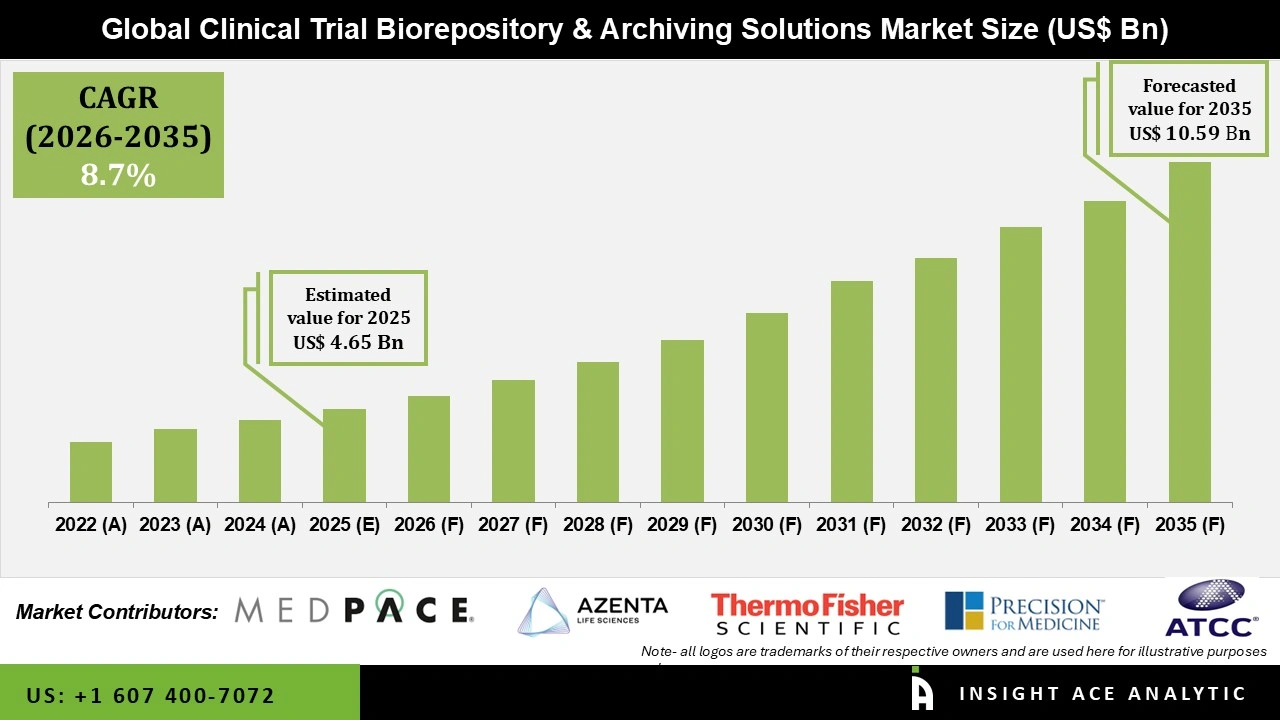

Global Clinical Trial Biorepository and Archiving Solutions Market Size is valued at USD 4.65 Bn in 2025 and is predicted to reach USD 10.59 Bn by the year 2035 at an 8.7% CAGR during the forecast period for 2026 to 2035.

