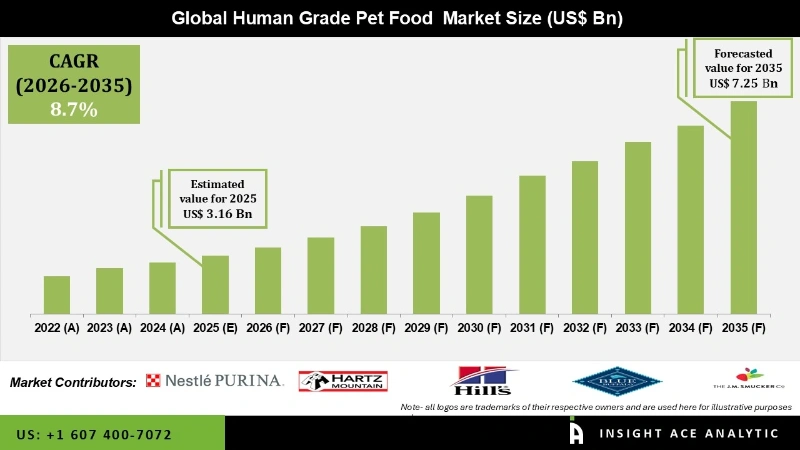

The Human Grade Pet Food Market Size was valued at USD 3.16 Bn in 2025 and is predicted to reach USD 7.25 Bn by 2035 at a 8.7% CAGR during the forecast period for 2026 to 2035.

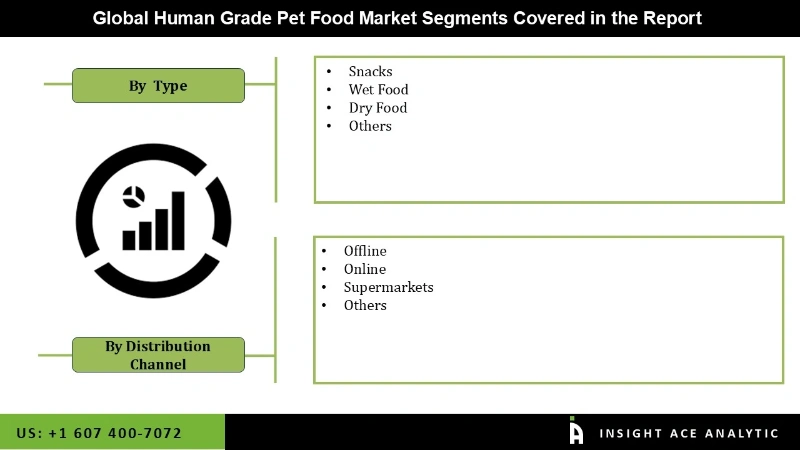

Human Grade Pet Food Market Size, Share & Trends Analysis Report, By Type (Snacks, Wet Food, Dry Food, and Others), Distribution Channel (Offline, Online, Supermarkets, and Others), By Region, Forecasts, 2026 to 2035.

Human-grade pet food means that the items used to make the food are legal and safe for humans to ingest. Human-grade pet food is safer because it is manufactured in the same facilities as human food. The worldwide pet ownership trend is on the rise, especially in developing economies, and it is expected to impact the global market for human-grade pet food significantly. The global human-grade pet food market is experiencing strong growth due to the increasing number of pet owners concerned about providing their pets with healthy, high-quality food. The growing urbanization and pet humanization drive this trend. Additionally, expanding the number of people owning pets worldwide is a great way to boost demand for pet food, opening up new markets for specialized pet foods. The worldwide market is growing because commodities in different price ranges are easily accessible. Clientele has several alternatives and can choose from different financial statuses.

However, market growth is hampered by the high cost of human-grade pet food and the product's inability to meet the market demand. E-commerce and digital marketing are essential for increasing the reach of products, and creative flavors and packaging designs attract customers and support the human-grade pet food market expansion. The adoption of human-grade pet food is expected to be expedited by pet owners due to the rising popularity of pets. Additionally, a large number of vendors in the market specialize in selling fresh pet food that is intended for human use.

The human-grade pet food market is segmented based on type and distribution channel. Based on type, the market is divided into snacks, wet food, dry food, and others. By distribution channel, it is divided into offline, online, supermarkets, and others.

The snacks segment is expected to hold a significant global market share in 2023 because pet owners are growing conscious of the benefits of using natural items in their pets' diets. The demand for good pet food is rising, and the trend of humanizing pets is becoming more pronounced. Pet snack premiumization and increasing disposable incomes fuel the market's expansion. The expansion of the pet industry is being propelled by rising disposable money, which in turn is funding new flavor and nutrition advancements, all contributing to the sector's growth.

Offline makes up most human-grade pet food because shoppers prefer in-store purchases, where they can personally examine and confirm the items' quality. The ability to compare different goods in person, quick availability, and personalized customer service all add to the attractiveness. Furthermore, this market experiences constant foot traffic and sales due to established trust and loyalty with local grocers and pet retailers, especially in countries like the US, Germany, the UK, China, and India.

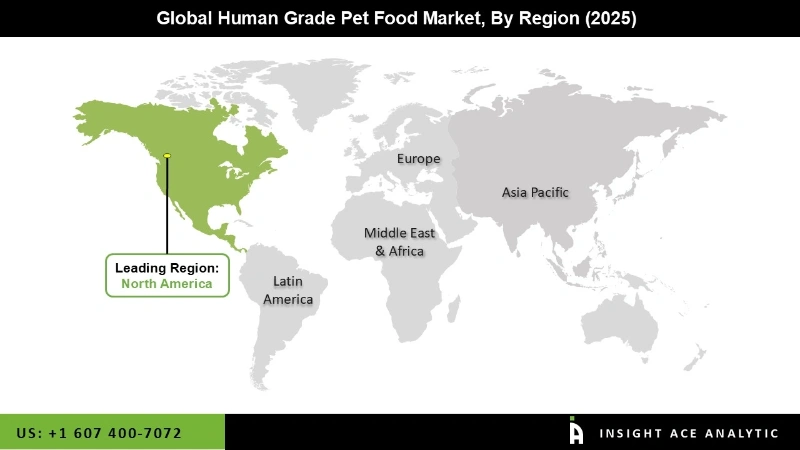

The North American human-grade pet food market is expected to register the highest market share in revenue in the near future. Because people are paying more attention to pet health and welfare, there is increased demand for human-grade pet food in emerging nations. Innovation in tastes, components, and health advantages is encouraged by the existence of major participants in the market, as well as the rising pet owners' purchasing capacity and per capita income. In addition, Asia Pacific is projected to grow rapidly in the global human-grade pet food market because there is a high prevalence of pet ownership, and people are gradually spending more on their pets’ health and happiness because they consider them part of the family. The need for high-quality foods is being driven by customers in Asia-Pacific who have a preference for premium and health-oriented products in the area.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.16 Bn |

| Revenue Forecast In 2035 | USD 7.25 Bn |

| Growth Rate CAGR | CAGR of 8.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Distribution Channel and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Nestle Purina, The Hartz Mountain Corporation, Hill’s Pet Nutrition, Blue Buffalo, The J.M. Smucker Company, Lupus Alimentos, WellPet LLC, and other prominent players. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Human Grade Pet Food Market- By Type

Human Grade Pet Food Market- By Distribution Channel

Human Grade Pet Food Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.