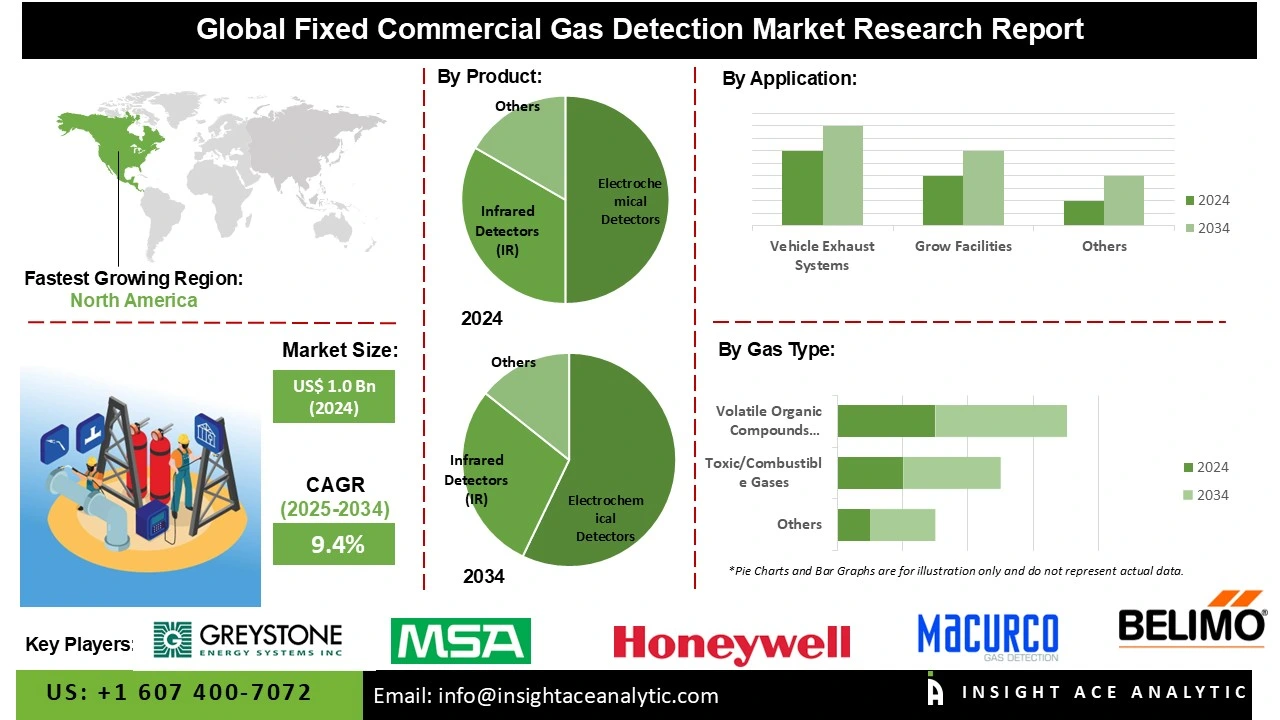

Fixed Commercial Gas Detection Product Market Size is valued at US$ 1.0 Bn in 2024 and is predicted to reach US$ 2.4 Bn by the year 2034 at an 9.4% CAGR during the forecast period for 2025-2034.

A fixed commercial gas detection system is a permanent, integrated safety solution designed to continuously monitor hazardous gases in industrial, commercial, and institutional facilities such as factories, warehouses, laboratories, hospitals, and parking garages. These devices use sensors to identify hazardous gases, flammable gases, and oxygen depletion. When dangerous levels are found, they activate automated ventilation controls or sound an alert.

Fixed systems, in contrast to portable detectors, are integrated into a facility's infrastructure and run around the clock to provide data logging, real-time alarms, and integration with building management systems. The fixed commercial gas detection product market is being driven by tightening safety standards across the commercial sector, as well as end users' increased awareness of safety and the potential risks of gas leakage.

Additionally, the use of fixed commercial gas detection products is anticipated to increase significantly as businesses prioritize worker safety and comply with legal requirements. The growing focus on risk reduction and preventive maintenance further heightens the need for a fixed commercial gas detection product. Moreover, the combination of artificial intelligence (AI) and the Internet of Things (IoT) is another important development in the fixed commercial gas detection product market.

IoT-enabled gas detectors can transmit data to cloud platforms or centralized control systems in real-time. To identify trends, anticipate potential gas leaks, and improve maintenance plans, AI algorithms analyze data. Gas detection systems are more effective because of this connection, which also reduces false alarms and enables preventive action to avoid mishaps. Thus, these factors are expected to boost growth in the fixed commercial gas detection product market over the forecast period.

