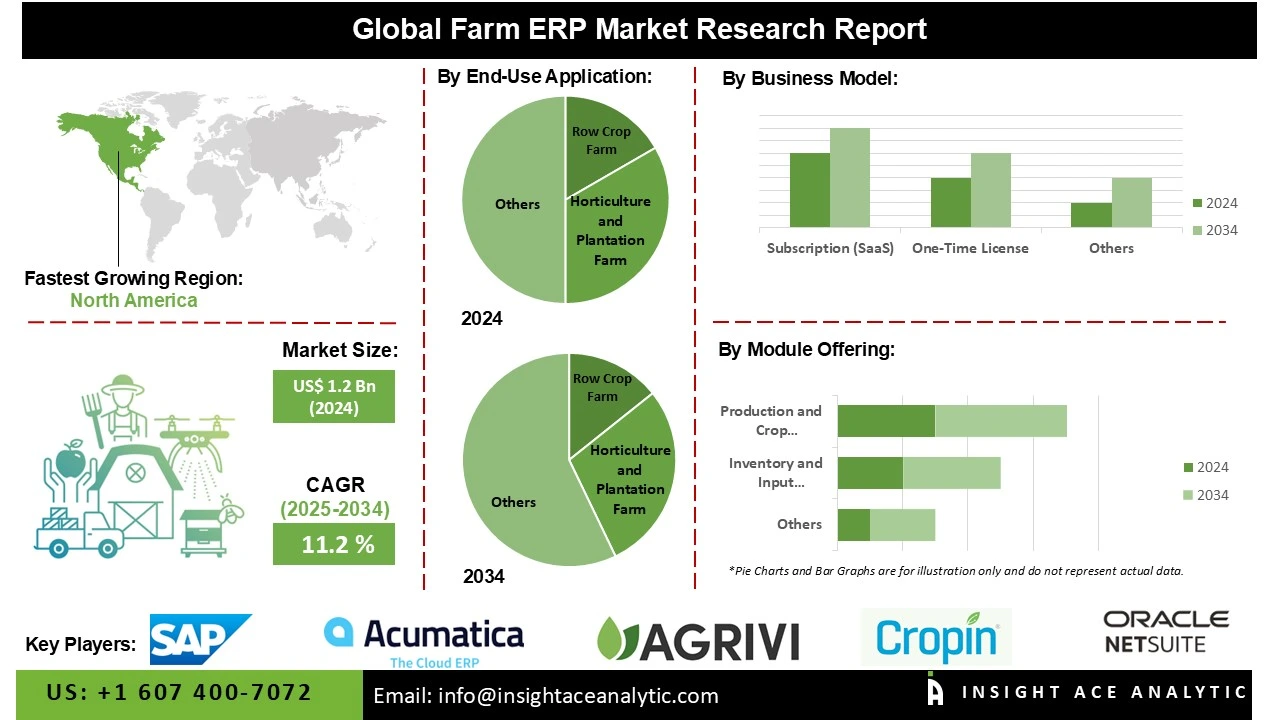

Global Farm ERP Market Size is valued at US$ 1.2 Bn in 2024 and is predicted to reach US$ 3.4 Bn by the year 2034 at an 11.2% CAGR during the forecast period for 2025-2034.

Farm ERP (Enterprise Resource Planning) is a centralised software solution designed to manage and streamline various farming and agribusiness processes. By combining modules for crop planning, procurement, finance, supply chain management, inventory management, and sales, it enables farmers, agribusinesses, and food firms to plan, monitor, and manage their operations more effectively.

Farm ERP enhances productivity, reduces operating costs, and facilitates informed decision-making through real-time data tracking and analytics. Numerous important factors are driving the growth of the farm EPR market. Advanced software solutions for data administration and analysis are required due to the growing adoption of precision agriculture techniques.

Additionally, the need for robust ERP systems that can track items from farm to table is being driven by the growing demand for supply chain transparency and food security. In addition, cloud-based ERP solutions are gaining popularity due to their affordability, scalability, and accessibility, which surpass those of on-premise systems. The government's increasing efforts to support the development of agricultural technology are also contributing to the expansion of the farm ERP market.

Moreover, ERP solutions that integrate social and environmental considerations into decision-making are being developed in response to the growing demand for sustainable agricultural methods. Farmers can evaluate their environmental impact, maximise resource utilisation, and enhance sustainability with these solutions. The increasing use of AI and machine learning in agriculture is also advancing the development of increasingly sophisticated and intelligent ERP systems, which can offer predictive insights and enhance decision-making across the board. Thus, the farm ERP market is expected to grow due to these factors during the projected period.

