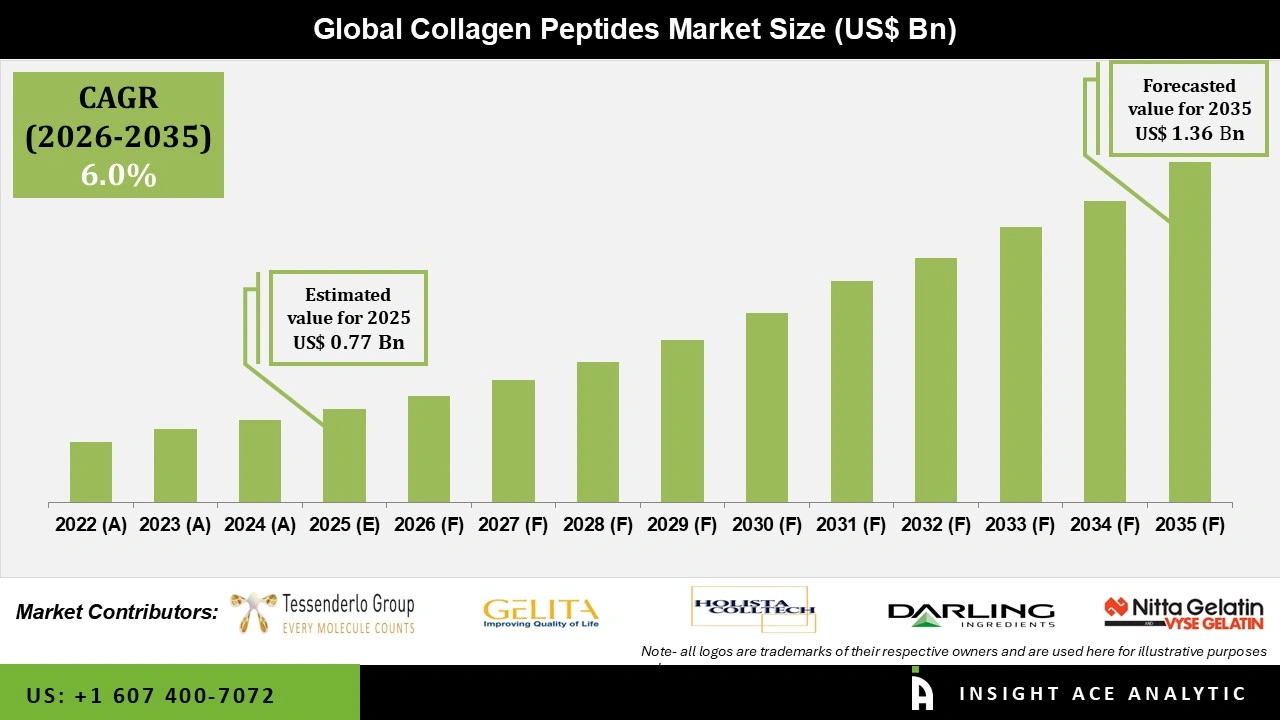

Global Collagen Peptides Market Size is valued at USD 0.77 Bn in 2025 and is predicted to reach USD 1.36 Bn by the year 2035 at an 6.0% CAGR during the forecast period for 2026 to 2035.

