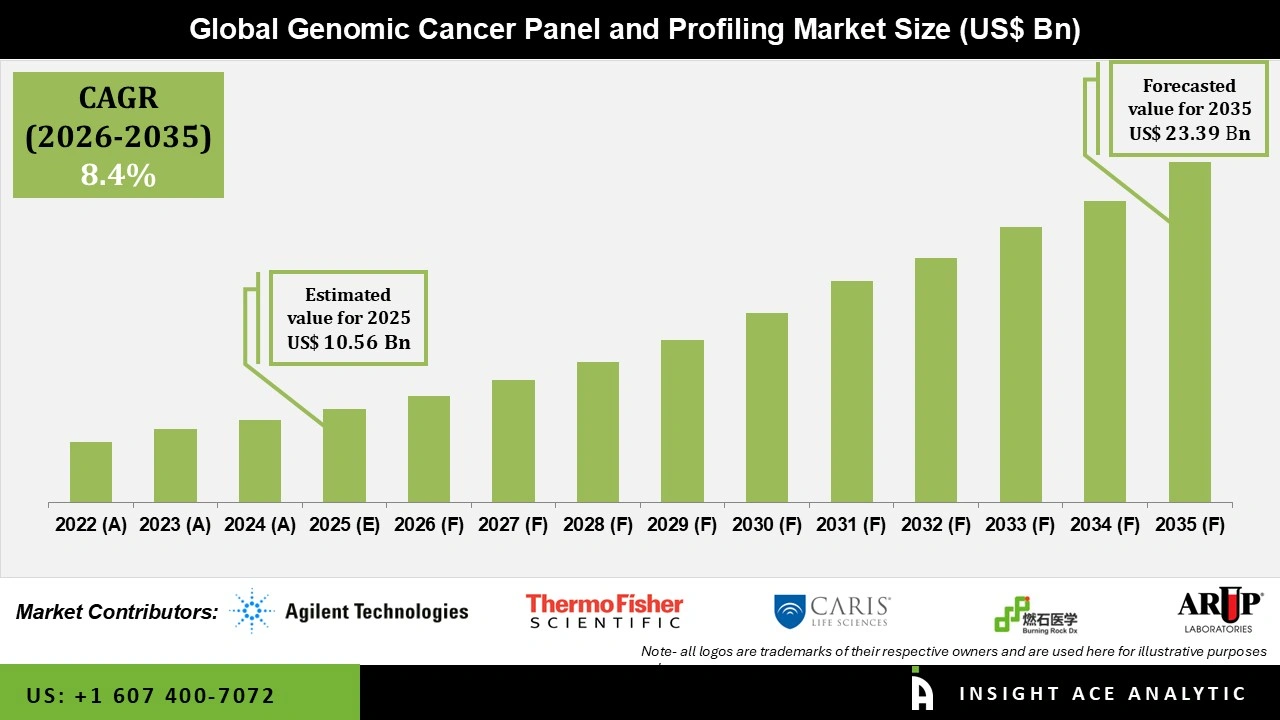

Global Genomic Cancer Panel and Profiling Market Size is valued at USD 10.56 Bn in 2025 and is predicted to reach USD 23.39 Bn by the year 2035 at a 8.4% CAGR during the forecast period for 2026 to 2035.