Some of the Key Players in Farm ERP Market:

· SAP SE

· Oracle Corporation (Oracle NetSuite)

· Shivrai Technologies Pvt. Ltd.

· Cropin Technology Solutions Pvt. Ltd

· AGRIVI d.o.o.

· Folio3 Software Inc.

· Velosio, LLC.

· Sage Group plc

· Acumatica, Inc.

· SourceEdge Software Technologies Pvt Ltd

· Khetibuddy Agritech Pvt Ltd

· Lighthouse Info Systems Pvt. Ltd.

· Mprise B.V.

· Priority Software

· Siagri (part of Aliare)

The Farm ERP market is segmented by module offering, business model, and end-use application. By module offering, the market is segmented into inventory and input management module, financial management module, production and crop monitoring module, others (field mapping and GIS module, mobile and multilingual access module, weather and advisory integration module, labor and workforce management module, iot and sensor integration module). By business model, the market is segmented into subscription (SaaS) and one-time license. By end-use application, the market is segmented into row crop farm (cereal grains, pulses, oilseeds (e.g., wheat, corn, soybean)), livestock and dairy farm, protected and controlled environment farm, horticulture and plantation farm (fruits, vegetables, nuts, vineyards, tea, coffee plantations), and others (includes mixed farming enterprises (crop + livestock silviculture, aquaponics, floriculture, government/institutional farms).

The growing requirement for data-driven decision-making in agriculture is driving significant growth in the farm ERP market's Production and Crop Monitoring module category. Farmers and agribusinesses are increasingly using digital tools to manage pest control in real-time, optimise irrigation, assess crop health, and monitor soil conditions. This module reduces agricultural losses and enables prompt interventions by combining weather forecasts, satellite imaging, IoT-based sensors, and predictive analytics. Further driving demand for these solutions is the increased emphasis on sustainability, resource optimization, and precision farming. Digital farming efforts are being promoted by governments and agri-tech firms, which is further increasing adoption.

The demand for integrated operations and data-centric management is making the livestock and dairy farm segment the market leader for farm ERP. These markets face complex challenges related to feed inventories, breeding schedules, animal health, and regulatory compliance. Through the seamless integration of all these tasks, ERP solutions enable farmers to optimise their resources and ensure supply chain traceability.

Farm ERP raises quality standards, promotes sustainable practices, and increases operational efficiency by automating critical processes. Real-time visibility and greater transparency enable farm managers to respond quickly to problems and sustain high productivity. In a dynamic agricultural context, the adoption of ERP systems in livestock and dairy farms ultimately promotes improved product quality, consumer trust, and long-term business viability.

North America's improved farming methods and increased use of technology have given it the largest market share globally. The US and Canada are at the forefront of adopting and utilising new technologies, including agricultural automation, precision farming, and the Internet of Things. Sustainable farming is being promoted by numerous government initiatives that provide financial incentives for the use of digital tools. North America's farm ERP market dominance is further solidified by the need for resource efficiency and the growing awareness of the food security issue, which motivates farmers to adopt better software.

Furthermore, growing expectations for farm productivity, government support for digital agriculture programs, and higher technical investments are all contributing to the Asia Pacific region's faster growth. In countries with high levels of agricultural production, this expansion is particularly apparent. Moreover, businesses seeking to leverage technology to automate processes, enhance resource management, and ensure food security have a significant opportunity to adopt farm ERP in countries like China and India, given their extensive agricultural holdings. Mobile-accessible cloud-based ERP systems are very popular in this field.

Farm ERP Market by Module Offering-

· Inventory and Input Management Module

· Financial Management Module

· Production and Crop Monitoring Module

· Others

o Field Mapping and GIS Module

o Mobile and Multilingual Access Module

o Weather and Advisory Integration Module

o Labor and Workforce Management Module

o IoT and Sensor Integration Module

Farm ERP Market by Business Model -

· Subscription (SaaS)

· One-Time License

Farm ERP Market by End-Use Application-

· Row Crop Farm

o Cereal Grains

o Pulses

o Oilseeds (e.g., Wheat, Corn, Soybean)

· Livestock and Dairy Farm

· Protected and Controlled Environment Farm

· Horticulture and Plantation Farm

o Fruits

o Vegetables

o Nuts

o Vineyards

o Tea

o Coffee Plantations

· Others

Farm ERP Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.