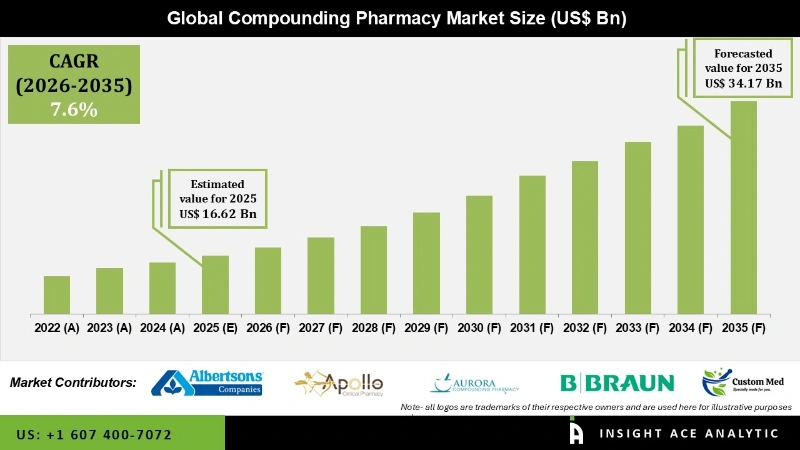

The Compounding Pharmacy Market Size is valued at USD 16.62 Bn in 2025 and is predicted to reach USD 34.17 Bn by the year 2035 at an 7.6% CAGR during the forecast period for 2026 to 2035.

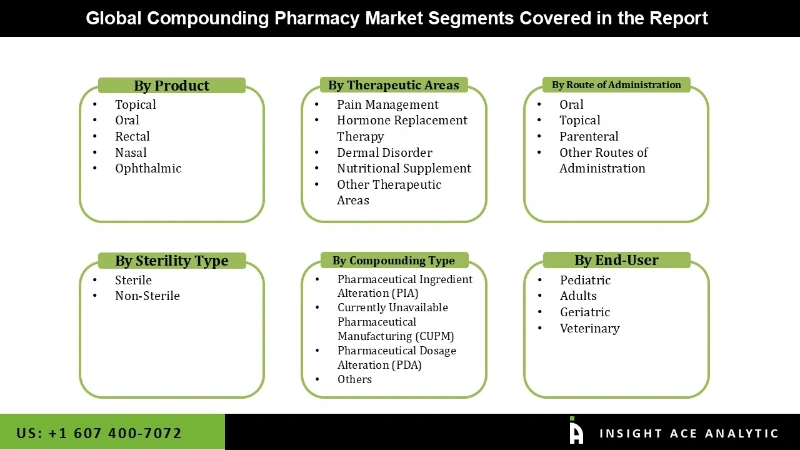

Compounding Pharmacy Market, Share & Trends Analysis Report, By Products (Topical, Oral, Rectal, Nasal, Ophthalmic), By Therapeutic Areas, By Route of Administration, By Sterility Type, By End User, By Compounding Type, By Region, and Segment Forecasts, 2026 to 2035.

Compounding is the creation of a pharmaceutical preparation of a drug by a licensed pharmacist to meet the unique needs of an individual patient, whether human or animal when a commercially available drug does not suffice. This may be necessary when a patient cannot tolerate the commercially available drug, when the exact preparation needed is unavailable on the market, or when a drug is in shortage or discontinued. Compounded medication is occasionally referred to as "personalized medicine" due to its ability to be tailored to the unique health requirements of each patient. Customized medications that are unavailable from commercial drug manufacturers are manufactured by compounding pharmacies. Pharmaceutical compounding is a valuable tool for addressing the unique requirements of a patient that cannot be accommodated by commercially available medications.

In February 2024, the Parenteral Drug Association (PDA) began a four-year partnership with the U.S. FDA's Compounding Quality Center of Excellence, aiming to improve the quality and accessibility of compounded drugs. This collaboration focuses on expanding training programs for professionals in outsourcing facilities and the broader compounding community, as well as creating interactive platforms for knowledge sharing and collaboration. While compounding is primarily regulated at the state level by boards of pharmacy, community and hospital pharmacists can claim exemptions from certain federal regulations under Section 503A of the Food, Drug, and Cosmetic Act. Despite these exemptions, both federal and state authorities oversee compounding practices to ensure medication safety, with pharmacists required to adhere to specific standards and regulations regarding the quality and integrity of drug ingredients, as overseen by the FDA.

