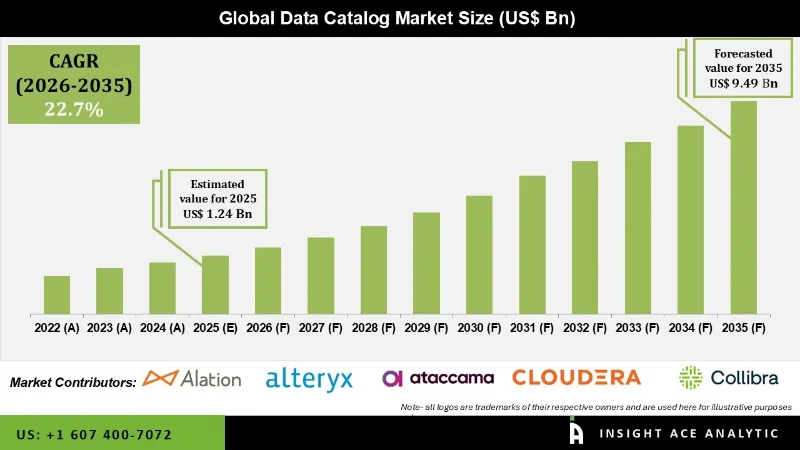

Global Data Catalog Market Size is valued at USD 1.24 Bn in 2025 and is predicted to reach USD 9.49 Bn by the year 2035 at a 22.7% CAGR during the forecast period for 2026 to 2035.

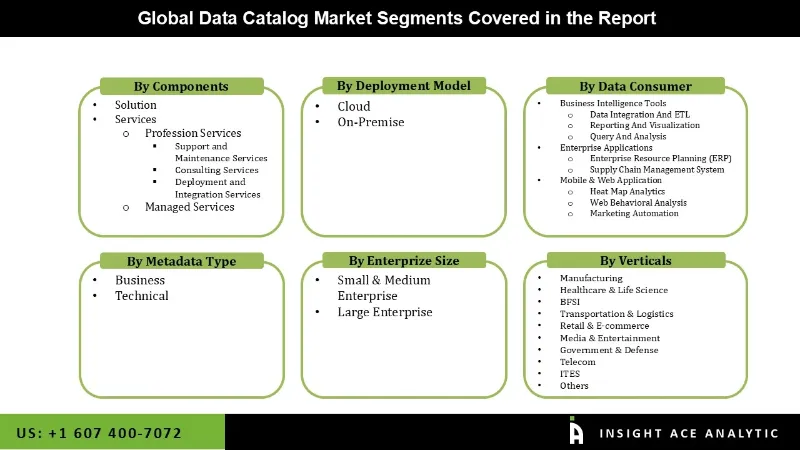

Data Catalog Market Size, Share & Trends Analysis Report By Components (Solution, Services (Professional Services (Support and Maintenance Services, Consulting Services, Deployment and Integration Services), Managed Services), By Deployment Model (Cloud, On-Premise), By Data Consumer, By Metadata Type, By Organization Size, By Verticals, By Region, And By Segment Forecasts, 2026 to 2035.

A data catalog is a structured list of all an organization's data assets that provides a sophisticated yet easy-to-use predicate-based search experience for technical and business metadata linked to data entries. The data catalog market is expanding due to the ever-increasing demand for data governance and compliance. Organizations are using data catalog solutions more and more to ensure regulatory compliance and efficient data management. Companies competing in the data catalog industry work together to offer customers comprehensive solutions that incorporate analytics, governance, and data management.

In order to improve data-driven decision-making, simplify data discovery, and guarantee compliance, key actors collaborate closely with organizations. Furthermore, the proliferation of cloud services and big data technologies contributed to data catalogs' popularity by making it easier for businesses to handle the variety and amount of their enormous datasets.

However, the data catalog market is expected to be hindered by the high implementation cost, technical complexities, and lack of data catalog professionals. Furthermore, the COVID-19 pandemic caused an increase in the demand for effective data management, access, and governance to support digital transformation efforts and hastened the adoption of data catalog solutions as firms transitioned to remote work. Additionally, the increasing necessity for cloud-based solutions and the growing need for effective data management are driving market growth.