Some of the Key Players in Fixed Commercial Gas Detection Product Market:

· Macurco Inc.

· American Gas Safety LLC

· Honeywell International Inc.

· Greystone Energy Systems Inc.

· Senva Inc.

· MSA Safety Incorporated

· BELIMO AIRCONTROLS, Inc.

· INTEC Controls (BC Solutions, LLC)

· TOXALERT International, Inc.

· Quatrosense Environmental Limited (QEL)

· Critical Environment Technologies Canada Inc.

· Others

The fixed commercial gas detection product market is segmented by gas type, product, and application. By gas type, the market is segmented into toxic/combustible gases, oxygen (O₂), volatile organic compounds (VOCs), and others. By product, the market is segmented into electrochemical detectors, catalytic bead detectors, infrared detectors (IR), and others. By application, the market is segmented into boiler rooms, vehicle exhaust systems, data centers, grow facilities, cold storage facilities, battery storage & charging rooms, and others.

In 2024, the fixed commercial gas detection product market was dominated by the toxic/combustible gases segment. Due to tighter government regulations on indoor air quality and growing awareness of occupational health risks, the hazardous gas fixed gas detection industry is still seeing rapid expansion. Toxic gases like carbon monoxide (CO) and nitrogen dioxide (NO₂) can build up in business facilities, including offices, hospitals, labs, and parking garages, due to inadequate ventilation, fuel-burning appliances, or vehicle emissions. Even at low concentrations, these gases can have detrimental effects on one's health, including long-term organ damage, fatigue, and respiratory problems.

The vehicle exhaust systems segment dominated the fixed commercial gas detection product market in 2024. The growing need for air quality monitoring and emission management in enclosed or semi-enclosed spaces, including parking garages, automotive workshops, tunnels, and transport terminals, has driven the growth of the vehicle exhaust system market. The use of fixed commercial gas detection systems to monitor harmful gases, including carbon monoxide, nitrogen dioxide, and hydrocarbons, released by internal combustion engines, is growing. Large subterranean parking facilities are being built more quickly due to urbanization and infrastructure development. Local safety laws and building regulations require proper ventilation and gas monitoring in these facilities.

The fixed commercial gas detection product market was dominated by the Asia Pacific region in 2024. This growth may be linked to several factors, including stringent regulations on gas detection and monitoring, expanding industrialization, and greater awareness of worker safety. The Asia-Pacific region, including countries such as China, India, Japan, and South Korea, is seeing increased demand for stationary commercial gas detection products. Furthermore, the fixed commercial gas detection product market is growing due to several factors, including strong industrial activity, government-led safety initiatives, and rapid development of digital infrastructure. These detectors are crucial for ensuring worker safety and preventing any accidents caused by leaks or gas emissions.

North America is expected to grow at the fastest rate in the fixed commercial gas detection product market over the forecast period, driven by increasing safety and environmental protection needs in commercial facilities, which call for continuous gas monitoring to safeguard personnel and infrastructure. The US market for fixed commercial gas detection products dominated this region. The increasing requirement for safety and environmental protection in industrial sectors, including data centers, manufacturing plants, and hazardous facilities, which necessitate continuous gas monitoring to protect both people and infrastructure has led to significant growth in the fixed commercial gas detection product market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.0 Bn |

| Revenue Forecast In 2034 | USD 2.4 Bn |

| Growth Rate CAGR | CAGR of 9.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Gas Type, By Product, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Macurco Inc., American Gas Safety LLC, Honeywell International Inc., Greystone Energy Systems Inc., Senva Inc., MSA Safety Incorporated, BELIMO AIRCONTROLS, Inc., INTEC Controls (BC Solutions, LLC), TOXALERT International, Inc., Quatrosense Environmental Limited (QEL), and Critical Environment Technologies Canada Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Fixed Commercial Gas Detection Product Market by Gas Type

· Toxic/Combustible Gases

· Oxygen (O₂)

· Volatile Organic Compounds (VOCs)

· Others

Fixed Commercial Gas Detection Product Market by Product

· Electrochemical Detectors

· Catalytic Bead Detectors

· Infrared Detectors (IR)

· Others

Fixed Commercial Gas Detection Product Market by Application

· Boiler Rooms

· Vehicle Exhaust Systems

· Data Centers

· Grow Facilities

· Cold Storage Facilities

· Battery Storage & Charging Rooms

· Others

Fixed Commercial Gas Detection Product Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.