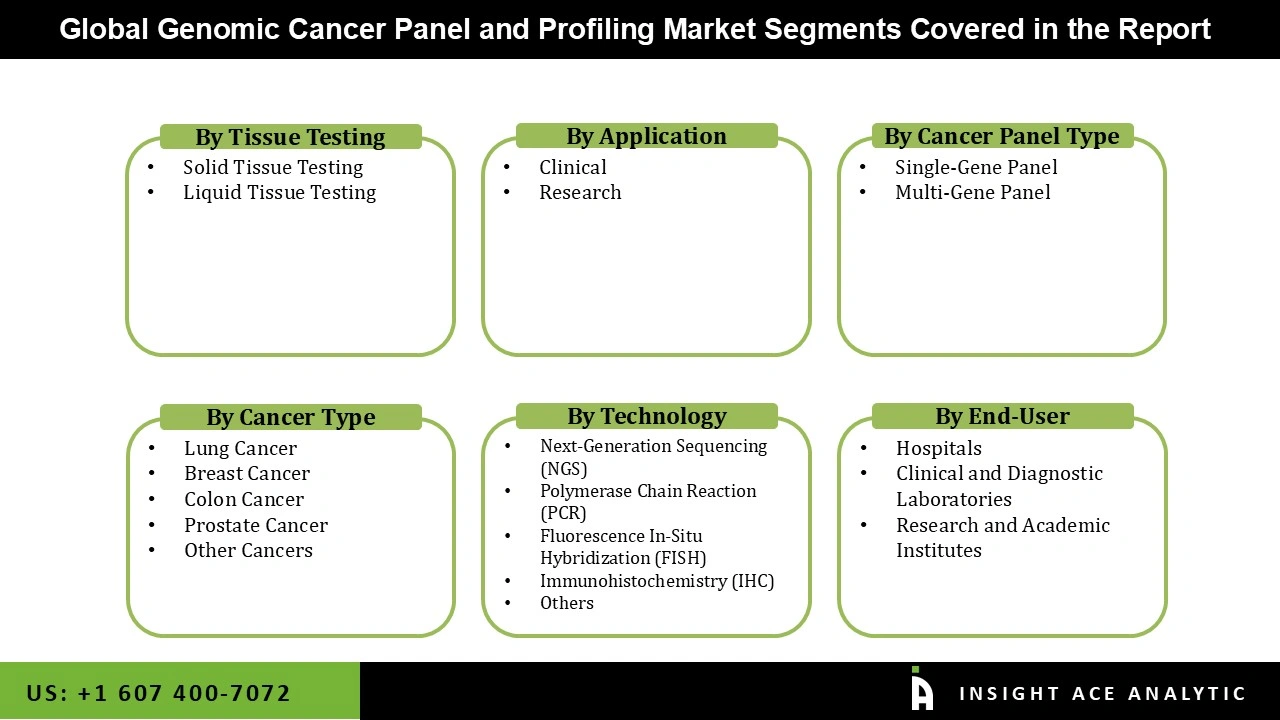

Genomic Cancer Panel and Profiling Market Size, Share & Trends Analysis Report By Tissue Testing (Solid Tissue Testing, Liquid Tissue Testing), By Cancer Panel Type (Single-Gene Panel, Multi-Gene Panel), By Cancer Type (Lung Cancer, Breast Cancer, Colon Cancer, Prostate Cancer, Other Cancers), By Application, By Technology, By End User, By Region and By Segment Forecasts, 2026 to 2035.

Genomic cancer panels and profiling are cutting-edge method for early cancer detection that studies tumour genetic features before symptoms manifest. One of the main benefits of using these panels is the extensive genetic information they may give, which helps with early detection and creating individualized treatment programs. Genomic cancer panels and profiling can revolutionize cancer treatment, which is driving demand in the industry. Greater emphasis on early diagnosis as part of cancer patient therapy has contributed to the meteoric surge in the worldwide genomic cancer panel and profiling industry. The increasing demand for liquid biopsy tests is also driving industry growth. Furthermore, the rising cancer risk associated with people's changing lifestyles is another factor influencing the expansion of the industry.

However, the market growth is hampered by the lack of awareness criteria for the safety and health of the genomic cancer panel and profiling market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high genomic cancer panel and profiling, because the search for, creation of, and validation of biomarkers for use in cancer detection and prognosis incur substantial financial costs. There must be proof for the clinical field to use a newly developed candidate biomarker. Potential biomarkers are being found at a rate that is much faster than they can be validated.

The high prices of these tests make them difficult for patients to afford, which will likely limit their usage in cancer profiling. Strict restrictions imposed by the coronavirus outbreak, such as limiting contact and implementing lockdown precautions, have hindered regular cancer screenings. Counts of cancer have plummeted as a result of a considerable decrease in the false positives caused by COVID-19 infections, which include lung cancer and mild respiratory disease. COVID-19 may have an outsized impact on cancer patients compared to the overall population.

The genomic cancer panel and profiling market is segmented based on tissue testing, cancer panel type, cancer type, application, technology and end user. Based on tissue testing, the market is segmented into solid and liquid tissue testing. The market is segmented by cancer panel type into single-gene and multi-gene panels. As per the cancer type, the market is segmented into lung cancer, breast cancer, colon cancer, prostate cancer, and other cancers. According to application segment is categorised into clinical and research. By technology, the market is segmented into next-generation sequencing (NGS), polymerase chain reaction (PCR), fluorescence in-situ hybridization (FISH), immunohistochemistry (IHC), and others. By end user, the market is segmented into hospitals, clinical and diagnostic laboratories, and research and academic institutes.

The liquid tissue testing genomic cancer panel and profiling market is expected to hold a major global market share in 2022. liquid tissue testing is quickly becoming the method of choice in the global genomic cancer panel and profiling industry. This bodes well for the future of cancer research and treatment, as liquid sample testing is likely to supersede more conventional approaches.