The data catalog market is segmented based on component, deployment model, data consumer, metadata type, Enterprise size, and End-Users. According to the component segment, the market is categorized into Solution, Services (Profession Services, (Support and Maintenance Services, Consulting Services, Deployment and Integration Services), Managed Services). As per the deployment model, the market is segmented into cloud and on-premise. By data consumer, the market is segmented into business intelligence tools and mobile & web applications. By metadata type, the market is segmented into business and technical. The Enterprise size segment comprises into small & medium enterprises and large enterprises. By end-users, the market is segmented into manufacturing, healthcare & life science, BFSI, transportation & logistics, retail & e-commerce, media & entertainment, government & defence, telecom, ITES and others.

Data catalog services are expected to hold a major global market share in 2023 because consulting, support, and installation services are in high demand. As more firms use these solutions, there is a growing need for professional services in the data catalog sector. These services necessitate expert assistance to guarantee smooth integration, correct usage, and continuous maintenance, which is fueling the segment's expansion.

The large enterprise industry is growing because there is a growing demand for advanced analytics, scalable data management, and the ability to handle enormous amounts of data. Large companies need strong data catalog solutions to make better decisions, have better data governance, and stay in compliance with legislation. The increasing number of companies implementing digital transformation programs is also contributing to the sector's expansion.

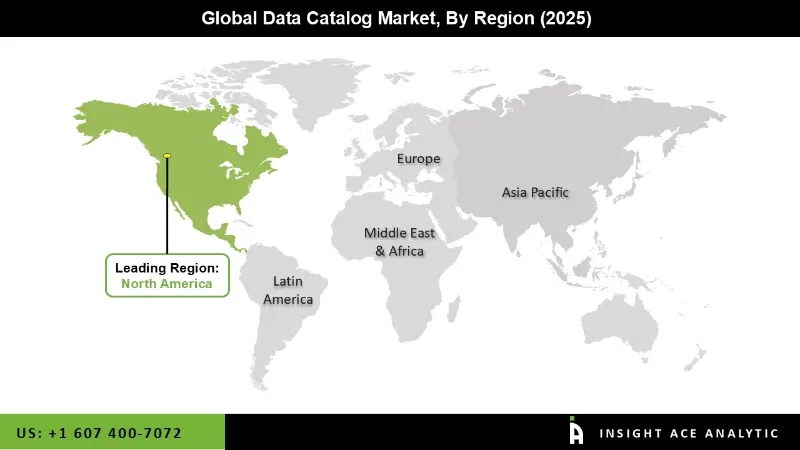

The North American data catalog market is expected to document the highest market share in revenue in the near future. It can be attributed to rapid developments in technology, the broad use of cloud-based solutions, and a growing focus on data governance and compliance with regulations. The presence of major market participants in the area also contributes to its growth. In addition, Europe is estimated to show rapid growth in the global data catalog market due to increasing demand for efficient data management and the expanding popularity of cloud computing. Investments in sophisticated analytics solutions and the region's growing IT infrastructure are also driving market expansion in this area.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.24 Bn |

| Revenue Forecast In 2035 | USD 94.9 Bn |

| Growth Rate CAGR | CAGR of 22.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Deployment Model, Data Consumer, Metadata Type, Enterprise Size, And End-Users |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Alation, Inc., Alteryx, Inc., Ataccama Corporation, Cloudera, Inc., Collibra NV, Google LLC, International Business Machines Corporation (IBM), Informatica LLC, Microsoft Corporation, Oracle Corporation, Talend, Inc., Tibco Software Inc., Zaloni, Inc., Denodo Technologies, Inc., Tableau Software, LLC (a Salesforce Company), Amazon Web Services, Inc. (AWS), Cambridge Semantics Inc., Erwin, Inc. (by Quest Software), Tamr, Inc., Data.World, Inc., Alex Solutions Pty Ltd, Octopai Ltd., Immuta, Inc., Solidatus Ltd., Zeenea, Atlan Pte. Ltd., Stemma Technologies, Inc., Castor EDC, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Data Catalog Market By Components-

Data Catalog Market By Deployment Model-

Data Catalog Market By Data Consumer-

Data Catalog Market By Metadata Type-

Data Catalog Market By Enterprize Size-

Data Catalog Market By Verticals-

Data Catalog Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.