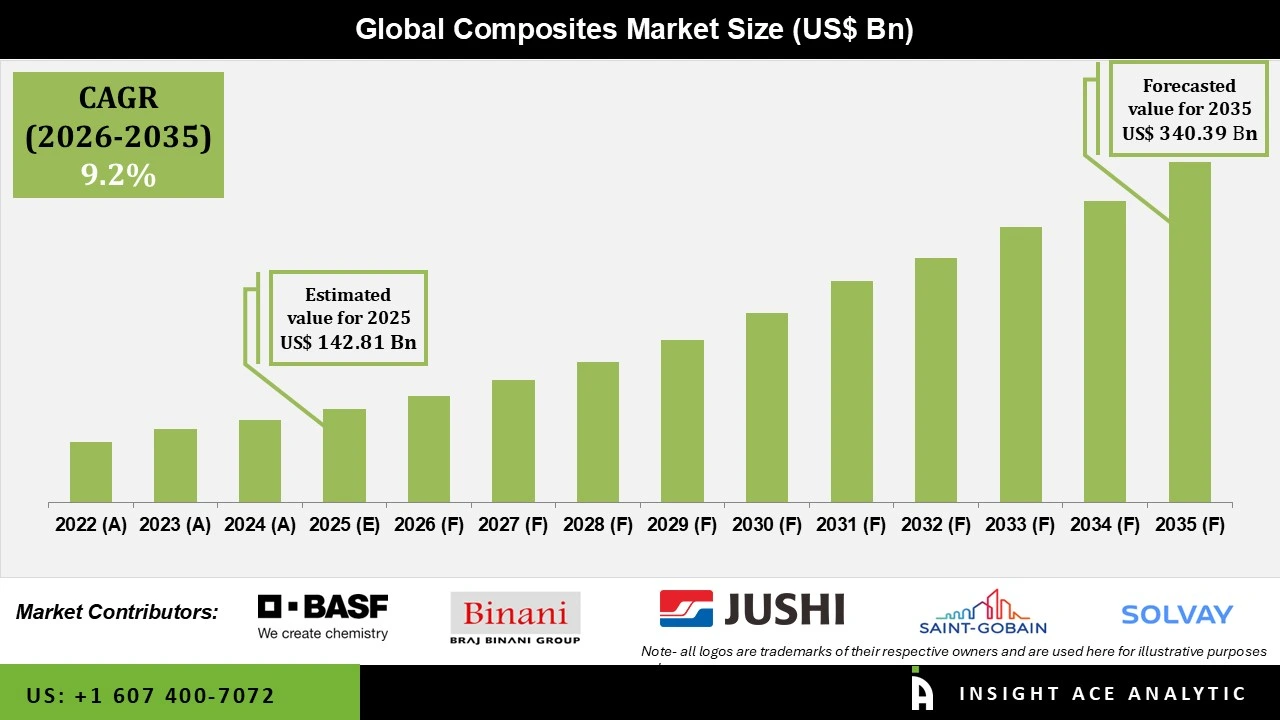

Global Composites Market Size is valued at USD 142.81 Billion in 2025 and is predicted to reach USD 340.39 Billion by the year 2035 at a 9.2% CAGR during the forecast period for 2026 to 2035.

