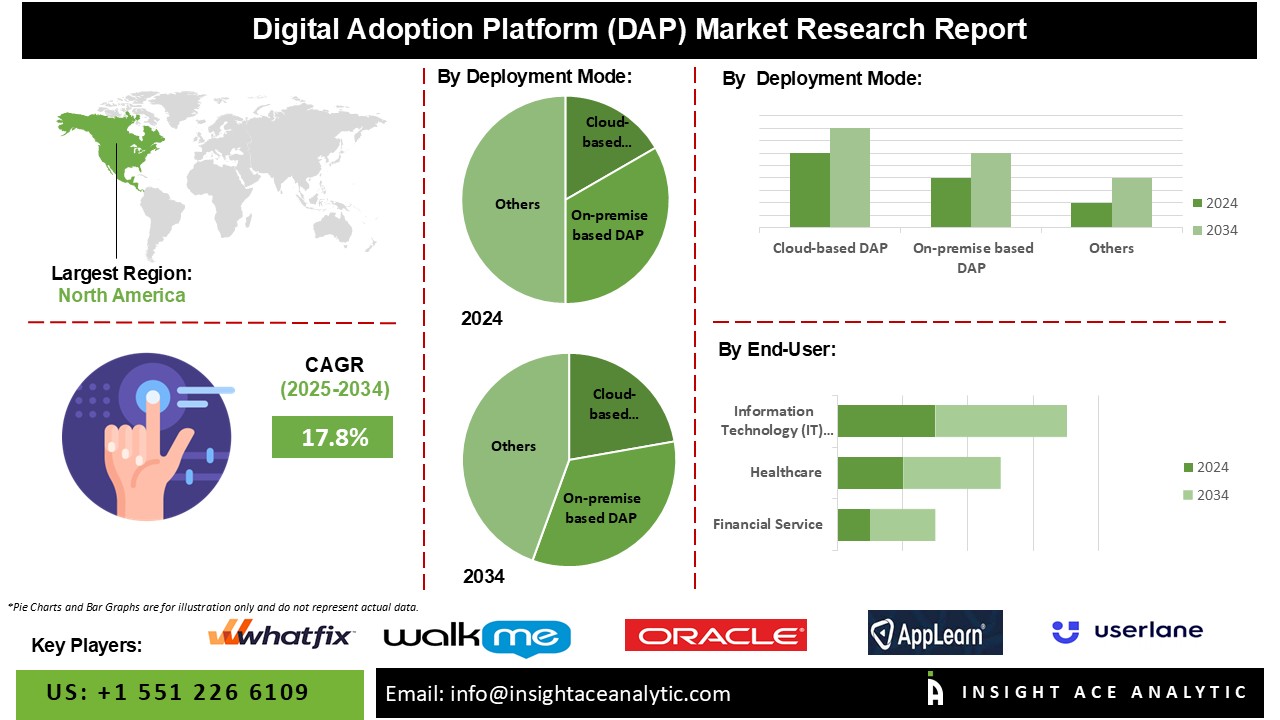

Digital Adoption Platform (DAP) Market Size is predicted to grow with a 17.8% CAGR during the forecast period for 2025-2034.

Digital adoption platforms (DAPs) drive end-user adoption by integrating no-code software with desktop, online, and mobile apps. This software offers application end-users with in-app advice and real-time support. Several factors contribute to the rising new technological advancement: a robust economy, increased consumer spending, supportive government policies, and a growing population. The digital adoption platforms (DAP) market is expanding due to the increasing prevalence of digital trends, rising customer demand, and decreasing operating expenses. This business is booming because workers are increasingly turning to digital adoption platforms (DAP) that allow them to monitor the status of their employee's work and maximize the effectiveness of software used in the workplace.

However, many up-front expenditures are associated with digital adoption platform (DAP) solutions. Furthermore, smaller enterprises may be unable to afford the operational costs related to technology upkeep and updates. In addition, technical advancements, strong collaborations with government companies, and their help to consumers execute tasks efficiently across many applications by providing consistent experiences will propel the industry's growth during the forecast period.

The digital adoption platform (DAP) market is segmented based on deployment mode and vertical. Based on deployment mode, the market is segmented into cloud-based DAP and On-premise based DAP. By vertical, the market is segmented into information technology (IT) & telecom, healthcare, financial service, retail & E-commerce, and others.

The On-premise-based DAP category will hold a significant share of the global digital adoption platform (DAP) market in 2022. This is because many businesses choose to host their DAP infrastructure internally, particularly those with stringent data security requirements. These companies choose to keep their systems On-premise to meet their operational demands and preferences while ensuring compliance and security.

The financial service segment is projected to increase in the global digital adoption platform (DAP) market because of the growing dependence on digital resources to maintain competitiveness in a dynamic market, boost operational efficiency, and enrich consumer experiences. Financial institutions are prioritizing digital transformation projects to satisfy their customers' increasing demands, which is predicted to lead to a boom in demand for DAP solutions, expanding this market's segment in the future.

The North American digital adoption platform (DAP) market is expected to register the highest market share in revenue in the near future because businesses with a strong emphasis on technology, a high level of digital maturity, and the satisfaction of both employees and customers drive the market demand for them. In addition, the Asia Pacific region's market is anticipated to experience expansion in the global market for digital adoption platforms (DAP) because of technological advancements, the growing digitization initiatives in developing nations such as China and India, as well as the need for effective solutions for staff training and customer interaction, reduce the complexity of digital adoption platform, and modern technology, which drives the market growth in this area.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 17.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Deployment Mode And Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Whatfix, WalkMe, Stonly, Oracle, AppLearn, SAP, Userlane, Pendo, Knowmore, and Appcues, amongst others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Component

By Deployment

By Use Case

By End-User Industry

By Enterprise Size

Companies

· WalkMe

· Whatfix

· AppLearn (Nexthink)

· Appcues

· Inline Manual

· Newired

· Oracle

· Userlane

· Toonimo

· UserGuiding

· Pendo

· Userpilot

· Apty

· Chameleon

· Spekit

· Mixpanel

· UserIQ

· Nickelled

· MyGuide

· Usetiful

· Helppier

· Tour My App

· Intro.js

· GuideCX

· Other prominent player

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.