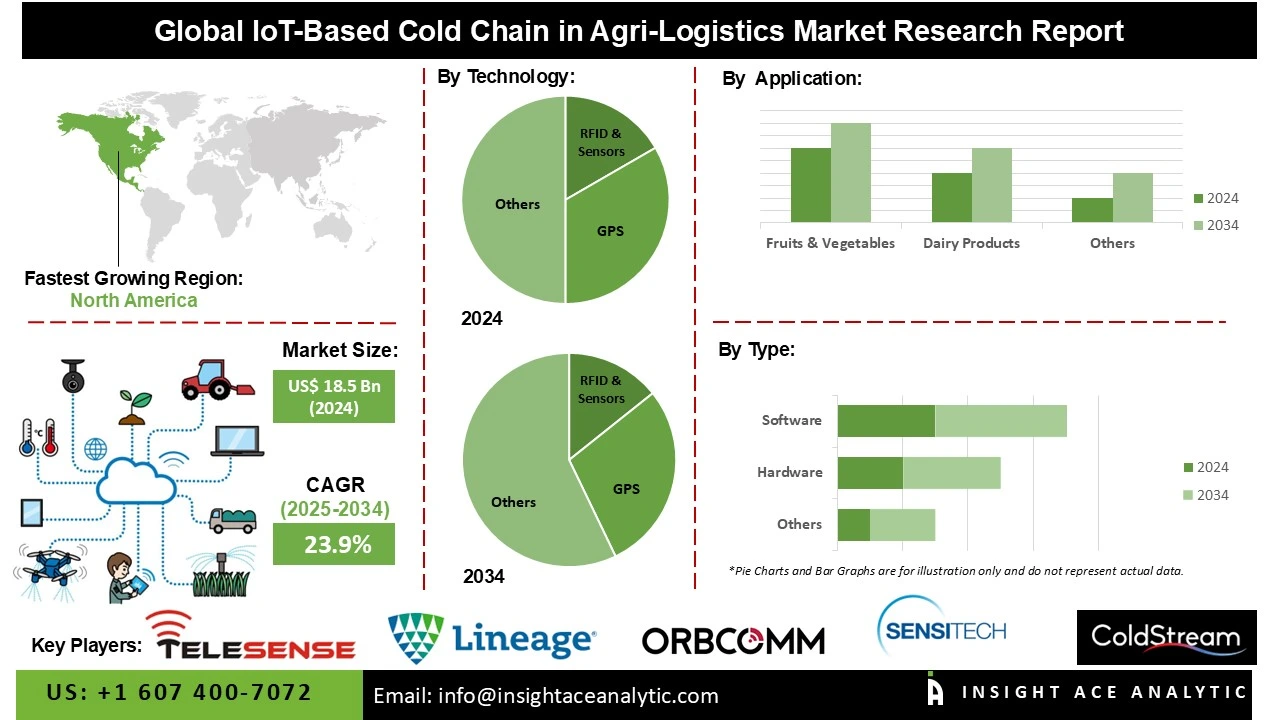

IoT-Based Cold Chain in Agri-Logistics Market Size is valued at US$ 18.5 Bn in 2024 and is predicted to reach US$ 149.9 Bn by the year 2034 at an 23.9% CAGR during the forecast period for 2025-2034.

IoT-Based Cold Chain in Agri-Logistics is a system that integrates Internet of Things (IoT) devices—such as temperature, humidity, and location sensors—with communication networks and data platforms to monitor, control, and optimize the storage and transportation conditions of perishable agricultural products.

This system ensures product quality and safety by providing real-time visibility, automated alerts, and data-driven management throughout the supply chain. The increasing incorporation of real-time tracking and monitoring systems is a significant trend influencing the IoT-based cold chain in the agri-logistics market. The necessity to maintain exact temperature control during storage and transportation has grown crucial due to the rising demand for perishable items, especially in industries like food, healthcare, and pharmaceuticals.

Additionally, the IoT-based cold chain in the agri-logistics market is growing as a result of several factors, including the development of refrigeration technology, stricter regulations, and the growth of the healthcare and pharmaceutical industries. Furthermore, increasing use of blockchain technology to improve security, transparency, and traceability is another noteworthy development in the Indian IoT-based cold chain management market.

Some of the Key Players in IoT-Based Cold Chain in Agri-Logistics Market:

