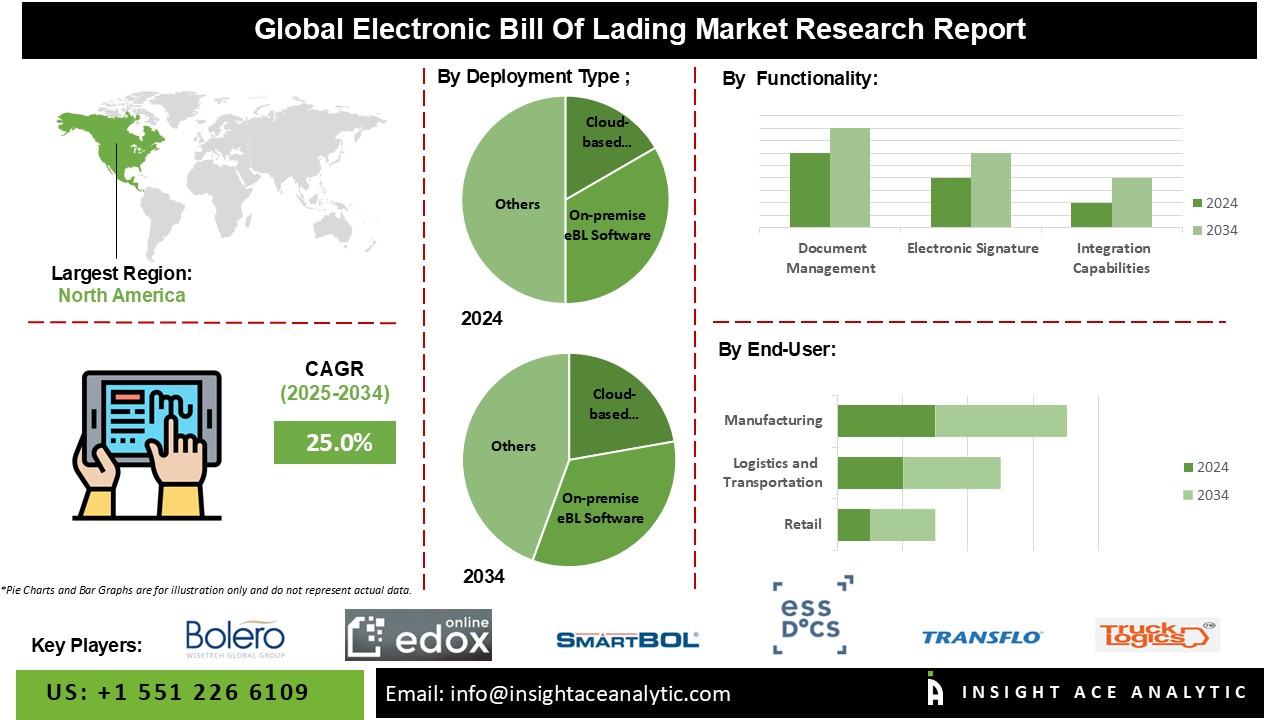

Electronic Bill of Lading Market Size is predicted to witness a 25.0% CAGR during the forecast period for 2025-2034.

Electronic bills of lading (eBL) systems automate these documents' creation, transmission, and processing, cutting down on the time and effort required to complete these tasks. The electronic bill of lading (eBL) combines a legal ruleset with technology to mimic the operations of a paper bill of lading. It is a digital alternative to the classic paper bill of lading. Electronic bills of lading (eBL) offer a more efficient and extensible solution for handling the ever-increasing number of transactions compared to traditional paper-based methods. Electronic bills of lading also allow users to monitor shipments in real time as they travel from origin to destination. Transportation times are reduced, supply chain efficiency is increased, and disruptions are less likely due to this transparency. Furthermore, increased reliance on digital trade procedures, strict international trade rules, and compliance standards are anticipated to fuel market expansion.

However, the market growth is hampered by the data privacy criteria for the safety and health of the electronic bill of lading market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high electronic bill of lading because Security issues, incompatibilities, and a lack of standards among eBL platforms are some of the non-functional criteria that are limiting the market's progress. Electronic bills of lading are essential to ensure the security and legitimacy of digital documents. Unlike paper bills of lading, electronic ones require strong digital security measures to prevent unauthorized access and modification. Due to the COVID-19 pandemic, which has affected the worldwide market and forced the closure of numerous factories to protect their personnel from contracting the virus, the expansion of the industry may be hindered.

The electronic bill of lading market is segmented based on functionality, end-use industries, and deployment type. As per the functionality, the market is segmented into document management, electronic signature, integration capabilities, and compliance and security features. By end-use industries, the market is categorised into manufacturing, logistics and transportation, retail, healthcare, and others. By deployment type, the market is segmented into cloud-based eBL software and on-premise eBL software.

The logistics and transportation electronic bill of lading market is expected to lead with a major global market share in 2022. Because the sector handles a lot of shipments and transactions, it relies heavily on bill of lading (BL) documentation. As the industry strives to update and enhance its processes, there is a rising demand for electronic solutions to manage BLS better.

The cloud-based eBL software industry makes up the bulk of acrylic acid ester usage because of the scalability and flexibility offered by cloud-based eBL software. Businesses may easily increase or decrease operations in response to demand without investing heavily in new infrastructure, especially in countries like the US, Germany, the UK, China, and India.

The North American electronic bill of lading market is expected to record the maximum market revenue share in the near future. It can be attributed to the regulatory backing from the government, new technologies, and more informed consumers. In addition, Asia Pacific is estimated to grow rapidly in the global electronic bill of lading market due to the region's acceptance of BYOD and enterprise mobility, rising demand for strong solutions, continuing digital transformation, and fast digitization.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 25.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By functionality, End-Use Industry, Deployment Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Vector, Bolero, E-Tiles, SmartBOL, essDOCS, edoxOnline, TruckLogics, Transflo, WaveBL and Seatech EDOC. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Electronic Bill of Lading Market By Functionality-

Electronic Bill of Lading Market By End-use Industries-

Electronic Bill of Lading Market By Deployment Type-

Electronic Bill of Lading Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.