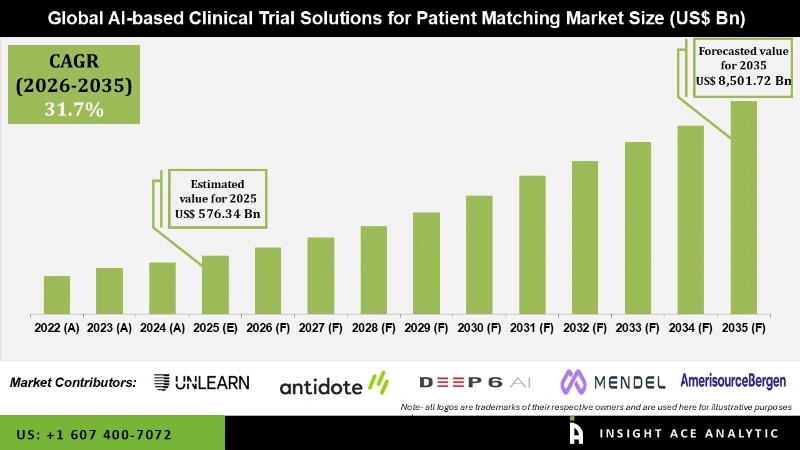

Global AI-based Clinical Trial Solutions for Patient Matching Market Size is valued at USD 576.34 Million in 2025 and is predicted to reach USD 8,501.72 Million by the year 2035 at a 31.7% CAGR during the forecast period for 2026 to 2035.

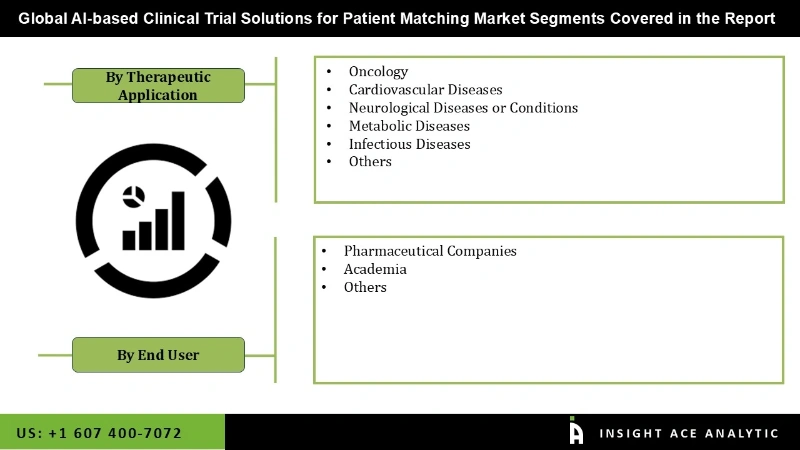

AI-based Clinical Trial Solutions for Patient Matching Market Size, Share & Trends Analysis Report By Therapeutic Application (Oncology, Cardiovascular Diseases, Neurological Diseases or Conditions, Metabolic Diseases, Infectious Diseases, Others), By End-Use, By Region, And By Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

A network-wide clinical trial matching tool powered by artificial intelligence (AI) called VIPER. AI technology is intended to enable, prioritize, and expedite patient enrollment during the trial recruitment process. The use of AI-powered solutions in controlling and implementing medical testing is responsible for the market’s expansion. These solutions can help shorten the duration of the clinical trial cycle, which lowers costs and improves reliability while also improving the efficiency of trial production. The primary driver of AI-based clinical trial solutions for the patient matching market is that a massive percentage of pharmaceutical companies are forced to make significant investments in new drug development to increase the number of products in their product pipelines. Clinical and biomedical research using digitalization is creating prospects for AI-based clinical trial solutions for the patient-matching market.

Leading pharma companies are incorporating cutting-edge technological solutions for improved patient management and clinical outcomes. Government entities in developed nations fund the development of AI-based clinical trial survey technologies while establishing a strong regulatory foundation. Additionally, governments in emerging economies are educating stakeholders about AI-based clinical trial solutions so that they may concentrate on finding novel treatments and expediting patient enrollment, which will increase patient experience and monitoring. However, risks associated with data privacy might constrain AI-based clinical trial solutions for the patient-matching market in the coming years.

