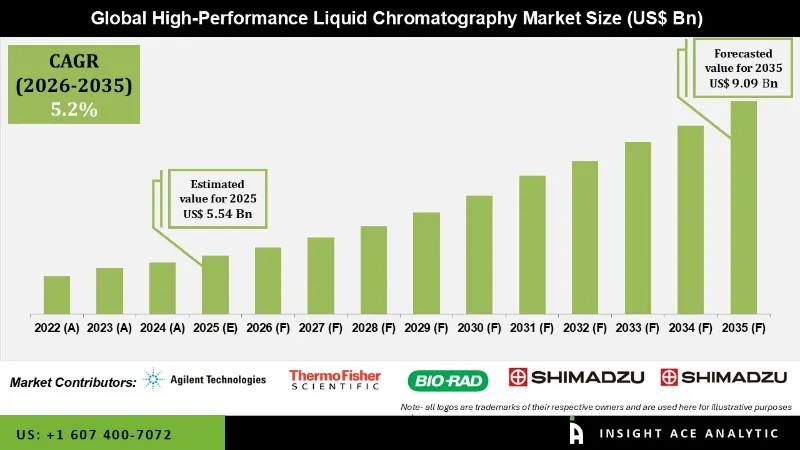

High Performance Liquid Chromatography Market Size was valued at USD 5.54 Bn in 2025 and is predicted to reach USD 9.09 Bn by 2035 at a 5.2% CAGR during the forecast period for 2026 to 2035.

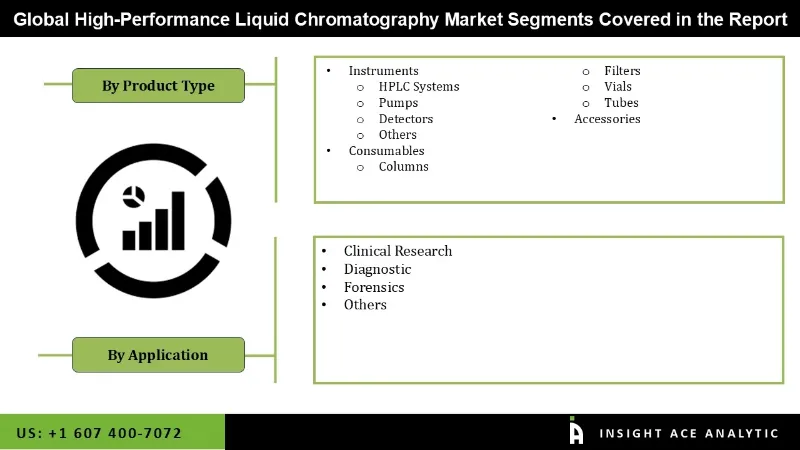

High-Performance Liquid Chromatography Market Size, Share & Trends Analysis Report, By Product (Instruments, Consumables and Accessories), By Application (Clinical Research, Diagnostics, Forensics and Others), By Region, Forecasts, 2026 to 2035

High Performance Liquid Chromatography Market Key Takeaways:

|

High-performance liquid chromatography allows for the separation, identification, and quantification of all components in a combination. Worldwide, businesses are working to perfect and sell high-performance liquid chromatography and all the parts and pieces that accompany it. The market is growing due to developments in high-performance liquid chromatography technology, with many industry heavyweights focusing on creating and incorporating AI into high-performance liquid chromatography systems. Additionally, factors, including the rising prevalence of chronic and acute diseases and the need for additional research into preclinical and clinical settings to discover novel medications, are propelling the market's expansion. Furthermore, due to continued advancements and increased investment in research and development, high-performance liquid chromatography technology is a vital tool for businesses. It meets these industries' ever-changing demands and standards and is expected to boost market expansion in the coming years.

However, the high cost of high-performance liquid chromatography and the upfront and recurring expenditures for purchase and installation, including maintenance, speciality solvents, and columns, hindered the market's growth. Furthermore, increasing R&D activities and rising investments by prominent players are expected to create lucrative revenue growth opportunities for players operating in the global high-performance liquid chromatography market over the forecast period.

