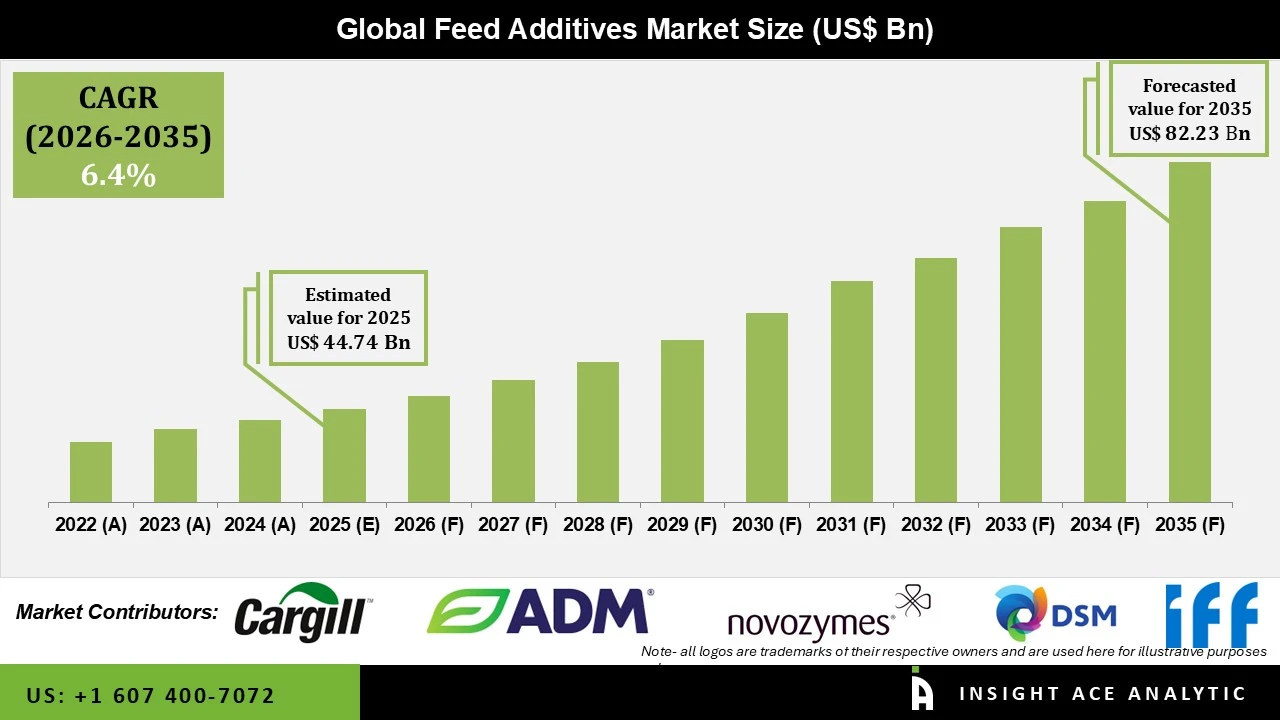

Feed Additives Market Size is valued at USD 44.74 Bn in 2025 and is predicted to reach USD 82.23 Bn by the year 2035 at a 6.4% CAGR during the forecast period for 2026 to 2035.

