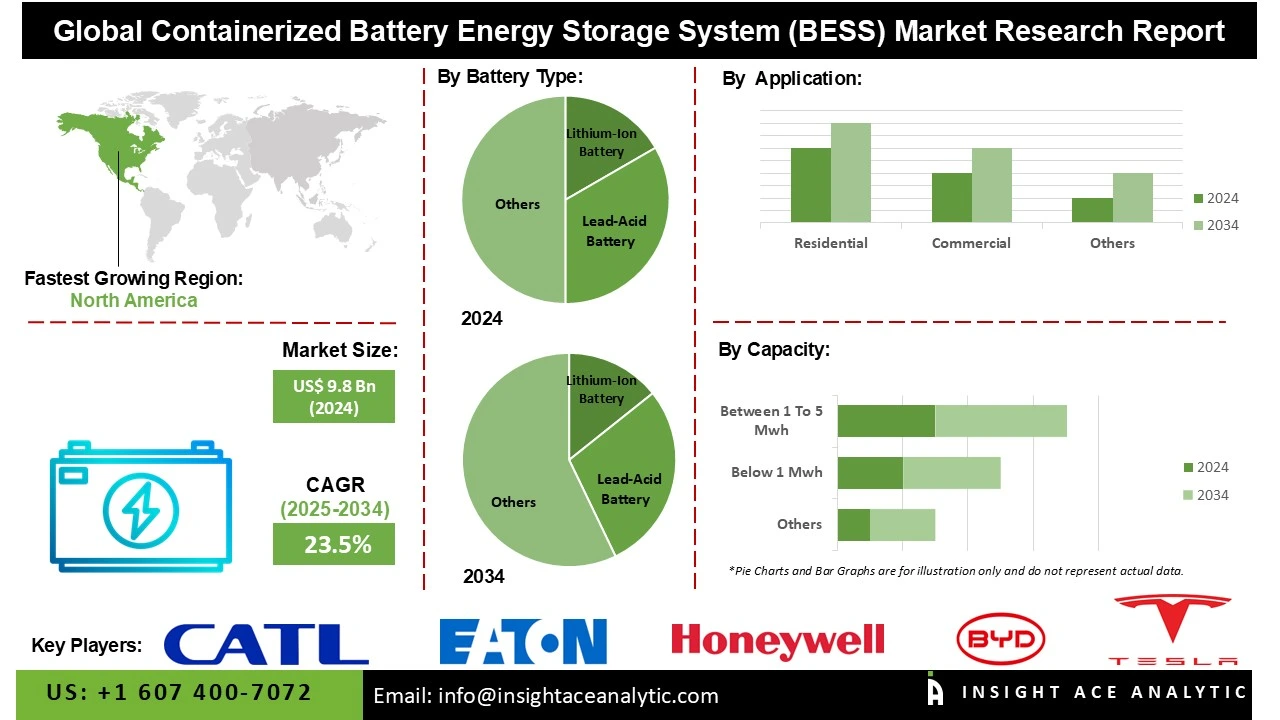

Containerized Battery Energy Storage System (BESS) Market Size is valued at US$ 9.8 Bn in 2024 and is predicted to reach US$ 77.6 Bn by the year 2034 at an 23.5% CAGR during the forecast period for 2025-2034.

A Containerized Battery Energy Storage System (BESS) is a turnkey, factory-assembled energy storage solution housed in standard 20-ft, 40-ft, or 45-ft ISO containers, typically ranging from 1 MWh to 100+ MWh per site when scaled. Each unit integrates high-energy-density lithium-ion batteries (predominantly LFP chemistry), bi-directional power conversion systems (PCS) with grid-forming capability, advanced battery management systems, HVAC-based thermal regulation, certified fire detection and suppression, and an energy management system (EMS) for real-time optimization.

