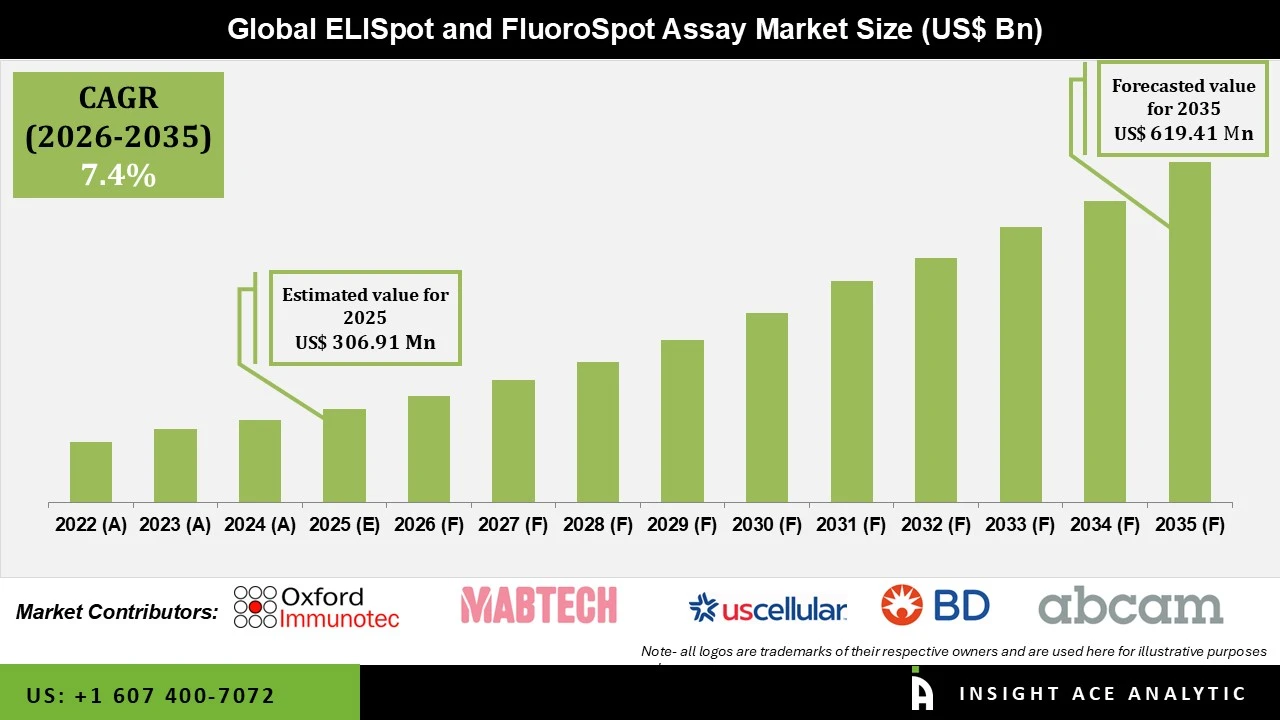

ELISpot and FluoroSpot Assay Market Size is valued at USD 306.91 Mn in 2025 and is predicted to reach USD 619.41 Mn by the year 2035 at a 7.4% CAGR during the forecast period for 2026 to 2035.

