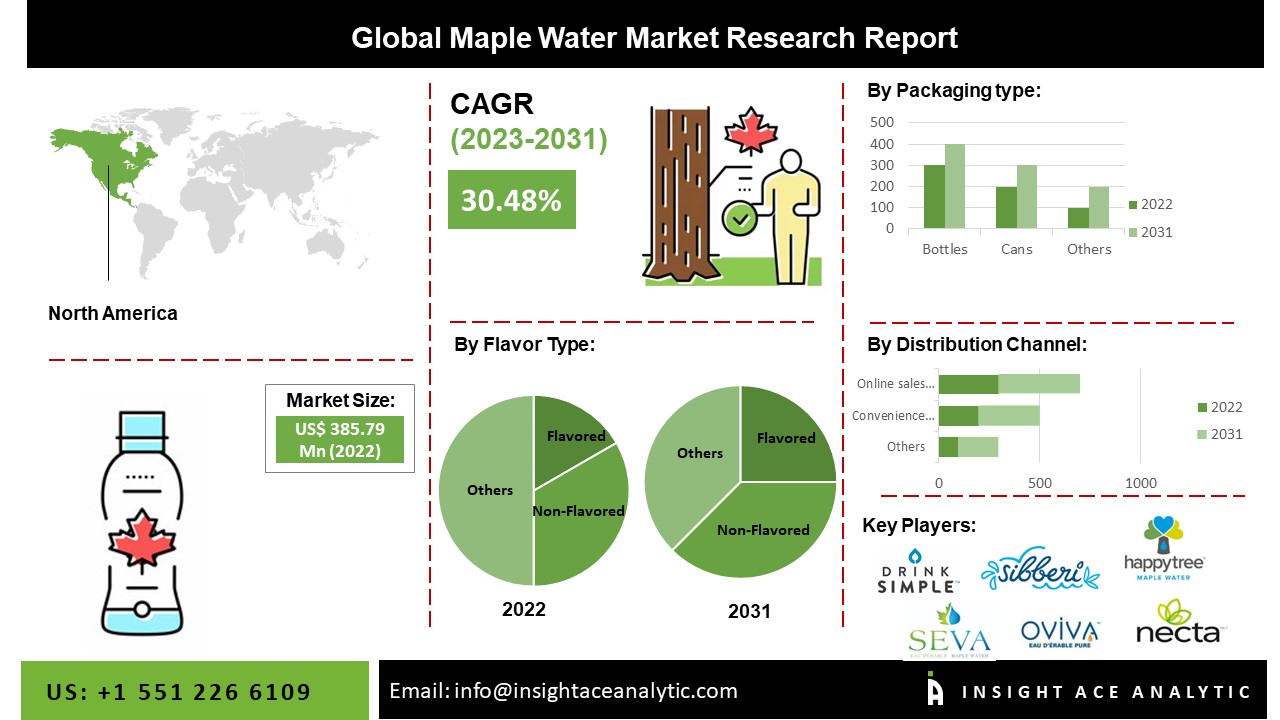

The Global Maple Water Market Size is valued at 385.79 Million in 2022 and is predicted to reach 4173.40 Million by the year 2031 at a 30.48 % CAGR during the forecast period for 2023-2031.

Maple water, commonly known as sap, is a clear liquid plant-based water that flows speedily from maple trees for a short period of time in early spring. A natural process fills maple water with nourishment. Maple water includes 46 unique bio-active chemicals, some of which have antioxidant characteristics and minerals such as potassium, zinc, limestone, and chromium. The increased health consciousness among the general public propels the maple water business forward.

With changing lifestyles and nutritional habits, there is a growing demand for organic and plant-based beverages over carbonated drinks, juices, and effervescent drinks. In line with this, maple water is gaining popularity as a weight management and sports recovery drink due to its low-calorie content. Other factors include rising demand for natural sweeteners, maple syrup, butter, liqueur, and baked sweets, aggressive promotional efforts by manufacturers, and convenient product availability via proliferating online retail channels, which are likely to boost the market even further.

Additionally, the crucial factor that has fueled the growth of the global maple water market is the rising health trend of increased consumption of low-calorie beverages. The increased demand for flavored, fortified, or sparkling maple water is attributable to the increasing customer desire for value-added hydration in line with developing consumer tastes. Some players are also earning from electrolyte-containing hydration products for athletes, which may help the industry grow even further.

The maple water market is segmented on flavor, packaging, and end-use. Based on flavor, the market is segmented into flavored and unflavored. Based on packaging, the maple water market is segmented into tetra, bottle, pouches and cans. Based on end-use, the maple water market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online retail stores, and other distribution channels.

The flavored category will control the market throughout that time. This can be linked to the rising global demand for flavored beverages serving refreshing drinks. As flavored beverages help consumers connect with real and familiar flavors, this influences how they choose which products to buy.

Bottles grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Maple water and other such beverages are regularly marketed in glass bottles in supermarkets, convenience stores, and online marketplaces, among other distribution channels, in addition to plastic pet bottles. Bottles can be produced in various sizes, forms, or colors and branded with the production company's logo, making them flexible to consumer needs. Most maple water bottles are available in various hues, including clear, frosted, and colorful versions. They are frequently made of plastic and glass, which are easily moldable.

The North American maple water market is expected to register the highest market share in revenue soon. There is more potential in the North American maple water market due to growing customer demand for natural products and an increase in the availability of healthy maple trees. This is partly due to the region's growing demand for packaged flavored beverages and increased awareness of the health advantages of maple water. A further factor supporting the production of maple water is the spread of sugar maple tree plantations throughout eastern Canada and the Northeastern United States. In addition, Asia Pacific is projected to grow rapidly in the global maple water market. With a rising preference for low-calorie, naturally sweetened water products, maple water demand and consumption are projected to increase soon, propelling the market's expansion. Major firms' presence in the area is also a factor in their market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2022 | USD 385.79 Million |

| Revenue Forecast In 2031 | USD 4173.40 Million |

| Growth Rate CAGR | CAGR of 30.48 % from 2023 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2023 to 2031 |

| Historic Year | 2019 to 2022 |

| Forecast Year | 2023-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Flavor Type, Packaging Type, Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Drink Simple, Sibberi Ltd., Drink Maple Inc., Smith And Salmon, Inc. (Sap), Seva Maple Water, Oviva Eau D’erable Pure, Maple3, Lower Valley Beverage Company, Drink Happy Tree, Necta Nature. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Flavor

By Packaging

By Distribution Channel

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.