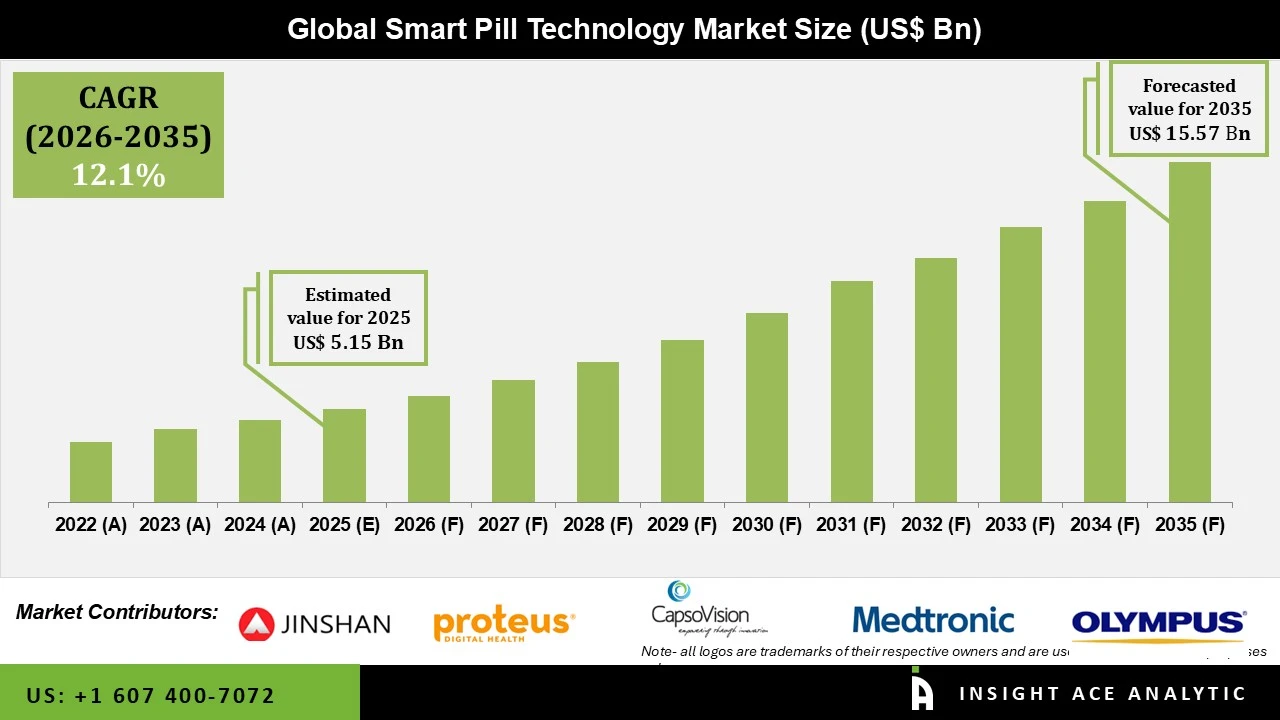

Smart Pill Technology Market Size is valued at USD 5.15 billion in 2025 and is predicted to reach USD 15.57 billion by the year 2035 at a 12.1% CAGR during the forecast period for 2026 to 2035.