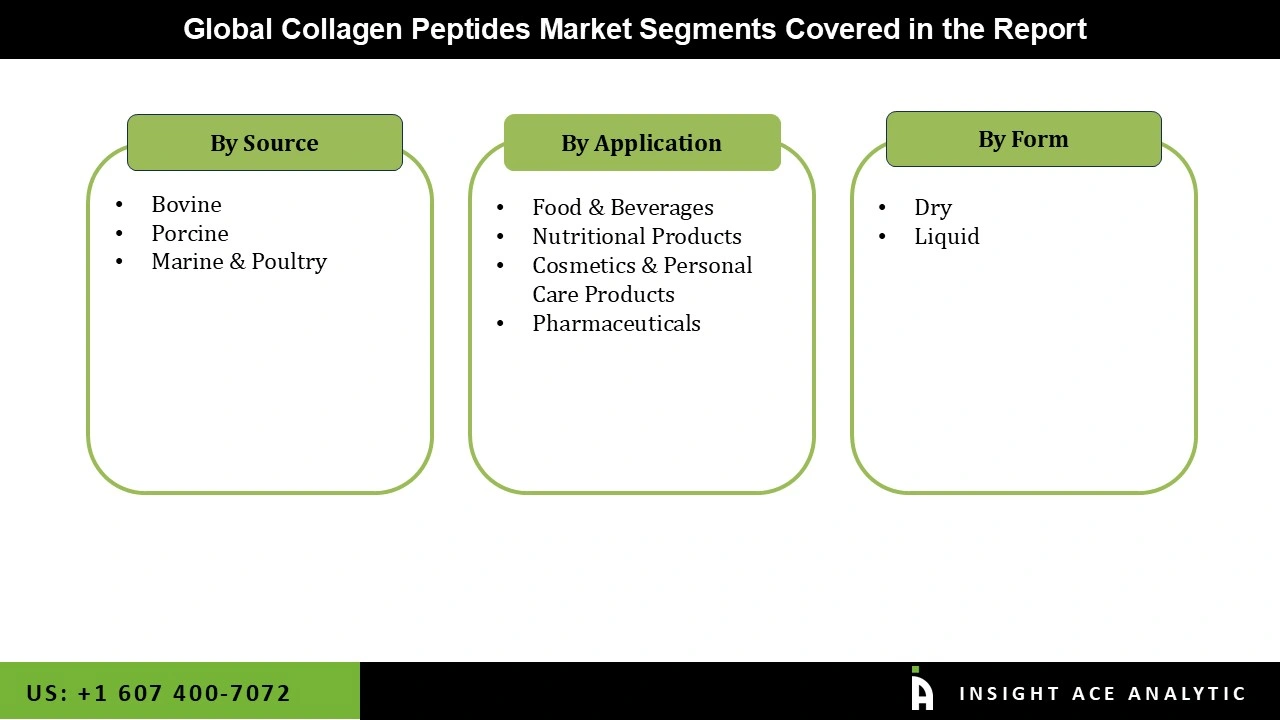

Collagen Peptides Market Size, Share & Trends Analysis Report By Source (Bovine, Porcine, Marine & Poultry), By Form (Dry, Liquid), By Application (Food & Beverages, Nutritional Products, Cosmetics & Personal Care Products, and Pharmaceuticals), Region, and Segment Forecasts, 2026 to 2035

The growing demand for functional foods, dietary supplements, beverages, cosmetics and personal care products, technological advancements in collagen extraction techniques, and the constant efforts in R&D activities by the companies operating in the collagen peptides market would provide lucrative opportunities for product innovations and improvements.

In recent years, collagen peptides have evolved in popularity in the health and wellness industry. In addition, they are widely used in the food industry to produce candies and chocolates. The collagen peptides can help improve skin and bone health as well.

However, several other alternatives, like alginate, cellulose, polylactic acid, etc., have been used in regenerative medicine, which is anticipated to hinder the growth of the collagen peptides market.

The collagen peptides market is segmented based on source, application, and form. The source segment comprises bovine, porcine, marine & poultry. By application, the collagen peptides market is categorized into food & beverages, nutritional products, cosmetics & personal care products, and pharmaceuticals. The form segment has two groups: dry and liquid.

By source, the bovine group dominated the market in 2022. Technological advances have made obtaining collagen from different sources more comfortable, providing a variety of collagen peptide products to meet specific preferences and diet needs. Bovine-based production of collagen peptides is an economical process. Animal products such as cow skin, bones, ligaments and other body parts are readily available as they are the most consumed meat in the world. The augmented production of collagen peptides and the ease of availability of raw materials are projected to drive market expansion over the forecast period.

By application, the food & beverages segment led the collagen peptides market share in 2022. This growth can be attributed to collagen properties like peptides’ absorption capacity, texturizing, & thickening. Collagen is one of the most critical proteins in the human body, providing support to tissues and muscles. This will encourage the use of collagen peptides in food products, thereby supporting industry revenue growth over the forecast period.

Moreover, collagen peptides are used in dietary supplements to maintain healthy and active lifestyles. Cosmetics & personal care products are also expected to raise the demand for collagen peptides in the forthcoming years. For instance, in December 2022, Nitta Gelatin, a collagen peptide supplier, announced that its freshwater fish collagen peptides had been certified to Aquaculture Stewardship Council (ASC) standards. The ingredients are part of Nitta Gelatin’s Wellnex Replenwell line of collagen peptides that helps in reducing the visible signs of skin ageing, including wrinkles, dryness, and loss of elasticity.

