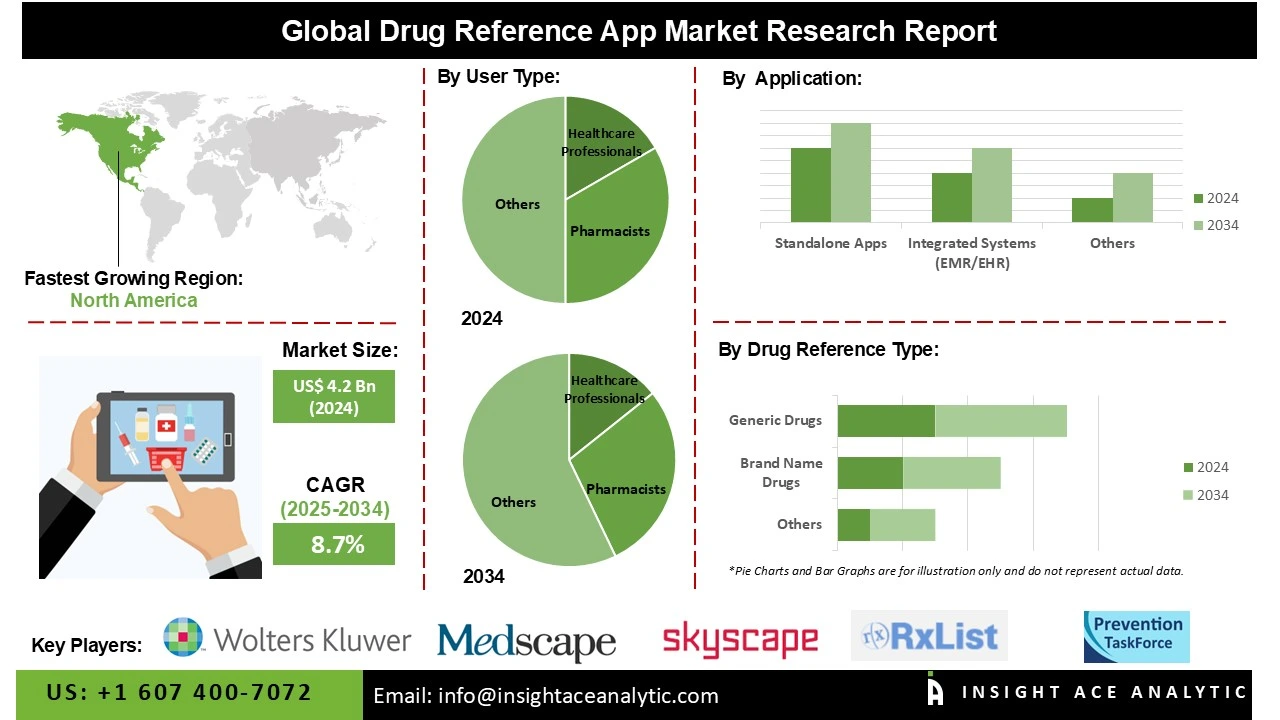

Global Drug Reference App Market Size is valued at US$ 4.2 Bn in 2024 and is predicted to reach US$ 9.3 Bn by the year 2034 at an 8.7% CAGR during the forecast period for 2025-2034.

A drug reference app is a digital tool designed to provide healthcare professionals, students, and consumers with quick, reliable, and comprehensive information about medications. A drug reference app is an indispensable tool in modern healthcare. It streamlines workflow, enhances the accuracy of medical treatment, and ultimately contributes to higher standards of patient safety and care.

The market for medication reference applications is seeing tremendous growth, propelled by the rising prevalence of smartphones and the escalating adoption of healthcare applications globally. With patients and healthcare professionals increasingly relying on mobile platforms for quick, reliable, and accessible drug information, these apps are becoming important tools for improving medication safety, reducing errors, and enhancing patient care. Rising need for real-time updates, dosage guidelines, side effect tracking, and drug interaction alerts further boost adoption. Moreover, the convenience of digital access, coupled with rising awareness about mobile health solutions, is a significant driver of market expansion.

The drug reference app market is growing steadily as healthcare professionals and patients increasingly rely on mobile solutions for exact and instant medical information. These apps provide comprehensive drug details, such as dosage, interactions, and side effects, which enhance clinical decision-making and patient security. Technological advancements such as AI-powered search, integration with electronic health records (EHRs), real-time updates, and offline access significantly improve app functionality and reliability. Additionally, the expansion of telemedicine, digital health adoption, and the requirement for user-friendly, evidence-based resources further drive market expansion, allowing faster and safer access to critical drug-related information.

Some of the Key Players in the Drug Reference App Market:

