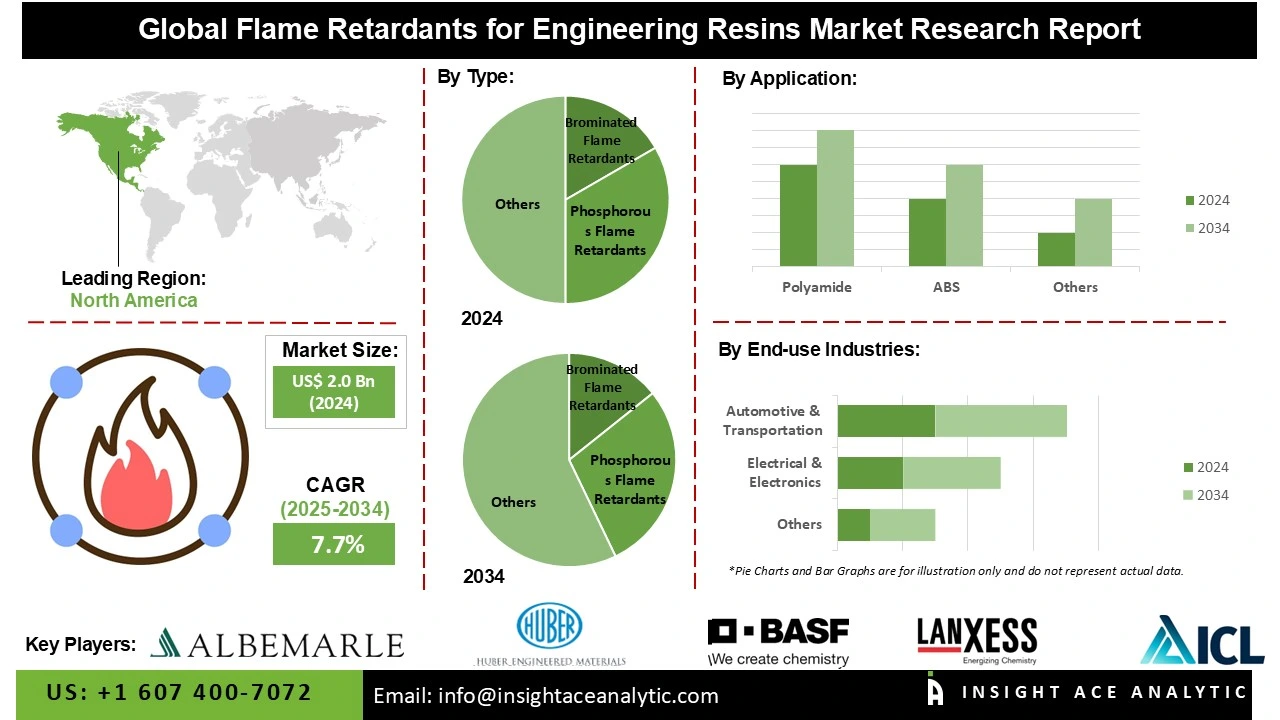

Global Flame Retardants for Engineering Resins Market Size is valued at US$ 2.0 Bn in 2024 and is predicted to reach US$ 4.12 Bn by the year 2034 at an 7.7% CAGR during the forecast period for 2025-2034.

Flame retardants are essential for improving the fire safety of engineering resins including ABS, polycarbonate, and polyamide, which are extensively utilized in high-performance applications within the automotive, electrical, and construction industries. The global market for these additives is experiencing significant growth, driven by stringent safety regulations, heightened awareness of fire hazards, and the rapid expansion of industries such as electric vehicles and consumer electronics. According to the International Energy Agency (IEA), global electric car sales surpassed 17 million in 2024, accounting for more than 20% of total vehicle sales, underscoring the growing demand for lightweight, high-performance materials that meet rigorous fire safety standards.

However, the market faces challenges due to increasing environmental and health regulations, particularly concerning halogenated flame retardants. These restrictions have prompted a shift toward the development and adoption of non-toxic, eco-friendly alternatives.

Some of the Key Market Players in Flame Retardants for Engineering Resins Market:

The Flame Retardants for Engineering Resins market is comprehensively segmented by Type (Brominated, Phosphorous, and Other flame retardants), Application (including Polyamide, ABS, PET & PBT, Polycarbonate, and PC/ABS Blends), and End-use Industry (notably Electrical & Electronics and Automotive & Transportation), reflecting the diverse formulations required to meet specific performance and regulatory requirements across different material systems and industrial applications.

The Phosphorous Flame Retardants category led the Flame Retardants for Engineering Resins market in 2024. This convergence is because of they meet safety regulations and effectively reduce flammability. Their ability to fit into various resin formulations without losing effectiveness helps explain their strong presence in the market. Growing emphasis on sustainability, these products are believed to be more environmentally friendly than brominated flame retardants.

The largest and fastest-growing Application is Polycarbonate, a trend is because of its remarkable mechanical qualities, including as its high impact strength and optical clarity, polycarbonate is widely used in a variety of applications, including construction materials, electronic housings, and automobile parts. Because polycarbonate can integrate flame-retardant chemicals while still retaining its intended qualities, it is a valuable commercial product.

In 2024, North America, spearheaded by the United States, dominated the global market for Flame Retardants for Engineering Resins, a position solidified by its advanced manufacturing infrastructure, technological prowess, and the concentration of major industry players with robust distribution networks. However, the Asia-Pacific region is now exhibiting the most rapid growth, fueled by accelerating industrialization, massive urbanization, and booming electronics, automotive, and construction sectors. Countries such as China, India, and South Korea are driving this expansion through heavy investment in high-performance, fire-safe materials to comply with increasingly stringent safety regulations, positioning APAC as the engine of the market's future expansion.

Flame Retardants for Engineering Resins Market by Type-

· Brominated Flame Retardants

· Phosphorous Flame Retardants

· and Other Types

Flame Retardants for Engineering Resins Market by Application-

· Polyamide

· ABS

· PET & PBT

· Polycarbonate

· PC/ABS Blends

· and Other Applications

Flame Retardants for Engineering Resins Market by End-use Industries-

· Electrical & Electronics

· Automotive & Transportation

· and Other End-use industries

Flame Retardants for Engineering Resins Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.