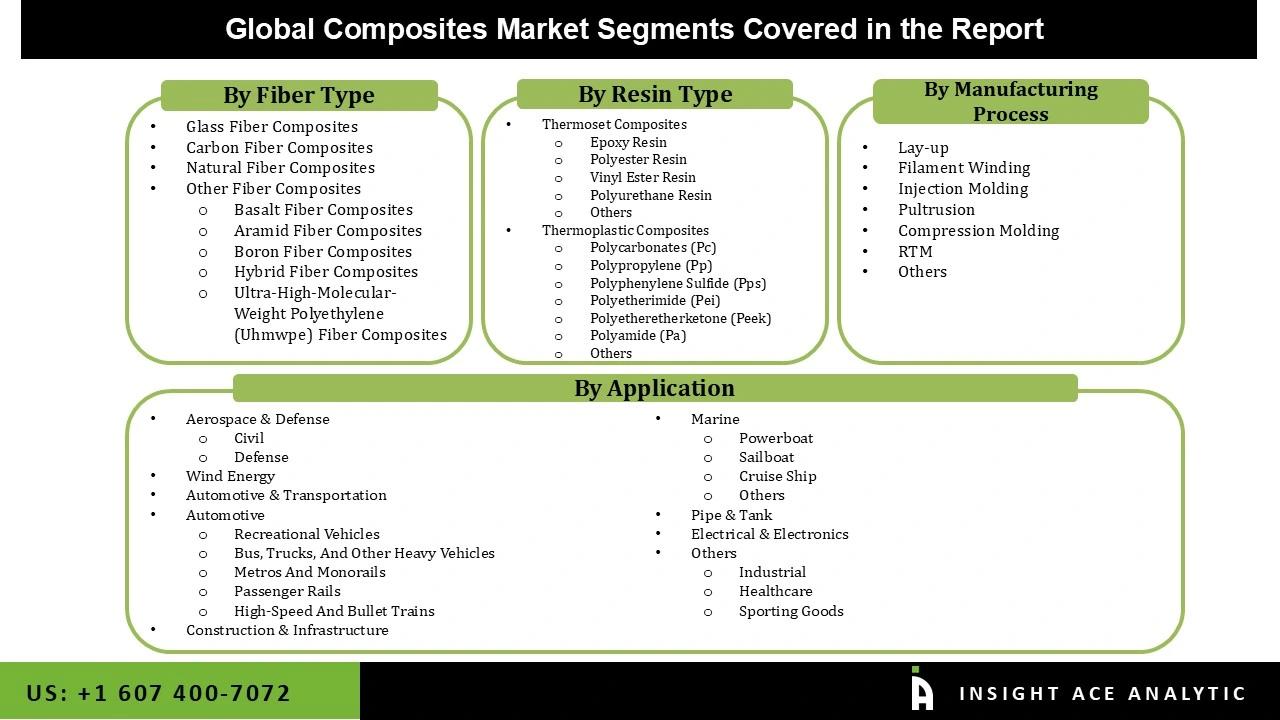

Composites Market Size, Share & Trends Analysis Report By Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process, By End-Use Industry, By Region, And Segment Forecasts, 2026 to 2035

A composite is a substance made up of two or more different substances that, when combined, are more potent than when used separately. Numerous industries, such as architecture, infrastructure, and automotive, are adopting composites. They have distinct qualities that make them the ideal replacement for substances like granite, steel, aluminum, and wood. This increase is responsible for the expanding need for weightless components in the automotive and transportation sectors.

Additionally, during the predicted years, the market expansion is expected to be supported by increased use of innovative lightweight components across all industrial sectors. Composites are used in the aerospace and defense industries because they significantly lower the body weight of military aircraft and helicopters. It is believed that a weight reduction is necessary to improve overall performance and fuel efficiency, and it is anticipated that this will become the main factor boosting the industry's growth.

Automotive manufacturers have been compelled to advance their technologies and create low-pollution vehicles by the mounting environmental concerns and strict pollution control legislation. In addition, the implementation of environmental legislation, particularly in Europe and the United States, has compelled automotive manufacturers to use composites in the production of automobiles. The market growth is anticipated to increase gradually as a result. Due to their high price, composites can only be used in high-end automobiles.

The composites market is segmented on the fiber type, resin type, end-use industry and manufacturing process. Based on fiber type, the market is segmented into glass fiber composites, carbon fiber composites, natural fiber composites and other fiber composites. Based on resin type, the market is segregated into thermoset composites and thermoplastic composites. Based on the end-use industry, composites market is segmented into aerospace & defense, wind energy, automotive & transportation, construction & infrastructure, marine, pipe & tank, electrical & electronics and others. Based on the manufacturing process, the market is segmented into lay-up, filament winding, injection molding, pultrusion, compression molding, RTM and others.

The thermoset composites category seized the highest revenue share, and it is anticipated that they will continue to have that position during the anticipated time. A substrate or base material like paper, cotton fabric, or glass cloth, along with an adhesive or resin-like epoxy, melamine, or silicone, make up the majority of thermoset composites. The thermoset laminate is produced by pressing layers of material into sheets while heating and applying pressure to the base material, which is covered with adhesive. Strong materials comprised of a substrate and resin are known as thermosetting materials. They cannot be reformed, and high temperatures do not cause them to melt, yet they are easily machinable since they are naturally stiff.

