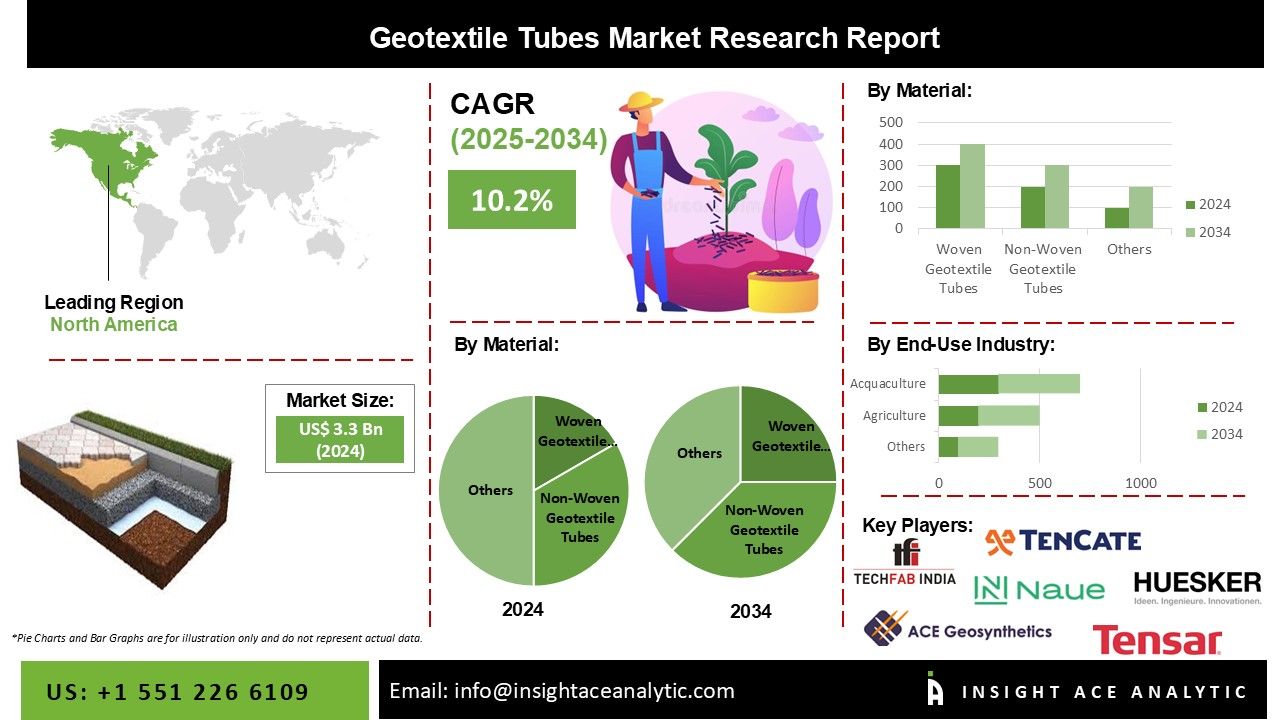

Geotextile Tubes Market Size is valued at 3.3 billion in 2024 and is predicted to reach 8.6 billion by the year 2034 at an 10.2% CAGR during the forecast period for 2025-2034

Key Industry Insights & Findings from the report:

Permeable geotextiles are used to create cylindrical geotextile tubes, which are engineered constructions. They are covered with gabions, filled with materials like slurry or sand, and made of high-tenacity polypropylene yarns. Geotextile tubes show resistance to biological, ultraviolet (UV), and rotting damage. As they are resistant to chemicals, acids, and alkalis, they also help to increase stability and reduce wind and water erosion. Since they help to reduce and prevent the leakage of contaminants into the environment during the processing, transit, and final disposal of contaminants, geotextile tubes are frequently used for shoreline protection, dewatering, desludging, dredging materials, mining waste, and erosion control applications.

Because of this, geotextile tubes are widely used in a variety of industries, including construction, agricultural, marine, and wastewater treatment. These tubes are constructed on-site by hydraulically pumping local soil into prefabricated geotextile tubes, resulting in a solid, continuous construction that is very resistant to water currents.

The geotextile tubes are perfect for applications involving sludge removal or dewatering. Dewatering and desludging, as well as protection, are accomplished using geotextile tubes, also known as geotubes, geobags, soil tubes, geo containers, or dewatering bags. These tubes are typically produced from woven or nonwoven polypropylene/polyester yarns and are used in the maritime, environmental, and agricultural industries. They are impervious to chemical, alkaline, and acid deterioration as well as biological, UV, and rotting degradation. All these factors drive the geotextile tubes market growth.

The Geotextile tube market is segmented into material and end-use industry. Based on material, the market is bifurcated into woven geotextile tubes and non-woven geotextile tubes. On the basis of the end-use industry, the market is segmented as wastewater treatment, agriculture, aquaculture, pulp and paper mills, construction, marine, and others.

The largest market share for geotextile tubes was held by the non-woven category. It is anticipated that non-woven segments will be created by needle punching through weaving, heating, and chemically gluing fibers together. Due to their improved porosity, these materials are typically used in filters or separation systems. The expansion of the geotextile tube market is anticipated to be fuelled by their expanding use in structural applications.

The maritime end-use category took the lead in the product market. The main reason boosting the segment's expansion is rising investment in initiatives to conserve coastal areas and revitalize beaches. Additionally, the category is growing as a result of increased product usage in the construction of flood control structures.

The Asia Pacific region dominated the market in 2021. Geotextiles that are cylinder-shaped are made of permeable materials. In the Asia Pacific region, it is predicted that the construction industry will contribute significantly to the market's overall growth for geotextile tubes. This is explained by the increased use of geotextile tubes and mats in India's road construction projects. To prevent the aggregate layers from sinking into the subsurface, geotextiles are used as a separator between the subsoil and aggregate layer of roads.

In addition, about significant share of the global geotextile tube market was located in Europe. When it comes to launching several projects to stop coastal erosion, Europe has been at the forefront. The country's growing urbanization is encouraging significant expenditures in development projects including road building and maintenance, which is driving the geotextile tubes market expansion. Additional government measures to bridge the gap between rural and urban settings responsibly can be linked to the market growth in the area.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 3.3 Bn |

| Revenue forecast in 2034 | USD 8.6 Bn |

| Growth rate CAGR | CAGR of 10.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material And End-Use Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Techfab India Industries Ltd, Koninklijke Tencate, Flexituff Ventures International Limited, Huesker, Ace Geosynthetics, Officine Maccaferri, Geofabrics Australasia Pty Ltd, Naue Gmbh & Co., Fibertex Nonwovens And Tensar International. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Geotextile Tubes Market By Material-

Geotextile Tubes Market By End-use industry-

Geotextile Tubes Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.