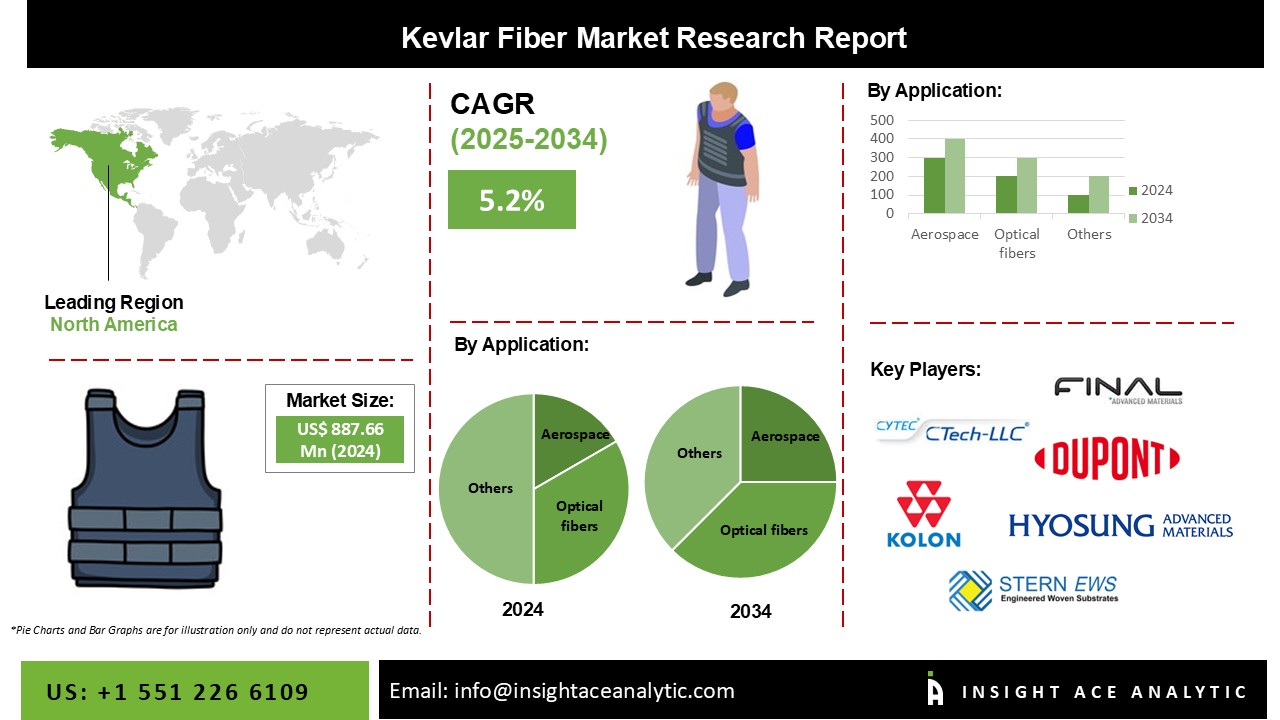

Kevlar Fiber Market Size is valued at 487.66 million in 2024 and is predicted to reach 801.82 million by the year 2034 at an 5.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

The fiber kevlar, which belongs to the family of aliphatic polyamides, combines high stiffness, tensile physical, durability, and thermal stability. Due to strict government requirements regarding worker safety, kevlar fiber market expansion is propelled by rising product consumption from various industries, including healthcare, oil & gas, manufacturing, and others.

Many nations' rising defense expenditures and the aerospace industry's rising need for kevlar fiber are anticipated to fuel the market's expansion. The market, gained from a significant rise in market growth from the medical industry. A rise in drilling activities both onshore and offshore, as well as the development of the shale oil and gas industry, are predicted to enhance demand for the product.

Additionally, as a result of temporary production halts in end-user industries like automobiles, aircraft, and semiconductors during the pandemic scenario, there was a decrease in the requirement for kevlar fiber-based products, which in turn had a negative influence on the demand. However, governmental limitations led to the temporary closure of many different industries, reducing the product market.

