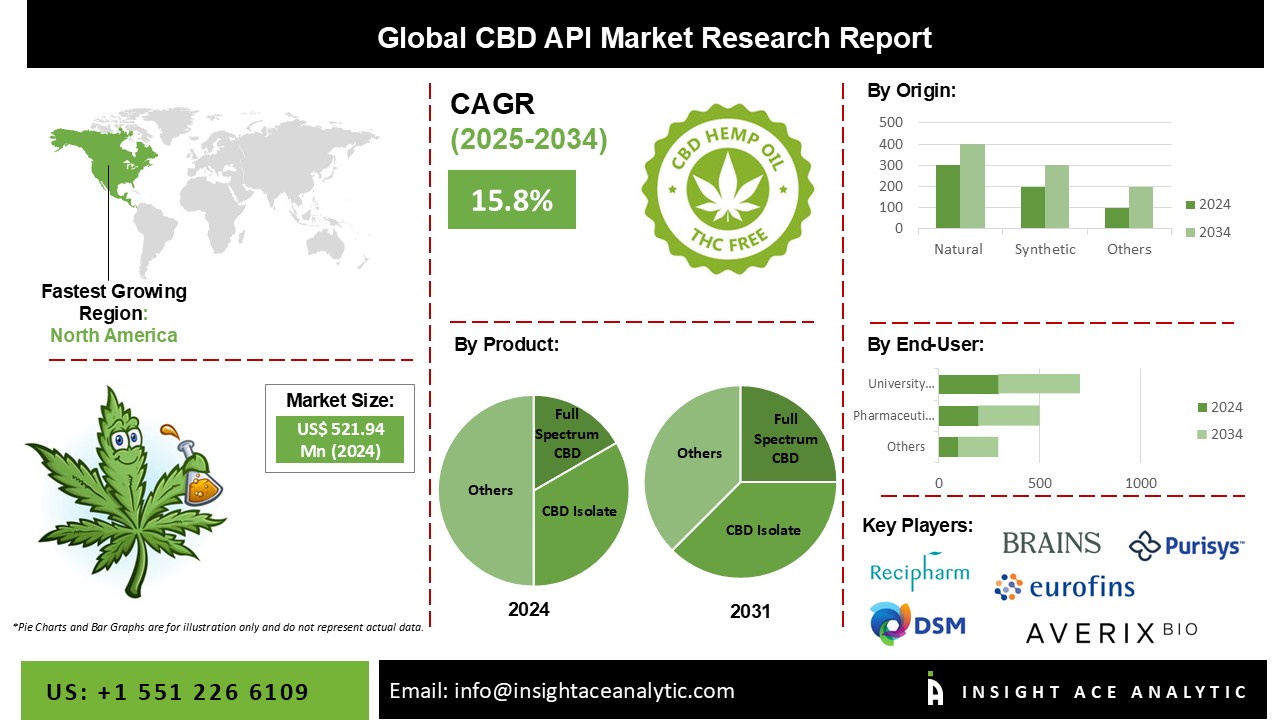

Global CBD API Market growth is valued at US$ 521.94 Mn in 2024 and is expected to reach US$ 2233.37 Mn by 2034, with a CAGR of 15.8% during the forecast period of 2025-2034.

Key Industry Insights & Findings from the report:

While cannabis includes over one hundred distinct cannabinoids, such as tetrahydrocannabinol (THC) and lesser cannabinoids, such as CBN and CBG, CBD is the most well-known. CBD binds to multiple cell receptors throughout the body, directly and indirectly revealing its extensive medicinal potential. Cannabidiol (CBD) research is developing rapidly, providing clinical support for the human body, mind, and emotions. Each cannabinoid possesses unique characteristics, medicinal capabilities, chemical structure, and advantages. CBD is frequently extracted and manufactured into CBD-based oils, tinctures, topical creams, and edibles due to its versatility and well-tolerated nature.

All cannabinoids produce therapeutic effects through interaction with the endocannabinoid system (ECS), and CBD is not dissimilar. The ECS is a complex cell signalling system in all animals, composed of endocannabinoids and receptors. CBD regulates a variety of biological processes, including pain perception, emotion, sleep, and immunological response. Cannabidiol is very sensitive for the human body as it shows various side effects. EPIDIOLEX is the first prescription CBD product approved by the FDA for the treatment of seizures associated with Lennox-Gastaut syndrome (LGS), Dravet syndrome, or tuberous sclerosis complex (TSC) in individuals aged one year and older. It implies that clinical trials have thoroughly examined its safety and efficacy profile.

The market is primarily driven by the rising demand for Cannabidiol (CBD) for health and well-being applications. Cannabidiol is beneficial for treating anxiety and seizures and lowering pain. Due to the absence of psychotropic effects, Cannabidiol is the cannabinoid most commonly used for therapeutic purposes, and it is in great demand for health and wellness purposes, which is the primary market driver. In addition, the increasing acceptability and use of products as a result of regulatory approvals is a significant driver that is anticipated to increase the manufacturing of CBD-infused products. In addition, government funding for therapeutic research and collaborations with prominent market players will enhance the development and demand for CBD as an API.

