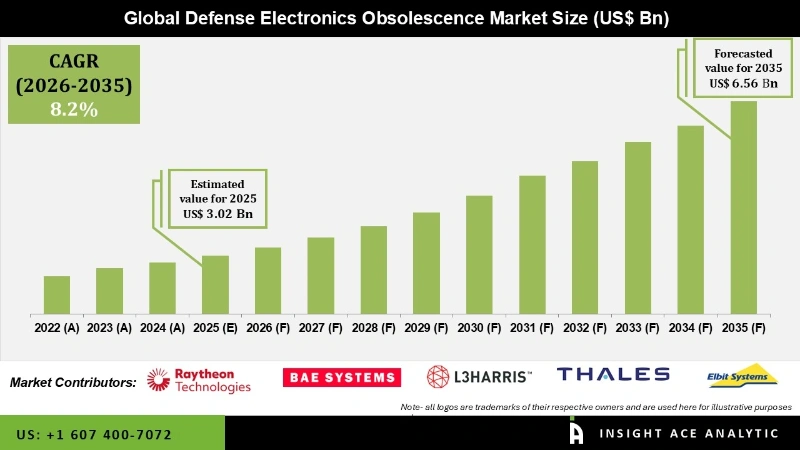

Defense Electronics Obsolescence Market Size is valued at USD 3.02 Bn in 2025 and is predicted to reach USD 6.56 Bn by the year 2035 at a 8.2% CAGR during the forecast period for 2026 to 2035.

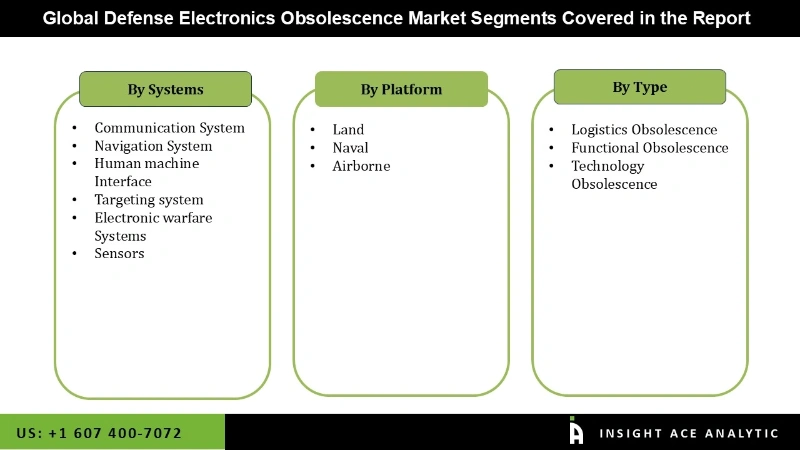

Defense Electronics Obsolescence Market Size, Share & Trends Analysis Report By System (Communication System; Navigation System; Human Machine Interface; Flight Control System; Targeting System; Electronic Warfare System; and Sensors), By Platform (Land, Naval, Airborne), By Type (Logistics Obsolescence, Functional Obsolescence, Technology Obsolescence), By Region, And By Segment Forecasts, 2026 to 2035.

Obsolescence poses a major difficulty in defence electronics, mostly because of the swift pace of technological improvements and the extended life cycles of military equipment. Components and systems can become obsolete, unavailable, or incompatible with newer technologies, which can pose dangers to defence readiness and security. To tackle obsolescence, it is necessary to engage in strategic planning that encompasses lifecycle management, technology updates, and the utilization of commercial off-the-shelf components whenever feasible. Possible solutions may include system redesign, the substitution of components, or utilization of emulation technologies to guarantee ongoing functionality and support for defense activities.

Applications in military and defence necessitate these systems' greater situational awareness, faster reaction times, and enhanced precision. Restrictive regulatory norms and criteria play a crucial role in determining the lifespan of systems and components in the defense electronics obsolescence industry. Furthermore, the defense electronics obsolescence market is experiencing strong expansion, mostly attributable to the increasing production of electric vehicles. Any vehicle that gets at least some of its power from an electric source is considered an electric vehicle. The electric energy flow and control are crucial aspects of electric cars that rely on defense electronics obsolescence.

However, the market growth is hampered by the high-cost criteria for the safety and health of the defense electronics obsolescence market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high defense electronics obsolescence, because defense electronics have a high initial investment and avionic device installation and upgrade costs are also substantial, which is limiting the market's total growth. Defense electronics are subject to export laws and restrictions on international trade. The dual goals of protecting the nation and limiting technological progress are the driving forces behind these regulations. Businesses in the international electronic protection industry may face challenges due to export restrictions. The global market has been hit hard by the COVID-19 pandemic, and many manufacturers have had to close their doors in an effort to keep their employees safe from the virus. This has put a damper on the industry's growth prospects.

