Global Incontinence Care Products (ICP) Market Size is valued at USD 12.69 billion in 2024 and is predicted to reach USD 21.98 billion by the year 2034 at a 5.8% CAGR during the forecast period for 2025-2034.

These incontinence care products are worn discreetly within undergarments and are made to absorb urine. Pull-up underwear and sanitary pads are made with the same hydrophobic layer used in disposable diapers. New and improved incontinence solutions are largely responsible for the industry's rapid growth in recent years. Adult incontinence and using adult diapers no longer carry the same social stigma they once did, thanks to the introduction of products with increased absorbency, superior odour control, and superior breathability. Because of this, more people are learning about incontinence products for bowel and bladder incontinence.

In addition, the growing number of older adults is one of the main drivers of the incontinence devices industry. The rapid rise of home care services for older people, as well as the increasing popularity of online shopping, are both factors that could boost demand for incontinence care items. Increases in research and development spending. One major trend in the incontinence care products industry is the creation of goods aimed squarely at men and women are all factors that are expected to boost the market.

However, the market for incontinence care products is expected to expand, although two of the most intractable issues are hopelessness and a lack of personal cleanliness. This information also demonstrates that incontinence is still regarded as a stigmatizing disorder in many parts of the world. The negative effects of COVID-19 on numerous sectors are expected to pose a threat to the incontinence business in the coming years. In the wake of the COVID-19 pandemic, only the most urgent ostomy procedures have been carried out, which has significantly influenced the ostomy care industry. Patients with acute and chronic illnesses are typically treated outside hospitals, either at home or ambulatory care centres. As a result, there has been a rise in interest in incontinence and ostomy care items for use in private homes.

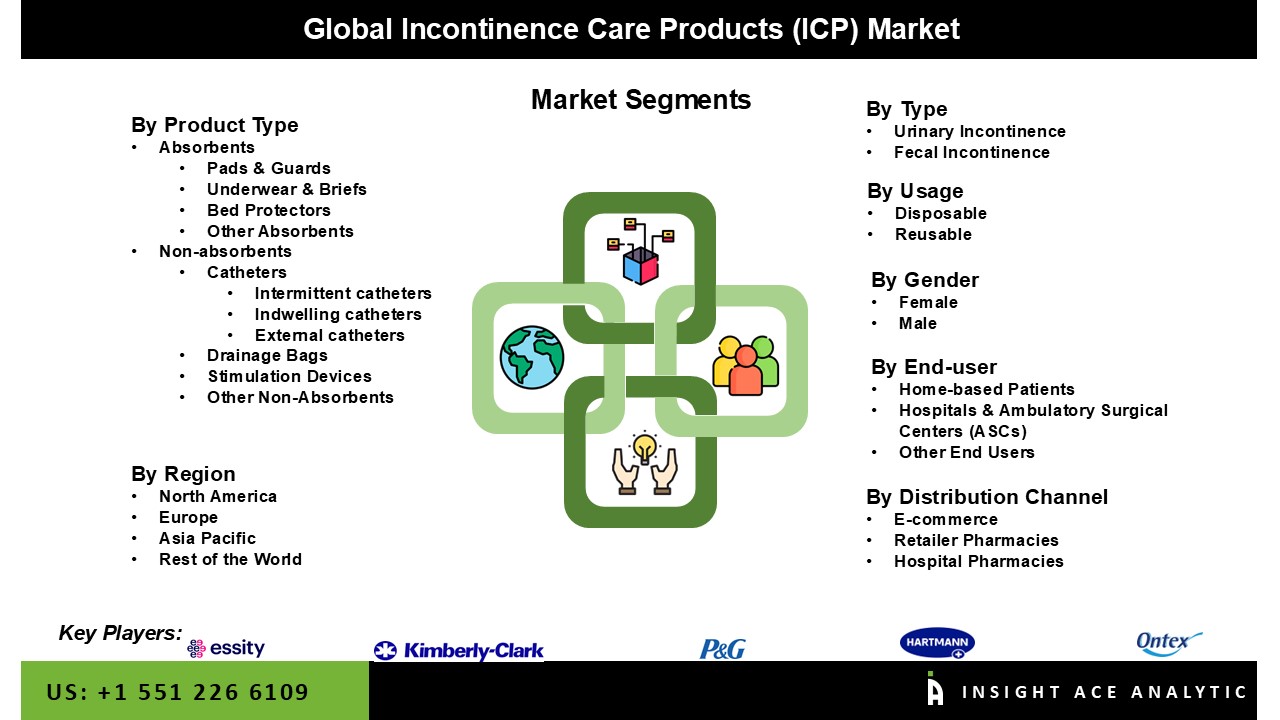

The Incontinence Care Products (ICP) Market is segmented based on product, type, usage, distribution channel and end-use. According to product segment, the market is segmented into absorbents which includes pads & guards, underwear & briefs, bed protectors, other absorbents, whereas, non-absorbents comprises catheters (intermittent catheters, indwelling catheters, external catheters), drainage bags, stimulation devices, and other non-absorbents. The type segment includes urinery incontinence and fecal incontinence. As per the usage, the market is segmented into reusable and disposable. The gender segment comprises male and female. By Distribution Channel segment, the market is divided into e-commerce, Retailer Pharmacies, Hospital Pharmacies. According to end-users, the market is divided into Home-based Patients, Hospitals & Ambulatory Surgical Centers (ASCs), and Other End Users.

The absorbent incontinence care products (ICP) category is expected to record a major global market share in 2022. Absorbents can be used to clean up moderate to large spills of potentially toxic compounds, allowing food and other products to be stored for longer periods under damp conditions.

The reusable is projected to grow rapidly in the incontinence care products (ICP) market because reusable are quickly reaching capacity. More reusable will need to be built. Reusing something is the same as keeping it out of a landfill. Reusing an item six times before tossing it means you avoid throwing away five times as much trash, especially in countries like the US, Germany, the UK, China, and India.

The Asia Pacific Incontinence Care Products (ICP) Market is expected to register the greatest market share in revenue in the near future. It can be attributed to Internet sales booming, disposable incontinence products are being widely used, and the government strongly supports the industry as a whole. In addition, Europe is estimated to grow rapidly because of expanding interest in home health care and consumer demand for associated hygienic goods. The high rate of incontinence cases, the growth of large cities, the sizeable elderly population, the abundance of hospitals, and the encouragement of this trend by the government are all major contributors.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 12.69 Bn |

| Revenue Forecast In 2034 | USD 21.98 Bn |

| Growth Rate CAGR | CAGR of 5.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Usage, By Gender, By Distribution Channel, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Essity Aktiebolag (publ) (Sweden), The Procter & Gamble Company (US), Kimberly-Clark Corporation (US), HARTMANN (Germany), Ontex BV (Belgium), Unicharm Corporation, Coloplast A/S, Cardinal Health, Inc., Medline Industries, Mckesson Corporation, Abena, Attindas Hygiene Partners Group, Hollister Incorporated, Dynarex Corporation, Convatec Group Plc, Becton, Dickinson And Company, Wellspect Healthcare, Stryker, First Quality Enterprises, Inc., Principle Business Enterprises, Inc., Tzmo SA, Primare International Ltd., Drylock Technologies, Northshore Care Supply, Nobel Hygiene |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Incontinence Care Products (ICP) Market By Product Type

Incontinence Care Products (ICP) Market By Type

Incontinence Care Products (ICP) Market By Usage

Incontinence Care Products (ICP) Market By Gender

Incontinence Care Products (ICP) Market By Distribution Channel-

Incontinence Care Products (ICP) Market By End Use-

Incontinence Care Products (ICP) Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.