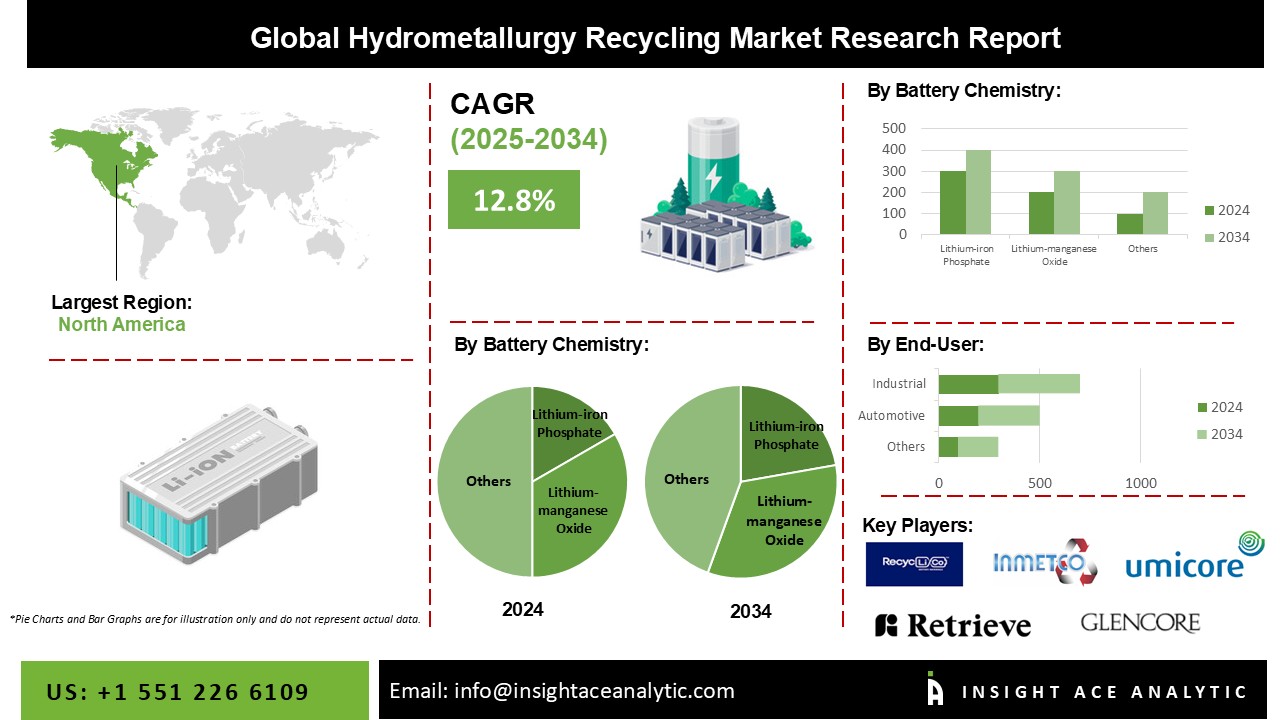

Hydrometallurgy Recycling Market Size is predicted to witness a 12.8% CAGR during the forecast period for 2025-2034.

In the recycling process known as hydrometallurgy, metals are extracted and recovered from diverse waste sources using aqueous solutions and chemical processes. In contrast to pyrometallurgy, which depends on high temperatures, hydrometallurgy separates and recovers metals from the input materials utilizing a variety of methods, including leaching, precipitation, solvent extraction, and others. In hydrometallurgical recycling, the waste materials are processed using certain chemical mixtures that dissolve the target metals with great precision while leaving the non-metallic components behind. Then, the dissolved metals are removed from the solution using procedures such as solvent extraction or precipitation.

There is a rising need for recycled materials across all industries due to the focus on sustainability and the ideas of the circular economy. The growing demand for recovered materials in sectors including electronics, automotive, construction, and renewable energy is satisfied by the hydrometallurgy recycling process, which offers a dependable and effective way to recover valuable metals from waste streams. The lack of knowledge about recycling practices and the need for sizable investments in infrastructure, machinery, and specialized skills are expected to restrain the market's expansion.

The Hydrometallurgy Recycling market is segmented on the basis of battery chemistry and end-user. Based on battery chemistry, the market is segmented into Lithium-iron phosphate and Lithium-nickel manganese cobalt. The end-user segment includes Power and Automotive.

The most significant market share belongs to the lithium-nickel manganese cobalt category. This is due to the extensive usage of lithium-ion batteries with NMC cathodes in numerous sectors, including grid energy storage systems, consumer electronics, and electric vehicle transportation. The demand for effective recycling techniques to recover priceless metals like lithium, nickel, manganese, and cobalt is rising as these batteries approach the end of their useful lives. An efficient alternative is provided by hydrometallurgical recycling, which takes used batteries and uses chemical processes to leach and recover the metals from them.

The power segment is predicted to develop at the fastest rate in the market. This can be related to the rise in demand for effective and environmentally friendly energy storage options in the power industry, such as batteries. Energy storage is essential to reduce intermittency problems as renewable energy sources gain popularity.

It is anticipated that the North American region will make up the majority of the market. This can be ascribed to a number of elements, such as the area's highly developed recycling infrastructure, strict environmental legislation, and growing emphasis on sustainability practices. There is a significant demand for effective recycling techniques in North America due to the enormous volume of waste, including electronic waste and end-of-life batteries.

Recovering precious metals from these waste streams is made possible by hydrometallurgical recycling. However, according to projections, the Hydrometallurgy Recycling Market's fastest-growing category will be the Asia Pacific region. This can be ascribed to various reasons that have fueled the area's explosive growth. First off, there is a necessity for effective recycling techniques due to the considerable trash output caused by rising industry and urbanization in nations like China and India. This waste includes used batteries and electronic debris.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 12.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Battery Chemistry And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Umicore, Glencore International AG, Retriev Technologies Inc., International Metals Reclamation Company, LLC (INMETCO), American Manganese Inc., Li-Cycle Corp., Neometals Ltd., Recupyl SAS, Tes-Amm Singapore Pte. Ltd., and Fortum OYJ. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Hydrometallurgy Recycling Market By Battery Chemistry-

Hydrometallurgy Recycling Market By End-user-

Hydrometallurgy Recycling Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.