The defense electronics obsolescence market is segmented based on systems, application type, platform, and type. According to systems, the market is segmented into Communication System (Transponders, Transreceivers, Antennas, Transmitters, Receivers), Navigation System, (Inertial Navigation System (INS) (Altimeter, Magnetometer, Gyroscope), Global Positioning System (GPS), Navigation Computer), Human machine Interface (Navigation Display, Primary Flight Display, Multi-function Display), Targeting system (Radars (Antenna, Transmitter, Receiver, Digital Signal Processors, Power Amplifier, Duplexer), Electro-optic & Infrared (Transmitter, Receiver, Beam Expander, Optical Sensor, Detector, Signal Processor)), Electronic warfare Systems (Jammers (Transmitter, Receiver, Control Unit, Display), Sensors (Infrared Sensors, Motion Sensors, Lidar Sensors, Pressure Sensors, Radiation Sensors, Magnetic Sensors, Biometric Sensors, Humidity/Temperature Sensors, Proximity Sensors). By platform, the market is segmented into Land (Combat Vehicles, Main Battle Tanks, Infantry Fighting Vehicles, Armored Personnel Carriers, Light Armored Vehicles, Combat Support Vehicles, Armored Combat Support Vehicles, Mine-Protected Vehicles), Naval (Aircraft Carriers, Destroyers, Frigates, Corvettes, Submarines, Patrol Vessels, Mine Countermeasures Ship, Amphibious Ship), Airborne (Combat Aircraft, Transport Aircraft, Special Mission Aircraft, Combat Helicopters). By type, the market is segmented into logistics obsolescence, functional obsolescence, and technology obsolescence.

The navigation system defense electronics obsolescence market is expected to lead with a major global market share. The advent of sophisticated navigation systems has greatly improved the quality of life behind the wheel. Saving time and easing tension, these devices direct vehicles along the most efficient routes with real-time traffic information.

The airborne category is expected to have the highest market share because of the considerable risk of becoming outdated associated with the sophisticated electronics used in military aircraft. These electronics include aerial delivery systems, helmet-mounted displays (HMDs), communication systems, palletized loading systems (PLS), and radars.

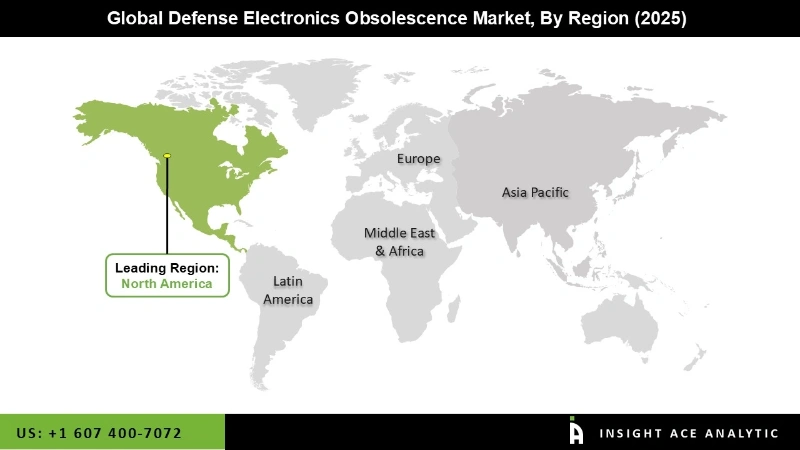

The North American defense electronics obsolescence market is expected to record the maximum market revenue share in the near future. It can be attributed to due to its innovative technology, strong industrial foundation, and large defense budget. In addition, Europe is projected to show rapid growth in the global defense electronics obsolescence market because many different types of end-user industries have a strong demand for power electronics. In addition, the region's robust automobile market will fuel even further market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.02 Bn |

| Revenue Forecast In 2035 | USD 6.56 Bn |

| Growth Rate CAGR | CAGR of 8.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By System, By Platform, By Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Raytheon Technologies Corporation, BAE Systems, L3Harris Technologies, Inc., Thales, Elbit Systems Ltd, Hexagon Ab, Leonardo S.P.A., Curtiss-Wright Corporation, Bharat Electronics Ltd, Ultra Electronics, Hindustan Aeronautics Ltd, Lockheed Martin Corporation, TT Electronics, Siemens AG, Cyient Limited, Converge, Fermionx, Radel Advanced Technology Pvt. Ltd., Larsen & Toubro Limited, Actia |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Defense Electronics Obsolescence Market By Systems-

Defense Electronics Obsolescence Market By Platform-

Defense Electronics Obsolescence Market By Type-

Defense Electronics Obsolescence Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.