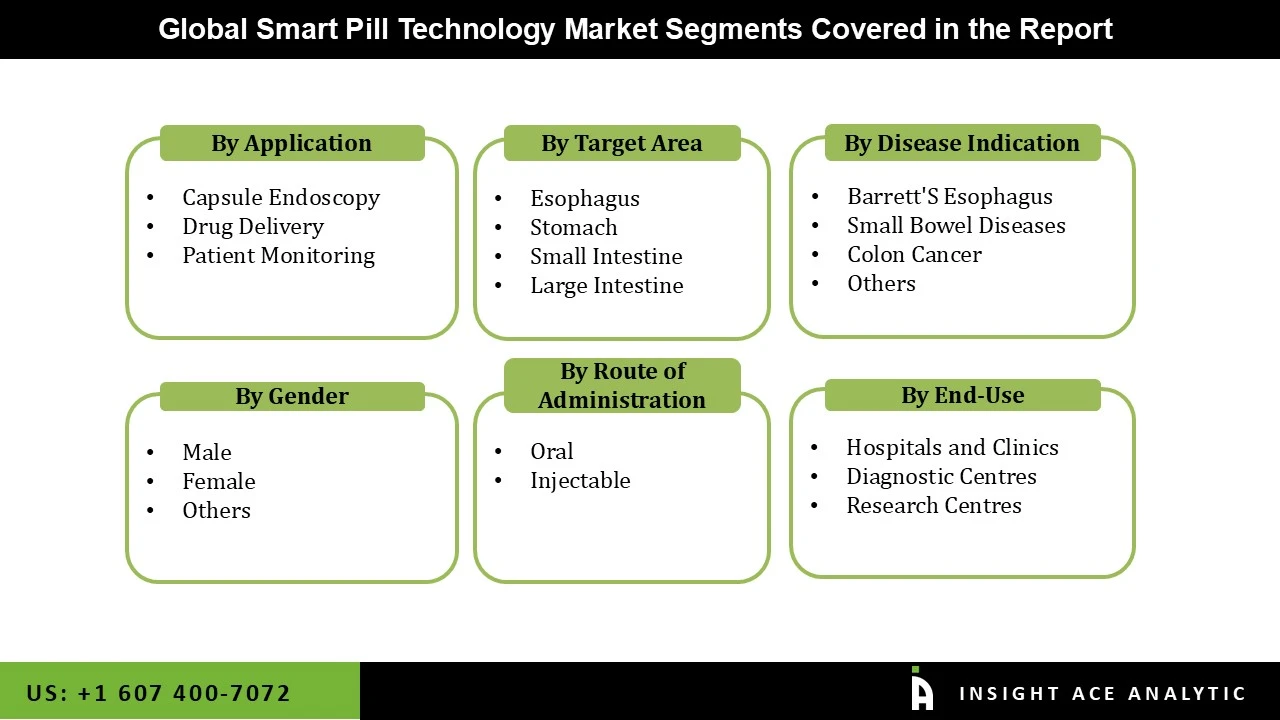

Smart Pill Technology Market Size, Share & Trends Analysis Report By Application(Capsule Endoscopy, Drug Delivery, Patient Monitoring), By Target Area, By Disease Indication, By End-User, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

By bridging the gap between digital technology and healthcare, smart pill technologies have sparked a new wave of change in the healthcare sector. Digital ingestible pills containing edible electronic sensors are known as "smart pills." Investment levels in the market for smart pill technologies are rising quickly. Many investors are drawn to smart pill technologies due to their growing appeal among a sizable portion of the world's population. In mergers, acquisitions, and startups, numerous businesses and investment firms make significant investments. These elements could contribute to the market for smart pill technology growing more quickly. Among these are smart medicines. To expand their customer base, the market participants for smart pill technologies make significant investments in R&D efforts.

Moreover, the leading market growth drivers are the participants improved reimbursement rates and more superficial regulatory approvals for capsule endoscopy. The desire of patients to choose this treatment, ease of monitoring body processes and managing medicines, and general health are the main market drivers. However, factors offering a hurdle to the smart pill technology market growth include probable health hazards related to a smart pill being introduced into the body, privacy concerns, and ethical considerations.

The smart pill technology market is segmented on the application, target area, disease indication and end users. Based on application, the market is divided into capsule endoscopy, drug delivery and patient monitoring. Based on the target area, the smart pill technology market is segmented into the esophagus, stomach, and small and large intestines. Based on the disease indication, the smart pill technology market is segmented into barrett's esophagus, small bowel diseases, colon cancer and others. Based on end-use, the smart pill technology market is segmented into hospitals, clinics, diagnostic centers, and research centers.

The market's leading segment is capsule endoscopy. It is anticipated that factors like wireless health monitoring and site-specific drug delivery will encourage both patients and doctors to use these technologies. A procedure called capsule endoscopy—called GI capsule, camera capsule, pill camera, or wireless end capsule—is employed to diagnose GI diseases. Devices for capsule endoscopy consist of four microcapsules: a light source, a color camera, a transmitter, and a battery. A lot of flexibility is available with capsule endoscopy. Both wireless patient monitoring and intelligent drug delivery (also known as Bio-MEMS drug delivery system) via smart pills are still in their infancy.

Hospitals and clinics grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. The way that patients are treated in hospitals has changed noticeably. In the comfort of a patient's sensor, embedded systems or diagnostic tools support monitoring vital signs, including temperature, pH, pulse, and others. The ability to integrate sensors and electronics at lower power levels on materials like silicon is growing. This improves the multiple drug delivery applications for sensors. As a result, the market for hospitals and clinics is expanding, creating new opportunities for the smart pill market to expand.

North America is anticipated to post respectable gains during the study period. Medical researchers' ongoing progress in the area of ingestible electronics is what is fueling this rise. The U.S. FDA and other regional agencies have been developing standards for obtaining digital smart tablet approval. In addition, the rise in colorectal cancer incidence, improvements in healthcare technology, and the regulatory clearance of new products. All these variables are anticipated to present growth prospects for the players operating in this region. Besides, Asia-Pacific smart pill market share would grow more quickly than any other region. Because of the growing older population, rising healthcare spending, and advancements in medical technology.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.15 billion |

| Revenue Forecast In 2035 | USD 15.57 billion |

| Growth rate CAGR | CAGR of 12.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Application, Target Area, Disease Indication, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | RF Co., Ltd, JINSHAN Science and Technology, Proteus Digital Health, HQ, Inc., CapsoVision, Inc., Medtronic Plc., Olympus Corporations, IntroMedic Co., Ltd, Check Cap, Koninklijke Philips N.V. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Application

By Target Area

By Disease Indication

By End-User

By Gender-

By Route of Administration-

By End-Use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.