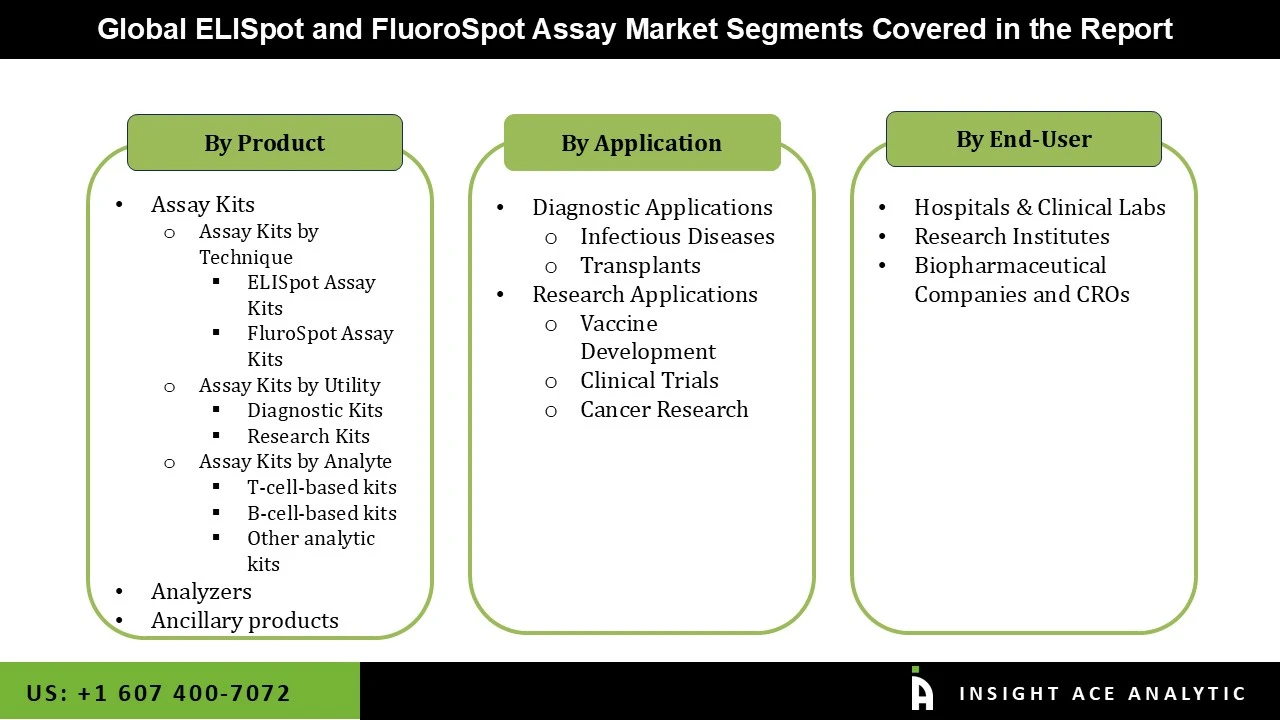

ELISpot and FluoroSpot Assay Market Size, Share & Trends Analysis Report By Product (Assay Kits, Analyzers, Ancillary products), By Application (Diagnostic Applications, Research Applications), By End-User, By Region, And By Segment Forecasts, 2026 to 2035

Several reasons are predicted to drive the ELISpot and FluoroSpot assay market. For starters, expanding vaccine research to combat drug-resistant strains, the increasing global prevalence of chronic illnesses, and technological advancements in ELISpot and FluoroSpot analyzers and test kits are likely to drive market expansion. ELISpot is an important technique in producing vaccines for various disorders, including AIDS, tuberculosis, malaria, cancer, and influenza. The ELISpot test is commonly used in clinical research to evaluate vaccinations. According to a June 2021 article published in BMC Infectious Diseases Journal, the FluoroSpot assay based on the ELISpot was more accurate than enzyme-linked immunoassay (ELISA) or flow cytometry (FCM). As a result, these assays are given priority to ensure precision in research diagnosis.

Key companies' strategic activities, such as product launches, approvals, alliances, and research projects, are also projected to drive market expansion. Ardigen and ImmuMap, for example, announced a research agreement in April 2021 aimed at discovering T-cell receptors (TCRs) receptive to tumor-associated neoantigens. The cooperation includes ELISpot tests, next-generation sequencing (NGS), MHC multimer labelling and sorting, and 10x Genomics Single Cell Immune Profiling. Such advancements are projected to stimulate assay innovation and, as a result, market growth.

The ELISpot and FluoroSpot Assay market is segmented based on product, application, and end-user. The market is segmented as assay kits by technique, by utility, by analyte, analyzers, and ancillary products based on product. The application segment includes diagnostic applications and research applications. Based on end-user, the market is bifurcated into hospitals & clinical labs, research institutes, and biopharmaceutical companies & CROs.

Assay kits are essential in a variety of applications, such as life science research, medicine development, and environmental monitoring. These applications include disease pathway research, screening for potential medication candidates, and evaluating biopharmaceutical manufacturing processes. Because of reasons such as the high prevalence of chronic diseases and the increased usage of these goods for vaccine development in clinical research, the assay kits segment maintains a dominant share.

The research institutes segment is expected to expand moderately over the projection period. The segment's expansion can be attributed to a greater emphasis on R&D activities in research institutes, particularly in the domains of immunology, infectious illnesses, and cancer research. More research institutes are expected to adopt ELISpot and Fluorospot assays for research and development purposes, propelling market growth in this sector.