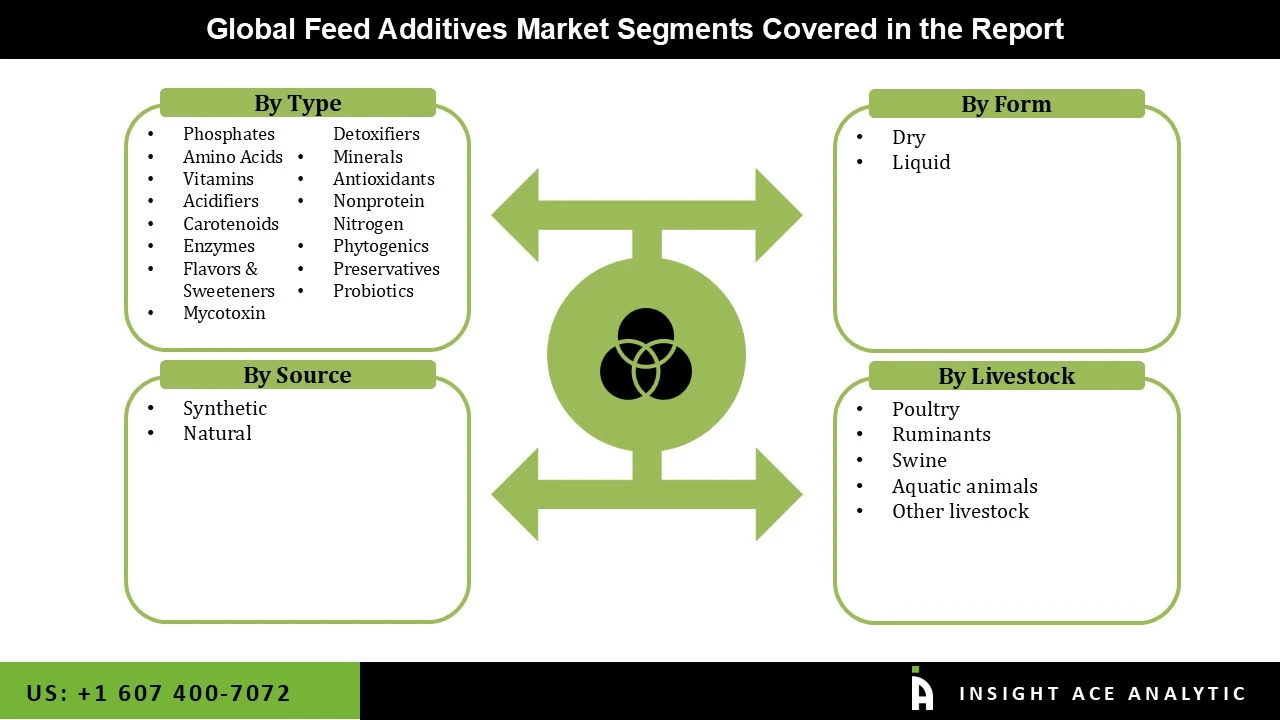

Feed Additives Market Size, Share & Trends Analysis Report By Type (Phosphates, Amino Acids, Vitamins, Acidifiers, Carotenoids, Enzymes, Flavors & Sweeteners, Mycotoxin Detoxifiers, Minerals, Antioxidants), By Form (Dry, Liquid), By Source (Synthetic, Natural), By Livestock, By Region, And By Segment Forecasts, 2026 to 2035

Feed additives are substances or compounds that are incorporated into animal or livestock feed to improve the quality, nutritional value, and overall performance of the feed and the animals that consume it. These additives serve various purposes, including enhancing animal health, growth, and production efficiency. Feed additives are essential in this pursuit because they improve nutrient utilization, stimulate optimal growth, and guarantee the animals' health. Included in this category are chemicals that aid in the breakdown and absorption of food, such as probiotics, enzymes, amino acids, and vitamins.

The constant push for greater feed efficiency in agriculture and livestock production is a major factor in the growing feed additives market. Because of its significant effects on farmers and the natural world, feed efficiency has become a focal point in animal husbandry. Animals' health and productivity in the feed industry benefit from feed additives that make their food easier to digest. If scientific tests show that a feed additive represents no danger to the well-being of living things or the environment, only then will it be approved for release onto the market.

However, the market expansion is being stymied by the strict regulatory criteria for the safety and health of feed additives, and the potential threat to human health from antibiotic resistance has increased in prominence, necessitating this action. These restrictions have led to a shift away from the use of antibiotics in feed additives and toward more environmentally and socially sound alternatives. The COVID-19 pandemic has drastically altered the standards of the meat sector. Customers are becoming increasingly worried about their health, which is causing a decline in the market for meat. Because of this, there has been a movement in consumer preference toward plant-based proteins, which has slowed the expansion of the industry. Supply chain disruption is leading to a dramatic spike in the price of meat, particularly beef and pork. This has led to price instability in the meat market and a slowdown in meat consumption.

The Feed additives market is segmented based on type, form and source. Based on type, the market is segmented into phosphates, acidifiers, amino acids, vitamins, carotenoids, enzymes, flavors & sweeteners, mycotoxin detoxifiers, minerals, and antioxidants. According to form, the market is divided into dry and liquid. By source, the market is segmented into synthetic and natural.

The synthetic antifog additives category is expected to hold a significant global market share in 2024. Synthetic additives typically have lower unit prices because of their streamlined production procedures. Producers and farmers benefit from these price reductions.

The dry segment is projected to grow rapidly in the global feed additives market. Dry feed additives provide farmers greater flexibility because they may be used with a wider variety of feeding systems and animal diets. Because of their versatility, cattle farmers increasingly favor them, which bodes well for their market dominance and future expansion, especially in countries like the US, Germany, the UK, China, and India.