The Ai-based clinical trial solutions for the patient matching market are segmented based on therapeutic application and end users. Based on therapeutic applications, the AI-based clinical trial solutions for the patient matching market is segmented as oncology, cardiovascular diseases, neurological diseases or condition, metabolic diseases, infectious diseases, and others. By application, the AI-based clinical trial solutions for the patient matching market are segmented into pharmaceutical companies, academia, and others.

The pharmaceutical company’s segment is expected to hold a major share in the global AI-based clinical trial solutions for patient matching market in 2021 due to the increased emphasis on creating biomarkers and diagnostics that work better, employing AI-based innovations to find new drug targets and streamlining the application development. The expanding pharmaceutical sector is further fueling the market due to the prevalence of chronic diseases and the rising demand for new treatments. The market is also benefiting from a partnership between major pharmaceutical companies and AI providers to use AI technologies designed for the entire process of discovering new medicines.

The oncology segment is projected to grow rapidly in the global AI-based clinical trial solutions for the patient matching market. The number of AI-based clinical trial solutions for patient matching is rising due to the rising incidence rate of cancer worldwide, positively affecting the industry. Leading pharmaceutical corporations are also collaborating with AI development firms to deploy AI-based oncology technologies created for the creation of pharmaceuticals., especially in countries such as the US, Germany, the UK, China, and India.

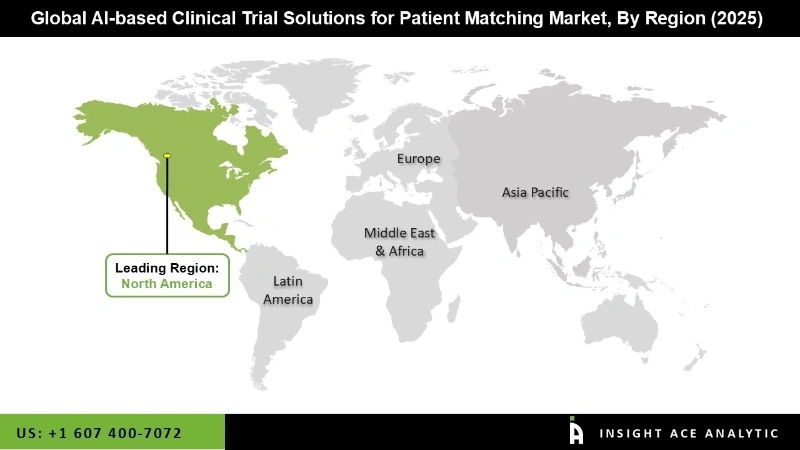

The North America AI-based clinical trial solutions for the patient matching market are expected to register the highest market share in revenue soon. The development of a sizable patient population, affordable access to highly skilled labor, and reasonable hiring rates are the fundamental causes of this. The market’s growth is primarily driven by increased usage of AI-based technologies and rising awareness of these solutions. A greater number of startups have emerged due to the growing consumption, which is anticipated to create new prospects for the industry in this region.

In addition, Asia Pacific is projected to grow at a rapid rate in the global AI-based clinical trial solutions for the patient matching market. The growing demand for AI-based technology and the incorporation of government initiatives contribute to the region’s growth. Major market players are also boosting their R&D in AI-based technologies for clinical trials to enhance their market shares. Activities include joint ventures, agreements, affiliations, and other strategic alliances with rival market participants.

Recent Developments:

| Report Attribute | Specifications |

| Market size value in 2025 | USD 576.34 Million |

| Revenue forecast in 2035 | USD 8,501.72 Million |

| Growth rate CAGR | CAGR of 31.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Therapeutic Application, End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Unlearn.AI, Inc., Antidote Technologies, Inc., Deep6.ai, Mendel.ai, Aris Global, Deep Lens AI, AmerisourceBergen Corporation, Konaks, Microsoft Corporation, GNS Healthcare. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Therapeutic Application

By End-use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.