Research and academic institutes comprise the bulk of genomic cancer panels and profiling because research institutes substantially facilitate the development of new cancer medicines and improve cancer diagnostics. Research institutions rely on gene panels and profiling tests for patient evaluations because they are leaders in clinical trials and drug development, especially in countries like the US, Germany, the UK, China, and India.

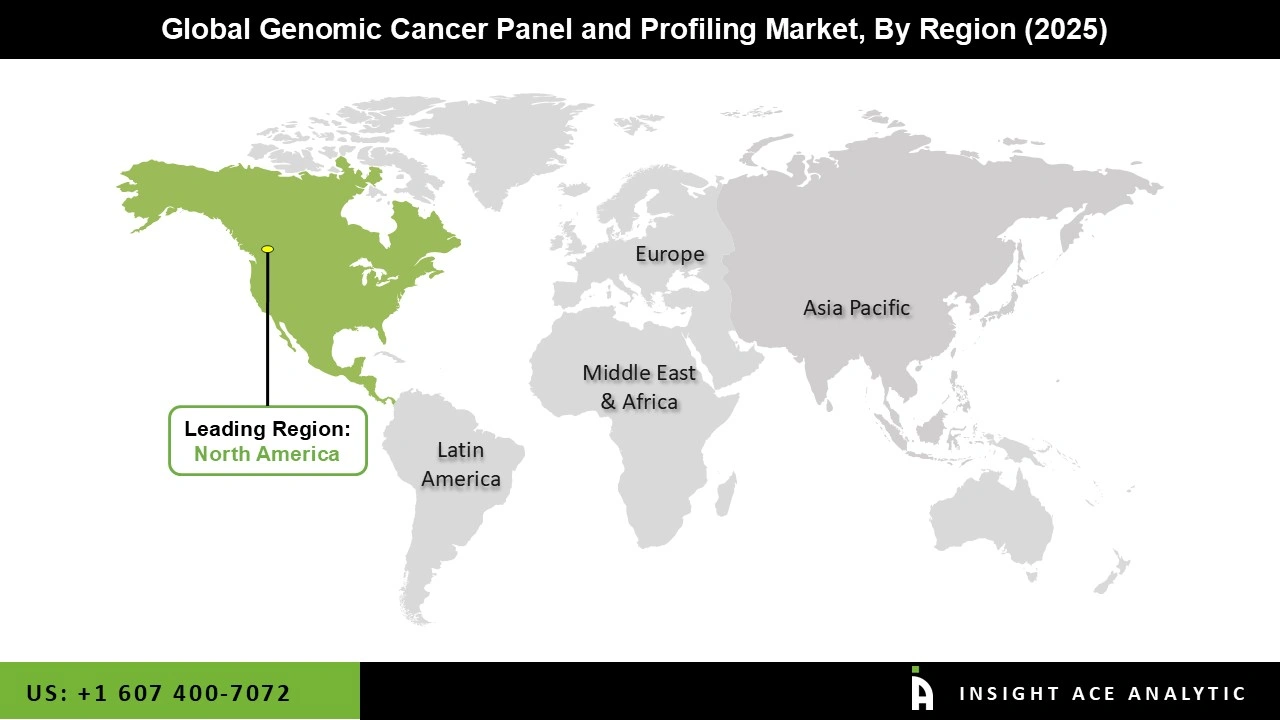

The North American genomic cancer panel and profiling market is estimated to lead with the maximum market revenue share in the near future. It can be attributed to because of the high concentration of major international corporations in the area, the rising cancer rate, and the widespread use of biomarkers in medication development.

In addition, Asia Pacific is estimated to grow rapidly in the global genomic cancer panel and profiling market because different methods are being used in diagnostic centres, and more people are becoming aware of therapy procedures.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 10.56 Bn |

| Revenue Forecast In 2035 | USD 23.39 Bn |

| Growth Rate CAGR | CAGR of 8.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Tissue Testing, By Cancer Panel Type, By Cancer Type, By Application, By Technology, By End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Agilent Technologies, Inc., ARUP Laboratories, Burning Rock DX, Caris Life Sciences, Thermo Fisher Scientific, Inc., Danaher Corporation (Integrated DNA Technologies, Inc.), Exact Sciences Corporation, F. Hoffmann-La Roche Ltd, Fulgent Genetics, Genecast Biotechnology Co., Ltd, Illumina, Inc., Invitae Corporation, Qiagen N.V., NeoGenomics, Inc., Sysmex Corporation, HTG Molecular Diagnostics, Inc., Predictive Oncology, Inc., NanoString Technologies, Inc., Guardant Health, Inc., Foundation Medicine, Genscript Biotech Corporation, Tempus Labs, Hologic, Inc., Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.