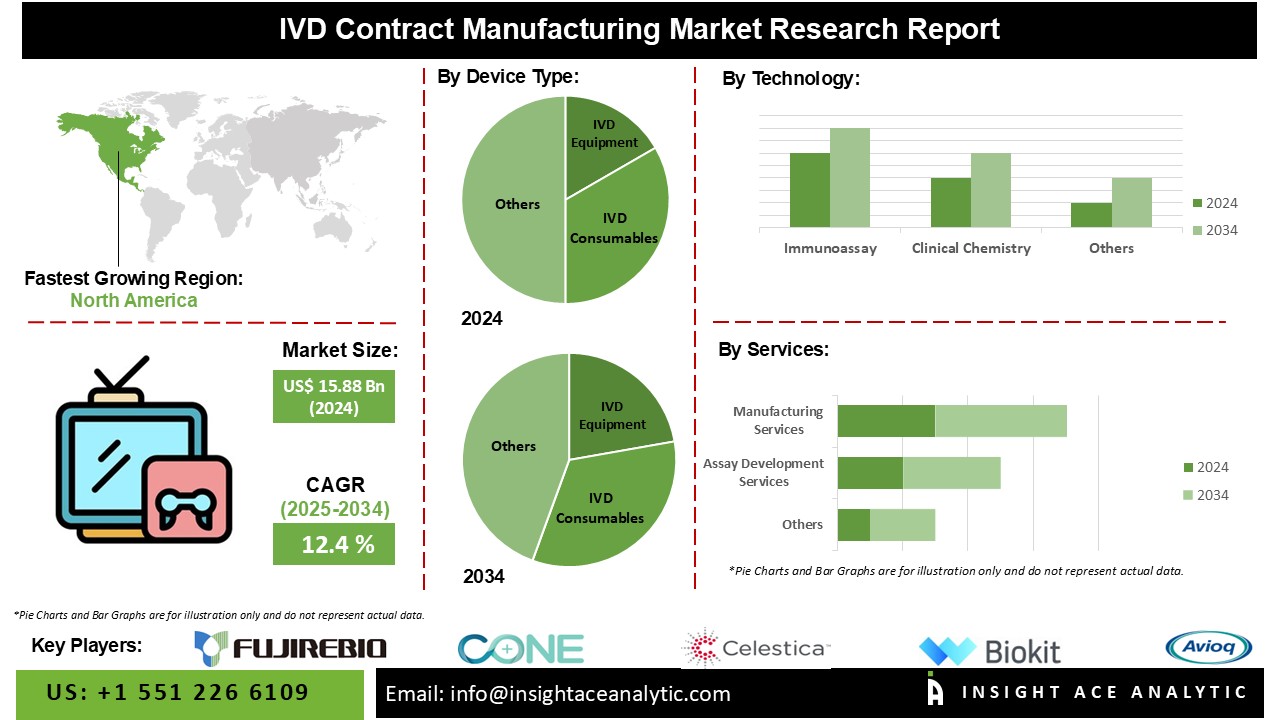

IVD Contract Manufacturing Market Size is valued at 15.88 billion in 2024 and is predicted to reach 50.50 billion by the year 2034 at a 12.4% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

In vitro diagnostics (IVDs) are medical instruments/devices that use biological samples, such as blood or tissue, to diagnose various diseases and infections. IVD tests and assays range from simple tests like SARS-CoV-2 tests to complex laboratory IVD tools.

The global IVD market is the largest segment of the medical technology industry and is expanding with healthcare investments and an increasing focus on early detection and preventive care. The IVD industry is constantly evolving to meet the needs of clinical demands and personalized treatments.

The main reasons for the growth of this market are increasing demand for cheaper and better products, IVD OEMs gaining a foothold in the capital market, and the reduced risk of development failure. Additionally, the emergence of CMO facilities in various countries will likely boost the IVD contract manufacturing market in the next few years. However, growing shortages of skilled workers, the risk of patent infringement and other concerns about intellectual property security are holding back business growth.

The IVD contract manufacturing market is segmented based on device type, technology, and services. The device type segment comprises IVD Equipment and IVD Consumables. By technology, the market is bifurcated into immunoassay, clinical chemistry, molecular diagnostics, microbiology, hematology, coagulation & hemostasis, and others. By services, the market is categorized into manufacturing services, assay development services, and other services.

IVD contract manufacturing is surging rapidly. There are many reasons why businesses choose to outsource their IVD production. Maybe they have insufficient facilities for manufacturing large quantities in-house, or they don't have the necessary skills. Here, contractor manufacturers play an essential role in providing high-quality, low-cost, and efficient products as compared to what businesses can achieve on their own. Moreover, contracting companies can often provide more services than the business itself can provide.

This contracting facility is also beneficial for startups and small-scale companies to design, produce and sell their equipment. For instance, in November 2022, Jabil Inc. expanded its developmental capabilities by opening a design center in Wrolaw, Poland. This would allow the company to develop leading-edge technologies for multiple industries, including the automotive and healthcare sectors.

Many outsourced companies in the IVD field choose to offer assay development services as they have limited financial capacity. Factors such as resource availability, growth and efficiency of R&D, reduced development time, lower cost, high efficiency, and expertise in assay development are considered to be the driving factors for the IVD contract manufacturing market.

Asia Pacific IVD contract manufacturing market dominated in 2022 and is expected to continue the same over the forecast period 2023-2031. The growth of this market can be attributed to rising demand for in vitro diagnostic tests, increased prevalence of diseases & infections, and growing mergers and acquisitions in the IVD sector.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 15.88 Bn |

| Revenue Forecast In 2034 | USD 50.50 Bn |

| Growth Rate CAGR | CAGR of 12.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Device Type, By Technology, By Services |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Avioq Inc., Biokit, Celestica Inc., Cenogenics Corporation, Cone Bioproducts, Fujirebio, Invetech, Jabil Inc., Kimball Electronics, Inc., Kmc Systems, Meridian Biosciences, Nemera, Nolato Gw, Inc., Nova Biomedical, Phillips Medsize Corporation, Sanmina Corporation, Savyon Diagnosticss, Stratec, Te Connectivity Ltd., Thermofisher, Viant Medical Holdings Inc., West Pharmaceutical Services, And Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

IVD Contract Manufacturing Market By Device Type-

IVD Contract Manufacturing Market By Technology-

IVD Contract Manufacturing Market By Services-

IVD Contract Manufacturing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.