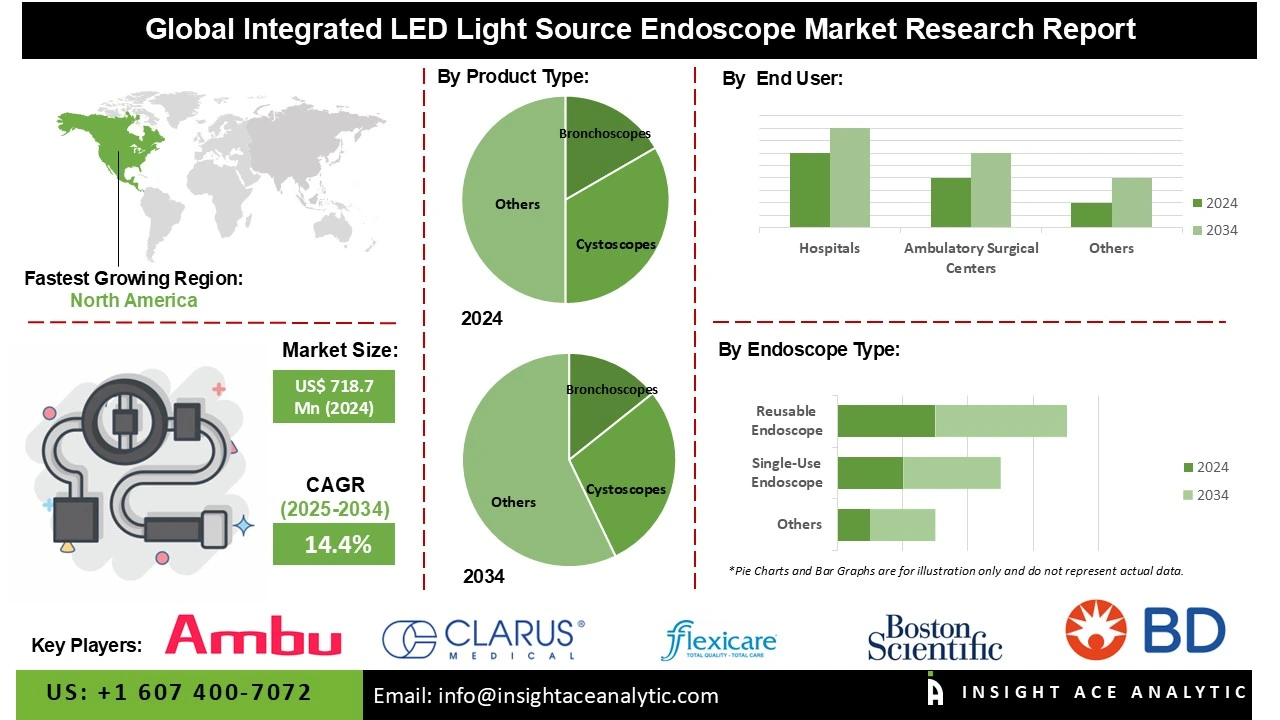

Integrated LED Light Source Endoscope Market Size is valued at US$ 718.7 Mn in 2024 and is predicted to reach US$ 2,634.5 Mn by the year 2034 at an 14.4% CAGR during the forecast period for 2025 to 2034.

Integrated LED Light Source Endoscope Market Size, Share & Trends Analysis Distribution by Product (Bronchoscopes, Cystoscopes, Ureteroscopes, Laryngoscopes, and Others), Endoscope Type (Single-Use Endoscope, and Reusable Endoscope), End-User (Hospitals, and Ambulatory Surgical Centers), and Segment Forecasts, 2025 to 2034

An integrated LED light source endoscope is a compact, high-resolution inspection tool with built-in LED lighting for bright, energy-efficient illumination. It eliminates the need for external light sources and is used in medical (surgeries, diagnostics) and industrial (machinery, pipes, automotive) applications. Key features include HD imaging, flexible/rigid probes, portability, and durability making it ideal for precise, real-time visual inspections.

The growth in chronic health conditions has created more demand for diagnostic tools with high efficacy, such as advanced endoscopic instruments that deliver superior image quality for early diagnosis, monitoring, and treatment. These diseases often need frequent diagnostic and therapeutic endoscopic techniques, which fuels the demand for cutting-edge imaging tools. Integrated LED light sources deliver superior illumination, energy efficiency, and compact design, expanding procedural accuracy and patient outcomes. With an increase in the number of chronic diseases globally, healthcare institutions increasingly embrace large-scale advanced endoscopic solutions.