The high-performance liquid chromatography market is segmented on the basis of product and application. Based on product, the market is segmented as instruments, consumables, and accessories. By application, the market is segmented into clinical research, diagnostics, forensics, and others.

The instruments category is expected to hold a major share in the global high-performance liquid chromatography market in 2023. This is attributed to instruments in the need for replacements from well-established laboratories that are upgrading to more modern and sophisticated high-performance liquid chromatography systems. In addition, high-performance liquid chromatography instruments are crucial in many different types of analytical applications in many different sectors. Consistent improvements in high-performance liquid chromatography technology have resulted in the creation of increasingly complex, dependable, and effective instruments, meeting the increasing need for rapid and accurate analytical methods in fields such as medicine, biology, epidemiology, and clinical trials.

The clinical research segment is projected to grow rapidly in the global high-performance liquid chromatography market because of the growing focus on precision medicine and personalized healthcare. As a result, dependable high-performance liquid chromatography in clinical trials is becoming more important as pharmaceutical and biotech firms pour more money into drug development and discovery. Every step of the pharmaceutical process, from initial research and development to clinical research and regulatory approval, relies on high-performance liquid chromatography.

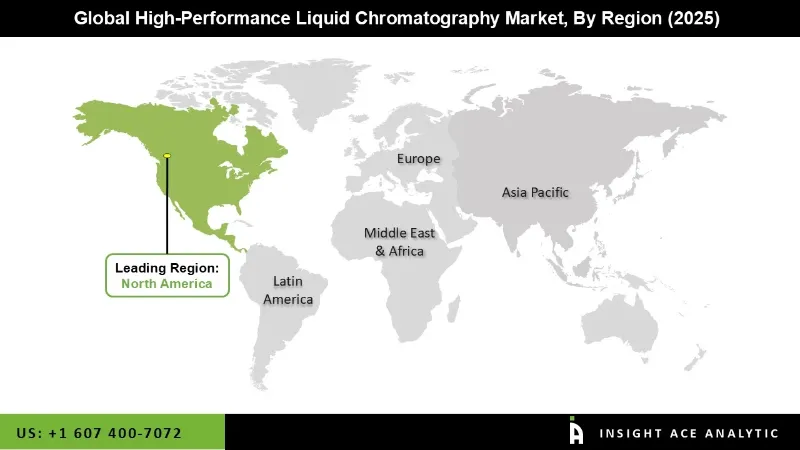

The North American high-performance liquid chromatography market is expected to register the highest market share in terms of revenue in the near future. This can be attributed to the demand for high-performance liquid chromatography for drug discovery, development, and quality control, which is being driven by the region’s thriving pharmaceutical and biotechnology industry, which places a significant emphasis on research and development.

Furthermore, high-performance liquid chromatography is required by the strict regulatory climate in North America, especially in the beverage, pharmaceutical, and environmental industries in the region, which are factors proliferating the growth of the target market in the region. In addition, Asia Pacific is projected to grow at a rapid rate in the global high-performance liquid chromatography market due to the increased focus on the safety of food and the environment. Further, the region's strengthening economy and expanding middle class drive up healthcare spending, which in turn drives up demand for high-quality food and stricter environmental safety regulations, all of which contribute to the expansion of the high-performance liquid chromatography market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.54 Bn |

| Revenue Forecast In 2035 | USD 9.09 Bn |

| Growth Rate CAGR | CAGR of 5.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer Inc., Merck KGaA, Hitachi, Ltd., YMC CO., LTD., Restek Corporation, Gilson, Inc., Phenomenex, Inc., JASCO, and Orochem Technologies Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

High-Performance Liquid Chromatography Market- By Product

High-Performance Liquid Chromatography Market- By Application

High-Performance Liquid Chromatography Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.