This prefabricated, plug-and-play architecture enables deployment in weeks rather than months, supports both behind-the-meter and front-of-the-meter applications, and is widely used for renewable firming, frequency regulation, arbitrage, black-start capability, transmission deferral, and microgrid/resilience projects.

Supportive government policies and financial incentives represent one of the most powerful drivers of the global containerized BESS market. Across regions, governments are accelerating the transition to clean energy through investment tax credits (e.g., U.S. ITC), capacity payments, low-interest loans, direct grants, accelerated depreciation, and favorable regulatory frameworks that recognize storage as a distinct grid asset.

These mechanisms significantly reduce upfront capital costs and project risk, encouraging utilities, independent power producers, commercial & industrial users, and developers to invest in containerized BESS. Mandates for renewable portfolio standards (RPS), carbon emission reductions, and grid resilience further create long-term, predictable demand for flexible, large-scale energy storage solutions.

As a result, policy-driven markets—particularly in North America, Europe, China, Australia, and parts of Southeast Asia and Latin America—are experiencing explosive growth in containerized BESS deployments. Favorable regulations not only lower financial barriers but also unlock new revenue streams (energy arbitrage, ancillary services, capacity markets), improving project bankability and return on investment.

This strong regulatory tailwind, combined with continued cost declines in battery technology, continues to propel the containerized BESS sector toward mainstream adoption and multi-gigawatt annual installation rates worldwide.

Some of the Key Players in the Containerized Battery Energy Storage System (BESS) Market:

