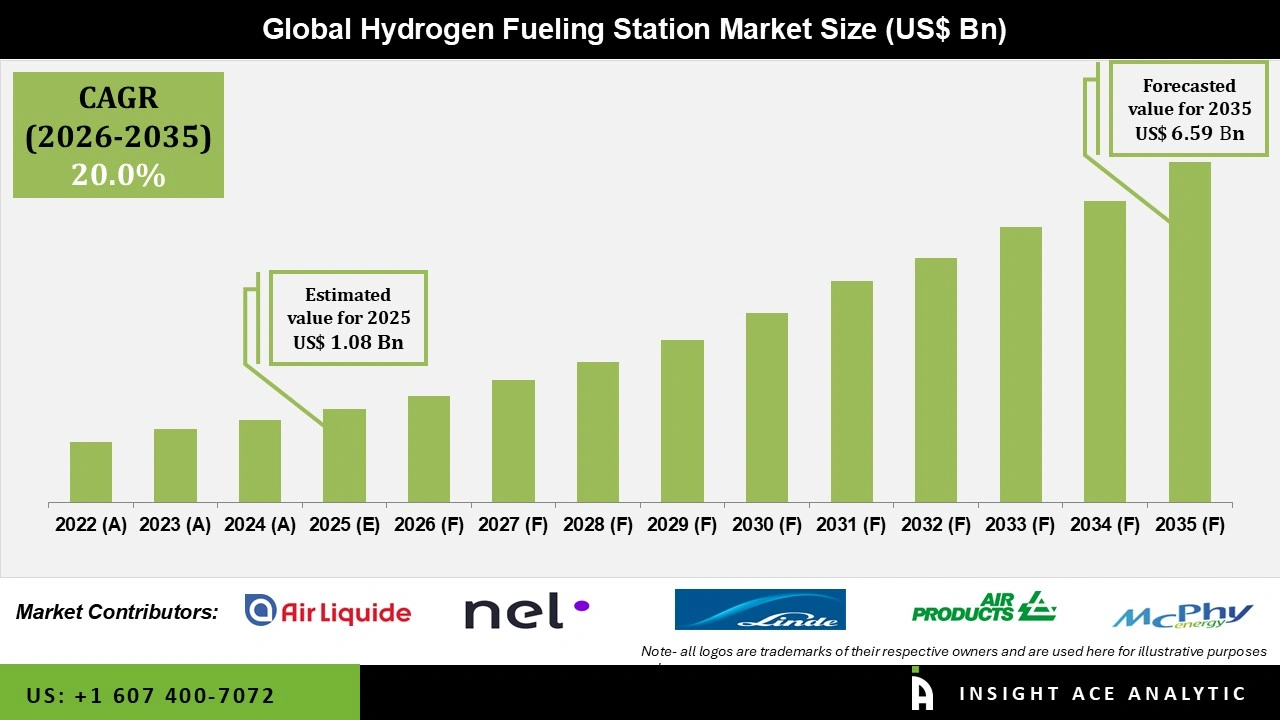

Global Hydrogen Fueling Station Market Size is valued at USD 1.08 Bn in 2025 and is predicted to reach USD 6.59 Bn by the year 2035 at a 20.0% CAGR during the forecast period for 2026 to 2035.