The compounding pharmacy market is segmented based on products, therapeutic areas, route of administration, sterility type, end-user, and compounding type. Based on the products, the market is segmented into topical, oral, rectal, nasal, and ophthalmic. Based on the therapeutic areas, the market is segmented into pain management, hormone, replacement therapy, dermal disorder, nutritional supplement, other therapeutic areas. Based on the route of administration, the market is segmented into oral, topical, parenteral, and others. Based on the sterility type, the market is segmented into sterile, and non-sterile. Based on the end user, the market is segmented into pediatric, adult, geriatric, and veterinary. Based on the compounding type, the market is segmented into pharmaceutical ingredient alteration (PIA), currently unavailable pharmaceutical manufacturing (CUPM), pharmaceutical dosage alteration (PDA), and others

Based on the therapeutic areas the market is segmented into pain management, hormone, replacement therapy, dermal disorder, nutritional supplement, other therapeutic areas, and oral. The pain management segment is a major driver, due to the high demand for customized pain relief solutions, particularly for patients with chronic or severe pain who may not find adequate relief from commercially available medications. Compounding allows for personalized formulations, including topical analgesics, customized doses, and alternative delivery methods, which can be critical for managing complex pain conditions.

Based on the by route of administration, the market is segmented into oral, topical, parenteral, other, routes of administration. The topical segment generally dominates. Topical formulations are highly sought after due to their effectiveness in treating a variety of conditions, including dermatological issues, localized pain, and hormone replacement therapy. Their ease of application and targeted treatment benefits make them a preferred choice for many patients and healthcare providers.

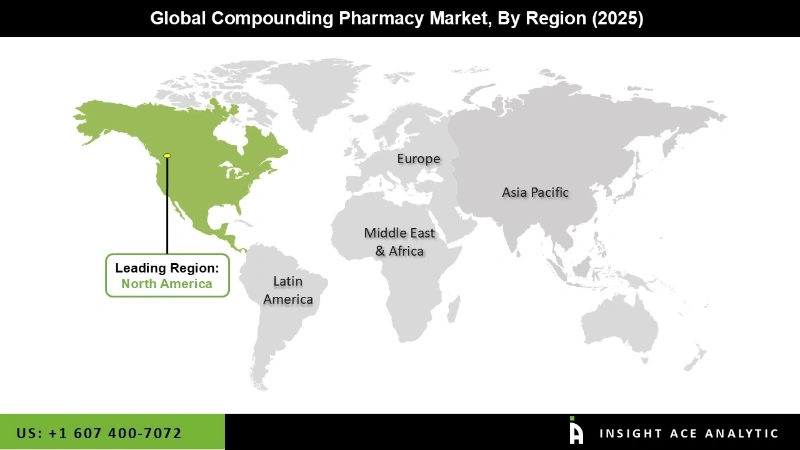

The rise of the regional market is being driven by the unavailability of some pharmaceuticals and the existence of multiple compounding pharmacies. The primary drivers propelling the market growth are the rising incidence of chronic diseases, the growing demand for customized drugs, the development of the healthcare infrastructure, and the growing awareness and demand for alternative therapies. The regulatory framework in North America, including stringent standards for compounded medications, supports the growth of the market by ensuring high-quality standards and safety.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 16.62 Bn |

| Revenue Forecast In 2035 | USD 34.17 Bn |

| Growth Rate CAGR | CAGR of 7.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Products, Therapeutic Areas, Route of Administration, Sterility Type, End-User, and Compounding Type. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Albertsons Companies, Apollo Clinical Pharmacy, Aurora Compounding, B. Braun Melsungen, Custom Med Apothecary, Fresenius Kabi, Fagron, Formul8, Fusion Apothecary, Galenic Laboratories, Institutional Pharmacy Solutions, JL Diekman and AQ Touchard, Letco Medical, Olympia Pharmacy, PharMEDium Services, Walgreen, Wedgewood Pharmacy, The London Specialist Pharmacy Ltd, MEDS Pharmacy, Rx3 Compounding Pharmacy, Clinigen Group PLC, Dougherty's Pharmacy, Inc., Lorraine's Pharmacy, Mcguff compounding pharmacy services. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Compounding Pharmacy Market - By Products

Global Compounding Pharmacy Market – By Therapeutic Areas

Global Compounding Pharmacy Market – By Route of Administration

Global Compounding Pharmacy Market – By Sterility Type

Global Compounding Pharmacy Market – By End User

Global Compounding Pharmacy Market – By Compounding Type

Global Compounding Pharmacy Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.