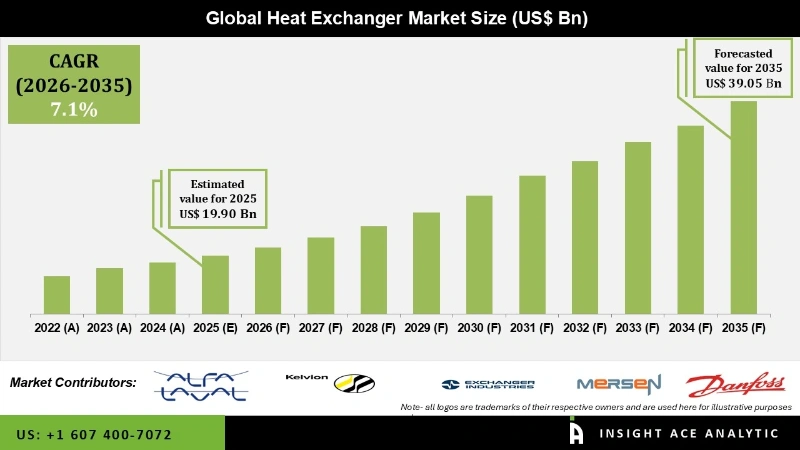

Global Heat Exchanger Market Size is valued at USD 19.90 Billion in 2025 and is predicted to reach USD 39.05 Billion by the year 2035 at a 7.1% CAGR during the forecast period for 2026 to 2035.

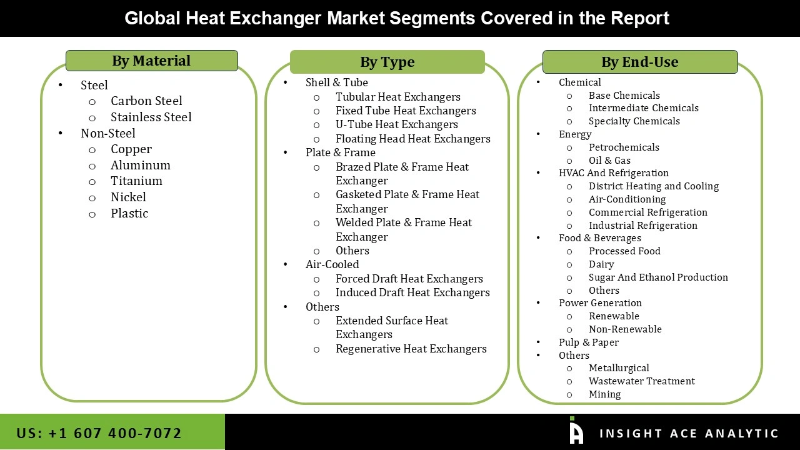

Heat Exchanger Market Size, Share & Trends Analysis Report By Raw Material (Steel, Copper, Aluminum), Type (Shell & Tube, Plate & Frame, Air Cooled), Application (Chemical, Energy, HVACR, Food & Beverage, Power Generation, Pulp & Paper), And End-Use, By Region, And Segment Forecasts, 2026 to 2035.

The demand for energy-efficient and affordable heating and cooling solutions in a variety of industries has fueled the growth and dynamism of the heat exchanger industry. Heat exchangers are tools to move heat from one fluid to another without allowing the two fluids to mix. They are employed in several processes, such as food and beverage processing, petrochemical and chemical processing, power production, HVAC (heating, ventilation, and air conditioning), and many more.

Over the coming years, the heat exchanger market development is anticipated to be driven by elevated demand for environmentally friendly HVAC systems, such as solar panels or geothermal energy for cooling and heating, to reduce energy consumption. Additionally, it is anticipated that over the next several years, demand for the product would increase due to the expanding need for HVAC systems in the commercial sector, which is caused by the expansion of the office, retail, and public building construction industries.

However, the heat exchanger market's high maintenance cost may limit the target market's growth during the forecast period. Furthermore, heat exchangers may be vulnerable to damage and wear and tear over time, which may affect their effectiveness. This can be extremely difficult in demanding operating situations like those in the petrochemical sector.

