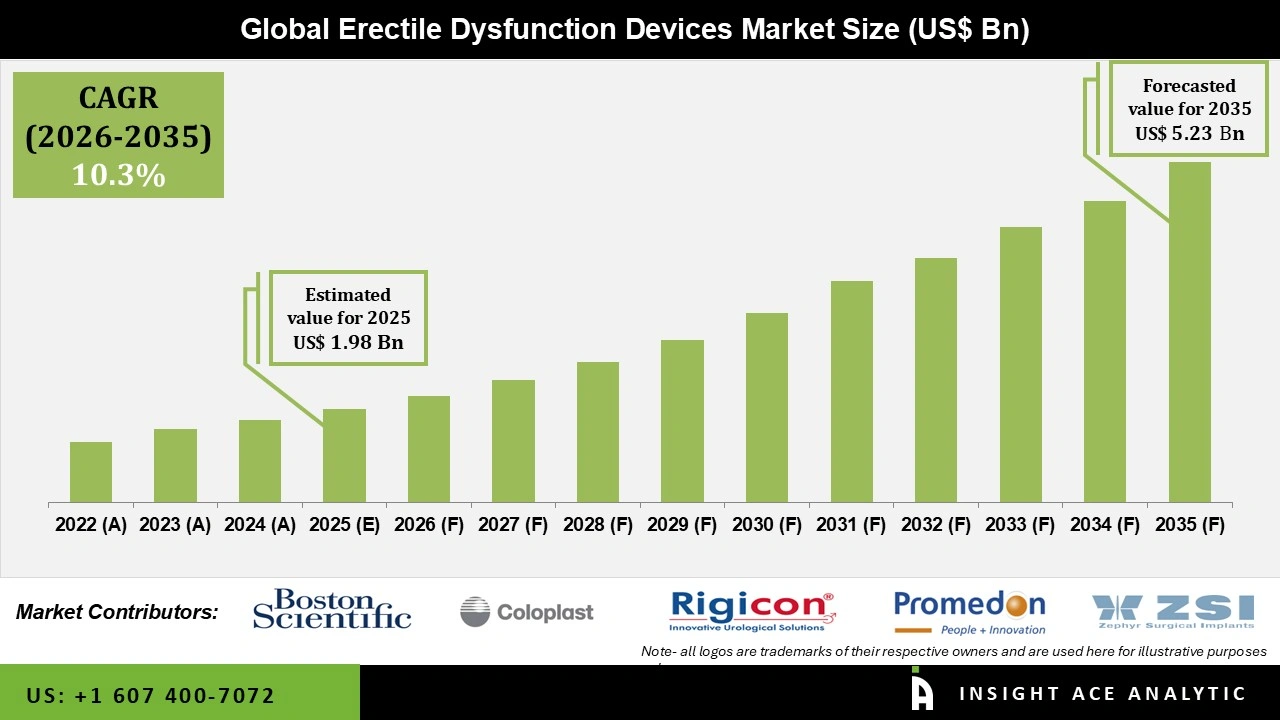

Global Erectile Dysfunction Devices Market Size is valued at USD 1.98 Billion in 2025 and is predicted to reach USD 5.23 Billion by the year 2035 at a 10.3% CAGR during the forecast period for 2026 to 2035.

