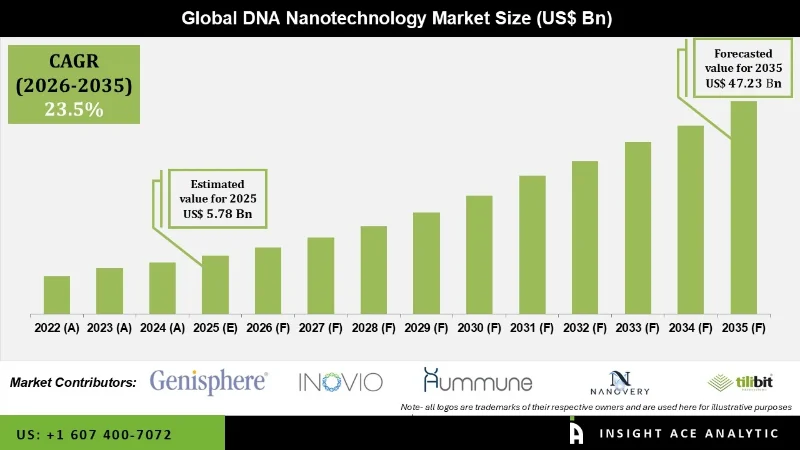

DNA Nanotechnology Market Size is valued at USD 5.78 Bn in 2025 and is predicted to reach USD 47.23 Bn by the year 2035 at a 23.5% CAGR during the forecast period for 2026 to 2035.

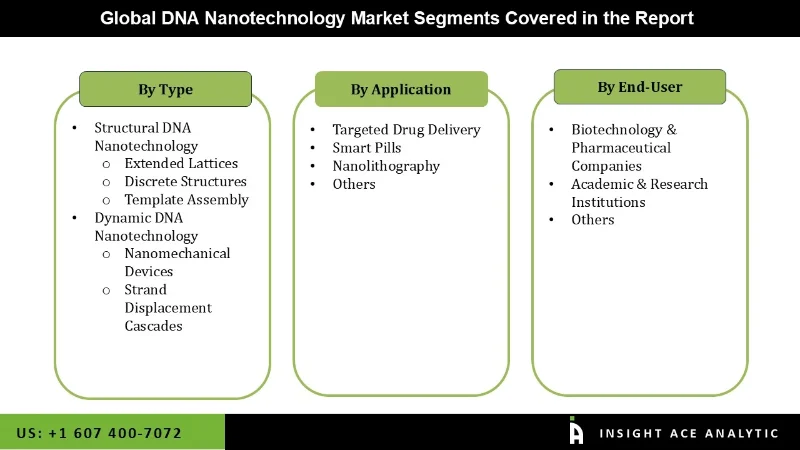

DNA Nanotechnology Market Size, Share & Trends Analysis Report By Type (Structural DNA Nanotechnology (Extended Lattices, Discrete Structures, Template Assembly), Dynamic DNA Nanotechnology (Nanomechanical Devices, Strand Displacement Cascades)), By Application (Targeted Drug Delivery, Smart Pills, Nanolithography, Others), By End User (Biotechnology & Pharmaceutical Companies, Academic & Research Institutions, Others), By Region, And By Segment Forecasts, 2026 to 2035

DNA nanotechnology is a potent tool in computing, electronics, medicine, and materials science because of its unique programmability, accuracy, and biocompatibility. The field's ongoing study and development are bringing up new opportunities to use life's molecular machinery to tackle difficult issues in science and engineering. This technique takes advantage of DNA's unique base-pairing characteristics to construct intricate molecular shapes and patterns. Rising R&D spending, expanding medical and biotech applications, and improved nanofabrication methods are the main forces propelling the DNA nanotechnology industry worldwide.

Solutions based on DNA nanotechnology are also seeing increased adoption due to the growing demand for tailored drug delivery systems and treatment. Another factor fueling the global rise of the DNA nanotechnology market is the cooperation between research organizations, academic institutions, and industry players. The expansion of the DNA nanotechnology market is being propelled by the expansion of its potential applications in domains including quantum information processing and nanotechnology circuitry, made possible by its combination with photonics and microelectronics.