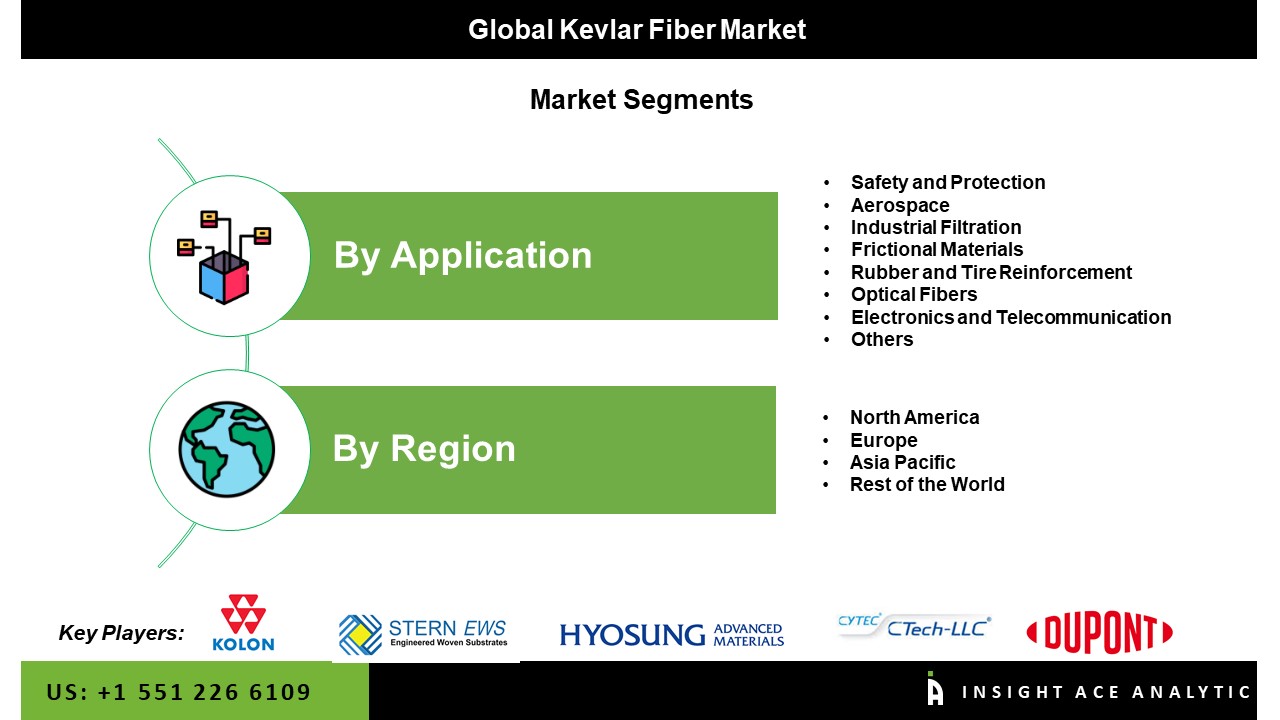

The kevlar fiber market is segmented based on application. By application, the market is segmented as safety and protection, aerospace, industrial filtration, frictional materials, rubber and tire reinforcement, optical fibers, electronics and telecommunication and others.

The safety and protection segment projected to grow rapidly in the global kevlar fiber market. This application segment is anticipated to rise thanks to the rising use of the product in protective apparel impenetrable to bullets and stabs as well as in helmets and protective gloves. Kevlar fiber is increasingly utilized in aerospace applications, including leading and trailing edge panels, suspension and steering doors, and the primary wing and fuselage architecture in new-generation aircraft. The product's characteristics, such as its exceptional strength, impact resistance, and lightweight, are anticipated to lead to a high consumption rate, especially in countries such as the US, Germany, UK, China, and India.

The North America kevlar fiber market is expected to register the highest market share in revenue soon. The region's expanding refurbishment operations, along with strict rules governing worker safety & protection in a variety of industries, are expected to drive market expansion. The ANSI in the United States has established protection standards that are projected to increase demand for goods such as protective gloves, helmets, and apparel. Significant investments will be expected in the industry, infrastructure, and healthcare sectors. In addition, Asia Pacific is projected to grow rapidly in the global kevlar fiber market. The demand for products in APAC is also projected to be influenced by growing internet usage in emerging economies, fast industrialization, and strong expansion in the telecom sector. Due to rising geopolitical tensions, big nations like China and India are spending more on the military, which is projected to present market expansion prospects.

In April 2023 – DuPont De Numerous Inc introduced Kevlar® EXOTM aramid fibre, the most important development in aramid fibre in more than 50 years, and a whole new technology platform designed to support countless applications where protection and performance are needed in the face of extreme and demanding circumstances. The first of many applications for Kevlar® EXOTMTM, which will provide an unmatched blend of low weight, flexibility, and aramid fibre protection, will be life protection.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 487.66 Mn |

| Revenue forecast in 2034 | USD 801.82 Mn |

| Growth rate CAGR | CAGR of 5.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Aramid Hpm LLC, C.S.R. Inc., China National Bluestar (Group) Co., Ltd., CTech LLC, DuPont De Numerous Inc., Final Advance Materials, GAB Neumann Gmbh, Hexcel Corporation, Huvis Corporation, Hyosung Advanced Materials, Kermel S.A., Kolon Industries Inc., MiniFIBERS Inc., SRO Aramid (Jiangzu) Co., Ltd., Stern EWS, Teijin Ltd., Toray Industries Inc., Yantai Tayho Advanced Materials Co. Ltd |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.