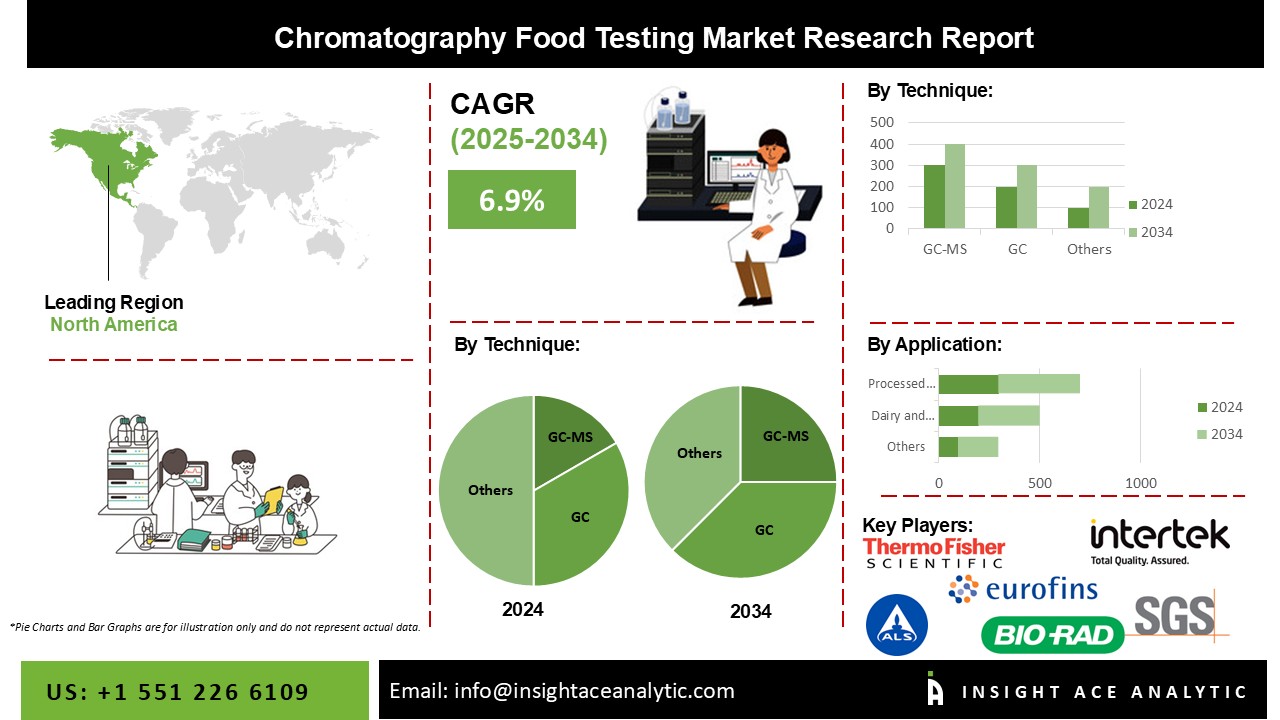

Chromatography Food Testing Market Size is predicted to record at an 6.9% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Chromatography is a flexible analytical method that may be used to recognize and quantify a variety of additives and pollutants in food products. In response to increased worries about food safety, quality, and authenticity, the chromatographic food testing business is a sector of the economy that is expanding quickly. The demand for this industry is expected to rise due to developing food traffic, rising microbiological contamination occurrences, rising food mislabeling incidents, and changing governmental rules on a global scale. It is expected that outbreaks of food-borne diseases and the growth of retail chains will propel the food testing industry forward.

However, chromatography equipment's high acquisition cost and upkeep might deter specific food testing labs and businesses. Moreover, chromatography testing can be labor-intensive, which presents a problem for food businesses that need to spot and handle food safety problems swiftly.

The Chromatography Food Testing Market is segmented based on technique; the market is segmented into gas chromatography-mass spectrometry (GC-MS), gas chromatography (GC), high-performance liquid chromatography (HPLC), liquid chromatography (LC), and others. Based on application, the market is further bifurcated into meat and meat, dairy and dairy products, cereal, grain, pulse, processed food, and others.

The gas chromatography food testing market is anticipated to develop at a CAGR of 9.8%. Compounds that can vaporize without decomposing are typically analyzed and separated using gas chromatography (GC). GC is used to identify compounds, prepare pure compounds from mixtures, and verify the purity of substances. It can also be used to separate the components in a mixture. The primary factor accelerating market growth is increased partnerships between chromatography instrument manufacturers, academic institutions, and research labs. Other factors driving the gas chromatography food market include an increase in GC-MS adoption, an increase in environmental pollution reduction policies and initiatives, an increase in food safety concerns, and an increase in the significance of chromatography tests in the drug approval process.

The fastest-growing sector is predicted to be grains, with a CAGR of 10.5%. Consumers want to know that the products they consume, sell, or buy are secure and wholesome at every point of the food supply chain. Verification through analysis for nutritional content, product quality, the absence of residues and mycotoxins, or the assessment of physical attributes is crucial in the grain commodity and stockfeed sector. The Food Testing Market is anticipated to grow as a result.

The technological trends in chromatography food testing are expected to drive the Asia Pacific market growth due to artificial intelligence (AI), digitalization, connection technologies, and smart, automated technologies powered by data & machine learning are the technical advancements in chromatographic food testing that are now driving the market expansion. Before the epidemic, there was a lot of interest in the advantages of smart and automated technologies. Moreover, Europe is expected to be the largest market growth due to the increasing adoption of chromatography testing techniques and accurate information about the nutrients in a particular food. Others are expected to drive the market's growth. Due to its increased food production and strict regulations for food quality, Europe is predicted to rule the global market for chromatographic food testing in 2022.

Recent Developments:

Chromatography Food Testing Market Report Scope

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 6.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Technique, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, Symbio Laboratories, BVAQ, QIMA, Pacific Lab, Merck KGaA, Cotecna, Mérieux NutriSciences, Food Safety Net Services, AsureQuality, ADPEN Laboratories, Inc., Element Materials Technology, Spectro Analytical Labs, NSF, R J Hill Laboratories Limited, ifp Institut für Produktqualität GmbH, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., and Shimadzu Corporation among others. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Chromatography Food Testing Market By Technique-

Chromatography Food Testing Market By Application-

Chromatography Food Testing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.