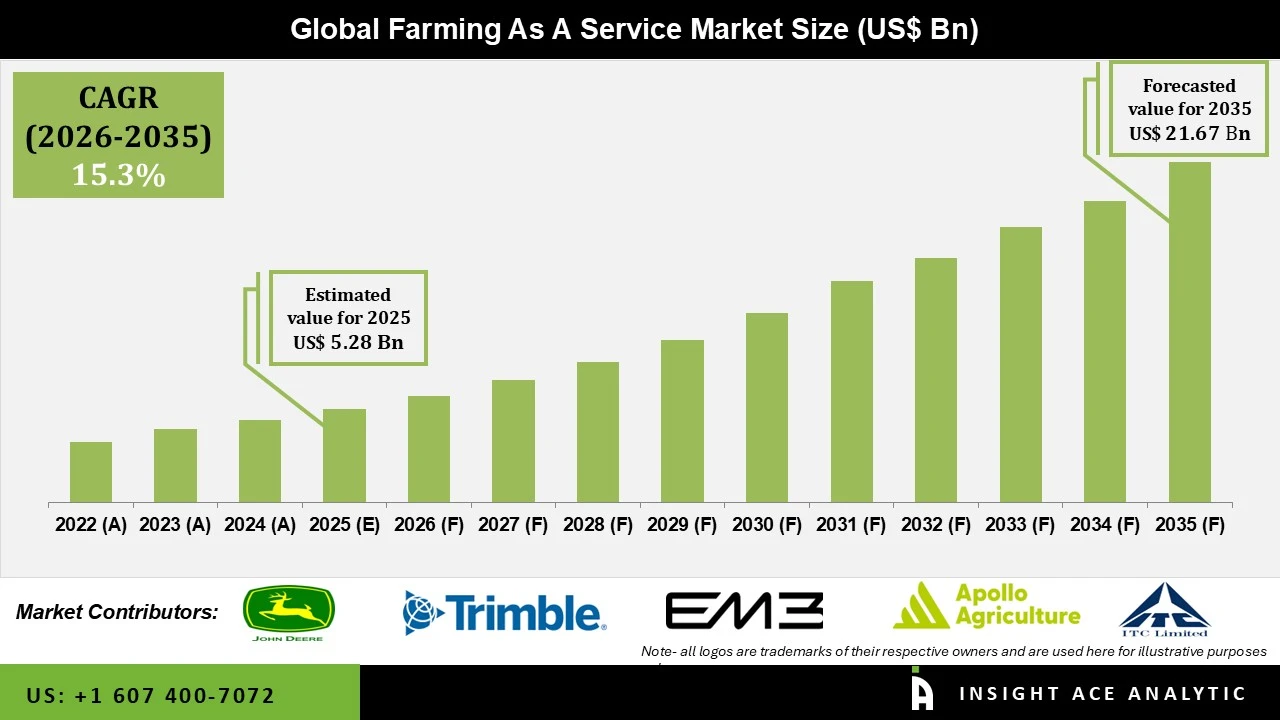

Farming As A Service Market Size is valued at USD 5.28 Bn in 2025 and is predicted to reach USD 21.67 Bn by the year 2035 at an 15.3% CAGR during the forecast period for 2026 to 2035.