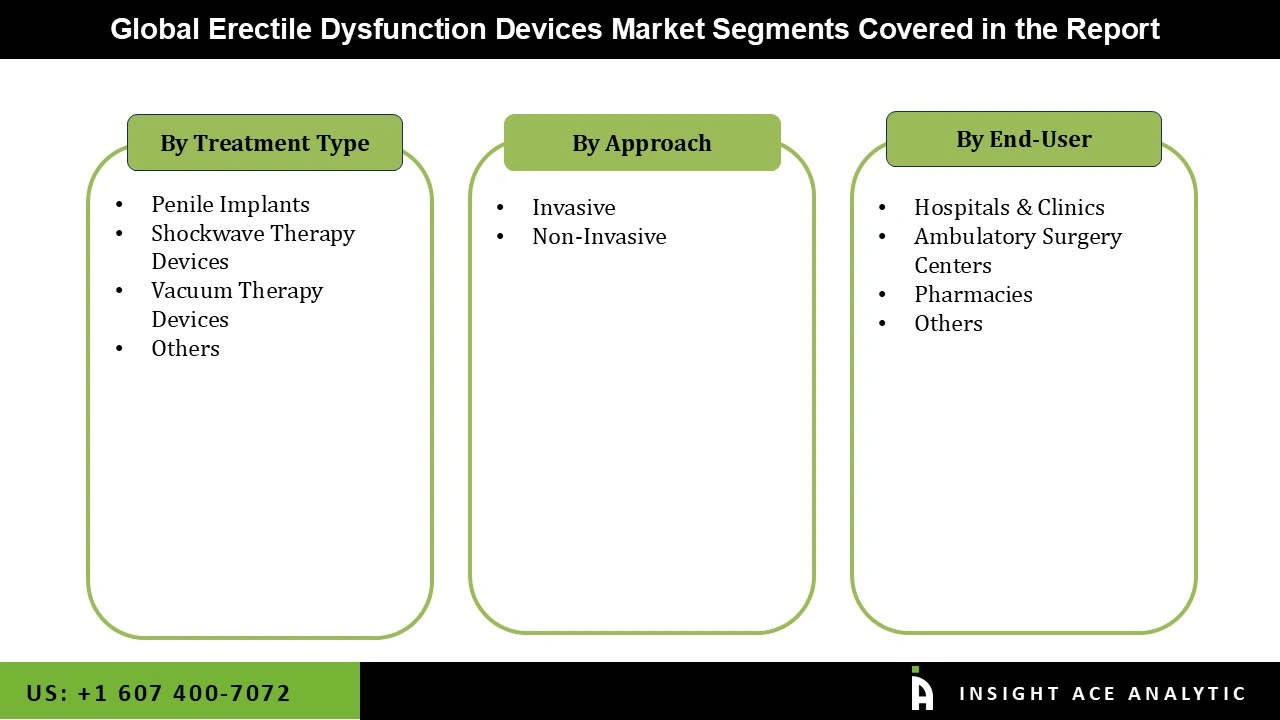

Erectile Dysfunction Devices Market Size, Share & Trends Analysis Report by Product (Penile Implants, Shockwave Therapy Devices, Vacuum Therapy Devices, Others), By Approach (Invasive and Non-Invasive), By End-User (Hospitals, Ambulatory Surgical Centers (ASCs)), Region and Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Patients with erectile dysfunction initially choose non-surgical alternatives such as injections, oral phosphodiesterase type-5 inhibitors (Viagra, Cialis, and others), suppositories, and penile pumps. The most popular choice for men seeking treatment for erectile dysfunction, however, is a penile implant if a patient does not respond to any of the aforementioned treatments.

According to the Cleveland Clinic, a non-profit academic medical centre with headquarters in Ohio, the United States, about 20,000 American males choose to have a penile implant each year. In the United States, penile implants are a common treatment choice, which is expected to spur market expansion over the upcoming years. Numerous awareness programmes focusing on the treatment of erectile dysfunction must be launched due to the condition's increased prevalence. Many companies, including Pfizer, are focusing on starting erectile dysfunction awareness programmes.

European impotence awareness campaigns and unbranded erectile dysfunction awareness campaigns aimed towards younger men are a couple of notable examples. For instance, in the United States, February 14 is recognised as National Impotence Day, on which the government and healthcare professionals raise public awareness of erectile dysfunction, its causes, and the range of treatment options available. They also pay attention to the various forms of erectile dysfunction and how it affects mental health.

The Erectile Dysfunction Devices market is segmented on the basis of treatment type, approach, and end user. Treatment type segment includes Shockwave Therapy Devices, Penile Implants, Vacuum Therapy Devices, and Others. Approach segments include Invasive and Non-invasive implants. End user segment includes Hospitals & Clinics, Ambulatory Surgery Centers, Pharmacies, and Others.

The penile implant category is expected to hold a major share of the global Erectile Dysfunction Devices market. Vacuum constriction devices, penile implants, shockwave therapy, and other device types are the main segments of the worldwide erectile dysfunction devices market. The market category expected to experience the highest growth rate is shockwave therapy. The non-invasive nature of the procedure, the absence of tablets or other pharmaceuticals, the expansion of companies making shockwave devices, and the rise of research into the use of shockwave therapy for the treatment of erectile dysfunction are expected to notice favourable market growth during the forecast period.

Due to a number of factors, the ambulatory surgical centres (ASCs) sector is anticipated to experience the most noteworthy growth in the market for erectile dysfunction devices. First off, ASCs offer a practical and affordable alternative for outpatient operations, such as the installation of devices for erectile dysfunction. They provide a welcoming and specialised setting that is furnished with the tools and qualified medical personnel required to carry out these treatments. Second, the demand for procedures carried out in ASCs is fueled by patients and healthcare professionals' growing desire for minimally invasive therapies.

