, the light-activated polymers market is expanding at the strongest and fastest rate in this area. Additionally, the region's growing urban landscape and industrial base foster an atmosphere that is favourable to the broad use of these cutting-edge materials. Rapid infrastructure development in nations like China and India is driving up demand for cutting-edge materials in the building, electronics, and automotive sectors. Light-activated polymers are appealing options for these expanding industries because they offer benefits such as energy efficiency, durability, and flexibility.

Light-activated Polymers Market by Product-

· UV/Visible-Curable Resins & Coatings

· Photopolymers for 3D Printing

· Photoresists & Microfabrication Photopolymers

· Other Products

Light-activated Polymers Market by Application-

· Coatings & Printing Inks

· 3D Printing & Additive Manufacturing

· Electronics & Semiconductors

· Biomedical/Life Sciences

· Other Applications

Light-activated Polymers Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.