Global Animal Feed Phytase Market Size is valued at USD 603.8 Mn in 2024 and is predicted to reach USD 1125.7 Mn by the year 2034 at a 6.6% CAGR during the forecast period for 2025-2034.

The phytase enzyme improves digestion and animal health while assisting livestock farmers in increasing phosphorus intake. Enough phosphorus intake in the diet promotes healthy reproduction in cattle, whereas phosphorus deficit raises metabolic issues. Due to rising domestic animal adoption, rising disposable income, and increasing commercial cow production, there is a significant increase in the need for animal feed phytase; thus, the market is expanding.

Rising meat and dairy product consumption are anticipated to promote market growth. Furthermore, a significant increase in disposable incomes and a growing taste for nutrient-dense diets are expected to increase animal husbandry, fostering the expansion of the animal feed phytase market. In the upcoming years, the development of the animal feed phytase market is expected to be supported by growing awareness of fungus derived from POME (palm oil mill effluent). Furthermore, the animal feed phytase business is seeing increased product penetration thanks to intensive research and development efforts related to phytase enzymes.

However, a rise in the calcium-to-phosphorous ratio can reduce laying hen performance, which hinders product penetration since hens need to metabolize a lot of calcium to create their eggshells. But as people who own animals become more aware of how easily phytase is digested by cattle, together with improvements in phytase feed products, market participants will likely be better able to manage these issues in the future.

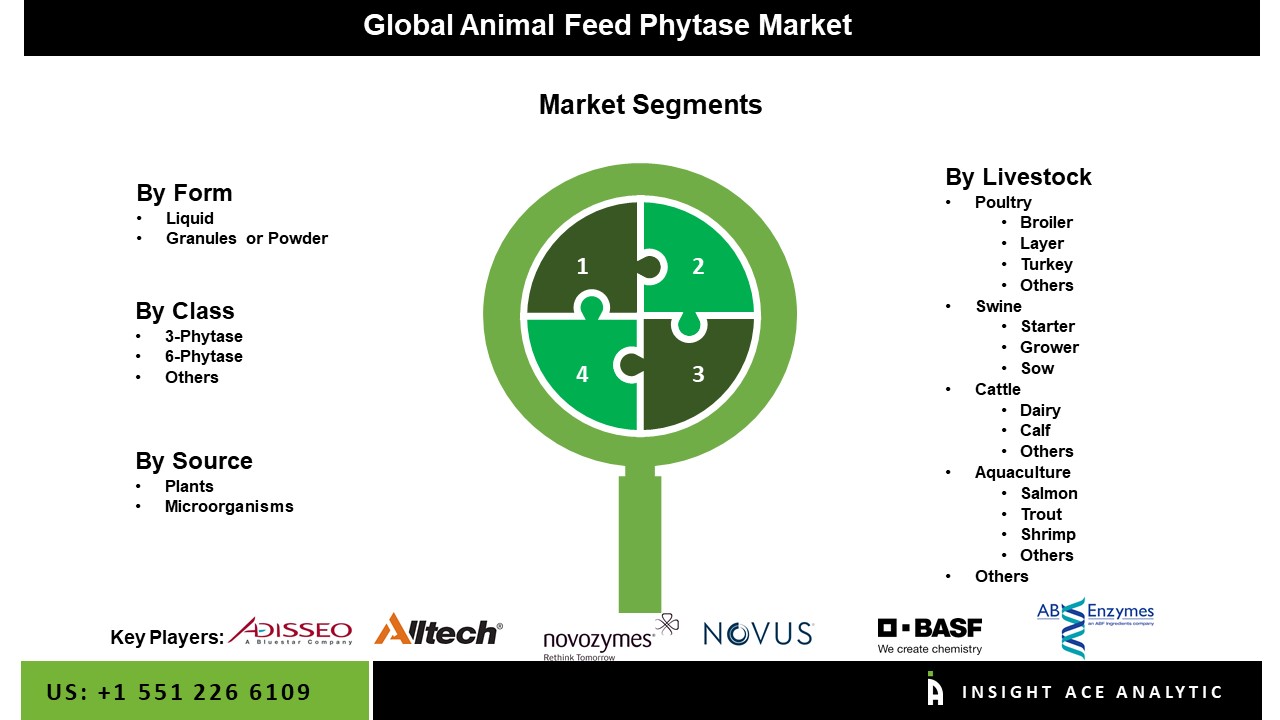

The animal feed phytase market is segmented on form, class, source and livestock. Based on form, the market is segmented into liquid and granules or powder. Based on class, the animal feed phytase market is segmented into 3-phytase, 6-phytase and others. Based on the source, the animal feed phytase market is segmented into plants and microorganisms. Based on the livestock, the animal feed phytase market is segmented into poultry (broiler, layer, turkey, others), swine (starter, grower, sow), cattle (dairy, calf, others), aquaculture (salmon, trout, shrimp, others) and others.

Based on form, the market is segmented into liquid and granules or powder. The granules or powder category is anticipated to grow significantly over the forecast period because all mash feeds frequently use uncoated powder formulations. Pigs and poultry, in particular, benefit greatly from powder-feed phytases because they increase gut activity. These enzymes are also considered suitable for pelleting at temperatures up to 70°C.

Based on the livestock, the animal feed phytase market is segmented into poultry (broiler, layer, turkey, others), swine (starter, grower, sow), cattle (dairy, calf, others), aquaculture (salmon, trout, shrimp, others) and others. The poultry category grabbed the highest revenue share, and it is anticipated that it will continue to hold that position during the anticipated time. The increase results from things like chicken and poultry being more susceptible to digestive issues. They typically struggle to digest between 20 and 25 per cent of the diet. As a result, feed enzymes like phytase are used in feeds to enhance the capture of minerals (such as zinc and calcium) and to aid in the breakdown of phytate and the release of phosphate content.

The North American animal feed phytase market is expected to register the highest market share in revenue in the near future due to the growing demand for nutrient-rich protein-filled feed products in the area. The region's nations' expanding cattle populations promote market income growth. Governments in the area are expanding the number of cattle, growing the demand for phytase, a component in animal feed. Additionally, the Asia Pacific is anticipated to expand at a significant rate over the course of the forecast period. The local aquaculture industry is anticipated to benefit from the expanding processed and fast food industries and a shift in consumer tastes toward ready-to-eat foods, encouraging the growth of the animal feed phytase market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 603.8 Million |

| Revenue forecast in 20314 | USD 1125.7 Million |

| Growth rate CAGR | CAGR of 6.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn,and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Form, Class, Source, Livestock |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | AB Enzymes (Associated British Foods PLC), Alltech, BASF SE, Novozymes, Novus International, Adisseo, DuPont, and DSM. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Form-

By Class-

By Source-

By Livestock

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.