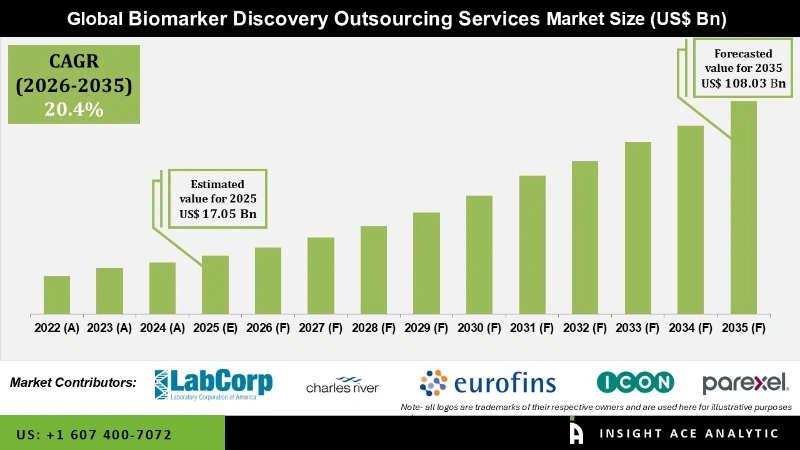

Biomarker Discovery Outsourcing Services Market Size is valued at USD 17.05 billion in 2025 and is predicted to reach USD 108.03 billion by the year 2035 at a 20.4% CAGR during the forecast period for 2026 to 2035.

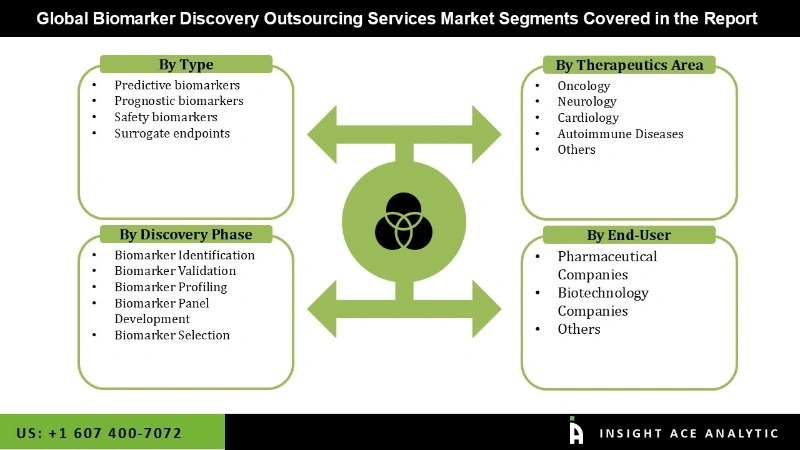

Biomarker Discovery Outsourcing Services Market Size, Share & Trends Analysis Report By Type (Predictive Biomarkers, Prognostic Biomarkers, Safety Biomarkers And Surrogate Endpoints), Therapeutic Area (Oncology, Neurology, Cardiology, Autoimmune Diseases), Discovery Phase (Biomarker Identification, Biomarker Validation, Biomarker Profiling, Biomarker Panel Development And Biomarker Selection) And End Users (Pharmaceutical Companies, Biotechnology Companies), Region And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The demand for personalized therapies and companion diagnostics, which rely on biomarkers, stands as a fundamental driver in the biomarker discovery services market. Collaborative initiatives involving academic institutions, research organizations, and pharmaceutical companies in biomarker discovery projects stimulate growth by combining resources and expertise. The COVID-19 pandemic underscored the crucial significance of biomarkers in the realm of infectious disease diagnostics and public health. This heightened awareness, along with increased research funding, has ignited growth within the biomarker discovery services market. The existence of supportive regulatory frameworks and guidelines for biomarker development and validation plays a pivotal role in encouraging the utilization of biomarkers in clinical applications, further propelling market growth. Additionally, the urgency of the pandemic has specifically fueled augmented funding and research interest in biomarkers for infectious diseases, delivering a substantial boost to the market. The strict regulatory demands and compliance considerations may pose obstacles to the delegation of biomarker discovery services.

Moreover, organizations must verify that their selected service providers adhere to essential quality and safety criteria, a task that can be intricate and time-intensive. Biomarker discovery involves a multifaceted and intricate process. Uncovering biomarkers that are both meaningful and practical frequently necessitates a profound comprehension of biology, bioinformatics, and data analysis, a challenge that may take more work to achieve through outsourcing

The biomarker discovery outsourcing services market is segmented on the basis of type, therapeutic area, discovery phase and end users. Based on type, the market is segmented as predictive biomarkers, prognostic biomarkers, safety biomarkers and surrogate endpoints. By therapeutic area, the market is segmented as oncology, neurology, cardiology, autoimmune diseases and others. By the discovery phase, the market is segmented into biomarker identification, biomarker validation, biomarker profiling, biomarker panel development and biomarker selection. By end users, the market is segmented into pharmaceutical companies, biotechnology companies and others.