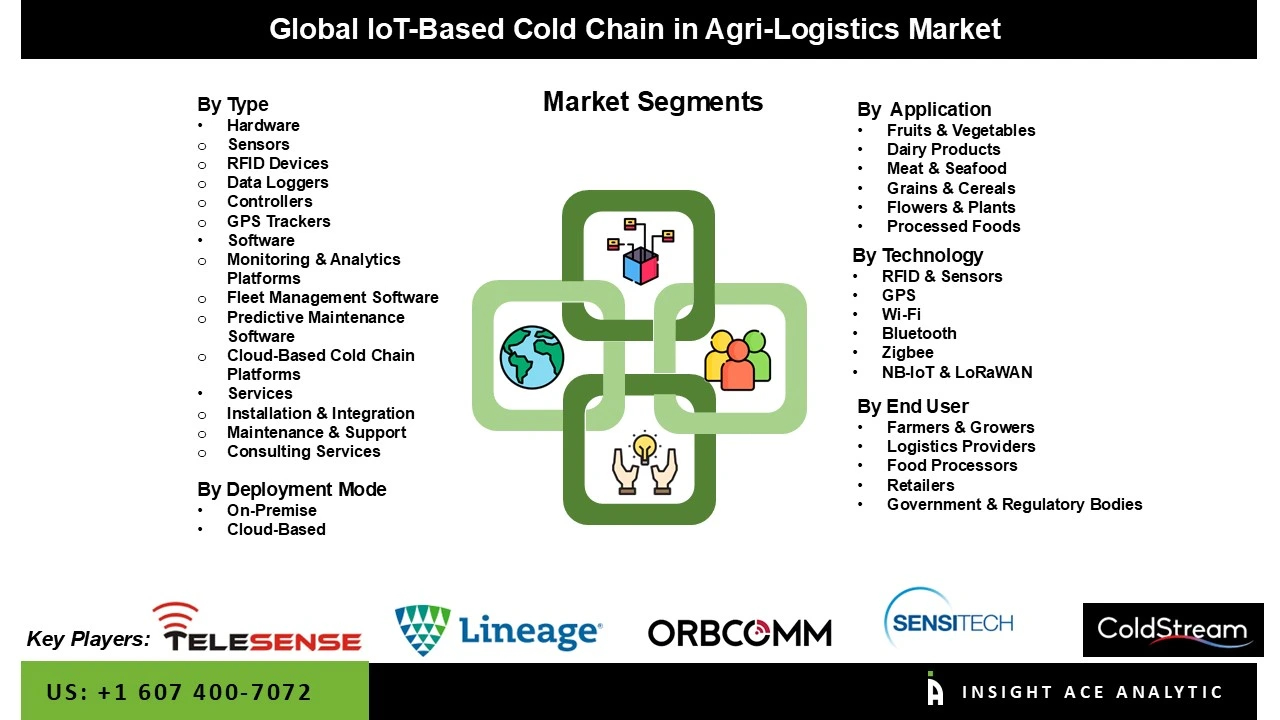

The iot-Based Cold Chain in Agri-Logistics market is segmented by Type, Deployment, Technology, Application, and End-user. The market is segmented by type into hardware, services, and software. The hardware category includes sensors, GPS trackers, data loggers, RFID devices, and controllers. The services segment comprises installation and integration, consulting services, and maintenance and support. The software segment covers cloud-based cold chain platforms, monitoring and analytics platforms, predictive maintenance software, and fleet management software. Additionally, by deployment, the market is divided into cloud-based and on-premise solutions. By technology, the market is segmented into Wi-Fi, RFID & Sensors, GPS, Zigbee, Bluetooth, and NB-loT & LoRaWAN. By application, the market is segmented into grains & cereals, fruits & vegetables, meat & seafood, dairy products, flowers & plants, and processed foods. By end-user, the market is segmented into farmers & growers, retailers, food processors, logistics providers, and government & regulatory bodies.

The hardware segment dominates the IoT-based cold chain in the agri-logistics market because smart sensors, RFID tags, and GPS trackers are widely used and provide real-time visibility into temperature, humidity, and shock levels during the transit of agricultural products. Particularly for perishable goods, farmers and shipping companies aggressively install these devices to guarantee safety and compliance. To enable more precise control over product quality, data loggers and controllers are essential for monitoring and controlling the internal conditions of transportation units.

With their ability to provide real-time, granular visibility of agricultural products, RFID & sensors are the dominant technology segment. Tracking products across distribution points and preserving environmental thresholds are made easier by this technology. To enhance inventory management, guarantee supply chain transparency, and perform risk assessments, stakeholders use sensor data. By facilitating smooth scanning and sorting between nodes, RFID tags also lower the possibility of human error.

North America's advanced infrastructure and strict food safety regulations had a significant impact on the IoT-based cold chain in the Agri-Logistics Market in 2024. Companies in these regions invest heavily in sophisticated tracking devices to monitor temperature-sensitive agricultural products. Additionally, government support and growing consumer demand for high-quality, fresh items are driving market expansion in these developed economies.

The European region is anticipated to have the fastest-growing market throughout the forecast period as countries modernize their agricultural supply chains. IoT-based cold chains have opportunities due to the expansion of organized retail and a rise in exports. In this field, the need for better logistics management, reduced food loss, and access to international markets further fuels the demand for efficient and cost-effective cold chain solutions.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 18.5 Bn |

| Revenue Forecast In 2034 | USD 149.9 Bn |

| Growth Rate CAGR | CAGR of 23.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Deployment, By Technology, By Application, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | ColdStream Technologies, Sensitech, TeleSense, Zest Labs, Americold, ThermoConnect, Maersk, DigiCold, SmartCold, Infratab, Honeywell, AgroMerchant, FreshTrack, Emerson Electric, Monnit, Controlant, Carrier Global, Lineage Logistics, Orbcomm, and vTrack Cold Chain |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

IoT-Based Cold Chain in Agri-Logistics Market by Type-

· Hardware

o Sensors

o GPS Trackers

o Data Loggers

o RFID Devices

o Controllers

· Services

o Installation & Integration

o Consulting Services

o Maintenance & Support

· Software

o Cloud-Based Cold Chain Platforms

o Monitoring & Analytics Platforms

o Predictive Maintenance Software

o Fleet Management Software

IoT-Based Cold Chain in Agri-Logistics Market by Deployment -

· Cloud-Based

· On-Premise

IoT-Based Cold Chain in Agri-Logistics Market by Technology-

· Wi-Fi

· RFID & Sensors

· GPS

· Zigbee

· Bluetooth

· NB-loT & LoRaWAN

IoT-Based Cold Chain in Agri-Logistics Market by Application-

· Grains & Cereals

· Fruits & Vegetables

· Meat & Seafood

· Dairy Products

· Flowers & Plants

· Processed Foods

IoT-Based Cold Chain in Agri-Logistics Market by End-user-

· Farmers & Growers

· Retailers

· Food Processors

· Logistics Providers

· Government & Regulatory Bodies

IoT-Based Cold Chain in Agri-Logistics Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.