The construction & infrastructure category is anticipated to grow significantly over the projection period. Composite materials provide significant improvements in corrosion resistance and structural response. Structures of composite materials include storage tanks, bridges, lighthouses, hydraulic systems, and door and window components. Composites have a high specific strength and can withstand higher stress per unit of weight due to their high strength and lightweight qualities, which make them an attractive building material.

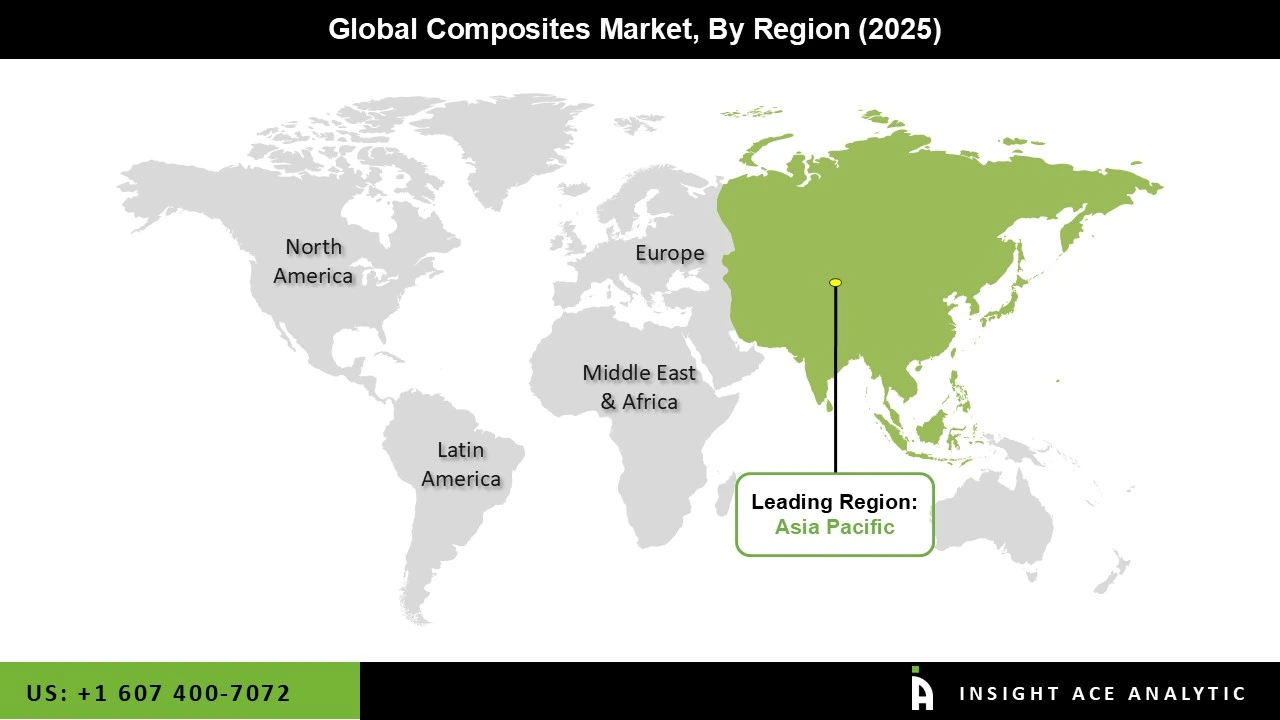

The Asia Pacific composites market is expected to register the highest market share in revenue in the near future. The market for composites in this area is expanding due to the rapid development of application sectors like transportation, wind energy, and aerospace & military. Additional factors accelerating the expansion include the cities' quick urbanization and significant carbon fiber producers in APAC. In addition, North America is projected to grow rapidly in the global composites market because of government funding and technological advancements in the aerospace and defense industries.

The U.S. Aerospace & Defense (A&D) industry is recognized as a leader in the design and development of technologically sophisticated aircraft and defense capabilities, and it is present in the area with several aircraft Original Equipment Manufacturers (OEMs). With a weight reduction of 20% to 50% in aircraft applications, composites offer great impact resistance and thermal stability.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 142.81 Billion |

| Revenue forecast in 2035 | USD 340.39 Billion |

| Growth rate CAGR | CAGR of 9.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Fiber Type, Resin Type, End-Use Industry And Manufacturing Process |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Owens Corning (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Holdings Corporation (Japan), Hexcel Corporation (US), SGL Group (Germany), Nippon Electrical Glass Co. Ltd. (Japan), Huntsman International LLC. (US), and Solvay (Belgium). |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.