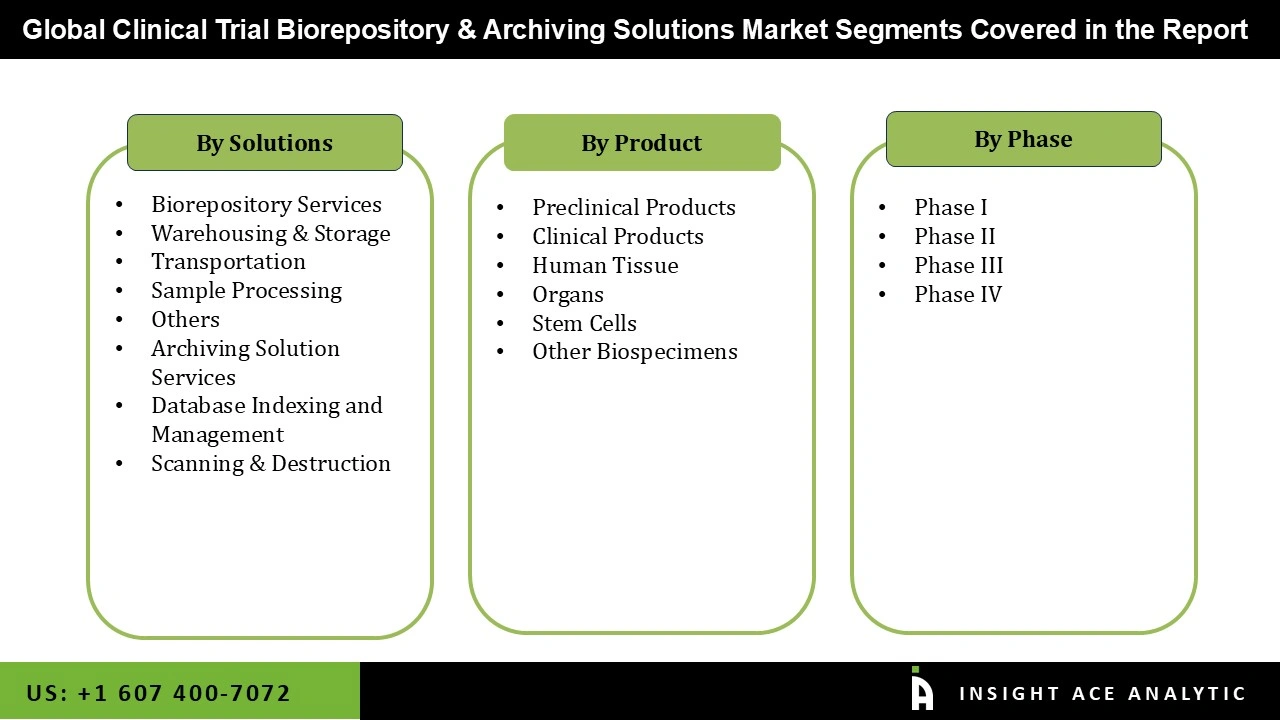

Clinical Trial Biorepository and Archiving Solutions Market Size, Share & Trends Analysis Distribution by Service (Archiving Solution, Biorepository Services), By Product (Preclinical, Clinical), By Phase (I, II, III, IV), and Segment Forecasts, 2026 to 2035.

Clinical trial biorepositories and archiving solutions play pivotal roles in the pharmaceutical and biomedical research sectors by providing specialized facilities and technologies for the storage, processing, and management of biological samples and clinical trial data. Biorepository services encompass the storage, management, and preservation of various biological specimens such as blood, tissue, and bodily fluids. These facilities maintain the integrity and long-term viability of samples, ensuring they are accessible for future research and development efforts aimed at treating diverse diseases. By offering well-characterized samples, biorepositories facilitate collaborative research initiatives among scientists and pharmaceutical companies, thereby accelerating the discovery of biomarkers and the development of innovative therapeutics.

Simultaneously, archiving solution services manage the vast quantities of data generated during clinical trials. These solutions organize and preserve data in a systematic manner, ensuring regulatory compliance and enabling researchers to extract valuable insights. Effective data management and integration empower researchers to analyze large datasets comprehensively, identify trends, and derive meaningful conclusions from patient information.

The Clinical Trial Biorepository & Archiving Solutions market is driven by increasing pharmaceutical R&D activities and significant technological advancements. These include enhanced data management systems, improved sample storage and retrieval processes, and innovations in cryopreservation and automated sample handling. These factors collectively boost efficiency, support regulatory compliance, and foster collaboration, thereby advancing biomedical research and drug development capabilities.

The clinical trial biorepository & archiving solutions market is segmented based on service, product and phase. By service the market is segmented into biorepository services and archiving solution services, biorepository services is sub segmented into warehousing & storage, transportation, sample processing, others, archiving solution services is sub segmented into database indexing and management, scanning & destruction. By product the market is segmented into preclinical products and clinical products, clinical products is sub segmented into human tissue, organs, stem cells, and other biospecimens. By phase the market is segmented into phase i, phase ii, phase iii, phase iv.

The Biorepository Services segment stands out in the Clinical Trial Biorepository and Archiving Solutions market due to increasing demand driven by oncology research and personalized medicine. These services provide essential biological samples for biomarker discovery, treatment response analysis, and targeted therapy development, crucial for advancing medical research. Technological advancements in automated sample handling, cryopreservation, and data management systems further enhance their efficiency and effectiveness. Compliance with regulations such as HIPAA ensures patient privacy and data security, solidifying biorepository services as pivotal in supporting collaborative research efforts and enabling data-driven insights in biomedical research and therapeutic innovation.