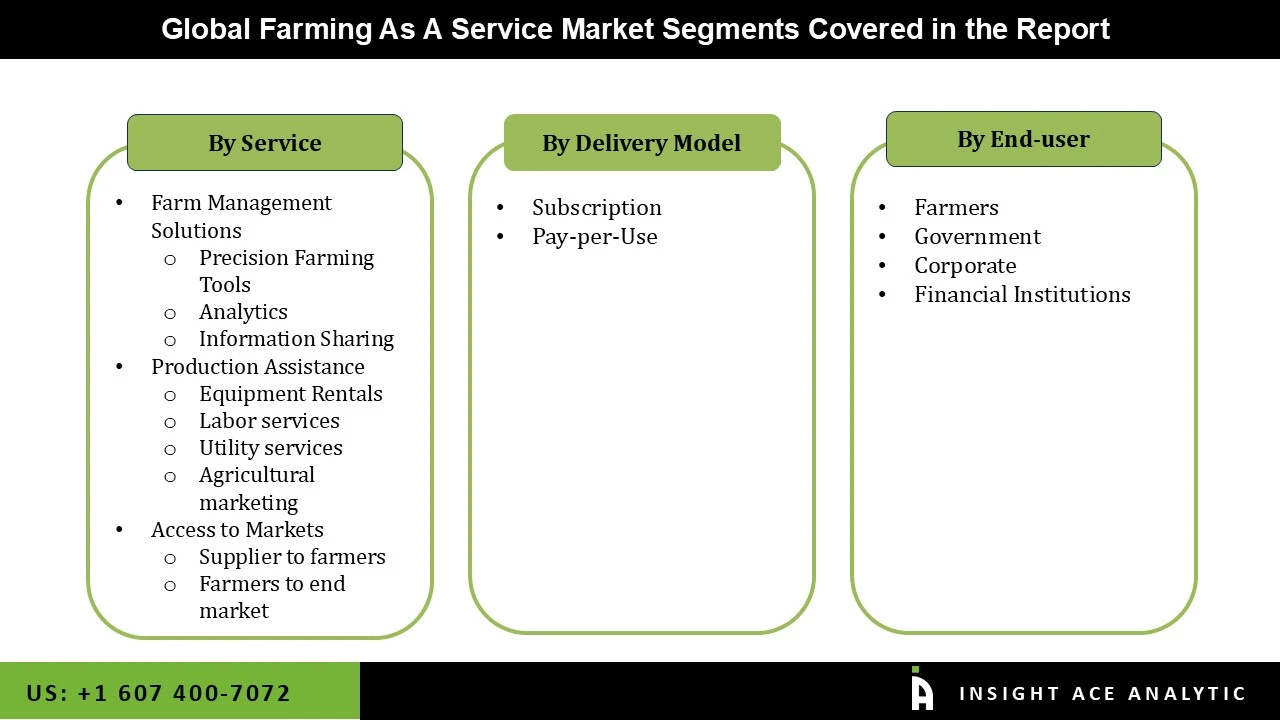

Farming As A Service Market, Share & Trends Analysis Report, By Service (Farm Management Solutions, Production Assistance, Access to Markets), By Delivery Model (Subscription, Pay-per-Use), By End-user, By Region, and Segment Forecasts, 2026 to 2035

"Farming as a Service" (FaaS) represents a gradual but significant shift in the agricultural sector's use of technology in recent years. This concept updates conventional farming by incorporating technology-driven solutions to provide crop management and equipment leasing services, thereby increasing productivity and sustainability. FaaS offers a more accurate and balanced picture of farming's future by fusing the advantages of contemporary technology with the comforts of traditional agriculture. By extending the "as a service" paradigms familiar in the IT sector, like Software as a Service (SaaS), to agriculture, FaaS aims to enhance the productivity, sustainability, and profitability of farming through a range of cutting-edge yet practical services.

For Instance, In July 2021, The goal of the new farm laws, which include "The Farmers' Produce Trade and Commerce (Promotion and Facilitation) Act, 2020," "The Farmers (Empowerment and Protection) Agreement On Price Assurance and Farm Services Act, 2020," and "The Essential Commodities (Amendment) Act, 2020," is to create an environment in which farmers have the freedom to choose how to sell their produce and can do so at a price that allows them to get paid fairly through alternate, competitive channels. Additionally,

In Aug 2022, The Indian Council of Agricultural Research (ICAR) encourages agricultural innovation, extension, and teaching. For various agricultural crops, a total of 1575 field crop types were released between 2014 and 21. Farmers received 91.43 crore agro-advisories using mobile devices between 2014 and 21. In the years 2014–21, ICAR created 187 mobile applications covering various farm and farmer-related activities. These ICAR applications are now combined onto KISAAN, a single platform. During this time, ICAR developed the Farmer FIRST (Farm, Innovations, Resources, Science and Technology) program, which aims to go beyond productivity and production by improving the interaction between farmers and scientists.

The Farming As A Service Market is segmented based on the by service, by delivery model, and by end-user. Based on the Service, the market is segmented into Farm Management Solutions, Production Assistance, and Access to Markets. Based on the by-delivery model, the market is segmented into subscription and pay-per-use. The end-user segment is segmented into farmers, government, corporations, financial institutions, and advisory bodies.

Based on the by-service, the market is categorized into farm management solutions, production assistance, and access to markets. Among these, the farm management solutions segment is expected to have the highest growth rate during the forecast period. Farm Management Solutions provides farmers with data analytics, real-time monitoring, and predictive insights. These tools enable farmers to make informed decisions about planting, irrigation, fertilization, pest control, and harvesting, leading to optimized resource use and higher productivity. The continuous development and adoption of technologies like IoT, AI, and blockchain in agriculture are making Farm Management Solutions more sophisticated and accessible. These advancements attract more farmers to adopt FaaS, driving market growth.