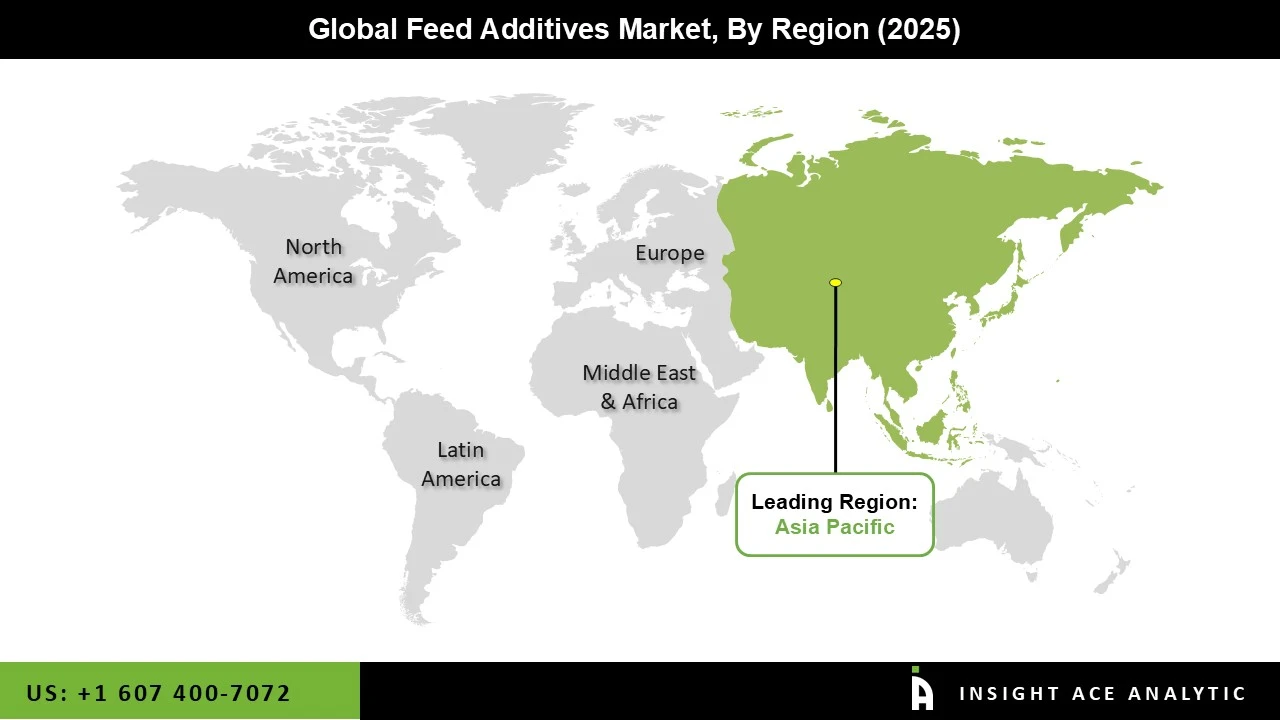

The Asia Pacific feed additives market is expected to record the maximum revenue share in the market in the near future. It can be attributed to because of the abundance of mills and pet food manufacturers in the area. The increasing national per capita meat consumption and expanding consumer awareness of the health benefits of meat will both contribute to the industry's continued growth. In addition, Asia Pacific is estimated to grow rapidly in the global feed additives market because there is a large cattle population and a variety of agricultural economies in the area. Because customer tastes in meat consumption are changing, major players are expected to expand their poultry feed product line.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 44.74 Bn |

| Revenue Forecast In 2035 | USD 82.23 Bn |

| Growth Rate CAGR | CAGR of 6.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Livestock, By Source, By Form, |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East |

| Competitive Landscape | Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances (US), Evonik Industries AG (Germany), BASF SE (Germany), DSM (Netherlands), Ajinomoto (Japan), Novozymes (Denmark), CHR. HANSEN (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc (US), Adisseo (France), BRF (Brazil), Solvay (Belgium), Global Nutrition International (France), Centafarm SRL (Italy), Bentoli (US), Nuqo Feed Additives (France), Novus International Inc. (US), Palital Feed Additives B.V. (Netherlands), VITAFORMS (US), ALLTECH (US), Neospark Drugs and Chemicals Private Limited (India), Tex Biosciences (P) Ltd. (India) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Feed Additives Market By Type -

Feed Additives Market By Form-

Feed Additives Market By Source-

Feed Additives Market By Livestock

Feed Additives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.