As CBD is a very delicate chemical compound for therapeutic use, FDA is approving CBD-derived drugs very carefully; hence only one drug has been approved yet. Such delays in approvals will impact the global demand for CBD as an API. The high cost of this market is the most significant obstacle they face. Since they are associated with medical advantages and necessitate extensive research to prepare products, they are unaffordable to most of the population. This is a crucial impediment to the expansion of the CBD business.

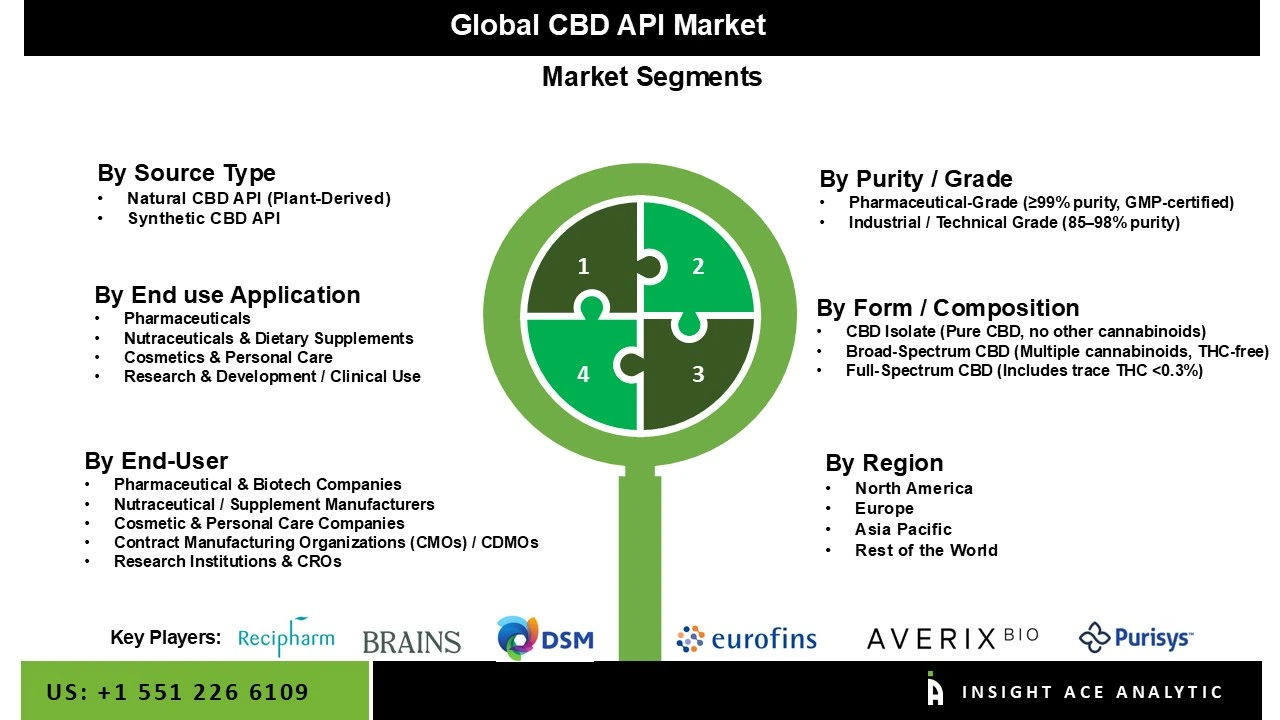

The CBD API market is segmented into three segments. The first segment is by product, including Full spectrum CBD, Broad-spectrum CBD, CBD isolate, and Others. The other segment is by Origin, which has two divisions, synthetic and natural, in which natural Origin is very much demanding in the current market. The third segment is Indication, which comprises Alzheimer's Disease, Autism, Cancer, Chronic Pain, Epilepsy, Psychosis, Anxiety & Depression, Obesity/weight loss, and Others. By Route of Administration segment the market includes Oral, Topical, Intravenous, Others.

Regionally, North America dominated the Cannabidiol (CBD) API market, which is anticipated to continue during the forecast period. Most of the CBD providers are present in the North American region, and the investments are at the peak for research and development on Cannabidiol-derived therapies.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 521.94 Mn |

| Revenue Forecast In 2034 | USD 2233.37 Mn |

| Growth Rate CAGR | CAGR of 15.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Source Type, End Use / Application, End User , Purity/Grade and Form / Composition |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Axplora / Farmabios, Transo-Pharm USA LLC, Biophore India Pharmaceuticals Pvt. Ltd., Veranova, Cohance Lifesciences, Malladi Drugs & Pharmaceuticals Ltd., Noramco / Purisys, Farmhispania, SCI Pharmtech, Alkem Laboratories, Arene Lifesciences, Arevipharma, Averix Bio, Celadon Pharmaceuticals, Embio Limited, Farmakem, DSM-Firmenich, KD Pharma Group / KD Phyto, Biovectra, Hyasynth, Indena, Bedrocan, Vantage Hemp, CB21 Pharma, Brains Bioceutical, Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

CBD API Market, By Source Type-

CBD API Market, By End Use / Application-

CBD API Market, By Purity / Grade-

CBD API Market, By End-User-

CBD API Market, By Form / Composition-

CBD API Market, By Region,

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.