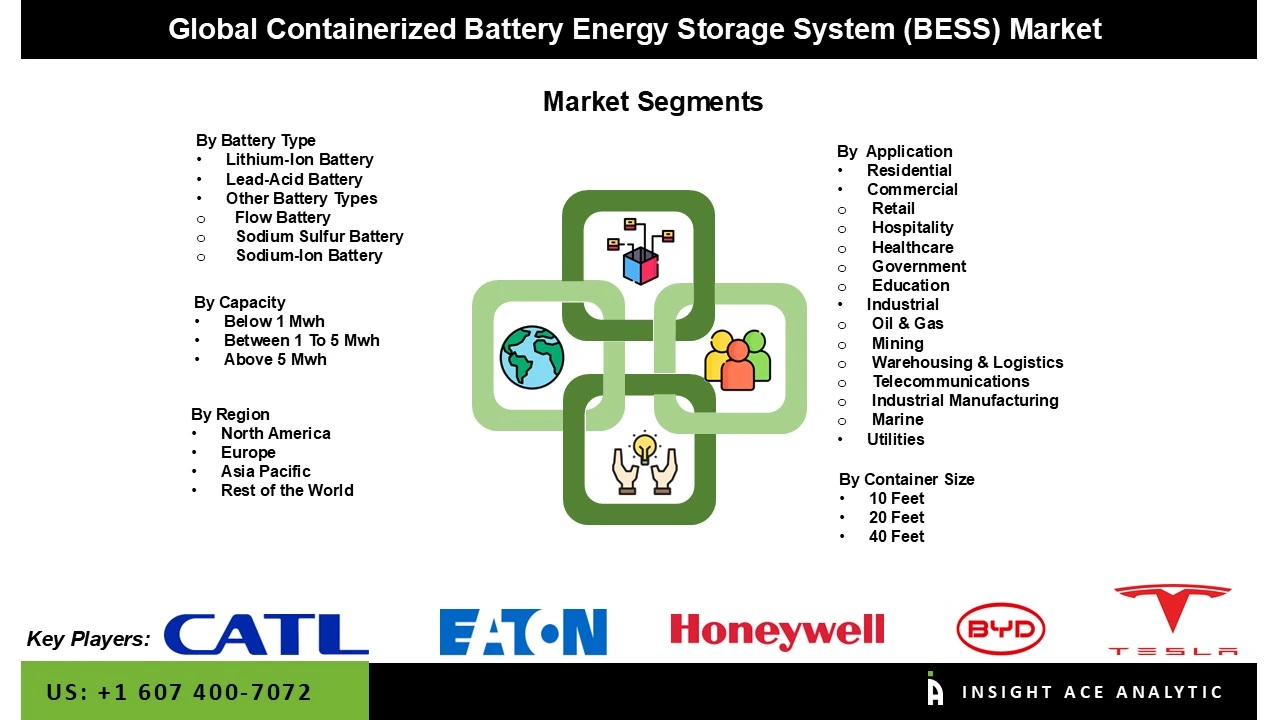

The market of containerized battery energy storage systems (bess) is segmented by battery type, capacity, container size, applications, and by region. The battery type segment covers lithium-ion batteries, advanced lead-acid batteries, and other battery types. By capacity, the market is segmented into below 1000 kwh, between 1000 & 5000 kwh, and above 5000 kwh. By container size, the market is segmented into 10 feet, 20 feet, and 40 feet. By container size, the market is segmented into residential, commercial & industrial, and utilities.

In 2024, the lithium-ion battery held the major market share due to the rising global shift toward renewable energy and decentralized power grids. Li-ion batteries offer high energy density, long cycle life, and faster charging capabilities, making them ideal for modular, containerized solutions. Prominent drivers include declining battery expenses, government incentives for clean energy, and the increasing requirement for grid stability and emergency backup power. These factors collectively boost adoption across commercial, industrial, and utility-scale applications.

The containerized battery energy storage system (BESS) market is dominated by residential due to the rising need for energy independence and backup power reliability. With frequent power outages, rising electricity expenses, and higher adoption of rooftop solar, households seek storage systems that deliver uninterrupted power and optimize self-consumption of renewable energy. Containerized BESS delivers modular, scalable, and space-efficient solutions for homes, allowing better load management and decreased reliance on the grid. Government incentives for residential solar-plus-storage further accelerate adoption.

North America dominates the market for containerized battery energy storage systems (BESS) due to the region’s rapid integration of renewable energy, increasing grid modernization efforts, and increasing demand for backup power during outages. The region faces rising electricity consumption and extreme weather events, making reliable storage important for resilience. Government incentives, clean energy targets, and investments in sustainable infrastructure further accelerate containerized battery energy storage system (BESS) adoption. Moreover, advancements in lithium-ion and flow batteries, along with declining storage expenses, are expanding deployment across utility, commercial, and industrial sectors.

Moreover, the Asia Pacific containerized battery energy storage system (BESS) market is also fueled by the rapid integration of renewable energy sources, specifically wind and solar, which require flexible storage to balance intermittency. Moreover, increasing energy demand, rising need for backup power, and declining battery expenses are boosting investments, making containerized BESS important for enhancing grid stability and resilience.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 9.8 Bn |

| Revenue Forecast In 2034 | USD 77.6 Bn |

| Growth Rate CAGR | CAGR of 23.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Battery Type, Capacity, Container Size, Applications and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Tesla, CATL, BYD, Eaton, Honeywell International, Inc., Fleunce, ABB, Delta Electronics, Inc., GE Vernova, Sungrow, Cummins, Inc., Altas Copco Group, NGK Insulators, Ltd., Alpha ESS Co., Ltd., and Microgreen Solar Corporation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Containerized Battery Energy Storage System (BESS) Market by Battery Type-

· Lithium-ION Battery

· Advanced Lead Acid Batteries

· Other Battery Type

Containerized Battery Energy Storage System (BESS) Market by Capacity-

· Below 1000 KWH

· Between 1000 & 5000 KWH

· Above 5000 KWH

Containerized Battery Energy Storage System (BESS) Market by Container Size-

· 10 Feet

· 20 Feet

· 40 Feet

Containerized Battery Energy Storage System (BESS) Market by Application-

· Residential

· Commercial & Industrial

· Utilities

Containerized Battery Energy Storage System (BESS) Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.