Based on the by-delivery model, the market is segmented into subscription and pay-per-use. subscription-based farming as a service has lots of opportunities to demonstrate show. It is a fantastic substitute for traditional means of leasing or selling products, where each purchase is handled as a separate transaction. Farmers that use the subscription-based model can pay for the good or service periodically for as long as they need it, without having to pay for it again later. Furthermore, a number of businesses are pushing for the use of subscription-based seices in order to reduce the risks connected with a downturn in company activity and produce more steady income.

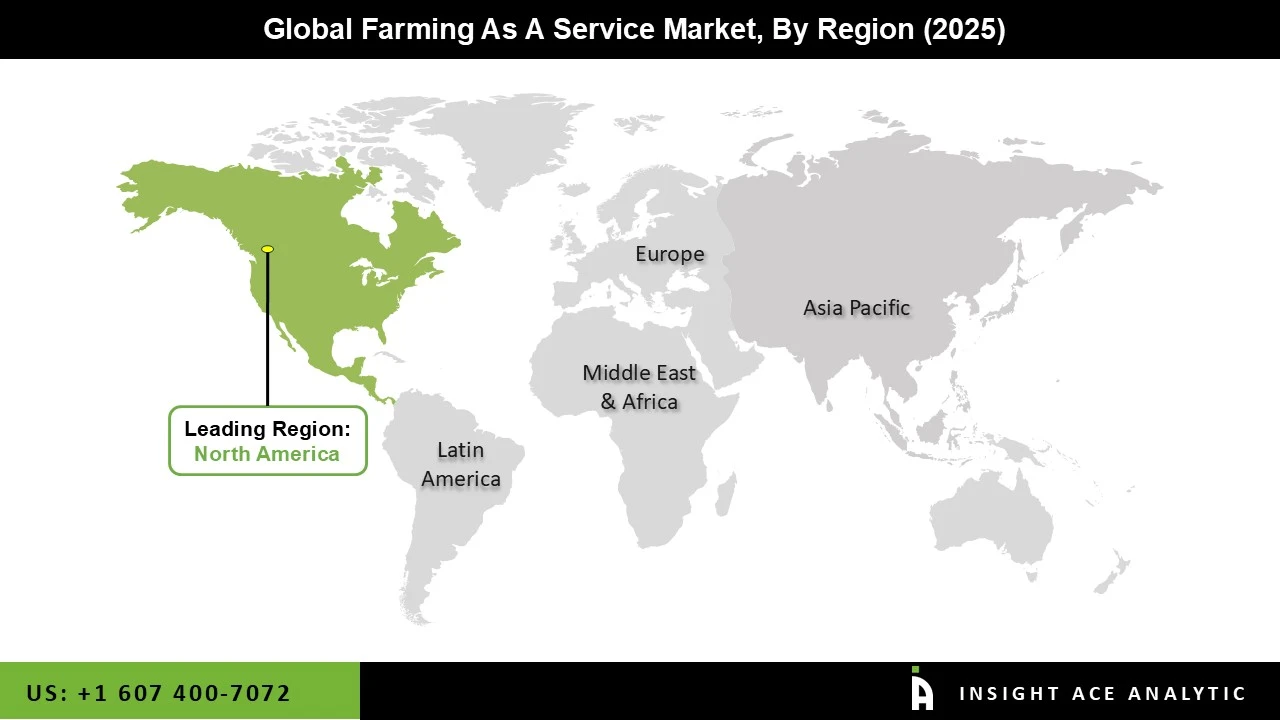

The market with the biggest revenue share is dominated by North America, and this trend is probably going to continue in the coming years. This is mostly due to the expanding application of FaaS models to increase agricultural output in the area. North America is a pioneer in the use of cutting-edge technologies. The increasing use of drones, smart crops, automated machinery, and livestock monitoring is assisting farmers in improving farm management, which in turn is fostering the growth of the regional market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.28 Bn |

| Revenue Forecast In 2035 | USD 21.67 Bn |

| Growth Rate CAGR | CAGR of 15.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service, Delivery Model, End-user |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | John Deere, ITC, TrimbleEM3, Apollo Agriculture, Accenture, Taranis, Precision Hawk, IBM, BigHaat, Ninja Kart, Em3 Agri Services Pvt. Ltd., SGS Société Générale de Surveillance SA, Ninjacart, AGRIVI, Hexagon Agriculture |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Farming As A Service Market - By Service

Global Farming As A Service Market – Delivery Model

Global Farming As A Service Market – End-user

Advisory Bodies Global Farming As A Service Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.