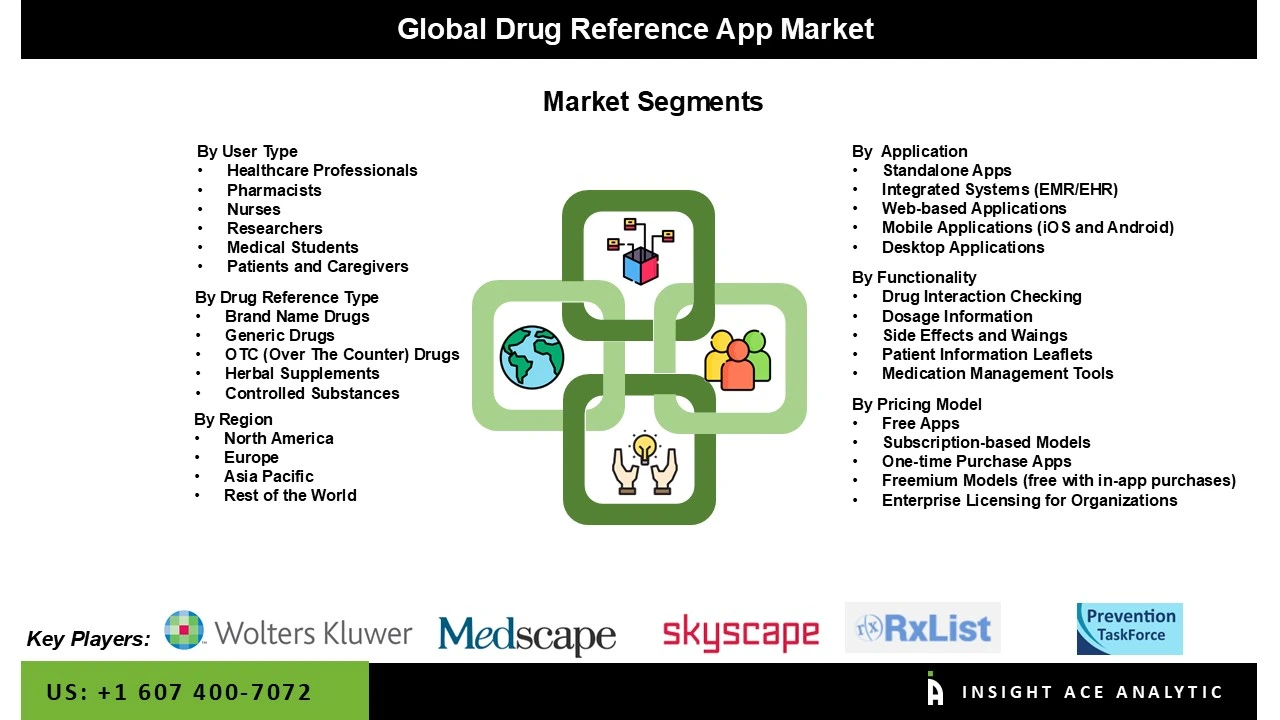

The drug reference app market is segmented by user type, application type, drug reference type, functionality, pricing model and By Region. As per the user type, the market is segmented into healthcare professionals, pharmacists, nurses, researchers, medical students, and patients & caregivers. By application type, the market is segmented into standalone apps, integrated systems (EMR/EHR), web-based applications, mobile applications (iOS and Android), and desktop applications. By drug reference type, the market is segmented into brand-name drugs, generic drugs, OTC (over-the-counter) drugs, herbal supplements, and controlled substances. By functionality, the market is segmented into drug interaction checking, dosage information, side effects & warnings, patient information leaflets, and medication management tools. The pricing model segment comprises free apps, subscription-based models, one-time purchase apps, freemium models (free with in-app purchases), and enterprise licensing for organizations.

The healthcare sector held the major market share as medical professionals and patients increasingly rely on digital tools for accurate, real-time drug information. Increasing smartphone penetration, telemedicine adoption, and the requirement for quick access to dosage, interactions, and side effects drive demand. Healthcare providers utilise these apps to improve prescription accuracy, reduce medication errors, and enhance patient safety. Growing integration with electronic health records (EHRs) and clinical decision-making systems further fuels market growth and adoption.

The drug reference app market is dominated by free apps over the projected period. Free drug reference apps provide healthcare professionals, students, and patients with easy access to essential drug information, including dosage, interactions, and side effects, without cost barriers. Their availability on smartphones and tablets supports quick, on-the-go medical decision-making. The increasing need for accurate, real-time information in clinical practice, combined with the affordability and accessibility of free apps, is a strong driver for market growth.

North America dominates the market for drug reference apps due to the region’s increasing need for quick, reliable, and easily accessible medical information. Rising smartphone adoption among healthcare professionals, coupled with the demand for accurate drug interaction data and dosage guidelines, drives app usage. The region’s strong digital healthcare infrastructure, supportive regulations, and emphasis on reducing prescription errors further enhance adoption. The market is also being stimulated by the integration of telemedicine platforms and electronic health records (EHRs).

Moreover, the Asia Pacific drug reference app market is also boosted by the growing adoption of digital healthcare tools, increasing smartphone penetration, and the need for quick, reliable medical information. Rising demand from healthcare professionals for accurate drug databases, dosage guidelines, and interaction checks drives growth. Additionally, regulatory support for digital health, telemedicine integration, and patient awareness about safe medication use enhance adoption. The region’s focus on improving clinical decision-making and reducing medication errors is a key driver.

Drug Reference App Market by User Type-

· Healthcare Professionals

· Pharmacists

· Nurses

· Researchers

· Medical Students

· Patients and Caregivers

Drug Reference App Market by Application Type-

· Standalone Apps

· Integrated Systems (EMR/EHR)

· Web-based Applications

· Mobile Applications (iOS and Android)

· Desktop Applications

Drug Reference App Market by Drug Reference Type-

· Brand Name Drugs

· Generic Drugs

· OTC (Over The Counter) Drugs

· Herbal Supplements

· Controlled Substances

Drug Reference App Market by Functionality-

· Drug Interaction Checking

· Dosage Information

· Side Effects and Waings

· Patient Information Leaflets

· Medication Management Tools

Drug Reference App Market by Pricing Model-

· Free Apps

· Subscription-based Models

· One-time Purchase Apps

· Freemium Models (free with in-app purchases)

· Enterprise Licensing for Organizations

Drug Reference App Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.