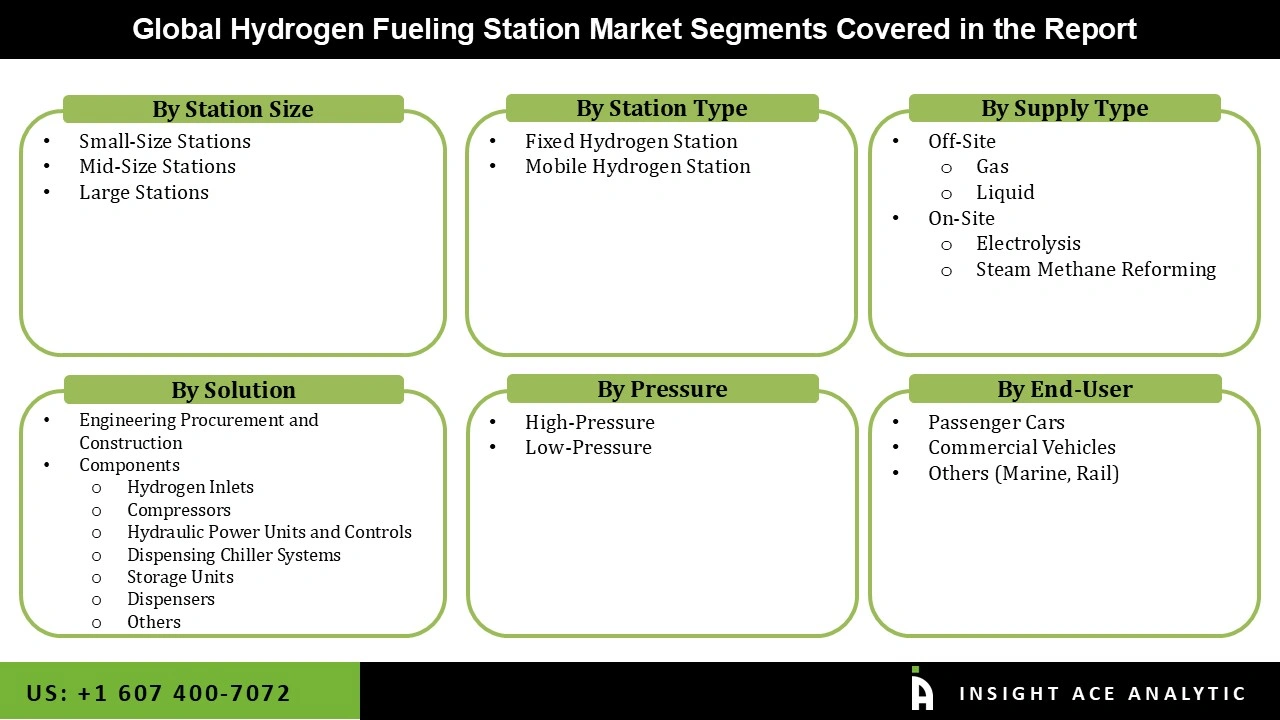

Hydrogen Fueling Station Market Size, Share & Trends Analysis Report By End-Users (Passenger Cars, Commercial Vehicles, Others (Marine, Rail)), By Station Size (Small-Size Stations, Mid-Size Stations, Large Stations), By Station Type (Fixed Hydrogen Station, Mobile Hydrogen Station), By Supply Type, By Solution, By Pressure, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

A hydrogen fuelling station is where hydrogen gas is dispensed for fuel in hydrogen-powered cars. These stations are an important part of the infrastructure required to widely adopt hydrogen fuel cell vehicles (FCVs). There are numerous types of hydrogen filling stations, and they serve an important role in enabling a clean and sustainable transportation system. Several factors contribute to the development and expansion of the hydrogen fueling station market. These factors are critical in establishing the landscape for hydrogen infrastructure and promoting hydrogen fuel cell car uptake. Government policies, incentives, and laws that encourage the development of hydrogen fuelling infrastructure are critical. To stimulate private investment in the construction and operation of hydrogen filling stations, governments may offer grants, tax credits, or subsidies.

However, the COVID-19 pandemic has already caused disruptions across various industries, including the energy and transportation sectors. The pandemic caused interruptions in worldwide supply chains, disrupting the fabrication and distribution of hydrogen filling station components. Delays in the supply chain could have hampered the development and upkeep of hydrogen infrastructure.

The Hydrogen Fueling Station Market is segmented on the basis of end-users, station size, station type, supply type, solution, and pressure. The end-user segment is segmented as Passenger Cars, Commercial Vehicles, and Others (Marine, Rail). The station size segment includes Small-Size Stations, Mid-Size Stations, and Large Stations. By station type, the market is segmented into fixed hydrogen stations and mobile hydrogen stations. The supply type segment includes off-site and on-site. According to solutions, the market is segmented into Engineering Procurement and Construction and Components. By pressure, the market is segmented into High-Pressure and Low-Pressure.

The Fixed Hydrogen Station category is expected to hold a major share of the global Hydrogen Fueling Station Market in 2024. Several main factors are contributing to the increased demand for fixed stations. As the transition to hydrogen-powered vehicles accelerates, there is an increasing demand for dependable and fixed refuelling infrastructure. Fixed stations provide a steady and easily accessible source of hydrogen, allowing a rising user base to be more convenient and accessible. In addition, advances in fixed hydrogen generation technologies, such as on-site electrolysis and pipeline supply, are increasing the viability and sustainability of these stations.

The Commercial Vehicles segment is projected to grow at a rapid rate in the global Hydrogen fuel station Market. The demand for hydrogen-powered commercial cars is increasing significantly, thanks to a number of causes. As businesses and transportation sectors seek to minimize their carbon footprint, hydrogen fuel cell technology offers an appealing solution, particularly in areas with stringent operational requirements. These vehicles offer a feasible alternative to traditional internal combustion engines, particularly for heavy-duty applications such as trucks, buses, and commercial fleets.