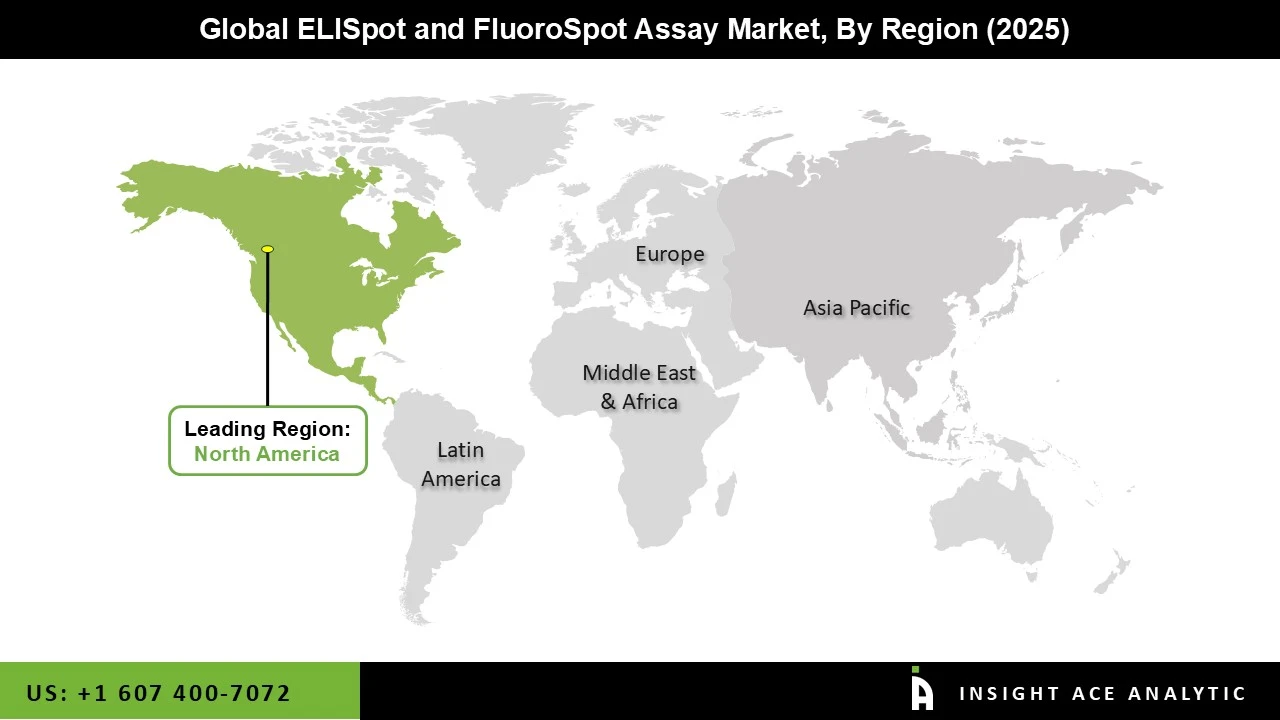

Due to the presence of FDA-approved ELISpot and FluoroSpot test kits, the presence of health remuneration policies, the rise in chronic infection, and the rise in the older population, the United States dominates the global ELISpot and FluoroSpot assay in the North America region. The test kits segment is dominant in the United States because it is cost-effective and offers accurate therapy for patients in the United States. Germany, on the other hand, dominates the global ELISpot and FluoroSpot assay in the European area due to the presence of untapped prospects for ELISpot and FluoroSpot assay in Germany and the increased prevalence of cancer patients in Germany.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 306.91 Mn |

| Revenue Forecast In 2035 | USD 619.41 Mn |

| Growth Rate CAGR | CAGR of 7.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Oxford Immunotec (UK), Cellular Technology Limited (US), Mabtech (Sweden), Becton, Dickinson and Company (US), Abcam plc. (UK), Bio-Techne.(US), Mikrogen Diagnostik (Germany), Autoimmun Diagnostika GmbH (Germany), U-CyTech (Netherland), Medix Biochemica (Finland), Merck KGaA (Germany), Bio-Sys GmbH (Germany), Anogen-Yes Biotech Laboratories Ltd (Canada), Abnova Corporation. (Taiwan), Biorbyt Ltd (UK), Tokyo Chemical Industry Co., Ltd. (Japan), MP BIOMEDICALS. (US), BOC Sciences. (US), ZenBio, Inc (US), Jackson ImmunoResearch Inc (US), Krishgen Biosystems. (India), NATIONAL ANALYTICAL CORPORATION (India), STEMCELL Technologies Inc. (Canada), SERVA Electrophoresis GmbH (Germany), IST Scitific LTD (England). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

ELISpot and FluoroSpot Assay Market By Product-

ELISpot and FluoroSpot Assay Market By Application-

ELISpot and FluoroSpot Assay Market By End-User-

ELISpot and FluoroSpot Assay Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.