The heat exchanger market is segmented based on material, type and end-use industry. Based on material, the market is segregated as steel and non-steel. By type, the market is segmented into shell & tube, plate & frame, air-cooled and others. Based on the end-use industry, the market is segmented into chemical, energy, HVACR, food and beverages, power generation, pulp and paper and others.

The chemical category currently holds a dominant position in the global heat exchanger market and is anticipated to expand fastest. This is because heat exchangers are widely used in the chemical industry for various processes, including heating, cooling, condensing, distillation, isolation, etc. Heat exchangers can also endure ongoing chemical reactions, which enables crucial operations to be finished safely and effectively.

The shell and tube segment dominated the market, and it is anticipated that it will further continue to develop at the highest rate over the projection period. This is a result of its advantages over heat exchangers, including cheaper prices compared to plate-type coolers, simplicity of use at higher working temperatures and pressures, and others. It is well known that shell and tube heat exchangers are simple to maintain and work with various seawater coolants.

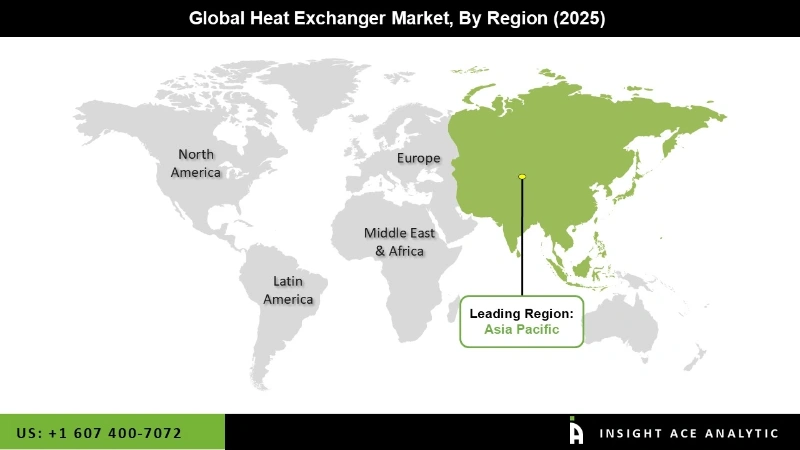

Asia-Pacific will hold a market share and dominate the global heat exchanger market. Equipment that transfers heat from one working fluid to another is called a heat exchanger. The usage of heat exchangers for cooling and heating is very common. The liquids are kept apart by a solid wall in order to prevent mixing. They are extensively utilized in many different applications, including residential heating, air conditioning, refrigeration, hydropower dams, waste treatment, the production of oil and gas, chemical and petrochemical industries, and many more.

Internal combustion engines are where heat exchangers are most frequently used. In these engines, coolant from the engine circulates through radiator coils as air passes by, cooling the coolant and heating the incoming air. Additionally, with a significant proportion of the market, Europe dominated. This can be attributed to rising infrastructure spending on private and public levels, which is anticipated to drive up product demand for HVAC-R applications. Furthermore, the rising demand for equipment with improved durability, efficiency, and fouling resistance across industries is likely to augment the heat exchanger market growth over the coming years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 19.90 Billion |

| Revenue forecast in 2035 | USD 39.05 Billion |

| Growth rate CAGR | CAGR of 7.1% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Polymer And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | ALFA Laval (Sweden), Kelvion Holding Gmbh (Germany), Exchanger Industries Limited (Canada), Mersen (Denmark), Danfoss (US), API Heat Transfer (US), Boyd Corporation (US), H.Guntner (UK), Limited (Germany), Jhonson Controls (Ireland), XYLEM (US), Watec Corporation, Spx flow, Lu-Ve S.P.A., Lenox International Inc., Air Products Inc., Barriquand Technologies Thermiques, Barank, Inc, Chart Industries, Doosan Corporation, Funke Heat Exchanger Apparatebau Gmbh, Hisaka Words, Ltd, Hindustan Dorr-Oliver Ltd, Koch Heat Exchanger PVT. LTD. Pune India, Swep International Ab, Smartheat, Sierra S.P.A, Thermax Limited, Vahterus OY |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Heat Exchanger Market By Material-

Heat Exchanger Market By Type-

Heat Exchanger Market By End-use Industries-

Heat Exchanger Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.