The Preclinical segment is experiencing rapid growth within the Clinical Trial Biorepository and Archiving Solutions market, driven by several key factors. Foremost among these is the accelerated approval rate of novel drugs, vaccines, and medicines by regulatory bodies, which spurs demand for preclinical research services. The segment benefits from an increased success rate in preclinical trials and reduced production costs, making it increasingly attractive for pharmaceutical and biotechnology companies. Biorepository services play a crucial role in this growth by providing secure and controlled environments for the storage and management of biological specimens essential for preclinical trials.

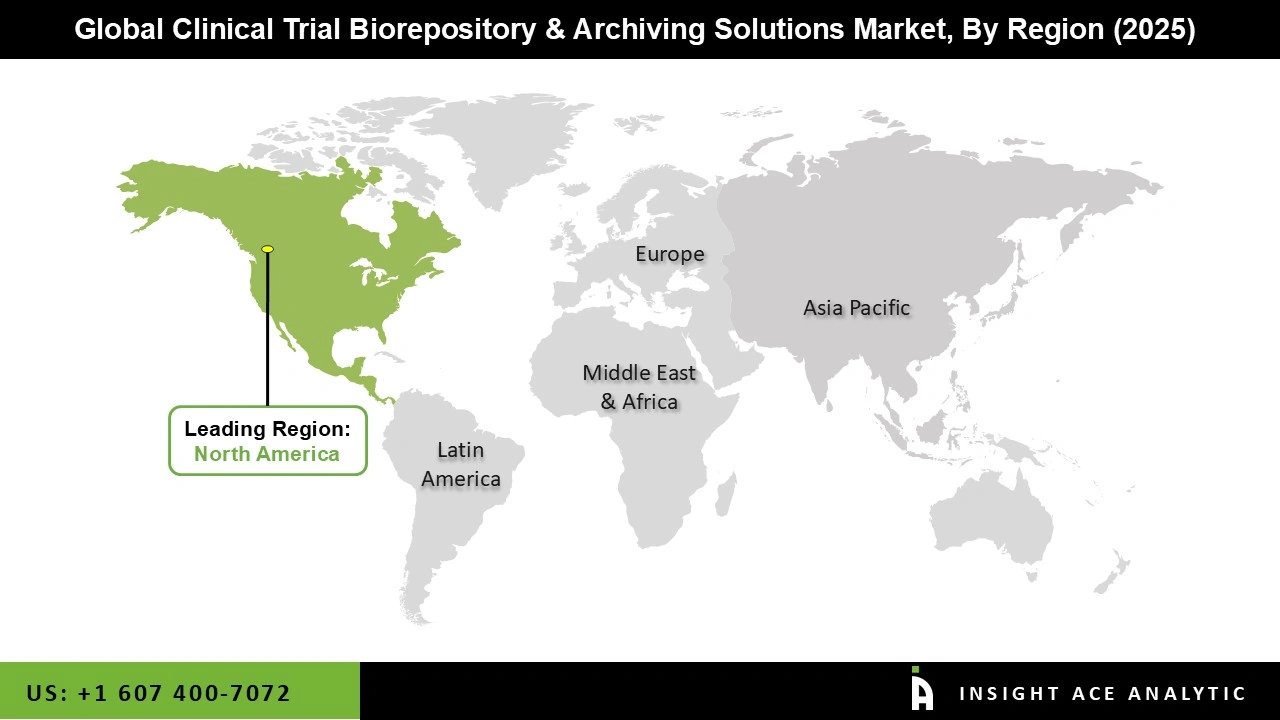

North America is at the forefront of the Clinical Trial Biorepository and Archiving Solutions market, driven by several key factors. The region hosts a robust pharmaceutical industry characterized by a high volume of clinical trials aimed at developing new treatments and therapies.

Additionally, North America boasts a dense network of research institutions, universities, and hospitals that actively conduct clinical trials, necessitating reliable biorepository and archiving solutions for the storage and management of biological samples and trial data. Furthermore, substantial investments in pharmaceutical research and development by companies in the region, coupled with government funding initiatives like those from the National Institutes of Health (NIH), further bolster the demand for these solutions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 4.65 Bn |

| Revenue Forecast In 2035 | USD 10.59 Bn |

| Growth Rate CAGR | CAGR of 8.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service, By Product, By Phase, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Azenta U.S., Inc., Thermo Fisher Scientific Inc. (Patheon), Precision for Medicine, Inc., Medpace, LabCorp Drug Development, ATCC, Q2 Solutions, Labconnect, Charles River Laboratories, Cell&Co, Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.