The demand for integrated LED light source endoscopes is expected to rise further due to the rising need for minimally invasive surgical procedures, which need cutting-edge imaging tools. Integrated LED light source endoscopes provide superior illumination, energy efficiency, and compact design compared to traditional systems. Their integration of LED light sources decreases maintenance, expands image clarity, and extends device lifespan. Rising adoption of endoscopy in gastroenterology, urology, and ENT procedures, along with advancements in medical imaging technology, expands the market.

Some of the Key Players in the Integrated LED Light Source Endoscope Market:

The Integrated LED light source endoscope market is segmented by product, endoscope type, and end-user. By product, the market is segmented into bronchoscopes, cystoscopes, ureteroscopes, laryngoscopes, and others. By endoscope type, the market is segmented into single-use endoscope (flexible single-use endoscope, rigid single-use endoscope) and reusable endoscope (proximal reusable endoscope, distal reusable endoscope). The end-user segment consists of hospitals and ambulatory surgical centers.

In 2024, the demand for safer options for identifying and diagnosing symptoms related to the chest caused the bronchoscopes sector to hold the major market share. These problems often need frequent diagnostic and therapeutic endoscopic techniques, boosting the need for cutting-edge imaging tools. Integrated LED light sources deliver superior illumination, energy efficiency, and compact design, expanding procedural accuracy and patient outcomes. As the need to treat chronic illnesses rises, healthcare facilities increasingly adopt these innovative endoscopic solutions.

The integrated LED light source endoscope market is dominated by hospitals due to the increasing incidences of chronic diseases such as urological and gastrointestinal disorders, and respiratory diseases. These endoscopes deliver expanded illumination, decrease heat emission, and improve image clarity, making them ideal for numerous minimally invasive procedures. Hospitals prioritize equipment that allows patient security and faster recovery, leading to expanded adoption of integrated LED techniques. The growing number of surgical procedures in hospital settings further boosts market expansion.

North America dominates the market for integrated LED light source endoscopes due to cutting-edge healthcare infrastructure, expanding adoption of minimally invasive techniques, and a rising geriatric population prone to chronic diseases. The region's rising healthcare expenditure and rapid technological advancements help the integration of LED-based endoscopes, which deliver expanded imaging, energy efficiency, and longer lifespan. Moreover, rising awareness and early diagnosis initiatives contribute to a higher need for reliable and high-performance endoscopic solutions across North America.

However, Europe is the second-largest region in the market for integrated LED light source endoscopes. This is due to the continuously growing elderly population suffering from chronic diseases and the increasing incidence of colorectal cancer and gastrointestinal disorders. European healthcare systems rely on early diagnosis and minimally invasive procedures, encouraging the adoption of cutting-edge endoscopic techniques. Integrated LED light sources deliver enhanced visualization, decrease heat emission, and expand device longevity, along with the region’s rising focus on precision diagnostics and cost-effective healthcare delivery.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 718.7 Mn |

| Revenue Forecast In 2034 | USD 2,634.5 Mn |

| Growth Rate CAGR | CAGR of 14.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Endoscope Type, By End-User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Ambu A/S, Becton, Dickinson and Company, Boston Scientific Corporation, Clarus Medical LLC, Flexicare (Group) Limited, GI View Ltd., HOYA Corporation (Pentax Medical), KARL STORZ, OTU Medical, Richard Wolf GmbH, Verathon Inc., Innovex Medical Co., Ltd., MacroLux Medical Technology Co., Ltd., NeoScope Inc., and Uroviu Corporation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Integrated LED Light Source Endoscope Market by Product-

· Bronchoscopes

· Cystoscopes

· Ureteroscopes

· Laryngoscopes

· Others

Integrated LED Light Source Endoscope Market by Endoscope Type -

· Single-Use Endoscope

o Flexible Single-Use Endoscope

o Rigid Single-Use Endoscope

· Reusable Endoscope

o Proximal Reusable Endoscope

o Distal Reusable Endoscope

Integrated LED Light Source Endoscope Market by End-User-

· Hospitals

· Ambulatory Surgical Centers

Integrated LED Light Source Endoscope Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.