The biomarker validation category is expected to hold a major share of the global biomarker discovery outsourcing services market in 2024. The process of "biomarker validation" serves to confirm the accuracy, reliability, and clinical suitability of potential biomarkers. It encompasses both the discovery of biomarkers in research settings and their subsequent integration into clinical applications. The demand for biomarker validation services is substantial, primarily driven by the emphasis on translating research findings into clinical practice. Additionally, regulatory entities like the FDA and the European Medicines Agency (EMA) mandate rigorous validation of biomarkers to ensure their suitability for diagnostic, prognostic, or treatment selection purposes. These factors are anticipated to act as catalysts for market expansion.

The predictive biomarkers segment is projected to grow at a rapid rate in the global biomarker discovery outsourcing services market. Pharmaceutical and biotechnology firms are increasingly utilizing predictive biomarkers to identify patient groups with a higher likelihood of responding positively to experimental drugs. Predictive biomarkers are appealing from a commercial standpoint due to their capacity to expedite drug development and streamline regulatory approval processes, thereby leading to cost savings and revenue generation. Predictive biomarkers are instrumental in driving innovation and growth within the biomarker discovery outsourcing services market. They offer the promise of more effective treatments, reduced healthcare costs, and improved patient outcomes, making them a focal point in the field of biomarker research and development.

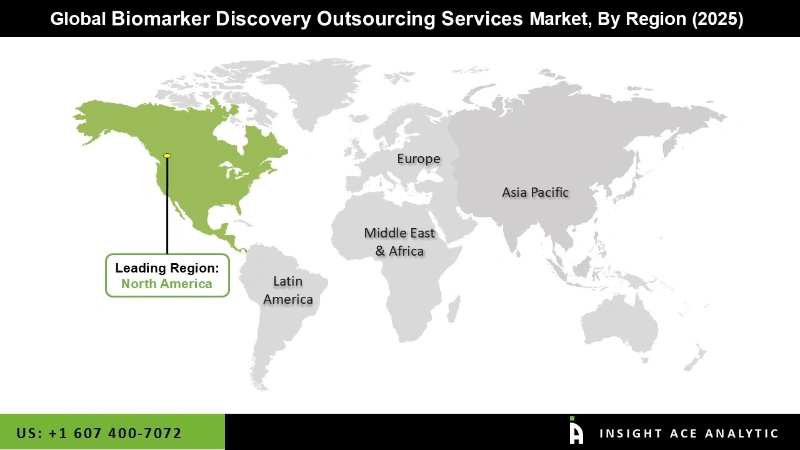

The North American biomarker discovery outsourcing services market is expected to register the highest market share. A strong focus on research and development, advanced healthcare infrastructure, regulatory support, collaborative partnerships, and significant funding characterizes the biomarker discovery outsourcing services market in North America. It plays a pivotal role in advancing personalized medicine and the development of innovative therapies. In addition, Asia Pacific is projected to grow at a rapid rate in the global biomarker discovery outsourcing services market. The Asia Pacific region has a diverse healthcare landscape with varying disease patterns and genetic profiles. This diversity creates opportunities for biomarker discovery, as specific biomarkers may be needed for different populations. Some countries in the region have initiated government-funded programs to support biomarker research and development. These programs aim to foster innovation and enhance the competitiveness of the biomarker discovery market in the Asia Pacific.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 17.05 Bn |

| Revenue Forecast In 2035 | USD 108.03 Bn |

| Growth Rate CAGR | CAGR of 20.4 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Material, Capacity, Voltage, And Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Laboratory Corporation of America Holdings; Charles River Laboratories; Eurofins Scientific; Celerion; ICON plc.; Parexel International (MA) Corporation; Proteome Sciences; GHO Capital; Thermo Fisher Scientific Inc., Evotec., Bio-Rad Laboratories, Inc., Svar Life Science, Sino Biological, Inc, Almac Group Limited, REPROCELL Inc., Frontage Labs, Biomcare ApS, Crown Bioscience, RayBiotech, Inc., Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biomarker Discovery Outsourcing Services Market By Type

Biomarker Discovery Outsourcing Services Market By Therapeutic Area

Biomarker Discovery Outsourcing Services Market By Discovery Phase

Biomarker Discovery Outsourcing Services Market By End-use

Biomarker Discovery Outsourcing Services Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.