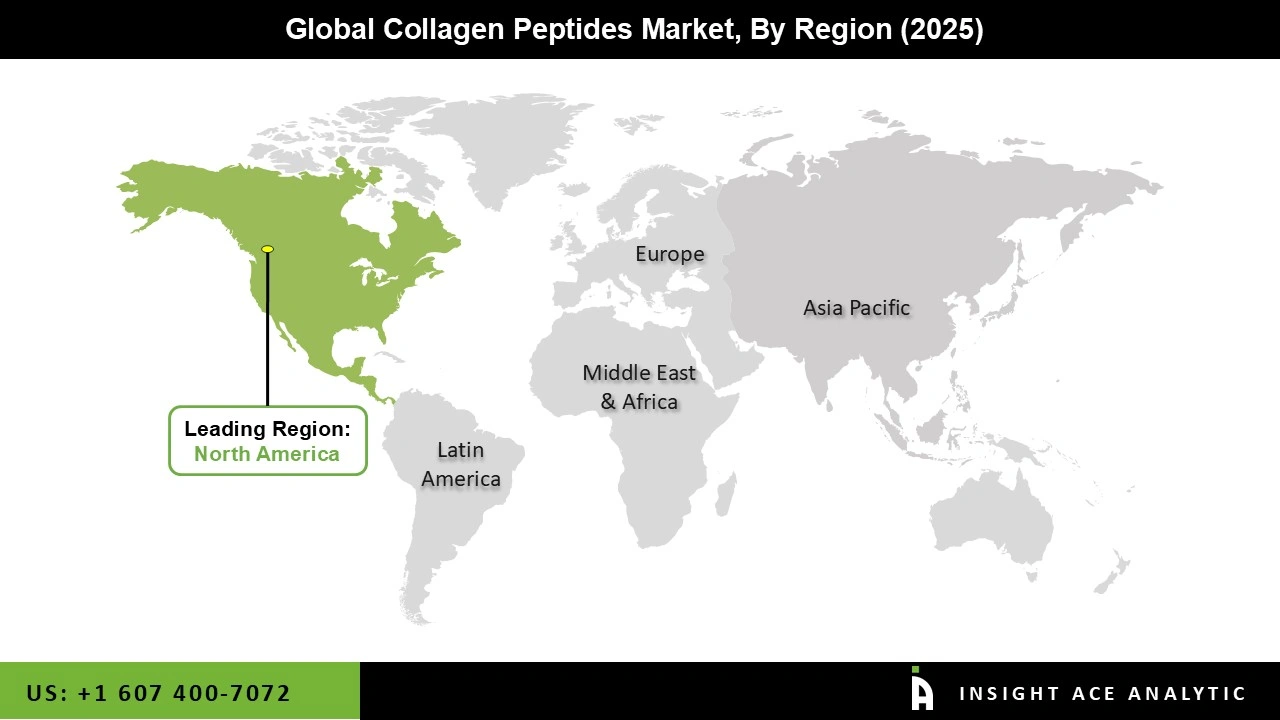

Europe is one of the leading regions in the pharmaceutical industry. Hence, collagen peptides are widely used in biomedical applications. Major players such as Tessenderlo Group (Belgium), Gelita AG (Belgium), and Lapi Gelatine S.p.A (Italy) are headquartered in this region, making Europe an important area for the collagen peptide market.

Some factors contributing to regional growth are growing public health awareness, well-established industries, and R&D investments for product innovations.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.77 Bn |

| Revenue Forecast In 2035 | USD 1.36 Bn |

| Growth Rate CAGR | CAGR of 6.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Source, By Application, By Form |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Tessenderlo Group (Belgium), Gelita AG (Germany), Holista Colltech (Australia), Darling Ingredients (US), Nitta Gelatin Inc. (Japan), Lapi Gelatin S.p.a (Italy), Weishardt (France), Crescent Biotech (India), Foodmate Co., Ltd. (China), Kayos (India), Aspen Naturals (US), Biocell Technology (US), Viscofan DE GmbH (Germany), Amicogen, Inc (South Korea), Kayos (India), Rudra Bioventures Pvt. Ltd. (India), Chaitanya Agro Biotech Pvt. Ltd. (India), ALPSURE LIFESCIENCES PRIVATE LIMITED (India), JELLICE GELATIN & COLLAGEN (Netherlands), and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.