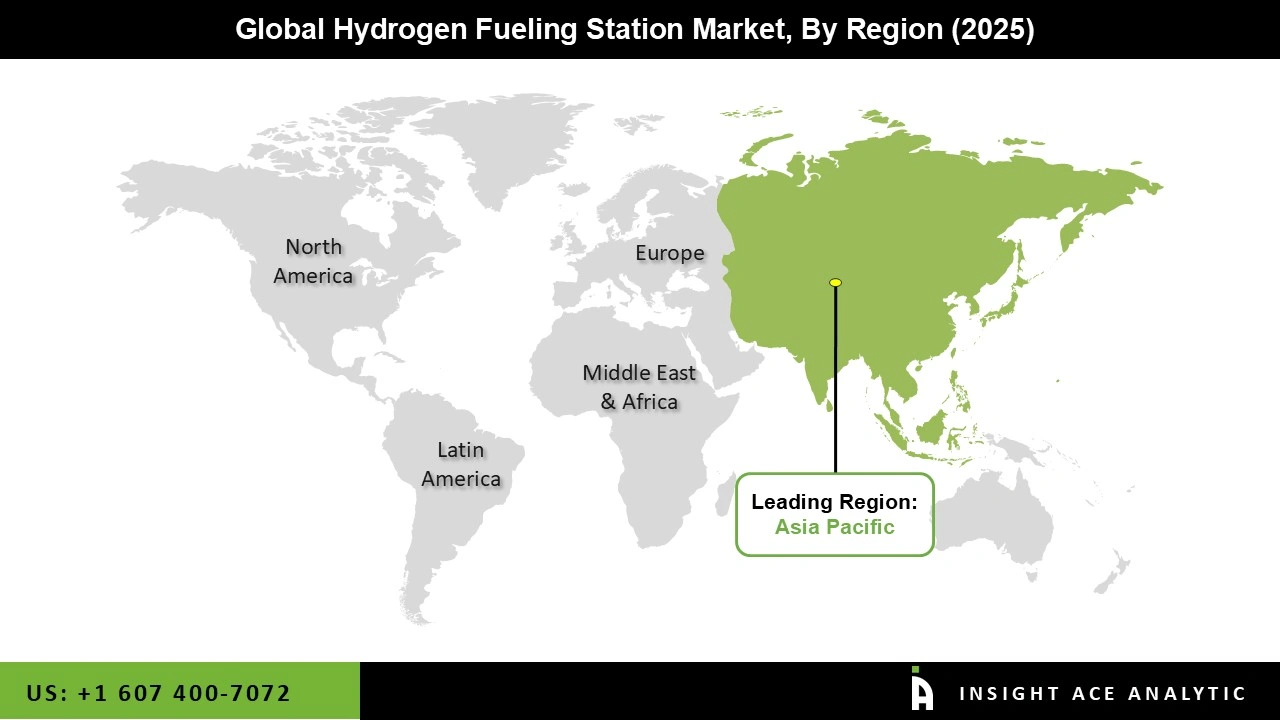

Asia Pacific Hydrogen Fueling Station Market is expected to record the maximum market share in revenue in the near future. The region's demand for hydrogen fueling stations has been continuously increasing owing to a number of critical variables. Concerns about climate change and the need to minimize greenhouse gas emissions have heightened interest in cleaner energy options, such as hydrogen. As a result, governments, industry stakeholders, and consumers are becoming more interested in encouraging the development of a strong hydrogen infrastructure. Additionally, advancements in hydrogen production technologies, particularly in the field of electrolysis and renewable hydrogen production, are bolstering confidence in the viability of hydrogen as a clean energy carrier.

Moreover, Europe is likely to grow at a significant rate. The need for hydrogen fuelling stations in Europe has increased significantly, owing to a number of critical considerations. The continent's aggressive climate targets, as well as the need to decarbonize key sectors, particularly transportation, have pushed governments, industry, and consumers towards cleaner energy options.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.08 Bn |

| Revenue Forecast In 2035 | USD 6.59 Bn |

| Growth Rate CAGR | CAGR of 20.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Units) and CAGR from 2026 to 2035 |

| Historic Year | 2021 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By End-Users, By Supply Type, By Solution, By Pressure |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Air Liquide, Nel ASA, Linde plc, Air Products and Chemicals, Inc., McPhy Energy S.A., Iwatani Corporation, Ingersoll Rand, Chart Industries, H2 MOBILITY, Sera GmbH, Powertech Labs Inc., Galileo Technologies S.A., Nikola Corporation, Atawey, Nanosun Limited, PDC Machines, Peric Hydrogen Technologies Co., Ltd and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.