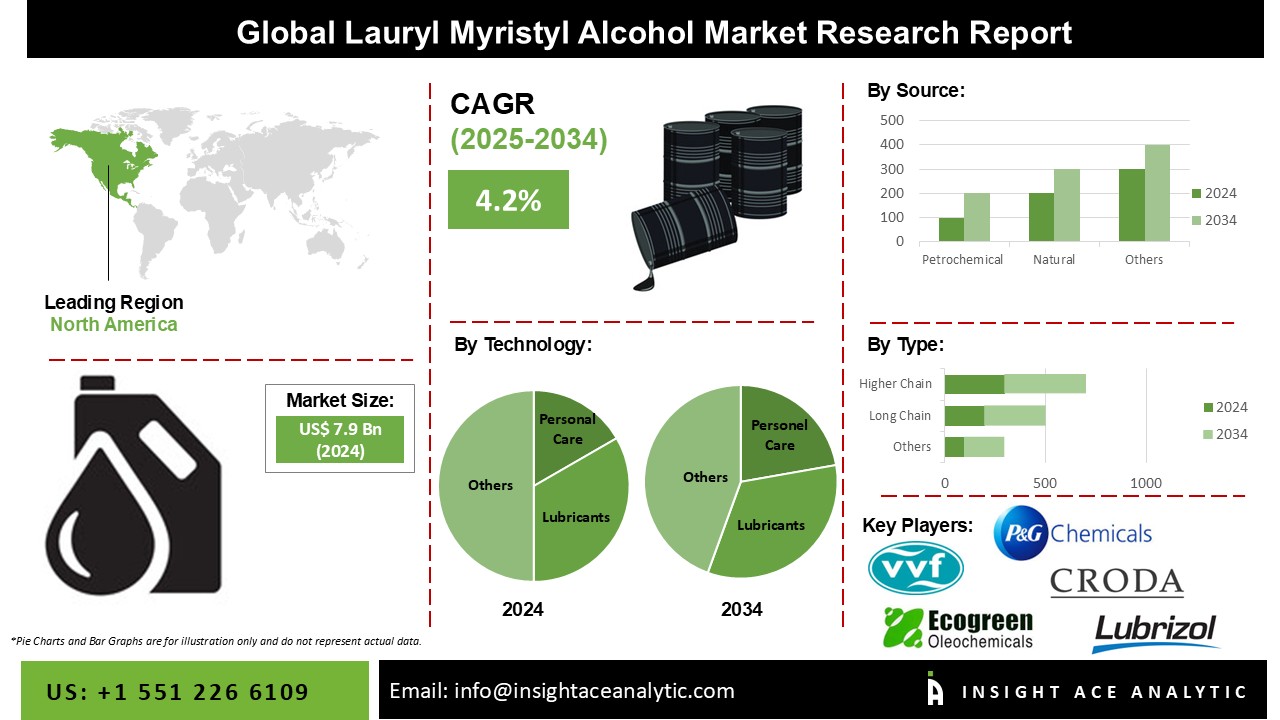

Lauryl Myristyl Alcohol Market Size is valued at USD 7.9 Bn in 2024 and is predicted to reach USD 11.8 Bn by the year 2034 at a 4.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Lauryl myristyl alcohol is a fatty alcohol commonly derived from natural oils. It has various applications, including use in cosmetics, pharmaceuticals, as a surfactant, emulsifier, and in industrial processes. It is valued for its emollient properties and ability to mix substances that don't naturally combine, such as oil and water. Growing per capita expenditure on cosmetic items and personal care, as well as rising demand for Lauryl myristyl alcohol from the paint and coatings and oil and gas industries, will likely fuel market expansion during the forecast period. The growing chemical and manufacturing sectors drive the global lauryl myristyl market alcohol. The broad range of applications in numerous industries drives up demand for lauryl myristyl alcohol. Consumers are utilizing more personal care items, which leads to a rise in the use of lauryl myristyl alcohol in cosmetics.

However, the Russia-Ukraine war and the post-COVID-19 pandemic may substantially impact the market for Lauryl Myristyl Alcohol. The current conflict between Russia & Ukraine may impair Lauryl Myristyl Alcohol manufacturing and supply lines, limiting the market growth.

The Lauryl Myristyl Alcohol Market is segmented based on application, source, and type. According to application, the market is segmented as industrial & domestic cleaning, personal care, lubricants, food & nutrition, plasticizers, pharmaceutical formulation, and others. The source segment includes petrochemical and natural. The market is segmented by type into long-chain, higher-chain, short-chain, and mid-cut chain.

The personal care category will majorly share in the global Lauryl Myristyl Alcohol Market in 2022. This expansion can be due to increased demand for personal care goods. Furthermore, the ability of personal care to operate as an emulsion stabilizer and viscosity-increasing agent, allowing items to be spreadable and creamy, has increased its use in personal care and cosmetic goods such as lipstick, sunscreen, and moisturizer, among others. Furthermore, the industrial and home cleaning segment is likely to direct the market owing to the rising preference for natural oils over chemicals.

The natural segment is projected to grow rapidly in the global Lauryl Myristyl Alcohol Market. This expansion can be linked to rising client demand for bio-based products. Natural sources of lauryl myristyl alcohol are environmentally friendly because they are sourced from plant-based sources such as coconut and palm oil. Palm and coconut oils. Fatty alcohols are also found naturally in animal and vegetable sources. Because of their great variety in lauryl chains, vegetable oils serve as traditional sources of fatty alcohol and are more prevalent in some applications than animal sources. As a result, these carbon chains are extremely beneficial in cleaning detergents. Furthermore, the petrochemical segment is expected to dominate the market due to rising customer demand for ecologically friendly and sustainable goods.

The North American lauryl Myristyl Alcohol Market is expected to record the maximum market share in revenue shortly. Owing to the increasing requirement in the food and cosmetic industries, North America dominates the lauryl myristyl alcohol market. Furthermore, the increasing prevalence of online retailing firms for chemicals and materials, particularly in emerging markets, is aiding expansion throughout the projection period.

However, the growing demand for lauryl myristyl alcohol in North America is due to its popularity in the cosmetics sector and its capacity to give various benefits, including increased foam stability, emollience, and viscosity control. Due to the rapid adoption of low-foaling detergents and cleaners, Asia Pacific is predicted to expand the fastest during the projection period. Furthermore, a tremendous increase in industrial production and chemical synthesis, particularly in China and the Indian subcontinental countries, is occurring.

Recent Developments:

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 7.9 Bn |

| Revenue Forecast In 2034 | USD 11.8 Bn |

| Growth Rate CAGR | CAGR of 4.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (KT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Source, By Type, By Application, |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | VVF LLC, Lubrizol Corporation, Croda International Plc., Dow Chemical Company, Eco Green Oleo chemicals, MSD OLEO FZC, Wilmar International Ltd., Procter & Gamble, Wall Chemie GmbH, The Lubrizol Corporation, Azelis Americas LLC, PT. Ecogreen Oleochemicals, BASF Care Creations, Godrej Industries Limited (Chemicals), Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Lauryl Myristyl Alcohol Market By Application-

Lauryl Myristyl Alcohol Market By Source-

Lauryl Myristyl Alcohol Market By Type-

Lauryl Myristyl Alcohol Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.