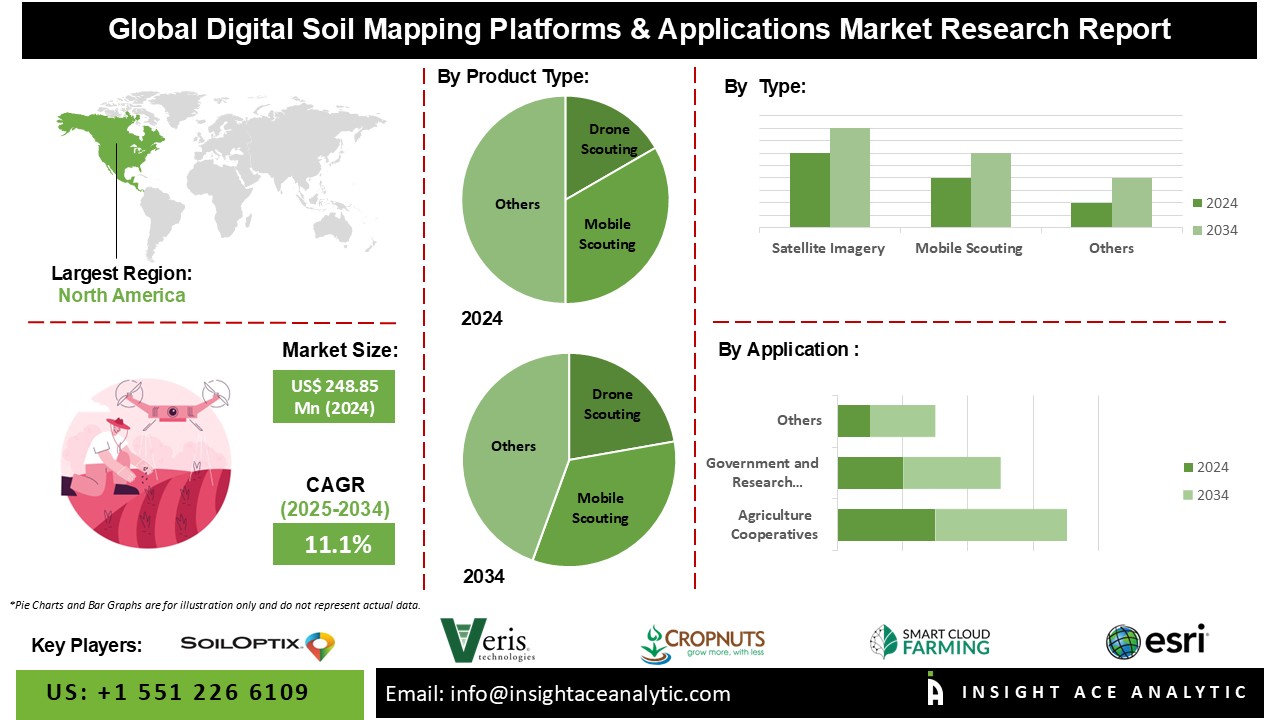

Digital Soil Mapping Platforms & Applications Market Size is valued at USD 248.85 Mn in 2024 and is predicted to reach USD 709.74 Mn by the year 2034 at an 11.1% CAGR during the forecast period for 2025-2034.

Digital Soil Mapping applies modern techniques and employment of advanced technologies such as GPS, remote sensing, GIS, and computational methods to generate detailed maps of soil characteristics. Field and laboratory data unite with spatial and non-spatial information to create quantitative links between soil properties and environmental variables. DSM uses geostatistical interpolation and other computational methods to generate geographically referenced databases more efficiently and at less cost than manual mapping.

The applications of DSM include the mapping of depth, texture, pH, and organic carbon of soil properties and modelling of soil dynamics such as hydraulic properties and carbon density. Soil sites have the interest of a wide range of users from the farmer to the landowner, governments, and forest managers in terms of critical and up-to-date information on soils that are believed to be crucial for issues such as sustainable agriculture, land degradation, and climate change. It generates high-resolution maps in detail and integrates with GIS that makes it very useful for modern soil management.

The digital soil mapping platforms and applications market is segmented by application and product type. By application the market is segmented into agriculture cooperatives, government and research institutes, agribusiness companies, and others. By product type market is categorized into drone scouting, mobile scouting, satellite imagery, others.

Through advanced technologies to efficiently and effectively optimize agricultural practices, agribusiness companies are at the forefront of driving the growth of digital soil mapping. Companies like Trimble use detailed soil data on pH levels, nutrient levels, and moisture content using precision agriculture to manage better and increase yields, maximizing resources. They integrate technologies such as drone scouting, mobile applications, and satellite imagery to continuously monitor the soil health, thus supporting real-time decisions and sustainable farming. The focus on sustainability together with global environmental goals fuels the demand for high-tech solutions in soil mapping in terms of both productivity and conservation.

Mobile scouting is gaining pace in the digital soil mapping market as it is straightforward, accessible, and more powerful. It allows farmers and agronomists to collect real-time data on the soil directly from the field with the help of smartphones or tablets, thus providing real-time decisions and timely interventions. Features such as GPS tracking, extensive user interfaces, and real-time analytics being added to mobile scouting apps by companies also enhance accuracy and make the technology accessible to more people. It optimizes the utilization of all resources and maximizes productivity while there is a growing emphasis on precision agriculture.

The North American region is primarily leading the market of digital soil mapping platforms and applications thanks to advanced agricultural practices, substantial investments in technology, and high adoption rates of digital tools like mobile scouting, drone scouting, and satellite imagery. Major companies include Trimble Inc., Deere & Company, and Ag Leader Technology, which are the top innovators in the sector. One of the emerging trends in remote sensing, data analytics, and IoT technologies is the enhancement of soil data acquisition to achieve improved accuracy and efficiency in sustainable agriculture that ensures North America's leadership in the market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 248.85 Mn |

| Revenue Forecast In 2034 | USD 709.74 Mn |

| Growth Rate CAGR | CAGR of 11.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, Product Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | SoilOptix, Veris Technologies, Inc., Crop Nutrition Laboratory Services Ltd., SMARTCLOUDFARMING, Esri, Trimble Inc., Ag Leader Technology, CropX inc., AgEagle Aerial Systems Inc, Taranis, EarthOptics, Teralytic, Corteva, EOS Data Analytics, Inc., Arable Labs, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Soil Mapping Platforms & Applications Market by Application -

Digital Soil Mapping Platforms & Applications Market by Product Type -

Digital Soil Mapping Platforms & Applications Market by region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.