In addition to improving patient happiness, this section enables shorter hospital stays, fewer post-operative problems, and quicker recovery times. This area of the market for erectile dysfunction products is also growing due to the growing healthcare infrastructure and the increase in ASCs around the world.

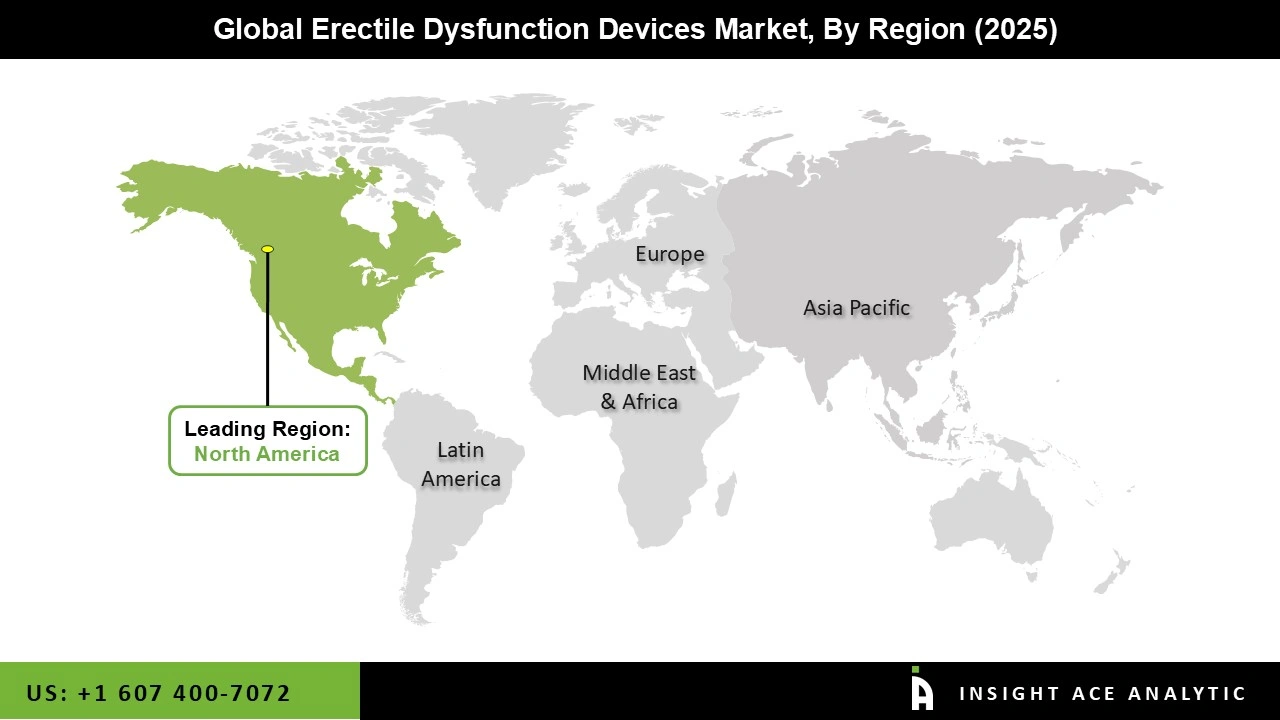

The erectile dysfunction devices market is expected to be dominated by the North American region for a number of reasons. Due to reasons including an ageing population and concerns with lifestyle, erectile dysfunction is pervasive in North America. This generates a sizable patient pool and increases the need for erectile dysfunction devices in the area. Second, the region has a state-of-the-art healthcare infrastructure, cutting-edge technology, and an advantageous reimbursement system that encourages the adoption of these devices.

The dominance of the North American segment in the erectile dysfunction devices market is also attributed to the existence of significant market participants, intensive research and development efforts, and a strong focus on men's health. Increased understanding and acceptance of erectile dysfunction as a curable ailment further add fuel to the market. Furthermore, the Asia Pacific region remains the fastest-growing market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.98 Billion |

| Revenue Forecast In 2035 | USD 5.23 Billion |

| Growth Rate CAGR | CAGR of 10.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, volume (number of units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Treatment Type, Approach, And End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Boston Scientific Corporation, Coloplast Corp., Zephyr Surgical Implants, Owen Mumford Ltd., Augusta Medical Systems, Storz Medical AG, Promedon, The Elator, Timm Medical, and Silimed |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.