However, the market growth is hampered by the high cost of developing and commercializing DNA nanotechnology products, worries about the scaling and replication of manufacturing procedures, and regulatory obstacles related to the security and effectiveness of DNA-based products are some of the challenges that restrict the market growth. In addition, COVID-19 increased the pace of scientific investigation, especially in diagnosis, treatment, and vaccine creation. Innovative vaccine delivery techniques and quick and sensitive diagnostic tests for SARS-CoV-2 detection have been made possible using DNA nanotechnology.

The DNA nanotechnology market is segmented based on type, application, and end user. Based on type, the market is segmented into structural DNA nanotechnology and dynamic DNA nanotechnology. By application, the market is segmented into targeted drug delivery, smart pills, nanolithography, and others. By end user, the market is segmented into academic & research institutions, biotechnology & pharmaceutical companies, and others.

The structural DNA nanotechnology DNA nanotechnology market is expected to hold a large global market share in 2022. Owing to its novel method for fabricating accurately and being amenable to programming nanostructures. Many fields, including nano-electronic device creation, targeted medication delivery, and medical diagnostics, can benefit from this technology's capacity to create intricate molecular structures and patterns. This technology's acceptance and market expansion is propelled by its revolutionary potential in several sectors.

Biotechnology and pharmaceutical companies are growing rapidly due to their growing spending on research and development, an uptick in interest in individualized healthcare, and a pressing need for novel medication delivery methods and treatment strategies. Because of these reasons, DNA nanotechnology is being used to create better, more specific medicines, growing this segment.

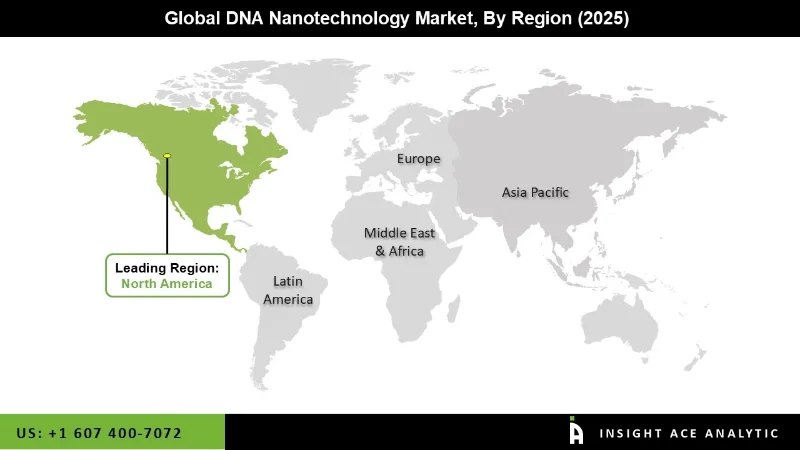

The North American DNA nanotechnology market is expected to register the maximum market revenue share in the near future. It can be attributed to the fact that the nation is home to a sizable biotechnology industry and several prominent business figures. Government subsidies and initiatives and a sufficient financial environment have fostered research and development endeavours.

In addition, Asia Pacific is predicted to grow rapidly in the global DNA nanotechnology market because rising healthcare spending, a thriving biotech industry, and a flood of capital from outside investors in key Asian markets are all factors fueling the boom. Additionally, a positive growth driver is the increasing attention of global businesses toward the expanding markets of the Asia Pacific region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.78 Bn |

| Revenue Forecast In 2035 | USD 47.23 Bn |

| Growth Rate CAGR | CAGR of 23.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | NuProbe, GATTAQUANT GMBH, Genisphere LLC, INOVIO Pharmaceuticals., Tilibit nanosystems, Aummune Therapeutics Ltd., Nanovery, Esya Labs, Nomic, Torus Biosystems, Parabon NanoLabs, Inc., NanoApps Medical Inc., Fox BIOSYSTEMS, Nanion Technologies GmbH, Mehr Mabna Darou, Inc., Nanowerk, Twist Bioscience Corporation, NanoInk Inc., Oxford Nanopore Technologies Ltd., Illumina Inc., Agilent Technologies Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Danaher Corporation, Bruker Corporation, New England Biolabs Inc., Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

DNA Nanotechnology Market By Type-

DNA Nanotechnology Market By Application-

DNA Nanotechnology Market By End User-

DNA Nanotechnology Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.