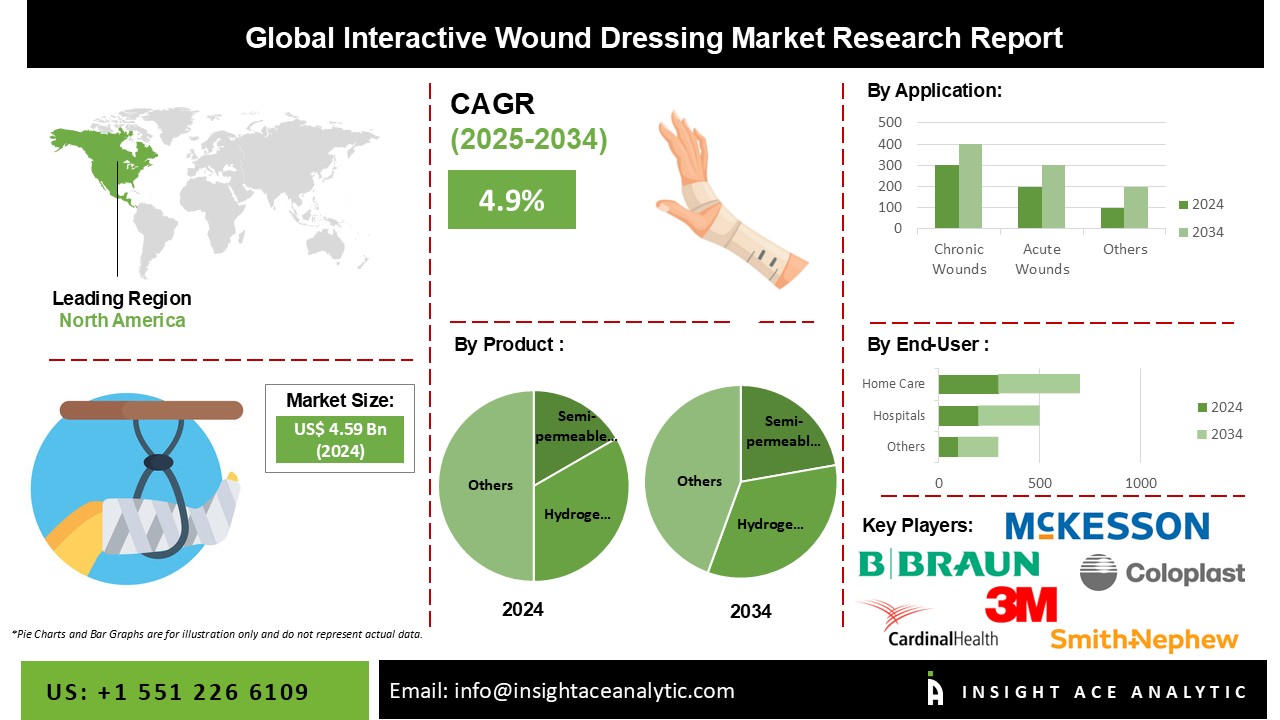

Interactive Wound Dressing Market Size is valued at 4.59 billion in 2024 and is predicted to reach 7.32 billion by the year 2034 at a 4.9% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

The market for wound dressings is anticipated to be driven by an increase in traumatic accidents around the world, an upsurge in the number of geriatric people, and an increase in the incidence of various wounds, such as pressure ulcers and surgical site wounds. Globally, the prevalence of chronic lesions such as diabetic foot ulcers and venous leg ulcers is rising. For instance, the NCBI estimates that approximately 6.5 million Americans suffer from mixed chronic wounds.

Additionally, it is anticipated that the growing diabetic population will fuel the market for wound dressings. For example, according to the CDC, 34.2 million Americans, or roughly 10.5% of the country's entire population, were diagnosed with diabetes in 2018. Additionally, according to diabeticfootonline.com, up to 34% of diabetics are at risk of having a diabetic foot ulcer. So, because of the causes, it is anticipated that the demand for wound dressing will increase, contributing to the expansion of the wound dressing market.

Additionally, older people are more prone to wounds. Hence an increase in the elderly population is anticipated to enhance the wound dressing industry. Technology developments have resulted in the innovation of wound dressings that can track the healing process and give healthcare workers real-time feedback. Traumatic burns are also having an impact on the development of this industry.

The Interactive Wound Dressing market is segmented on the basis of product outlook, application outlook, and end-use outlook. Product segment includes semi-permeable films dressing, semi-permeable foam dressing, and hydrogel dressing. The application segment includes chronic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, other chronic wounds, acute wounds, surgery & trauma, and burn injuries.End-use segment include hospitals, outpatient facilities, home care, and research & manufacturing.

In 2023, chronic wounds represented substantial share of total revenue. This is explained by a number of variables, including the rising incidence of diabetes, ageing populations, and lifestyle changes that have increased the risk factors for foot ulcers. The underlying causes of these wounds frequently include venous insufficiency, diabetes, and peripheral artery disease. According to estimates from the Australian Medical Association, chronic wounds impact 450 million people worldwide and are a serious health problem.

Semi-permeable film dressings had a considerable revenue share in 2023 and are anticipated to expand at the fastest rate over the forecast period. The rise in chronic wound prevalence explains this. The CDC estimates that 2.5 million Americans have chronic venous insufficiency, which results in venous leg ulcers and hence drives demand for the sector.

In 2023, North America had a significant share of worldwide revenue, dominating the market. The region has a high frequency of chronic injuries, such as venous leg ulcers and diabetic foot ulcers, which has led to a demand for efficient wound treatment options. Elderly people are more viable to develop chronic wounds, which is predicted to increase demand for cutting-edge wound care solutions like interactive wound dressings. Additionally, the region's increasingly ageing population has increased the prevalence of chronic diseases and injuries, increasing the market for wound care products like interactive wound dressings.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 4.59 Bn |

| Revenue forecast in 2034 | USD 7.32 Bn |

| Growth rate CAGR | CAGR of 4.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, Application, and End-use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | B. Braun SE; 3M; Cardinal Health, Inc.; Smith & Nephew; Coloplast; Mölnlycke Health Care AB.; ConvaTec Group PLC; McKesson Corporation; Medline Industries; PAUL HARTMANN AG; MediWound. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Interactive Wound Dressing Market By Product Outlook-

Interactive Wound Dressing Market By Application Outlook -

Interactive Wound Dressing Market By End-use Outlook -

Interactive Wound Dressing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.